Healthy Ageing The Seniors Market

advertisement

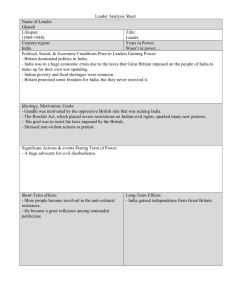

Healthy Ageing The Seniors Market 22nd May 2013 Helen King, Head of Consumer Insight & Innovation Aveen Bannon, Consultant Dietician, Dublin Nutrition Centre Growing the success of Irish food & horticulture Agenda Study background Dynamics of senior market Nutrition gap analysis Global focus and opportunities Bringing it all together Study Phase 1 Global Literature Review Nutritional Science & Marketing Study Phase 1 Phase 2 Global Literature Review Nutrient Gap Analysis Nutritional Science & Marketing 300 Food Diaries Japan, Sweden & GB Study Phase 1 Phase 2 Phase 3 Global Literature Review Nutrient Gap Analysis B2B Interviews Nutritional Science & Marketing 300 Food Diaries Understanding existing Global Consumer Focus Japan, Sweden & GB The challenge & opportunity It is widely accepted that lifestyle, diet and nutrition promote health, longevity and quality of life, yet up to 45% of older persons living at home, in hospitals or nursing homes are undernourished. Source: MCCP Phase 1/ Gibney 2010 Importance of the Senior market Size of the prize: 60+ reaches 1.2b in 2025 2050 2025 19802012 The amount of people over the age of 60 has doubled in this time period 1.2 billion people over the age of 60 There is estimated to be 2 billion people over the age of 60 The over 50’s global population has more than doubled since 1996 Source: MCCPTrendstream™/Phase 1 The Over 50’s are now a significant segment in Ireland They are 1.3 million Irish consumers … There will be a 15% increase in the over 50’s population over the next 5 years. Pattern replicated across Europe. Life Expectancy is increasing concurrently Average Life Expectancy Ireland UK Canada USA Sweden Japan 81 years 80 years 81 years 79 years 82 years 83 years Since 1960 Japan has achieved the highest gains in life expectancy + 10 yrs for women and +7yrs for men OECD 2011 A large, growing and wealthy cohort Aged over 60 as a percentage of the population In GB older people own 80% of the private wealth Over 50% of discretionary income in US is controlled by the over 50’s Declared revenues in Ireland of those over 65 estimated at €6.6 billion Seniors have more cash freedom 1 in 8 Boomers enjoy a disposable income of €1,000 per week 62% of Boomers feel they have enough money to do them A quarter of older households have given a material gift worth €5,000 or more to their children Amongst the Boomers, 49% are not saving at all Source: MCCPTrendstream™/ The Irish Longitudinal Study on Ageing (TILDA) 2011 Attitudes of Seniors Age & attitude Source: MCCP Phase 1/ New Nutrition Business Age & attitude Pre-seniors 40-49 years old healthy & active Source: MCCP Phase 1/ New Nutrition Business Age & attitude Pre-seniors 40-49 years old Young seniors 50-60 years old aware of changing ability healthy & active Source: MCCP Phase 1/ New Nutrition Business Age & attitude Pre-seniors 40-49 years old Young seniors 50-60 years old Middle seniors 60-70 years old managing at least one illness aware of changing ability healthy & active Source: MCCP Phase 1/ New Nutrition Business Age & attitude Grand Seniors 80+ years old fragility & loss of independence Seniors 70-80 years old Pre-seniors 40-49 years old Young seniors 50-60 years old Middle seniors 60-70 years old managing at least one illness aware of changing ability healthy & active Source: MCCP Phase 1/ New Nutrition Business health issues & acute illness Seniors want to be impervious to ageing 1 in 4 of 65-74 year old continues to earn a wage in December 2012 Of the 7.3 million people ages 55-64 5.3 million work full time and 2 million work part time 23% of 65-74 cited wages as an income source Source: MCCPTrendstream™/ Aviva Real Retirement Report GB Winter 2012 Seniors strive to retain what they have to stay independent 50% of older people suggest that they are worried about becoming a burden as they age ‘I'm not afraid of getting old, I’m afraid of not getting old and dying healthy’ ‘The only thing with me is health, health is everything’ ‘you need to be in the mind-set of looking after yourself’ I’ve become more philosophical, I think don’t put too much butter on the toast’ Source: MCCPTrendstream™/ Pfizer Health Index 2012 Mentally and physically more active than ever before 1 4 66% sought out new groups of friends 60% of Boomers have made changes to their home in the last 12 months 5 2 70% of Boomers are positive towards travel and visiting places 54% taken up a new hobby 3 33% of men named getting a better work life balance as their biggest priority 6 56% of Boomers agree that technology has made their lives easier Experian Credit Expert 2011/Aviva Real Retirement Report 2012/Pfizer Health Index 2012 Healthy life years are now a necessity In the US 63% say they might have to push back their expected retirement date because of current economic conditions In the GB 11% of those in their 70s are in some form of paid employment In GB, the number of workers in paid employment 65+ rose from 412k in 2001 to 870k 2010 Between 2006-2016, 93% of the growth in the US labour force is estimated to be amongst workers over the age of 55 Source: MCCP Phase 1/ Nesta 2009/Pew Research Center’s Social and Demographic Trends Project 2009 Healthy living Focus has shifted from number of years towards ‘healthy life years’ Source:MCCPTrendstream™/ Phase 1 Seniors are ageing physiologically faster "Despite their longer life expectancy over previous generations, U.S. baby boomers have higher rates of chronic disease, more disability and lower selfrated health than members of the previous generation at the same age," Dr. Dana E. King/Huffington Post 2013 Malnourishment is becoming the norm, most notably in hospitals Source:MCCPTrendstream™/ Phase 1 More cost effective to keep people at home & healthier % Community Home care & out patient Hospital Institutions Source: MCCP Phase 1/ Furman 2006 Malnourished At risk of malnutrition Normal 3 9 23 20 26 43 45 48 71 47 32 32 Social isolation is a key driver of malnutrition Many elderly people are unable to comply with balanced nutrition – meal skipping is prevalent Nutritional Analysis 300 Food Diaries Japan Sweden Britain + Questionnaires Age Profile Age 60% 50% 40% 30% 20% 10% 0% 50-59 60 - 69 Sweden Source: Bord Bia/ MCCP Phase 2/ Gfk Japan 70 - 79 Britain 80 + Japan Body Mass Index (BMI) 100% 75% Sweden Britain Japan 50% 25% 0% BMI below BMI within BMI above recommended recommended reommended range range range • Japan had the largest proportion within the recommended BMI range • 60% of Britain respondents were above the recommended BMI range Source: Bord Bia/ MCCP Phase 2/ Gfk Japan Do you take supplements, drinks or alternative medicines ? 40% 30% Sweden Britain 20% Japan 10% 0% Sweden Source: Bord Bia/ MCCP Phase 2/ Gfk Japan Britain Japan Number of ailments highest in Britain Number of ailments Country Japan Sweden Britain 0 1-2 3+ 50 - 64 37.5% 62.5% 0% 65 + 28.3% 63.3% 8.3% 50 - 64 25.4% 64.4% 10.2% 65 + 17.1% 68.3% 14.6% 50 - 64 21.4% 67.1% 11.4% 65 + 20.0% 53.3% 26.7% Age category Age category Age category Percentage of individuals living alone 60% 50% 40% 30% 20% 10% 0% Sweden Britain Japan had the lowest proportion living alone (11%) Source: MCCP Phase 2/ GFK Data 2012 Japan Typical Meal Items Country Breakfast Lunch Dinner Beans, noodles, rice, vegetables, fish, seaweed, tofu, miso, daikon Snacks Japan Rice, vegetables, seaweed, fish, bread, egg, fruit, yogurt Beans, noodles, rice, vegetables, fish, seaweed, tofu, miso, daikon Sweden Oatmeal, cheese, bread, fruit, yogurt, sour milk Pasta, rice with Potato with meat meat, chicken , (particularly sausage), fish and cheese fish vegetable burger meals – take away Fruit, crackers and cheese, bread and butter, cakes Britain Breakfast cereals, toast, coffee Sandwich – mainly ham or cheese Biscuits, yogurts, fruit, crisps, cakes Fish & chips, Curry & rice, Meat, vegetables and potatoes, Ready meals, Pies,Take aways Occasional sweet foods Meal skipping is cause for concern Breakfast Sweden Britain Dinner Snacks X X Japan • Lunch X Tendency in Sweden to eat a large breakfast and skip lunch while Britain tend to skip breakfast Source: Bord Bia/ MCCP Phase 2/ Gfk Japan Dietary Observations Sweden - high intake of fruits , butter, dairy, fatty meats. Japanese - high intake of fish, rice and condiments Swedish - high protein diets for weight loss Britain - low calorie diets for weight loss Britain rely more on conveninece meals Japan showing a trend of westerisation choosing high fat and sugary foods in 50-64 age group Source: Bord Bia/ MCCP Phase 2/ Gfk Japan Calorie intake % Energy RNI 160% 140% 120% 100% Sweden 80% Britain 60% Japan 40% 20% 0% Sweden Britain Japan Energy Breakdown Recommended Energy Breakdown 15 – 20 % 50 – 55 % 30 – 35 % Source: Bord Bia/ MCCP Phase 1&2 / Gfk Japan/ Tokudome et al 2004 41% 20% 39% MACRONUTRIENTS: Fat, protein & carbohydrate Not all fats are bad SFA – Saturated Fat – These are fats that can raise cholesterol. MUFA – Monounsaturated fat – These are considered to be cardio protective fats. PUFA – Polyunsaturated Fats; omega -3 & omega 6 The ratio of Omega 3 to Omega 6 in the diet influences health Source: Bord Bia/ MCCP Phase 2/ Gfk Japan Carbohydrates – necessary for fuel and valued source of fibre Carbohydrate Breakdown Grams (g) 120 110 100 90 80 70 60 50 40 30 20 10 0 Sweden Britain Japan Fibre (AOAC) Sugar Recommended daily intake of fibre 24g - - - - Source: Bord Bia/ MCCP Phase 1/ Gfk Japan Starch Protein Sarcopenia – Nutritional Prospective • Sarcopenia is the loss of muscle mass and coordination that results from the process of aging • Protein plus regular exercise imperative • Timing of protein intake Source: Bord Bia/ MCCP Phase 2/ Gfk Japan Protein intakes – g/day 140 117 120 100 81 80 68 60 40 20 0 Sweden Britain Japan Quality of Protein relevant Amino acid Leucine stimulates muscle growth. Leucine is present in egg, fish, meat and poultry Source: Bord Bia/ MCCP Phase 2/ Gfk Japan Micronutrients – Vitamin D • Vitamin D is critical to muscle & bone health • Sources: Sunlight, eggs, cod liver oil, liver, fortified foods • The elderly population are at risk because of the amount of time spent indoors, covering up due to feeling cold. Source: Bord Bia/ MCCP Phase 2/ Gfk Japan Vitamin D % RNI 70% 60% 60% 50% 40% 37% 25% 30% 20% 10% 0% Sweden Britain Japan Vitamin D deficiency is associated with osteoporosis & sarcopenia Source: Bord Bia/ MCCP Phase 2/ Gfk Japan Minerals – calcium, magnesium, Iron, iodine, zinc & selenium Calcium & Magnesium Intakes % Magnesium RNI % Calcium RDA 150% 133% 121% 100% 50% 81% 78% Sweden Britain 50% 0% 0% Sweden • 172% 150% 95% 100% 200% Britain Japan Japan The interplay between magnesium, calcium & vitamin D are essential for immune system, bone health, metabolism & heart health and blood pressure Source: Bord Bia/ MCCP Phase 2/ Gfk Japan Incidence of Osteoporosis 9% 10% 6% 6% 5% 0% Sweden Sweden Britain Britain Japan Japan Britain - lowest intakes of magnesium, calcium & Vitamin D Big variations in Iodine intakes % Iodine RNI 1885% 2000% 1500% Sweden 1000% 500% Britain 274% 0% Sweden • • • Japan 79% Britain Japan Iodine is required for metabolism. Prolonged iodine deficiency may cause goitre or hypothyroidism Seafood, seaweed & dairy are good dietary source of iodine Source: Bord Bia/ MCCP Phase 2/ Gfk Japan Electrolytes – are ionic solutions that keep the body properly hydrated so muscles and nerves can function properly. They are also crucial to the release of toxic internal waste High Sodium v’s low potassium intakes Increase heart disease risk % Sodium RNI 400% 100% 281% 300% 75% % Potassium RNI 83% 73% 71% Sweden Britain 50% 200% 174% 157% 25% 100% 0% Sweden • • Britain Japan Japan Low intake of potassium – Good dietary sources include fruits, vegetables and potatoes High salt intake secondary high intakes of processed foods in Europe & condiment usage in Japan. Heart Disease & Diabetes…a global issue? 20% 17% 16% 15% 15% 10% 13% 13% 10% 10% 9% 6% 5% 0% Sweden Raised BP & cholesterol Britain heart condition Japan Diabetes Blood pressure & cholesterol was the leading condition in Japan and Britain These issues were also in the top 3 in Sweden Diabetes most prevalent in Britain (13%) Source: Bord Bia/ MCCP Phase 2/ Gfk Japan Core Nutritional Findings • Sarcopaenia – Protein Intakes & Meal Skipping • Obesity Risk - Poor fibre, high fat & sugar intakes and meal skipping • Heart Risk – Low MUFA, high SFA intakes, high salt, low potassium, low fibre intake • Bone health - Poor vitamin D & Magnesium intakes Industry focus & opportunities ‘Elderly nutrition is the next big golden seam in the European food industry… What everyone is struggling with is how to tackle it Everyone even knows the ailments but how do you get it to market?’ - B2B Interview Source: MCCP Phase 3 B2BInterviews It’s a vicious Cycle: To be well you need to eat well Change in body composition Muscle/weight loss Sensory factor decreases appetite Decrease in Mobility Source: MCCP Phase 3 B2BInterviews Natural choice of diet does not arrest the cycle ‘The diets they naturally choose would consist of cup of tea and brown bread – there’s very little cooking and an overall lack of interest of food’ Barriers to commercialisation Health Overt health can equal punishment Branding & positioning, health benefits need to be clearly explained Barriers for suppliers Health Channel & Comms Overt health can equal punishment Branding & positioning, health benefits need to be clearly explained Communication through health care professionals or carers Messaging: not patronising, category communication e.g. lifestyle nutrition Barriers for suppliers Health Overt health can equal punishment Branding & positioning, health benefits need to be clearly explained Channel & Comms Communication through health care professionals or carers Messaging: not patronising, category communication e.g. lifestyle nutrition Product Fortification, portion size, nutrition, natural quality of ingredients, personal taste, packaging – all have to converge Consumer Barrier: Connection exists but not in depth Bone/joint health: calcium understood but not necessity for protein fortification Heart health: Cholesterol – rise of statins (work to keep cholesterol low) Mental health – agility specifically Alzheimer’s Diabetes – obesity means rise of diabetes issues: foods that control sugar intake Source: MCCP Phase 3 B2BInterviews Consumer Barrier: The connection exists but not in depth Bone/joint health: calcium understood but not necessity for protein fortification Heart health: Cholesterol – rise of statins (work to keep cholesterol low) Mental health – agility specifically Alzheimer’s Diabetes – obesity means rise of diabetes issues: foods that control sugar intake Source: MCCP Phase 3 B2BInterviews Communicate with their mind-set not their age Sensitive to age Don’t want to be patronised Appreciate their needs being considered Source: MCCP Phase 3 B2BInterviews Areas of industry focus Cognitive health: dementia, alertness and sleep Source: MCCP Phase 3 B2BInterviews Areas of industry focus Cognitive health: dementia, alertness and sleep Sarcopenia: ‘the age of protein is approaching us’ Source: MCCP Phase 3 B2BInterviews Areas of industry focus Cognitive health: dementia, alertness and sleep Sarcopenia: ‘the age of protein is approaching us’ Dysphagia: poor swallow Source: MCCP Phase 3 B2BInterviews Areas of industry focus Cognitive health: dementia, alertness and sleep Sarcopenia: ‘the age of protein is approaching us’ Dysphagia: poor swallow Digestive health: enzymes, predigesting proteins Source: MCCP Phase 3 B2BInterviews Areas of industry focus Cognitive health: dementia, alertness and sleep Sarcopenia: ‘the age of protein is approaching us’ Dysphagia: poor swallow Digestive health: enzymes, predigesting proteins Heart health: omega 3, omega 12, flaxseed Source: MCCP Phase 3 B2BInterviews Areas of industry focus Cognitive health: dementia, alertness and sleep Sarcopenia: ‘the age of protein is approaching us’ Dysphagia: poor swallow Digestive health: enzymes, predigesting proteins Heart health: omega 3, omega 12, flaxseed Calcium Source: MCCP Phase 3 B2BInterviews Opportunity: Miniaturisation For example: Consumers need protein, lipids, fibre – All things that don’t easily go into a tablet due to volume required – Need to figure out a way of getting correct amounts into a consumer in a way that they are willing to consume, typically beverages Source: MCCP Phase 3 B2BInterviews Opportunity: Modified texture products Poor swallow : Currently a recognised market in the US Source: MCCP Phase 3 B2BInterviews Muscle problem : thickening with starch usually, proteins are used in drinks due to low viscosity But starch/texture changes impact flavour/smell. Combinations must be managed Opportunity: Rightsizing & snacking •Many of this target audience live alone •Smaller portions make life easier and make it more likely they will purchase/eat Rightsizing Opportunity: Rightsizing & snacking •Many of this target audience live alone •Smaller portions make life easier and make it more likely they will purchase/eat Rightsizing •Snacking is inevitable especially with meal skipping, make it healthy not detrimental •Lower salt content food and snacks Healthy Snacking Opportunity: Protein and fortification of foods • Generally nutrition is going the way of more protein/veg and less carbohydrates e.g. Sports nutrition • Focus is currently on functional food/fortification of food rather than supplements • Nutritional supplement products won’t change much over the next 5-10 years Sports Nutrition Functional Foods Supplements Source: MCCP Phase 3 B2BInterviews Opportunity: Re-purposing What products are in your portfolio that could be repurposed for seniors? Your product may not be limited to who you think is your customer. 25% of baby food manufactured by Hipp is eaten by adults -This is because it is easy to digest and nutritionally balanced Source: MCCP Phase 1/ Claus Hipp/ Asher 2011 Packaging is a crucial factor ... Most effective way to generate loyalty is to introduce delivery systems that genuinely make life easier for mature consumers: – simple & easy to use/convenient – Legibility is a crucial factor 81% say ‘easy to open’ is a influencing factor to purchase compared with 58% of 25-34 cohort 88% of consumers look at the label on the food that they purchase at least some of the time Summing it all up ... Health Benefits will become greater source of financial burden Source: MCCP Phase 1/ JSANCO based on the Ageing Report 2009. DG SANCO European Commission /Jackson et al 2010/* Bloomberg BusinessWeek 2012/ **Yanzhong Huang The New York Times 2011 More cost effective to keep people at home and healthier Source: MCCP Phase 1/ Furman 2006 Three main areas Social Dynamics Health Education Commercial Solutions Social Dynamics Isolation & Skipping Meals Meal Planning At home services Hospitals Channel Direct delivery Multi channel Social Interaction Activity programmes Careful Communication Health Education Overcoming Consumer Barriers General Heart Healthy Messaging Fat levels - Increase MUFA decrease SFA Increase ratio of Omega 3:6 – via oily fishes, nuts & seeds Sarcopenia Connect protein to muscle loss Promote exercise and timing of protein intake Commercial Opportunities & Solutions Fortification & Product Delivery Sarcopenia via amino acids to increase protein intake Sports nutrition - link to casein Tryptophan-helps release serotonin to help sleep Leucine- triggers muscle growth Commercial Opportunities & Solutions Fortification & Product Delivery Sarcopenia via amino acids to increase protein intake Sports nutrition - link to casein Tryptophan-helps release serotonin to help sleep Leucine- triggers muscle growth Increase Fibre intake – breads, cereals and snack foods, soups Make convenience/pureed food less processed/sugary Salt - lower content in food and snacks Healthy snacks Repurposing / Pack Formats/ Portion sizes/ Textures/ Flavours Connecting main areas Social Dynamics Health Education Commercial Solutions Thank you www.bordbia.ie Helen King, Head of Consumer Insight & Innovation Aveen Bannon, Consultant Dietician, Dublin Nutrition Centre Growing the success of Irish food & horticulture