Poland Market Overview Bord Bia, Frankfurt November 27

advertisement

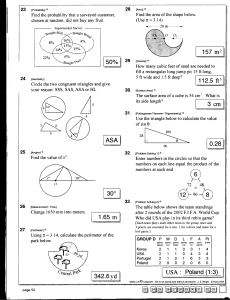

Poland Market Overview Bord Bia, Frankfurt November 27th 2008 Polish Market Overview • Population: 38.5 million. The main cities are Warsaw (1.6m), Lodz (783,700) and Krakow (734,400) • Language: Polish (Official) • Currency: Polish Zloty • Joined the EU in May 2004 • One of the lead economies in Central and Eastern Europe due to its high population. Market Overview • Great wealth gap between the country and the other Western Countries. GDP per capita €7,774.08 (2007) v Germany €28,012 (2006) • GDP growth rate predicted to be 4.7% in 2008 (IGD, 2007) • Inflation rate: 3.1% for 2008 (IGD, 2007) • Unemployment one of the highest in Europe,12.1% but is falling (IGD, 2007) • Consumer spending increasing (+18.9% 2007 v 2006) • VAT on goods and services: 7% • VAT on Food: 3% for unprocessed, 7% for other foodstuffs Irish Food Export Performance Irish Food exports to Poland 2007 Beverages 10.9% Live Animals 0.2% Meat 25.2% Miscellaneous Edible 41.4% Total Exports: Dairy 1.2% Fish 8.3% €46.7mn Vegetables and Fruit 1.5% Sugars 3.5% Animal feeds 5.9% Source: CSO Food and Drink Statistics 2007 Coffee,tea, cocoa, spices 1.8% Key Consumer Trends in the Market • Solid growth in retail sector: 11.9% in 2006 (IGD, 2007). • Per capita spending high in large cities (60% higher than national average), weak in poor rural areas. • Roughly half of retail sales in Poland are generated through the food retail sector. • Polish consumers are known to be extremely savvy and price conscious. • A recent law (2007) has come into force in Poland restricting the future size of Hypermarkets, so compact hypermarkets are becoming popular (IGD, 2007). • 20% of Consumer expenditure is on food and non alcoholic beverages (IFE, 2008). Retail Grocery Market • • • • • • Grocery Retail Value: €38.9 billion (Agri Food, 2008) Hypermarkets leading store format, 15% of national distribution. Tesco is the leading player. Others include Metro Group (Real), Carrefour, Auchan, Schwarz Group (Kaufland). Metro experienced a 9.4% growth in sales in 2006 to reach €2.687 billion (IGD, 2007). Supermarkets - Tesco, Carrefour, Intermarche, Polomarket, Rewe Discounter: Dominated by Biedronka (Jeronimo Martins), Schwarz Group (Lidl), Dansk Supermarked, Auchan’s Atak. Aldi Nord has recently entered the market (2007). Discounters have had heavy growth with Biedronka’s sales up 18.9% in Q1 2007. Retail Market by Type Grocery Market by type Discounter 32% Hypermarket 36% Source: IGD 2007 Cash and Carry 2% Supermarket 30% Retail Grocery Market • • • • Independent neighbourhood stores play an important role in national food supply especially in small towns and poor rural areas as well as cities. Kiosks - huge number spread across the country. State owned Ruch chain leading player (10,000 throughout Poland). Cash & Carry sector: Dominated by German Metro (Makro, Real), Rewe’s Selgros, Emperia Holding, Eurocash. Piotr i Pawel and Bomi are 2 premium supermarkets to have experienced growth in recent years with Piotr's sales up 17% to 216 million in 2006. Market Share of Top Ten Retailers Eurocash 6% Lewiatan 6% Rewe 5% Metro 19% Carrefour 8% Spolem 13% Schwarz Group 9% Auchan 10% Source: IGD, 2007 Tesco 12% Biedronka (JM) 12% Retail Market Structure Top 10 Retailer Total Sales (€m) Grocery Sales (€m) % Change Grocery Sales (06 vs 05) Grocery Retail Market Share* (%) No. of Grocery Stores Sales Area (sqm) Metro 3,447 2,687 +9.4% 2.67% 74 416,751 Spolem 1,807 1,807 +2.2% 5.27% >4,000 800,000 Jerónimo Martins 1,715 1,715 +27.2% 5.00% 905 452,952 Tesco 1,583 1,583 +18.4% 4.62% 144 435,251 Auchan 1,475 1,438 +3.5% 4.20% 34 194,000 Carrefour 1,189 1,189 +15.77% 3.47% 125 418,000 Lidl & Schwarz 1,250 1,250 +54.3% 3.65% 220 356,000 Rewe 661 661 +17.0% 0.24% 35 70,000 Leclerc 525 520 +12.2% 1.52% 19 83,900 Eurocash 507 507 +15.5% 0.74% >2,600 644,000 Lewiatan 500 500 +4.2% 1.46% >1,300 260,000 Source: IGD Analysis, Country Presentation, Poland Private Label First appeared in 1998 Accounted for 16% of sales in 2006 Number of SKU’s increased 80% since 2004 Considered as a product with very low quality or for ‘poor people’ Private Label Share % (2006) 80 70 74.4 (72.7) 60 % Private Label • • • • 50 49.7 (50.8) 40 44.4 (47.7) 30 20 17.7 (18.1) 10 13.4 (15.6) 10.5 (9.8) 10.3 (12.0) Tesco Ahold 0 Jeronimo Martins Casino Tengelmann Carrefour Metro Source: IGD Analysis Country Presentation Poland 2007 7.2 (8.6) Auchan 1.7 (3.0) Rewe Foodservice Trends • • • • Increasing disposable income and changing consumer habits drove growth in consumer foodservice in 2006. Consumer foodservice is highly fragmented but domestic companies dominate the market and this is through lower prices and tailored offerings. Outlets such as Da Grasso, Sfinka Polska and Pizza Dominium were the most successful in 2006. Independent outlets are the most dominant in terms of numbers and they cover the entire range from economy to premium. Despite not having the economies of scale of large chains they often offer lower prices. There is low urbanisation in Poland and the numbers living in urban areas is almost unchanged since the early 1990’s (62%); reasons for this relate to an ageing population and high unemployment - cost of living is lower in rural areas. This could be a limiting factor in consumer foodservice. Adopted from Euromonitor Data 2007 Foodservice Trends • • • • • There is expected to be expansion into the smaller cities in Poland for specialist coffee shops and casual dining full service restaurants, but they should bear in mind the lower purchasing power in smaller cities. Eating out is not part of Poland’s traditional lifestyle and there is a belief that home cooking is better quality than food in restaurants. There has been a number of failures on the Polish market for international chains eg Burger King withdrew after losing the price war with McDonald’s in 2001. However in 2007 they re-entered the market with AmRest running the outlets. There are currently 7 outlets. Dunkin Donuts also withdrew due to their prices being too high. Subway blame disappointing performance on their high costs. The Euro 2012 soccer championship to be held in Poland and Ukraine is expected to benefit foodservice with a higher disposable income resulting from investment and will also benefit the economy overall. Adopted from Euromonitor Data 2007 cD BP on al d' s S Sh ta to el l S il e Da le c G t ra Te ss o le Pi zz a Sp hi nx K P i P iz F C zz za a H D om ut in iu Fl m Co er ffe ynk M eH a r. ea H am ve n b G ur g re e en r W Ho ay Ca rt C a fé N fé es ca f O é th er s M Chained Consumer Foodservice Brands by market share and number of outlets 350 40 300 35 250 30 200 25 20 150 15 100 10 50 5 0 0 Adapted from Euromonitor Data 2007 No of Outlets Share Foodservice Establishments • Sfinks Polska SA – The largest restaurant network in Poland operating three brands: Sphinx, Chlopskie Jadio and WOOK Restaurant. It is the third largest foodservice company in Poland in terms of turnover. – Sphinx offers meat, salads, pasta, pizza, and desserts. – 108 establishments in Poland, Hungary, Czech Republic, Romania 102 of which are in Poland. – Took over premium restaurant chain Chlopskie Jadlo in 2006 – Chlopskie Jadlo offers traditional Polish cuisine in peasant surroundings – Currently 12 restaurants in operation – WOOK offers authentic Chinese food in 3 restaurants in Poland. Chlopskie Jadlo Peasant Style Restaurant Foodservice Establishments • Green Way – Polish vegetarian restaurant and bar chain – founded in 1997 as a healthy eating restaurant – 31 Greenway restaurants throughout Poland – 1 in Austria, 1 in Norway – Menu includes lentil soup, spinach dumplings, vegetarian enchiladas, fruit filled pancakes, vegetable juices and smoothies. – Greenway markets also sell products free from meat and animal derivatives – www.green-way.pl Foodservice Establishments • Pizza Dominium – started in Warsaw 1993 – offer handmade, original Italian pizzas, soups, snacks, salads, pasta and sandwiches – over 50 restaurants in cities throughout Poland – planning to expand into Romania with their restaurant chain. Other Foodservice Establishments • Coffee Heaven - Leading Eastern European Coffee Chain found in Poland, Czech Republic, Latvia, Bulgaria, Slovakia - Sells sandwiches and snacks as well as coffee - First opened in Poland in August 2000 - Currently has 48 coffee houses in Poland www.coffeeheaven.eu.com Reasons for targeting Poland • • • • • Largest Eastern European market currently for Irish food exports Total retail market +45% for 2005-2015 (€41.1bn) Solid growth market >10% per annum High penetration of premium segment for alcoholic beverages (32%) Significant immigrant population returning from Ireland with knowledge of Irish brands Barriers/challenges in supplying Polish market • • • • Market for high end premium products is small Foodservice market fragmented Very low per capita consumption of beef (5.2kg per annum) Price conscious consumers Bord Bia services 2009 • Beverage category report including market visit and buyer meetings (May 2009) • Bord Bia market mentor available for Eastern Europe market and trade related queries: Kieran Fahy Sarospatak ut 32 1125 Budapest Hungary Tel: +36 706 144871 Email: Kieran.fahy@freemail.hu