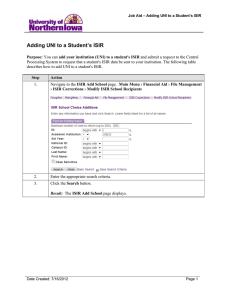

Loading ISIR Applicant Data into FAM 2016-17 Financial Aid System

advertisement