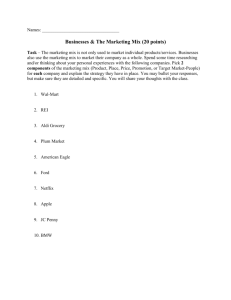

S E G

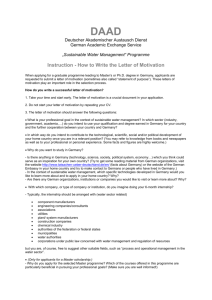

advertisement