Document 11045718

advertisement

O&WEY

HD28

.M414

~7

IV

OCT

T 1990

-*

ALFRED

P.

^s

WORKING PAPER

SLOAN SCHOOL OF MANAGEMENT

The Interaction between Time-nonseparable

Preferences and Time Aggregation

John Heaton

Dept.

of Economics and Sloan School of Management

Massachusetts Institute of Technology

WP #3181-90-EFA

June 1990

MASSACHUSETTS

INSTITUTE OF TECHNOLOGY

50 MEMORIAL DRIVE

CAMBRIDGE, MASSACHUSETTS 02139

The Interaction between Time-nonseparable

Preferences and Time Aggregation

John Heaton

Dept.

of Economics and Sloan School of Management

Massachusetts Institute of Technology

WP #3181-90-EFA

June 1990

V

\ *2

v^

&

,,

The Interaction Between Time-Nonseparable Preferences

and Time Aggregation

John Heaton

Department of Economics and Sloan School of Management

M.I.T.

June 1990

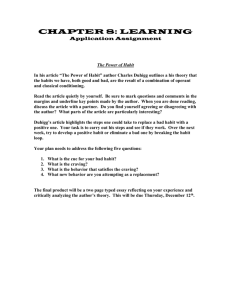

ABSTRACT

develop and empirically analyze a continuous - time

In this paper I

linear-quadratic, representative consumer model in which the consumer has

time-nonseparable preferences of several forms.

Within this framework I

show how time aggregation and time nonseparabilities in preferences over

show that the behavior of both

consumption streams can interact.

I

seasonally adjusted and unadjusted consumption data is consistent with a

model of time-nonseparable preferences in which the consumption goods are

durable and in which individuals develop habit over the flow of services

The presence of time nonseparabilities in preferences is

from the good.

important because the data does not support a version of the model that

focuses solely upon time aggregation and ignores time nonseparabilities in

preferences by making preferences time additive.

Many helpful comments and suggestions were made by Edward Allen, Toni Braun,

John Cochrane, George Constantinides Martin Eichenbaum, Ayman Hindy, Chi-fu

Huang, Narayana Kocherlakota, Robert Lucas, Robin Lumsdaine, Masao Ogaki

Chris Phelan, Paul Romer, Karl Snow, Grace Tsiang, Kei-Mu^Yi and and

participants of workshops at Chicago, Carnegie-Mellon,

Duke,

Harvard,

M.I.T.

Minnesota, Northwestern, Princeton, Queen's, Rochester, Stanford,

Toronto, Western Ontario, Wharton and Yale.

I

would especially like to

thank Lars Peter Hansen

for his

many suggestions and his constant

encouragment.

I gratefully acknowledge financial support from the Greentree

Foundation, the National Science Foundation, the Sloan Foundation and the

Social Science and Humanities Research Council of Canada.

This paper is a

revised version of my University of Chicago Ph.D. dissertation.

Any errors

are of course my own.

,

,

I.

Introduction

In

paper

this

linear-quadratic,

develop

I

show how

time

consumption

streams

can

several

of

aggregation and

analyze

consumer model

representative

time-nonseparable preferences

empirically

and

time

in which

show

I

that

durable

and in which individuals

The presence

from the good.

important because

the

of

in which

consumer has

framework

preferences

in

behavior

the

seasonally adjusted and unadjusted consumption data is

model of time-nonseparable preferences

the

Within this

forms.

nonseparabilities

interact.

continuous- time,

a

of

over

both

consistent with

a

consumption goods are

the

develop habit over the flow of services

time nonseparabilities

in preferences

not support a version of the model

data does

I

is

that

focuses solely upon time aggregation and ignores time nonseparabilities

in

preferences by making preferences time additive.

There has been an extensive

consumption

aggregate

by

implied

the

the data

expenditures

permanent

asset-pricing models.

amount of work examining whether or not

consistent

are

income

hypothesis

with

the

and

consumption-based

restrictions

Often these studies find that the theory does not fit

.

Because of these poor empirical results, many other studies relax some

of the auxiliary assumptions made in previous studies.

A closer examination

of the assumption that the decision interval of economic agents matches the

interval

of

data

collection caused

some

authors

to

replace

assumption that the interval between data observations

actual decision interval.

can

often

Christiano,

with

larger

the

than the

The result is a temporal aggregation problem that

allowed

for

in

Eichenbaum

and

Marshall

be

is

it

estimation

(1987)

and

inference.

find

that

For

rejections

example,

of

the

-

permanent income hypothesis could be due to temporal aggregation problems.

has

there

Concurrently,

been

much

work

examining

the

impact

2

of

time-nonseparable preference specifications upon the consumption-based CAPM

and the permanent income hypothesis.

and

Hansen

(1990)

discrete -time

models

and

Ogaki

for

(1988),

for

allow

that

Dunn and Singleton (1985), Eichenbaum

empirically

example,

durability

in

examine

consumption

the

data.

Although allowing for durability seems to help the fit of the model,

the

results do not provide a complete rationalization of consumption and asset

price data.

The purpose of this paper is to show how time-nonseparable preference

to understand much

specifications along with time aggregation can help us

about

the

behavior of aggregate

consumption.

motivation for

One

such

a

study is the fact that all studies, which examine the empirical relevance of

the temporal aggregation problem,

Within a continuous- time or fine discrete-time

time separable preferences.

this

model,

assumption

conduct the analysis within a framework of

far

is

from

appealing

since

implies

it

that

an

individual's preferences over consumption at one instant are unaffected by

consumption the instant before.

Hindy

and

within

a

Huang

(1989)

argue

In this vein,

that

the

Huang and Kreps

assumption

should be

and

time-separability,

These authors also argue

continuous -time model, should be dropped.

that preferences

of

(1987)

specified such that consumption at dates near

time t should be relatively substitutable for consumption at time

t.

The

argument against using a separable preference specification can also be made

on

the

grounds

consumption

that

of

a

for

measurement

most

problem:

National

classifications have a very durable nature.

clothing are defined as being nondurable.

we

Income

have

and

For example,

observations

Produce

on

Account

expenditures on

In conducting this study,

permanent

income

nonseparabilities

technology with

develop a continuous- time linear-quadratic

with

augmented

model

The

preferences.

in

a

I

general

a

form

assumes

model

of

very

a

time

simple

Although this is a

fixed rate of return to investment.

very severe restriction, my goal is to use this model as a laboratory for

aggregation and nonseparabilities

understanding how temporal

and

interact

for determining what type of preference specifications should or should not

be ruled out before moving on to more complicated environments.

I

apply

examples

several

unadjusted nondurable

of

time-additive version of the model

seasonally

to

consumption

services

plus

model

the

is

data.

adjusted

show

I

not consistent with the

However,

adjusted consumption data at monthly frequencies.

and

that

the

seasonally

the

model

is

consistent with the data if the consumption goods are allowed to be durable.

Further

the

I

form

show that there is some weak evidence for habit persistence (of

studied

Ryder

by

Constantinides (1990)

,

and

Heal

Sundaresan

(1973),

and

(1989)

for example) only if the habit is developed over the

flow of services from the durable nature of the goods.

Using quarterly seasonally unadjusted data

present evidence that the

I

durable nature of the goods may be understated in seasonally adjusted data

and

that

indicates

time- separable

that

there

is

perform

very

poorly

significant

role

for

models

a

.

habit

Also

data

this

persistence

in

understanding the seasonal behavior of consumption.

Along with these general empirical points

temporal

aggregation

and

make

relatively consistent with the data?

negative

also address the following

Can the presence of time-nonseparabilities mitigate the effects

questions:

of

I

autocorrelation

in

a

discrete-time,

time-separable

model

Can temporal aggregation overturn the

consumption

that

is

usually

introduced

with

and make

goods,

durable

a

story

durability

consistent with

positive

the

correlation in quarterly consumption?

rest

The

of

the

paper

structured as

is

In

follows.

Section

2,

I

examine a time-additive model that allows me to focus upon the effects of

aggregation.

temporal

I

data

adjusted

seasonally

quarterly

show that although the model

model

the

inconsistent

very

is

consistent with

is

with

monthly seasonally adjusted data and quarterly seasonally unadjusted data.

In

Section

I

3,

develop

a

with

model

nonseparabilities in preferences.

general

very

forms

of

time

show that with proper restrictions on

I

preferences, a law of motion for consumption can be derived that can be used

to estimate

the preference parameters.

also discuss why it is necessary

I

to focus upon specific parametric forms of the preferences.

Section 4 examines the capital stock and consumption dynamics implied

by

model

the

certainty.

I

in

the

discuss

case

habit

of

persistence,

in

a

world

of

perfect

further restrictions that are necessary so that the

model produces reasonable economic results.

In

Section

time-nonseparable

adjusted

5,

I

empirically

structure

preference

consumption

examine

First,

data.

of

I

several

Section

examine

3,

the

examples

using

effect

of

the

seasonally

of

making

preferences time-nonseparable by assuming that consumption goods are durable

with exponential

allow

for

habit

depreciation.

persistence

I

also

effects.

examine

Section

some

specifications

empirically

6

that

examines

a

version of the model that allows for seasonality in consumption and takes

this model to seasonally unadjusted data.

Section

7

concludes the paper.

II.

A Time-Separable Model

In this section,

income model.

I

examine a continuous- time linear-quadratic permanent

The preferences of the representative consumer in the model

time- separable so that

of this section are assumed to be

upon the time aggregation problem.

that

time

I

show,

aggregation

seasonally-adjusted

did Christian,

as

can

explain

Within the context

Eichenbaum and Marshall

much

aggregate

(s.a.)

can first focus

The model is a continuous -time version

of a model studied by Hansen (1987) and Sargent (1987).

of this model,

I

of

behavior

the

consumption.

quarterly

of

However,

(1989),

I

present

evidence using monthly s.a. consumption and quarterly seasonally unadjusted

(s.u.)

that

data

consumption data

time

3

.

that

inconsistent with

is

aggregation does not provide

the

complete

a

model and suggests

rationalization of the

This motivates the need to look at time-nonseparable specifications.

II. A.

A Continuous -Time Permanent Income Model

Assume first that there is a representative consumer with preferences

*

•

over consumption streams, c

(2.2)

U(c*) - -(1/2)

- [c (t):

£(/%xp(Vt)

<

(c*(t)

where b(t) is assumed to grow at the rate

(2.3)

b (t) - exp(/it)b, m >

t

<«

}

,

of the form:

2

-

b*(t)) dt]

/*:

0.

The geometric trend in b (t) will induce growth in the consumption process

:

,

Consider detrended consumption, c - (c(t): 0<t<«)

chosen by the consumer.

which is given by:

c(t) - exp(-/it)c*(t),

(2.4)

Then the preferences

of

the

t>0.

consumption given in

trending

over

consumer

(2.1) can be rewritten as preferences over detrended consumption:

U(c) - -(1/2) £(/%xp(-pt)

(2.5)

where p as

p

In what follows,

+ 2p.

As

consumption.

I

show

will

2

(c(t)

I

b) dt),

-

will refer to detrended consumption

subsequently,

this

remove all of the nonstationarity in consumption.

consumption process,

with

the

model

of

will have a unit root.

c,

Eichenbaum

Christiano,

and

detrending does

In fact,

This

is

to

Marshall

the

be

(1987)

not

detrended

contrasted

in

which

detrended consumption is stationary.

There is a technology for transferring consumption over time that has a

constant rate of return of

(2.6)

Dfc(t)

p

- pk(t) + e(t)

< t <«)

where (e(t):

-

c(t),

t>0

,

k(0) given,

is stochastic process

that describes the behavior of

endowments in the economy and k(t) gives the level of the capital stock in

the

economy

at

time

t.

uncertainty in the economy.

The

endowment

random

Note that

I

provides

the

source

of

have equated the risk free rate of

return to the discount factor after detrending the consumption process. This

corresponds

to

the

assumption

made

by

Flavin

(1981),

for

example.

.

Christiano,

Marshall

and

Eichenbaum

follow

(1987)

different

a

route

and

equate the discount factor to the rate of return, before detrending.

The

consumer maximizes

constraint (2.6)

.

objective

the

In Section 3,

function

consider solutions

I

subject

(2.3),

to

to

the

general model

a

that nests this model, however it is easy to see that the optimal consumption

process will be a martingale just as in Hall's (1978) model

.

because a unit of the consumption good given up at period

yields exp(pr)

units

period t+r

at

,

via

As

(2.6).

a

result,

the

t

This occurs

consumer

equates

the

marginal utility of the consumption good (muc) today to discounted expected

marginal utility of consumption tomorrow, times exp(pr):

(2.7)

muc(t) - exp(pr)E{exp(-pr)muc(t+l)|?(t)), r>0

- £{muc(t+r) |^(t))

where

!F(t)

gives the information set at time

of consumption at time

(2.8)

t

is

-(c(t)

c(t) - E{c(t+r)|3F(t)},

r

-

>

b)

,

(2.7)

Since the marginal utility

t.

implies that:

0.

The time derivative of consumption then satisfies:

(2.9)

Dc(t) - D£(t)

where D£(t)

is

the

(instantaneous)

innovation in the processes

the permanent value of the endowment shock process at time

the (random) measure induced by D£(t) satisfies £{D£(t)

2

t.

I

2

}

- a dt.

describing

assume that

Time Series Implications for Time -Ave raged Consumption

II. B.

The data are observations of time -averaged consumption expenditure over

a unit

differences

discrete

Jf*

t-i

consumption

time -averaged

in

time,

c(r)dr.

(2.10)

Although consumption is a martingale in continuous time,

of time.

when sampled

the

at

will

integers.

not

To

be

see

a

martingale

this,

let

c(t)

in

•

Then consider:

c(t+l)

-

c(t) - J^

- J^

+1

c(r)dr

+1

-C

[c(0

-

-

J^cCOdr

c(r-l)]dr

[j><r-l +r)dr]dr.

By changing the order of integration in the

last term of (2.10),

c(t+l)

-

c(t) can be expressed as:

(2.11)

c(t+l)

-

c(t) - u(t+l),

where (u(t): t-0,1,2,...) has the first-order moving-average representation:

(2.12)

u(t) - J^_ (t-r)Df (r) + £*(r-t+2)D|(r)

i

,

t-0,1,2

The first-order autocorrelation for u is:

(

2.13)

g<»Ct)u(t-l)) R(l) 2

£{u(t)

}

£&-!

(2/3) a

- 0.25

2

This result was originally derived by Working (1960)

7

In

version

of

matched with

the

discrete- time

a

consumption

data

is

this

where

model,

consumption

the

process

in

observed

the

model,

consumption differences are predicted to be uncorrelated over time [see e.g.

Hall

The

(1978)].

fact

first

the

that

consumption is correlated at the first lag,

difference

time-averaged

could help to explain some of

of the discrete-time permanent

the rejections

in

income hypothesis.

This

is

what Christiano, Eichenbaum and Marshall (1987) find when they use quarterly

data.

II. C

Data

To test the implications of the models in this paper,

I

focused solely

Q

upon consumption data

expenditures

.

The consumption measure

on nondurables

services

and

where

expenditures are those measured by the U.S.

seasonally adjusted (s.a.)

was

used.

The

quarter of 1952

from the

first

seasonally

to

the

quarter

used was per capita real

aggregate

the

adjusted

quarterly

1959

The

the

to

consumption

Department of Commerce.

and seasonally unadjusted (s.u.)

end of 1986.

of

I

data

runs

Both

quarterly data

from

the

first

seasonally unadjusted data runs

end of

1986

g

.

Monthly

seasonally

adjusted data from January 1959 to the end of 1986 was also used.

II .D Tests of the Model Using Quarterly and Monthly,

S.A.

Consumption

Data

The model predicts

order

1.

that c(t)

-

c(t-l)

is

Parameterize this moving average as:

a moving average process of

c(t)

(2.14)

8

is

is

e(t) + ^t(t-l)

9

Q

where £(«(t)

R(l)

c(t-l) -

-

2

-

)

and £{e(t)e(r)) -

1

we can estimate

0.25,

implied by

then

for

*

r

Under the assumption that

t.

and the trend parameter ^.

8

autocorrelation restriction.

the

The parameter

Table

2.1

gives

estimates of the parameters of the model with R(l) restricted to 0.25 using

seasonally-adjusted

Estimates

consumption.

of

given with

are

(2.14)

8

2

unrestricted are given in Table 2.2.

reported for the period 1952,1

are

estimated parameters

In both tables

1986,4

to

1959,1

and

1986,4.

to

The

latter subsample was used since this matches the period of the monthly data.

Log- likelihood values

also

are

reported

each

in

log- likelihood for each sample marginally improves

Likelihood

2.2.

tests

ratio

of

that

the

from Table 2.1 to Table

restriction

0.25

the

Notice

table.

for

yield

R(l)

probability values of 0.73 for that data set from 1952,1 to 1986,4 and 0.78

from

data

for

1959,1

This

1986,4.

to

because

occurs

autocorrelation of differences in detrended consumption

0.276

data

(0.067)

11

for

Hence

set.

longer data set and 0.260

the

the

restriction

on

R(l)

first-order

was estimated to be

(0.081)

implied

the

by

the

for

the

model

shorter

is

very

consistent with the data.

The model also implies

be

useful

in predicting

likelihood ratio

against

higher

and

tests

For

moving- average

models

significance level.

consumption change today.

P-values

of

moving- average

order

differences.

the

that information lagged two periods should not

the

of

longer

orders

of

models

data

2,

tests

set,

3

and

time

the

the

tests

of

4

not

do

set and the moving average model of orders 4 and

5

5

2.3

reports

additive

detrended

for

The moving average model of order

10

Table

consumption

model

reject

model

at

against

the

5%

for the longer data

for the shorter data set

against

evidence

provide more

the

However,

model.

could be

this

due

to

spurious correlation induced through seasonal adjustment or to the presence

cases,

tests

the

12

that are not completely removed.

of seasonal patterns

Table

in

that

indicate

2.3

Other than these

time-additive

the

reasonably consistent with the data as noted by Christiano,

model

is

Eichenbaum and

Marshall (1987).

Now

consider

consumption is

Since

measures

monthly

martingale

a

robust

seasonally

of

continuous

in

different

adjusted

the

time,

consumption.

nature

of

the

results

should

However,

the first-order autocorrelation in first-differences of detrended

monthly

consumption

be

significantly negative

to

estimated

is

The

.

intervals

-0.188

be

to

of

time

aggregation.

which

(0.052),

is

trend was estimated using maximum likelihood

just as was done for the quarterly data.

Table 2.4 reports estimates of the

trend and the moving average parameters

for

with and without

restriction using monthly

0.25

seasonally

adjusted

A likelihood ratio test of the restriction yields a probability value

data.

of

the

difference in consumption

the

essentially zero.

As

result,

a

the

model

does

not

seem

to

be

very

consistent with monthly seasonally adjusted data.

Why

is

this

happening?

Why

is

the

frequencies but not at monthly frequencies?

model

successful

at

In the next section

I

quarterly

relax the

time-separability assumption imposed upon preferences by (2.3) and show that

the

negative

Before

moving

autocorrelation

examined.

correlation

first-order

on

to

this

values,

in

monthly

preference -based

another

explanation

data

explanation

for

this

is

not

for

surprising.

the

finding

changing

must

be

Consider a discrete-time version of this time separable model in

which the model is assumed to be correct at monthly frequencies.

In this

the model implies that monthly consumption is a martingale.

Suppose

case,

11

equal

now that observed consumption is

to

consumption plus

model

the

an

Then

i.i.d. measurement error that is also independent of the model shocks.

observed consumption differences are given by:

c(t)

(2.15)

c(t-l) - u (t) + u (t)

-

where

is

u

model

the

u (t-l)

-

z

2

x

and

error

measurement error.

i.i.d.

the

is

u

2

1

Let E[u (t)

2

)

- a

2

and £(u (t)

2

- a

)

2

Note

.

that

that

implies

(2.15)

consumption differences have a first-order moving average representation and

2

that the first-order autocorrelation value is R(l) - -a /(a

let

a

2

-

then

1,

the

autocorrelation

first-order

for

2

+ a

_

2

)

detrended

.

If we

monthly

l

consumption differences gives us an estimate of a

2

of 0.232.

Given the behavior of consumption at monthly frequencies in (2.15),

it

is easy to show that quarterly consumption also follows a first-order moving

average

R

-

(1)

where

process

(19a

q

12 12

2

2

+

estimated value of a

R (1) of 0.162.

)/(4a

6ff

2

autocorrelation value

first-order

the

2

+

6a

2

-

)

(19

+

2

6a )/(4

+

6a

2

from the monthly data,

this

2

).

given by:

is

Using

the

2

implies

an estimate of

Although this is not equal to the value of 0.276 found with

i

quarterly data from 1959 to 1986,

is equal to 0.162,

level.

As

a

aggregation,

likelihood ratio test of whether R (1)

does not reject this restriction at the 10% significance

result,

is

a

this

capable

measurement

of

error

explaining

model,

the

autocorrelation values in quarterly and monthly data.

along with

changing

temporal

first-order

However, is an i.i.d.

measurement error model for consumption levels reasonable?

As Wilcox

(1988)

has argued,

a

component of the measurement error in

consumption is due to the misallocation of retail sales into the different

categories of consumption by the Commerce Department.

12

Since the allocation

.

correlation

in

measurement

the

measurement error

due

is

the

to

error.

any

If

based

upon

periodic

substantial

positive

is

introduces

this

establishments,

retail

of

surveys

classifications

consumption

into

sales

retail

of

other

component

this will also

introduce positive autocorrelation in the measurement error.

autocorrelation

error

measurement error will

reduce

the

role

Any positive

of measurement

explaining the behavior of consumption at monthly and quarterly

in

frequencies

.

in

the

collection practices of the Department of

and if these practices do not change very often,

Commerce,

of

and will

leave

a

large

role

for

the

economic

model

that

I

,14

,

consider

in the next sections

.

II. E

,

Tests of the Model Using Quarterly S.U. Consumption Data

In this

subsection

I

examine the

has for seasonally unadjusted data.

implications

that

simple model

this

To account for seasonality in the data,

the model must be modified in some manner.

One way to induce seasonality in

consumption is to add a seasonal deterministic bliss point process that will

induce

a

deterministic

pattern

seasonal

in

consumption.

Seasonal

point movements have been used in a similar way by Miron (1982).

6

I

show

that

the

time

additive

with

model

a

deterministic

bliss

In Section

bliss

point

process implies that consumption differences follow the process:

(2.16)

where

3(t)

-

again

autocorrelation

c(t-l) - u(t) + B(t)

u(t)

equal

has

an

to

0.25,

representation

MA(1)

and

B(t)

seasonal dummies

13

is

a

sequence

with

of

first-order

deterministic

consider the autocorrelation structure of the first

As a first pass,

consumption with

s.u.

in

differences

trend

and

seasonal

Table 2.5 gives the autocorrelation values for residuals.

dummies

removed.

The trend value

and seasonal dummies were removed using a likelihood function in which the

residuals

were

assumed

white

be

to

misspecified likelihood function,

Although

noise.

this

may

be

a

it will yield consistent estimates of the

autocorrelation values.

First, unlike the seasonally

There are two important things to notice.

adjusted quarterly data,

first-order

the

autocorrelation is not close

Hence with this different manner of accounting for seasonality,

0.25.

with

data

even

the

time -additive

model

frequencies.

Second, note that the autocorrelation value at the fourth lag

is

significantly

is

consistent

to

not

positive

and

large.

the

indicates

This

Quarterly

at

that

the

use

of

seasonal dummies does not remove all of the seasonality in the data and some

addition must be made to the model to account for this behavior.

III.

A Model with Time-Nonseparable Preferences

In this section,

dependencies

modify the model of section

I

preferences

in

over

consumption.

2

and introduce temporal

Nonseparabilities

are

introduced by specifying a mapping from current and past consumption goods

into a process called services.

The representative consumer is assumed to

have time- separable preferences over services.

into

services

is

type

a

of

The mapping from consumption

Gorman- Lancaster

technology

in

which

the

consumption goods are viewed as bundled claims to characteristics that the

consumer

durable

cares

goods

about

and

.

habit

The

as

form

of

special

14

nonseparabilities

parametric

nests

examples.

models

I

of

provide

.

sufficient conditions on the mapping from consumption to services such that

the

preferences

consumer's

the

and

accumulation problem are

capital

well

defined.

An important result that is exploited in Sections

assumptions,

these

under

marginal

the

univariate

a

utility

4,

process

and

5

martingale.

a

is

that

is

6

representation for observed consumption

Using this

fact,

derived.

also show that to give this model interesting empirical content,

I

a priori restrictions must be

is

placed upon the form of the nonseparabilities

This provides motivation for looking at specific forms of nonseparabilities

in sections 4, 5 and 6.

A Commodity Space for Services

III. A.

preferences

The

processes that

of

consumer

the

call services

I

.

model will

this

in

defined over

be

In the construction of the commodity space

the first piece that is needed is an information structure for

for services,

the economy.

Let (Q,?,Pr) be the underlying probability space.

economy

represented

is

filtration):

F-(?(t):

events at period

is

not

lost

t.

over

I

by

a

sequence

Let

the

?(t)£?(s) for

assume that

time.

sigma-algebras

sub

gives

?(t)

te[0,«)).

of

then

"ft xfl,

Information in the

t

set

of

x:Q

-*R,

where x(t)

is

the value

of

the

(a

distinguishable

process

+

function,

?

< s, so that information

stochastic

a

of

process at time

t.

is

a

Two

spaces of stochastic processes will be important.

Let ?

be the product sigma-algebra given by ?x£

Borel sets of R

l

.

Let

*

A

be a measure on R

l

where B

denotes the

*

that has density exp(-p t) with

*

respect to Lebesgue measure,

where

p

15

>

0.

I

denote

the

product measure

*

•

PrxX

given by

as Pr

,

The first space of processes that is needed is the

.

space of square- integrable processes:

L

2

4"

ar +

*

,y ,Pr ).

(ft

The second space of processes is used to limit the choice space of the

Let P be

representative consumer and is the commodity space for services.

of subsets of

the predictable sigma- algebra

ft

Services are required to

.

be measurable with respect to T and square integrable,

£

(ft

,T,Pr

Since

).

consumer will

the

be

making

requiring them to be predictable implies that,

only information generated by (f

III.B.

s

choices

at t,

an element of

over

services,

the consumer can use

< t).

Preferences over Services

preferences

The

:

i.e.,

time-nonseparable

of

over

representative

the

consumer

However

consumption.

it

is

are

assumed

convenient

to

to

be

first

assume that the consumer's preferences are time-separable over a stochastic

process,

s

to lie within the space £

The service process is assumed

called services.

*{s (t):0<t<»),

,r ,Pr ).

(ft

representative consumer evaluates s

Given a member of this space, s

,

the

via the utility function:

2

(3.1)

t/(s*)

- -(l/2)£{j^exp('-p*t)(s*(t)-b*(t)) dt}

*

where

{b (t):0<t<«)

is

a

deterministic process

describing the bliss point

*

movement.

(3.2)

To model growth,

I

b*(t) - exp(/it)b(t),

assume that b (t) grows at the rate p:

/i

> 0.

*

When b(t)

is a constant,

the geometric trend in b (t)

16

induces growth in the

chosen by

process

service

consumption process.

consumer

the

Consider

now

and,

as

detrended

growth

result,

a

services,

-

s

in

the

(s(t) :0<t<«)

given by:

s(t) - exp(-/it)s*(t),

(3.3)

t>0.

Then the preferences of the consumer over trending services given in (3.1)

can be rewritten as preferences over detrended services:

2

U(s) - -(l/2)E(J^exp(-pt)[s(t)-b(t)] dt)

(3.4)

where

p

— p

services

+

2fi.

Also,

.

I

In what follows,

I

will refer to detrended services as

will refer to detrended consumption as consumption, where

consumption is detrended in the same manner as in (3.3).

on

Let

A

be a measure

that has density exp(-pt) with respect to Lebesgue measure and let Pr

IR

2

+

+

Note that detrended services lie within 1 (0 ,? ,Pr

- Pr x A.

III. C.

).

Time Nonseparabilities

Time nonseparability in the consumer's preferences over consumption is

introduced by making s(t)

a

linear function current

and past consumption.

The dependence of services on current and past consumption will be modeled

by making services at time

on R

,

g,

and consumption,

1

(3.5)

s

t

a convolution between a nonrandom distribution

c:

- g*c

17

The distribution g will

where * denotes convolution of two distributions.

often put weight on all of R

to be zero for

<

r

in which case,

,

defined by setting c

is

(3.5)

One way to think of this convolutions is to let s (t)

0.

be given by:

(3.6)

s\t) - JJg(r)c(t-r)dr.

However,

the

integral

in

will,

(3.6)

be given by

not

in general

the

contribution

standard

notions of integration.

s

is

a

that

process

gives

consumption purchases from time

conditions

+

£ (n ,? ,Pr

for

the

+

)

s (t)

.

service

s(t) -

Although

s

2

let

2

be

s (t)

services

from

allow for initial

nonrandom member

a

of

gives the contribution to services at time t from the

initial stock of services.

(3.7)

In order to

onwards.

process,

to

s\t) +

The service process at time t is then given by:

2

s (t),

t>0.

could be collapsed into the bliss point process,

b,

it will be

useful to carry along a separate process for initial conditions.

For

a

particular

g,

preferences over consumption.

(3.5)

(3.4),

Below

I

and

(3.7)

give

the

consumer's

show how to restrict g and the space

of consumption processes so that the result in (3.7) is in £

(fl

," ,Pr

).

Examples of g

1.

service

Exponential

process

Depreciation

generated

by

a

of

a

Durable

durable

18

Good.

that

Let

undergoes

s(t)

be

the

exponential

.

In this case, g is given by:

depreciation.

1 9

if t <

g(t) -

(3.8)

exp(6t)

that

Suppose

where

,

\

/ c(r)dr

c (t)

< p/2.

5

>

t

is

a

diffusion

Then

process.

the

first

service process is given simply by:

s\t)

(3.9)

-

J [o

exp(fir)DC (t-r)d7(o)

4

where the integral in (3.9) is defined as a stochastic integral in the usual

Suppose

way.

services

further

in the

that

the

amount ^(0)

at

initial

t-0

condition is

given by a stock of

Then the second service process

.

is

given by:

2

(3.10)

s (t)

- exp(St)?(0)

In

this

initial

fact,

condition could be

process by adding to it a mass at

can

given

be

succinctly

as

a

collapsed

into

in the amount ?(0).

solution

to

the

the

consumption

The service process

stochastic

differential

equation:

(3.11)

Ds(t) - 5s(t) + Dc (t), with s(0) - ?(0)

a

2.

Habit Persistence.

Suppose that the consumer cares about the level

of consumption today relative to an average of past consumption so that the

consumer

develops

an

acceptable

level

of

Persistence of this form has been studied,

19

consumption

for

example,

over

time.

Habit

by Constantinides

Following Constantinides (1990)

and Sundaresan (1989).

and Heal (1973),

model habit persistence by assuming that

l

- c(t)

s (t)

(3.12)

that

Note

Pollack (1970), Ryder

Detemple and Zapatero (1989), Novales (1990),

(1990),

term

the

-

(

a(-7)J

s (t)

is of the form:

exp(70c(t-r)dr, 7<0

exp(7r)c(t-r)dr

-y)j

I

is

a

,

0<o<l

weighted

average

of

past

consumption, and a gives the proportion of this average that is compared to

current consumption to arrive at the level of services today.

x(t)

(

-7)Jexp(7r)c(t-r)dr

is

The process

referred to as the habit stock.

In this example, g is then given by:

(3.13)

g - A

-

at)

where A is the dirac delta function and

rj

is

given by:

if t <

'

(3.14)

ij(t)

-

exp(yt)

t

>

The initial condition for services are given by:

(3.15)

2

s (t)

- -oexp(7t)x(0)

where x(0) is the initial value of the habit stock.

Many other examples of time-nonseparable preferences can be mapped into

this notation.

20

:

ResCrictions on g and c

III. D.

Since the preferences of the representative consumer are defined over

),

some restriction needs to be placed upon the space

of consumption processes

and the distribution g such that the convolution

elements of £

given by

,"P

(fi

,Pr

results

(3.5)

in

member

a

of

£

+

(71

,? ,?r

)

desirable that the mapping be from all of £ (n*,P,Pr

Often

will

be

into £ (tf ,?,Pr*)

as

.

+

it

2

)

in the time-additive and habit persistence models.

The first restriction that

member of £

version of

(3.16)

(fl

g,

g'

(Dc)'

ch,

c'

define a discounted

:

- gh

g'

for t >0 and zero otherwise and

where h(t) - exp(-et)

let

impose insures that the mapping yields a

To describe this restriction,

,? ,Pr ).

denoted

I

- Dch and so on.

- p/2.

t

Similarly

The first restriction is in the form of

a restriction upon g and the space of admissible consumption processes:

Assumption

1:

The space of admissible consumption processes

is

restricted

to be

l

C

(3.17)

where

t

>

L

2

- [u c € £ (tf ,?,Pr*))

and

I

is

the smallest integer such that

2

(e

+w

-

2

)

L

g' (cj)g' (w)

is

A

essentially bounded and where

To

see

that Assumption

1

g'

is the fourier transform of g'

implies

that

21

(3.5)

maps

the

.

space of admissible

:

consumption processes into £ (Q ,2 ,Pr

]

]

dt)

Q

E{f~

g'

(w)g' (w)* c' (w) c' (w)*du>)

the fourier transform of

is

c' (w)

2

dt) - E[f° [g' *c(t)

Q

-

where

2

g*c(t)

E[f exp(- P t)[

(3.18)

consider:

),

c'

.

The second equality in (3.18)

Note that

follows from the Parseval formula.

.

+ D)(D J c)'(t)

(e

-

(D

J+1

c)'

.

Hence we have

2

E(f°o exp(-pt)[ g*c(t)

(3.19)

]

dt)

/\

Z

- £{/**

(e +»

" —00

Assumption

1

/\

£

(i)(D c)'

g' (w)g'

(w)(DcV

(u)*du.

and the Holder inequality imply that (3.19) is finite.

process

consumption

The

2 )' 1

information process

the

in

assumed

is

economy.

to

does not destroy the

distribution g so that the mapping (3.5)

the

further restrict

will need to

I

with

compatible

be

the

information

structure in the economy:

The Laplace

Assumption 2:

(f:Re(0 > p/2)

plane:

where

a

>

a'

compact sets Kc[a'

,«)

1^ (f)|

where

g,

g(f).

for each real

Further,

.

^

|g(DI

,

transform of

f° r

some

Z

£ (tf,?,Pr

+

19

¥

p.

51),

putting weight only on R

2

)

> p/2 and

which

in

J"

the half

- a + iw

depends

on

<?eK.

imply that g is one-sided,

a subset of)

a'

polynomial

Using Theorem 2.5 of Beltrami and Wohlers (1966,

2,

analytic

is

+

into 2 (0 ,7\Pr

22

+

)

.

1

Assumptions

1

and

and maps (possibly

Capital Accumulation

III. E.

The model is completed by assuming that there is a capital accumulation

that

technology

constant rate

allows

for

of

consumption over

time

at

the

p:

Dk(t) - pk(t) + e(t)

(3.20)

transfer

the

-

c(t),

k(0) given,

where k(t) is the level of the capital stock at period

t,

k(0) is an initial

condition and e(t) is an endowment process of the consumption good.

an element of £ (0 ,T ,Pr

)

and if c satisfies Assumption

1,

If e is

then k(t)

is

an

+

element of f*(Q*,P,Pr

).

The problem facing the consumer is to maximize the objective function

subject

(3.1)

choice

I

Because

ZJc(t).

of

mapping

the

to

(3.5)

the

necessarily consumption itself but

and

control

is a

the

technology

capital

variable

of

derivative of

c,

the

(3.20)

problem

is

by

not

it is convenient to

rewrite the mapping (3.5) as:

a

1

(3.21)

s

- g *Dc,

t

The distribution

g.

integration by parts

The

can always be found using a result that is analogous to

.

representative consumer solves

problem:

23

the

following resource allocation

2

(-l/2)E{rexpC-pt)[s(t)-b(t)] dt)

Max

(MP)

t

2

s(t) - g.*D c + s (t) and

subject to:

Dk(t) - pk(t) + e(t)

by choice of a

D c

process in C

c(t), k(0) given

-

Letting y (t)-D J c for j-0,2,

.

...

I,

the

Lagrangian for this problem is given by:

t - -(1/2) Elf* exp(-pt)\

[g

Q

X (t)[k(t)

k

-

t

*y (t) +

fc(0)

-

-z^v^h 00

where

A

To

and A

j-0,1,

characterize

problem let

g.

,

g«

2

s (t)

b(t)]

-

2

t

"

-

p/Jk(r)dr

7/ 0)

-

J

-

J%(r)dr +

/^(Odr]

> « (odr ]}

J

l-l are lagrange multipliers.

...,

first-order

the

conditions

for

optimization

this

be a distribution constructed in the following manner.

assigns weight gi(t)

be a distribution that,

weight only to the nonpositive real numbers.

to

-t

Let h be

so

that

the

g.

Let

assigns

function given

by:

n -

(3.22)

exp(-pt)

if

t

<

•

otherwise

The n

g^

is

given

by

g^n.

The first-order conditions for the choice of k(t)

for each t>0, are then given by:

24

and y

,

j-0,1,

...

I

(3.23)

EJ-gJ*[ gi

2

*y (t) +

s (t)

E|j^exp(-pt)A

-

(3.24)

A

E|j^exp(-pr)A

j

(3.25)

b(t)]|?(t)j

-

o

ji

ii

(t+r)dr|?(t)| -

(t+r)dr|3f(t)| - 0,

- 1,2,

j

0,

...

M,

+ £|j^exp(-pr)A (t+r)dr|y(t)l -

A

k

q

and

A (t)

(3.26)

p£|j^exp(-pr)A (t+r)dr|?(t)| -

-

k

Although

this

it

0.

k

problem

possible

not

is

general

for

characterize

to

forms

of

a

g,

complete

the

simple

implication

solution

for

to

services

can be derived

Notice that the solution for

£{A (t+r)|£(t)} -

- -A (t)/p J+

(3.27)

for j-0,1,2,

2

consumption good at

of

to Hall's

(3.27)

time

consumption

(1978)

b(t)]|?(t)j -

-

result.

gives

is

a

then imply that

hence

A (t)

yt)//.

marginal utility of a unit of the

the

Hence we have

t.

a martingale,

is

As a result we have:

4-1.

+ s (t)

(t)

utility

...

o

The left side of

(3.26)

Relations (3.24) and (3.25)

A (t).

£J-gJ*[g£*7

to

A (t),

martingale.

the

result

This

that

result

the

is

marginal

analogous

Because the marginal utility of consumption is a

martingale we have:

gj*[s(t+r)

(3.28)

where

I

£{u(t+r)

have

|SF(t))

-

b(t+r)] - g|*[s(t)

substituted

-

0.

To

in

the

allow

-

fact

for

the

25

b(t)] + u(t+r)

that

,

r>0

g f *y (t)+s (t)-s(t)

inversion

of

the

and

where

convolution

in

(3.28),

impose the following condition on g:

I

Assumption 3:

real

l/g(f)

and

> p/2

a'

polynomial P

Assumption

3

J"

is

analytic for

(

f

Re(D >

:

- a + iu where a >

a'

p/2)

.

|l/g(f)|

,

which depends on compact sets Kc[a'

,«>)

Further,

for each

\? (f)|

for some

<

where a€K.

implies that there is a one-sided forward looking distribution,

e

such that

6

i

g^

t

(3.29)

.

t

- A

where A is the dirac delta function.

s(t+r)

(3.30)

Since g

£

is

-

b(t) + g *u(t+r)

|

-

to (3.28) yields:

f

-

forward looking, and £(u(t+r ) ? (t)

E(s(t+r)

(3.31)

b(t+r) - s(t)

Applying g

b(t+r)|?(t)} - s(t)

-

- 0,

)

b(t),

or that s-b is a continuous -time martingale.

(3.30) implies that:

r>0,

This result can be summarized

in the following Lemma:

Lemma:

then

If

the

the mapping g given in (3.5)

process

(s-b)

chosen

by

the

satisfies Assumption

consumer

is

a

1,

2

and

3,

continuous- time

martingale.

I

will denote the time derivative of (s-b)[t]

26

as:

D(s-b)[t] - D£(t).

I

will assume that £{D£(t)

- a dt.

}

Implications for Time -Averaged Consumption

III.F.

Assumption

3

implies that there is a distribution g

such that:

s

g *g - A.

(3.32)

In fact the Laplace transform of the distribution g

will be useful in the following sections.

is

Using (3.32),

This fact

l/g(f)-

the convolution in

can be inverted to yield a mapping from services to consumption:

(3.5)

g'+s

(3.33)

1

-

c.

Differencing (3.33) between

l

g'*[s (t+l)

(3.34)

Since

s

is

-

and t+1 yields:

s\t)] - c(t+l)

martingale

a

t

and

s

-

c(t)

-

s

-

s

,

(3.34)

implies

the

following

representation for the first difference of consumption:

(3.35)

c(t+l)

S

-

c(t) - g*Sl_VZ(r) + g *[b(t+l)

8

-

Although

(3.5)

completely useful

conditions.

2

g *[s (t+l)

characterizes

for

However

empirical

if

the

-

the

27

b(t)]

s*(t)].

dynamics

work because

initial

-

of

of

conditions

consumption,

the

presence

die

quickly

it

of

is

not

initial

enough

then

asymptotically their effect on the consumption law of motion will be small.

»,_

I

2.

will impose the following condition upon the behavior of g *s (t)

Assumption

Assumption 4

such that lim

There exists an v >

4:

implies

that

Note

geometrically.

the

that

conditions

initial

Assumption

imposes

4

:

exp(ut)g *s (t) - 0.

filtered through

conditions

both

g"

die

on

the

2

initial conditions s (t) and the distribution

g.

Given that the initial conditions and g are such that Assumption 4 is

satisfied,

large

for

first-differences in

t,

the

consumption process are

given approximately given by:

(3.36)

The

c(t+l)

error

term

-

g'^^Cr)

c(t) -

in

the

S

+ g *[b(t+l)

approximation due

conditions is of smaller order than

to

the

-

b(t)]

omission

of

the

initial

t.

In the special case of a time-separable model in which c(t) - s(t) and

where b(t) is

a

constant,

(3.36) gives the familiar result that consumption

follows a (continuous- time)

random walk.

observed consumption as being averages

As

of

in Section 2,

I

interpret the

consumption expenditure

over

a

unit of time so that observed consumption is given by:

(3.37)

c(t) -

/^(r),

t-0,1,2,

..

By averaging (3.36) over a unit of time, we have the following theorem:

28

2

If the mapping g given in (3.5) and s

Theorem:

satisfy Assumptions

1,

and the consumer chooses consumption according to problem (MP)

and 4

the observed consumption process (c(t):

8(t)

(3.38)

c(t-l) - g'*v(t) + g

-

,

- 1,2,3,

t

*(/^ i

[b(r)

-

2,

3

then

satisfies:

...)

b(r-l)]dr) + o(t)

J^/^D^Odr

where v(t) -

- /^(t-r)D^(r) + /^<r-t+2)D£(r).

Since

term

the

o(t)

in

throughout

ignored

rest

the

asymptotically

is

(3.38)

of

time-averaged martingale and that the

obtained by "filtering" v(t) + [b(t)

constant,

be

b(t)

then

average representation for c(t)

where g

c

3

the function g

that

(c(t) -c(t-l)

-

(3.38)

implies

a

consumption is

in

g".

:

continuous- time

a

moving

c(t-l) of the form:

,

h(t) -

t

for te[0,l], h(t) -

If a continuous record of c(t)

otherwise.

With

b(t-l)] through

is

c(t-l) - g *D£(t).

-

- h*g

given

difference

w(t)

be

c

c(t)

(3.39)

first

that

will

it

More Restrictions on g are Needed

III.G.

Let

-

Notice

paper.

the

negligible,

(and as a result g

only

we

t-0, 1

,

.

.

.

)

discrete-time

)

t

for

€[1,2] and h(t) -

2

-

-

c(t-l) were available,

t

could be exactly identified.

have

discrete -time

the

the

best

29

we

can

do

is

However,

observations:

what can we learn about the form of g

data,

then

a

to

?

identify

the

representation

discrete-time moving average

time-averaged consumption

for

differences:

c(t)

(3.40)

where £{f(t)

to

-

)

from

map

c(t-l) - X . G°(j)£(t-j)

J

-

and £{e(t)e(r)} -

1

sequence

the

time-nonseparabilities

be

possible

*

We would like to be able

t.

c

function

the

to

)

r

describes

that

g

the

Of course without further restriction it will not

.

identify

to

{G

for

completely

function g

the

c

However,

.

note

that

(3.40) is exactly the relationship that arises in a discrete-time version of

the model in which the decision interval of the consumer is set equal to the

interval

In

data.

the

of

discrete- time

the

model,

reflects the discrete- time time-nonseparabilities

now

we

use

economic

the

discrete-time

interpretation

given

setting

of

representation

function

the

in preferences.

Would

(3.40).

Suppose

from

preferences

the

G(j)

this

the

economic

interpretation be far wrong?

To answer this question, we can use the analysis of Marcet (1986) which

shows

how

construct

finite

sequence

(G (j)}

this

mapping,

let

linear

g (t-3),

...

operator.

values of

c

the

combinations

Let a - g

.

Note

r.

that

constructed as

is

A be

of

the

functions

the

(3.41)

G (j)

a(t)

is

in

general

/Tg (t+j)a(t)dt

^

2

a(t) dt

c

(3.42)

of

L)

tdR

of

2

- -a*g (j)/Pa(t) dt

30

(

j

a

)

the

of

set

C

1

:

?roj'(g |A) where Proj denotes

Marcet (1986) shows that G

r

(in

c

-

C

c

closure

function

a

g (t-1),

the L

.

of

To

all

C

g (t-2),

projection

convolution of g (r)

is given by:

c

g

at

many

m

- -a*h*g (J)-

(3.43)

where a(t) - a(-t).

If G°(j) were an average of the function g (t)

for values of t near j,

then we would expect the discrete- time interpretation to be reasonably good.

However

for

implies

(3.43)

of

all values

that the G°(j)

and G°(j)

t

an average of the

is

will,

general,

in

lead

function g"(t)

poor

to

inferences

about the structure of preferences.

example,

For

consider

model

the

consumption good, as given by (3.8).

l-St if

c

(3.44)

g (t) -

St

exponential

of

In this example,

depreciation

of

the function g

the

c

is:

€[0,1]

t

(1+25) if t e (1,2]

-

otherwise

Further

0(1+6 -St) if te(l,2]

c

(3.45)

Proj(g |A)(t) -

otherwise

where

g

.

-

2

-

l)/(l-5+5 /3)

Further in this

case

the

Notice that if 6--VZ then

.

c

function G (j)

is

zero

for

j

not

and a equal

to

Hence consumption differences have the representation:

zero.

(3.46)

The

2

(S /6

c(t)

c

-

c(t-l) - G (0)e(t).

discrete-time

interpretation

of

this

is

that

preferences

are

time- separable which they are not.

Since the function G

will not in general allow us to obtain a correct

31

]

economic interpretation of preferences,

to

is

the plan for the

that summarize

g*

focus upon several simple forms of

for the estimation of the continuous- time form of g

study the dynamics

intuitive types

These restricted forms of

of time-nonseparability in preferences.

I

rest of the paper

g*

allow

In the next sections,

.

introduced by these preferences and examine how they

perform empirically.

IV.

Habit Persistence

An Illustration:

The

about

assumptions

mapping

the

from

consumption

services

to

introduced so far imply that the process [s-b) is a martingale supported by

stock processes

consumption and capital

In this section,

Assumptions

the

1

I

that are

2

+

of L (0 ,? ,Pr

+

)

.

examine the example of habit and show what restrictions

through 4 place upon the habit model.

economic

violates

potentially

solution

members

I

also examine whether

restrictions

(such

as

nonnegativity of the capital stock and consumption) that are not imposed in

the solution method.

The first assumption to be verified is Assumption

Fourier transform of

1.

Notice that the

for the habit persistence model of (3.12)

g'

is

given

by:

iw

a(-7)

(4.1)

g'(w) -

-

7 +

-

e

a(-7)

1

iu

j +

-

iw-7+€

e

and

w

(4.2)

2

+

w

A

g'

a(-7)

-

7

-

/

+ (e

-

7)

2

-

g'(w)g'(«)

In this case

[e

2

\ 2

A

(w)g' (w)

is

uniformly bounded and the space of consumption

32

consists

processes

of

processes

those

such

that

c

e

+

2

t (Q ,P,Pr

+

).

The

Laplace transform of g is given by:

(4.3)

.

g(

T

-

(1

r

-

a) 7

-

7

and the Laplace transform of g

is

given by:

i'(f) - l/i(f) -

(4.4)

r

- (l-a) 7

Notice that g(f) satisfies Assumption

2

if 7 < p/2 and that Assumption

*

3

requires 7 -(l-a)7 < p/2.

These restrictions allow 7 to be larger than

zero so that the habit effects

Also if 7 <

are

0,

a can be larger that

Although

important.

quite

of past consumption could grow over

time.

so that the effects of the habit stock

1

extreme

these

consistent with the model of Section

it

3,

is

parameter

important

to

settings

are

check whether

they lead to a violation of economic restrictions that are not imposed in

the solution.

To examine this issue, suppose that there is perfect certainty

the service process is a constant, s.

s (t)-0,

consumption at time

t

22

so that

Under the simplifying assumption that

is given by:

s

c(t) - g *s.

(4.5)

If Assumption

plane

a'

[l/g(0)]s.

>

0,

3

were strengthened such that l/g(f)

then as

Hence

the

t

approaches

«,

restriction

33

c(t)

that

is

analytic in the half

would approach

c(t)

be

the

nonnegative

constant

is

the

restriction that l/i(0) >

Assumption

However for many examples, a strengthening of

0.

is not necessary.

3

In the habit persistence model under perfect certainty,

at time

(4.6)

is given by:

t

c(t) - jexp( 7 *t)

-

(

7 /7*)[exp( 7 *t)

then c(t)

0,

If 7

positive only if 7<0.

>

then c(t)

,

then,

exp(7*t) (I-7/7 )s - exp(7 t) [a/(a-l)]s

large that one

23

1]U.

tends to (7/7 )s which is positive only if

(by setting a - 1)

If 7* -

-

*

*

Notice that if 7 <

7<0.

consumption

for

large

t,

7O

-

c(t)

which is again

is

approximately

For this to be positive, a must be

.

*

and 7 >0 implies that 7 <

Hence the economic restriction

0.

which Is a strengthening of

that consumption is positive requires that 7 <

Assumption

- s(l

2.

*

Notice however that Assumption

allows a >

1.

When a —

1,

3

is

satisfied as long as y<p/2.

consumption grows

This

linearly and when a >

1,

*

consumption grows geometrically at the rate 7

.

Although the nonnegativity

restriction on consumption is satisfied in this case,

the restriction that

the capital stock remains positive needs to be checked.

The capital stock at time t is given by:

(4.7)

k(t) - J"%xp(-pr)c(t+r)dr

-

J^exp( -pr )e(t+r )dr

.

Suppose that the endowment is constant over time at the level

(4.8)

k(t) - J"%xp(-pr)c(t+r)dr

-

'e/p

34

.

e,

then:

)

Notice that if 7 >0 (with 7<0) then the capital stock also is positive and

*

grows at the rate 7

*

- 0,

If 7

.

then the capital stock grows linearly over

*

If

time.

then

<

7

stock

capital

the

is

constant

over

time.

As

a

result, once the restriction 7<0 is imposed, no further restrictions besides

those in Assumptions

1,

and

2

are necessary to ensure that consumption and

3

the capital stock have reasonable dynamics.

The last assumption of Section

die

conditions

geometrically as

persistence example

2

8

g *s (t)

2

s (t)

is

3

restriction that the initial

required by Assumption

4.

In

habit

the

- -aexp(7t)x(0) and

- -crx(0)(D-7)J%xp(7%)exp(7(t-r))dr

- -ox(0)(D-7){exp( 7 *t)

(4.9)

the

(7

-

exp(- 7 t)}

-7)

*

- ax (

exp (7

)

t

*

Assumption

4

requires

to

7

be

that

less

zero

or

x(0)-0.

This

additional restriction needed for the empirical work of Sections

5

is

an

and

6,

but it is not a restriction that is implied by the economics of the model.

V.

Empirical Results with Seasonally Adjusted Data

In

this

described

in

section,

I

Section

3,

discussed in Section

b(t)

is

a

2.

empirically

using

the

examine

t.

examples

seasonally-adjusted

In this section

constant for all

some

I

of

the

consumption

model

data

will maintain the assumption that

Under this assumption,

I

show that if the

durable nature of consumption goods is modeled then the model performs much

better than the time -additive model of Section

35

2.

I

also show that there is

.

form of habit persistence

dramatic

evidence

(3.12).

The habit persistence model performs somewhat better if the durable

against

the

pure

However,

nature of the goods is modeled first.

as

given

the model provides

in

little

improvement in the fit of the data over the simple exponential depreciation

model

Exponential Depreciation

V. A.

The nondurables plus services consumption series examined in Section

2

contains several components that should be thought of as being durable.

For

clothing and shoes are components of nondurable consumption.

For

example,

this reason,

Section

2

it is of interest to relax the

time-separability assumption of

and model the durable nature of consumption.

One simple model of durables is given by the nonseparabilities induced

by the mapping (3.8) of Section

applied,

A

g'

A

:

- l/[«

g'( w )g'( w )

that

2

(e

2

2

+ (e-5)

2

]

*

+w )g' (w)g' (w)

As a result,

the solution to

essentially

is

boundedness requirement of Assumption

I.

can be

*

(w)g' (w)

#

Notice

3

the assumed regularity conditions on the mapping g must be checked.

Consider first

(5.1)

Before the analysis of Section

3.

the

1

is

bounded.

Hence

the

satisfied for a negative value of

problem will involve a law of motion

for consumption that is not necessarily a well defined stochastic processes.

This can be seen by considering the Laplace transform of the mapping from

services

Laplace

to

consumption which is

transform of the operator

given by

(D-S).

36

l/g(f)

-

f

-

S,

which

the

is

Hence consumption at time

t

is

given by:

c(t) - Ds(t)

(5.2)

- D£(t)

-

5s(t)

fis(t).

-

Note that the goods process has a component that is the time derivative of a

martingale

and,

as

a

result,

consumption

the

process

is

stochastic process but is a generalized stochastic process.

can tolerate very erratic consumption in this model,

not

a

real