S E D

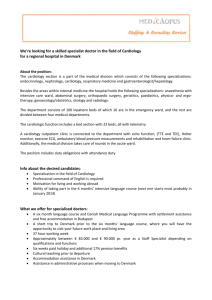

advertisement