Foodservice in the USA Jason Hawkins Kerry Americas - Brands

advertisement

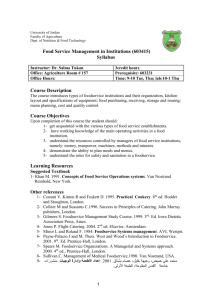

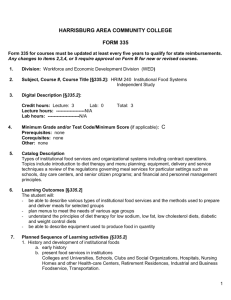

Foodservice in the USA Jason Hawkins Kerry Americas - Brands Kerry Foodservice Brands Overview of Kerry’s Foodservice Brands in the US Perspective on the US Foodservice Channel Impact of the Current Economic environment Recap & Discussion 1 Kerry Foodservice Brands in the US Kerry’s US Brands Business Key Channels Traditional Foodservice Restaurants Non-Commercial (Colleges, Hospitals, B&I) Travel & Leisure Specialty Coffee Coffee Roasters Coffee Shops Cash & Carry/Club Store Foodservice Operator Purchases Consumer Purchases 3 DaVinci Gourmet Brand Product Portfolio Flavored Syrups Over 140 Flavors Sugar Free (100% Splenda) Signature & Classic Sauces 10 Flavors Chocolate covered Espresso Beans Key Customer Segments Specialty Coffee Restaurants 4 Oregon Chai Brand Product Portfolio Liquid Chai Tea Concentrates Regular Concentrates (1:1) Super Concentrates (5:1) Dry Latte Mixes Capp Machine Mixes Single-Serve Packets Key Customer Segments Specialty Coffee College & University 5 Jet Brand Product Portfolio Fruit Smoothie Mixes 11 Innovative Flavors Easy to use – pour over ice & blend Blended Beverage Bases Formulated for high quality frappes Key Customer Segments Specialty Coffee Restaurants College & University 6 Golden Dipt Brand Product Portfolio Breadings & Batters Panko Japanese Bread Crumbs Multi-Purpose Coatings Pre-Dip Batters Bakery & Griddle Mixes Cakes, Muffins Pancakes, Waffles Key Customer Segments Restaurants 7 Perspective on the US Foodservice Channel Kerry Foodservice Distribution Model Closed Dist. (Chain) Nat. Chain (Applebee’s) Kerry Broadline Dist. (Sysco) Reg. Chain (Forza Coffee) Re-Dist. Independent Spec. Dist. (Bob’s) (Coffee) 1 20K+ 800K+ 9 Top 5 Broadliners Control 30% of Market Share of Market 2006 Top 5 Broadliners 1996 13% 30% 35% Other Broadliners 27% Specialists/ Club Stores 43% $216B 52% $144B 10 Source: Technomic Go-to-market considerations Direct or indirect Sales force Determine optimal distribution solution for your business Utilization of Brokers Brands and/ or private label platform Local market knowledge is fundamentally important 11 Source: Technomic Current Foodservice Issues Managing through a recession Sustainability Localisation of offering – menu/ flavor development Labeling and regulations 12 Source: Technomic Challenges of the Economic Environment Disposable Personal Income (DPI) DPI Peak Due to Tax Rebate; Otherwise Flat % Change vs. Prior Quarter 7.3% Tax Rebate Impact 1.4% -0.6% 0.1% 4Q-07* 1Q-08* 2Q-08(F) 3Q-08(F) -0.1% 4Q-08(F) *Preliminary Source: Blue Chip 14 Foodservice Channel Performance US Foodservice Industry Food & Non-Alcoholic Beverages Only Total Restaurants & Bars 2006 93.7 4.5% 2007 99.0 5.7% 2008 F 98.7 -0.3% Total Beyond Restaurants 78.7 3.3% 79.6 1.1% 73.2 -8.0% Total Foodservice 172.5 4.0% 178.6 3.5% 171.9 -3.8% Numbers may not add due to rounding. 2008 data are preliminary. Source: Technomic, Inc. 10-08 15 Challenges in Today’s Environment Average Price Increase This Year 9% 8% 7% 6% % Taking Price 5% 5% 55% 60% 6% 5% 59% 70% 77% Operators 87% 100% 95% Manufacturers 2005 2006 2007 2008 16 Source: Technomic Surveys; Distributor Intelligence Service Real Restaurant Sales Moving Downward 12-Month Moving Average % Change vs. Prior Year Recessions 7. 0% Mar 1994 6. 0% Sep 2000 Apr 2004 5. 0% 4. 0% 3. 0% Dec 1990 2. 0% May 1993 1. 0% Nov 2001 0. 0% -1. 0% Source: US Census Bureau; Technomic, Inc. 07 20 04 20 01 20 98 19 95 19 92 Nov 1991 19 19 89 -2. 0% 17 Consumer Insights 91% of consumers cutting back – eating out less frequently Cutting back more at Full Service than limited service restaurants Recognition of need for price increases 75% attribute to rising gas/ ingredients Would prefer gradual increases by operators Consumers still willing to pay for “high quality” and “premium” ingredients Retailer prepared meals have growing appeal Source: Consumer Pricing Strategy Report; Technomic, Inc. 18 Resulting Actions Manufacturer Actions Consolidating SKUs Reformulations “Firing” Unprofitable/ Unstable Customers Distributor Actions Focus on Value-Add services Supply chain optimization to control costs Operator Actions Focus on Value to increase traffic Control increased costs by reducing food waste and re-engineering menus (reducing portions, expensive ingredients, etc) Consumers Cutting back on eating occasions Quality still important Industry Consolidation 19 Conclusions Recap US Foodservice market is dominated by some Key players Foodservice market is extremely complex Robust distribution and supply chain model is critical Multiple go-to-market options Direct Indirect Partner Branded/ PL Current economic environment Consolidation inevitable across all players (manufacturers/ operators) Must bring value added services and programs to customers Critical to manage customer and product profitability Cost & Price management is challenging 21 Thank You Questions ?