The changing State of the Nation 26 February 2009

advertisement

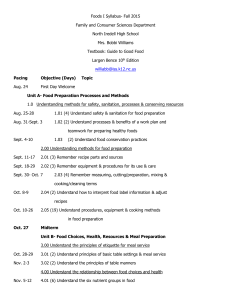

The changing State of the Nation Mark Thomson – Strategic Insight Director 26th February 2009 The State of the Nation 1. Life is not so easy in 2009 6. Summary 2. Changing priorities 5. New opportunities Agenda 3. Impact on key occasions 4. Has health gone away? Life is not so easy in 2009 Job insecurity Falling house prices Rising energy bills What’s for dinner? GfK Group Consumer Tracking How to Survive 2009 - Lucien van der Hoeven February 2009 Top of Mind 2008 Collective knowledge Brand Manufacturers: Retailers: 1. Corporate Responsibility 1. Corporate Responsibility (á 8) 2. Consumer Health and Nutrition 3. Retailer-Supplier Relations (á 3) (á 6) 3. Consumer Health and Nutrition (â 1) (á 11) 4. Technology / Supply Chain (â 1) (á 5) 5. The Economy / Consumer Demand (á 9) 6. Human Resources 6. The Retail/Brand Offer (á 10) 7. Technology / Supply Chain 8. Internationalisation 7. Human Resources (â 3) 8. Competition (â 6) 9. The Retail/Brand Offer 10. Competition 2. Food Safety (à2) 4. The Economy & Consumer Demand 5. Food Safety 6 Source = Cies – The Food Business Forum – Top of Mind 2008 (â 4) (à 8) 10. Retailer-Supplier Relations (â 4) 11. Customer Loyalty and Marketing (â 2) 9. Customer Loyalty and Marketing (â 5) (â 7) (á 10) 11. Internationalisation (à 11) (â 7) (à 9) Consumers generally enter the store with occasion based problems. “I want something healthy” “Friends are coming round” “I fancy indulging myself” “I don’t have time to cook tonight, it has to be easy” “What can I give the kids in their Lunchbox” Motives that equal cost are starting to stall A more austere and cautious consumer? Millions of occasions consumed for Indulgence 6400 6200 6000 5800 5600 5400 5200 5000 12 12 12 12 12 12 12 12 12 12 12 12 12 12 m/e m/e m/e m/e m/e m/e m/e m/e m/e m/e m/e m/e m/e m/e Aug Nov Feb May Aug Nov Feb May Aug Nov Feb May Aug Nov 2005 2005 2006 2006 2006 2006 2007 2007 2007 2007 2008 2008 2008 2008 The State of the Nation 1. Life is not so easy in 2009 6. Summary 2. Changing priorities 5. New opportunities Agenda 3. Impact on key occasions 4. Has health gone away? ’91 Recession Impact: Spend less eating in Half of us said we would spend less eating out 24% Spend less eating out ’91 Recession Impact: 50% 1 in 4 said they would tighten the budget in home TNS WorldPanel Usage % Agreeing Source: TNS FFP Recession Report 1991 What about now? The same results as in the last recession. Eating out get’s hit first and eating in is well down the list…. “If you were now forced to, which items would you actually cut back spending on ?” 20.3 18.5 1st choice 2nd choice 19.9 17 12.5 10.7 10.5 10.3 11.3 12.4 8.8 6.7 5.5 3.8 4.1 4.9 6.8 5.4 3.5 3.1 3 0.8 l s s oil ne ills ink TV tro cco tie r ou T o b y i / e l a d e h i k & ob are old lan rt P tS o fac ep l T l h d i o C n F e l e h o Ea e b p r / & i sc Fo ns rsn ol ng g& isu nm Mo i a i e M h n e r s i a P o t L u T / th t er lth Al c Ho n a Clo E He sic u M go tin ut ar e w ot Worldpanel on-line questioning Source: TNS Worldpanel On line Interviews Thinking of going to the Mediterranean this summer? What about the Isle of Harris? “The economic downturn WILL impact on holiday plans” TNS Travel and Tourism Omnibus Survey 2008 (2,000 adults across GB) Those agreeing Feb 2008 – 7% July 2008 – 19% January 2009 – 33% And the cost of going to the pub just keeps on growing …. … Assuming you can find one that is open Concerns about recession are causing 35% of on trade visitors to go out less often and 41% to spend less when they do. Source: TNS Alcovision Base: All respondents from June 2008 (300) Retailers now trusted more than Banks, due to perceived better response to Economic downturn % of people who have no trust in….. 25 Source: McCann Erickson's Moodier Britain survey Received Friday 28th Nov 2008 6 Banks Supermarkets What is more interesting about Tesco at present is a willingness to push at new frontiers. The decision to wrestle full control of the Tesco bank from its partner Royal Bank of Scotland suggests a major push into consumer banking at a time when trust in the high street banks is at a low ebb. Daily Mail 3rd December Fastest GROWTH 2008 vs 2007 (% change) 0 1 2 3 4 5 6 7 8 9 10 Q31 Support regional producers Q28 Buy same so little thought Q9 Level headed shopper Q10 Look for healthy products Q16 Price most imp factor Q7 Adverts help find prd avail. Q6 Find out abt new prods on TV Q3 Family meals eaten at table Q33 Choose local if I could Q15 Stick to shopping list •British-ness •Habit/routine •Price •Health •Formality (table) •Control Change vs 07 Fastest DECLINES 2008 vs 2007 (% change) -4 -3.5 -3 -2.5 -2 -1.5 -1 -0.5 Q2 Organic healthier •Organic •Convenience •Shopping fun •GM concern •Fairtrade Q37 More aware of good foods Q46 GDA information useful Q14 I am a good cook Q32 Rely on convenience prods Q49 Wheel of health good Q17 Find shopping fun Q29 Avoid GM Foods Q22 Organic better for envirmnt. Q30 Should buy more Fairtrade 0 The State of the Nation 1. Life is not so easy in 2009 6. Summary 2. Changing priorities 5. New opportunities Agenda 3. Impact on key occasions 4. Has health gone away? Price inflation has a direct knock on effect with the meal occasion. Price inflation The fixture The shopper The meal occasion There are several ways in which shoppers can reduce spend I need to reduce spend! Buy less categories Trading Down Retailers Buy on Offer Spending less Money Trade down price tiers What impact has this had on the meal occasion? I need to reduce spend! Eat less often Consume more staples Fewer treats Plan ahead more Cook more from scratch Use leftovers So how are consumers cutting back? Eat less often No Consume more staples Yes Fewer treats Yes Cook more from scratch Yes Use leftovers Yes The State of the Nation 1. Life is not so easy in 2009 6. Summary 2. Changing priorities 5. New opportunities Agenda 3. Impact on key occasions 4. Has health gone away? Recent headlines emphasising health benefits, relaunch of superfoods? So what is the main difference to the last recession in the early 1990’s? Prevalence of obesity (BMI > 30) in UK women 1994 - 2002 Tackling Obesities: Future Choices http://www.foresight.gov.uk 2007 They say dog’s often mirror their owners! Despite reduced levels of dieting overweight concern is high and growing (but only on in three overweight show concern) 18 17.8 Overweight concern 17.6 17.4 17.2 17 16.8 16.6 16.4 16.2 6 m/e Nov 2006 6 m/e Nov 2007 6 m/e Nov 2008 Dieting on the slide (yet overweight concern growing) 20 Been on diets in past 12 months 18 16 14 12 10 8 6 4 2 0 6 m/e Nov 2005 6 m/e Nov 2006 6 m/e Nov 2007 6 m/e Nov 2008 Less salt, more fibre and less Sats. Things looking better? % Change in Spend Y on Y to September ‘08 % Change in Spend Y on Y to March ‘08 Energy kcal 0.4 Protein Kg 0.5 Fibre Kg 0.8 0.4 Carbohydrate Kg 2.1 0.2 Sugars Kg 1.8 0.5 Fat Kg 1.3 0.8 Saturates Kg Sodium Kg 1.6 0.9 0.6 -1.0 0.3 -1.0 TNS WorldPanel Nutritional Database Kids are the fastest growing group of consumers to adopt 5 a day 12 m/e Aug 2005 2.5 12 m/e Aug 2006 12 m/e Aug 2008 2.9 2.7 2.8 2.8 2.7 2.6 2.6 2.2 Total 12 m/e Aug 2007 2.3 2.4 Children 2.5 2.4 2.5 2.5 2.5 Adult Males Average number of fruit & veg portions consumed per day TNS WorldPanel Usage Adult Females The State of the Nation 1. Life is not so easy in 2009 6. Summary 2. Changing priorities 5. New opportunities Agenda 3. Impact on key occasions 4. Has health gone away? In Home focus Comforting Familiarity Filling Entertaining Food mileage Still on the radar Health Home cooking Kids Values Replicating out of home treats will be an area of opportunity in 2009. 1 Roast Dinner 2 Pizza 3 Sandwiches 4 Fish & Chips 5 Stew/Casserole 6 Pie & Mash 7 Spaghetti Bolognese 8 Soup – as a meal 9 Lasagne 10 Shepherd’s Pies The Top 10 List is Main Evening Meals, Takeaway not included. Homemade & Manufactured Meals Social/Entertaining occasions have grown by 14% over the last year. +178 million occasions 64% of these occasions occur at the weekend So what are people consuming at these occasions? Younger Adults Food Kids Male Unisex Female Less of this Drink More of this TNS WorldPanel Usage 52 W/e November 2008 Index – Consumers Groups versus All Consumers Food and Drink security, a big theme in 2009 Can you stretch, or increase depth Breakfast Lunchtime Teatime Evening meal Giving consumers ideas to eat your product every day, or ideas to use your product as a cooking component. Food and drink remains important but our needs around it ARE changing Consumers now looking for familiar meal centres and food security Social entertaining becomes even more important as Out of Home meals decline Health will not go away, but does not command the same share of mind as it did in 2007. Home cooking continues to grow, as well as making food go further within the home Regional/local theme from 2007 still evident Mark.thomson@tns-global.com Tel: 07943 811715