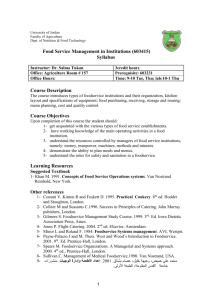

Irish Foodservice Channel Insights Growing the success of Irish food & horticulture www.bordbia.ie

advertisement