Food & Drinks Industry Day Converting Opportunities to Business Italy Market Overview

advertisement

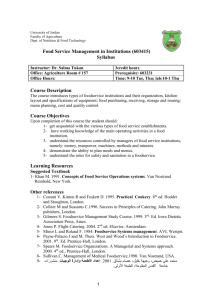

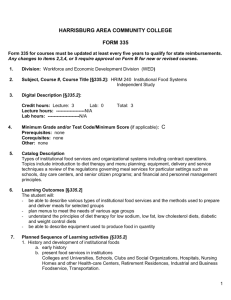

Food & Drinks Industry Day Converting Opportunities to Business Italy Market Overview Italy in figures Ø 4th largest EU economy Ø 0.3% growth rate Ø Inflation 2008: 3.8% Ø Unemployment: 6.9% North: 4% South: 12% Ø Right wing government early 2008 Ø Net importer Ø 14% domestic budget, food & beverages The Italian Consumer Ø Population: 59.5 million 63% wealthy north 37% poorer south Ø 26% single person households Ø 11% below poverty line Ø 5.8% foreign nationals (+16% on 2007) Ø 20% over 65, 33% by 2045 Ø Average family size 2.5 people Irish Export Performance 2007 (€ Value) . 11% 6% 3%2% 8% Meat & Livestock Beverages Fish Dairy Confectionery 70% Total Value: €376m Other Consumer attitudes to Food Ø Food & Drink market €103 billion Ø Meal times & cooking fundamental elements of daily life Ø Italy home of Slow Food movement Ø Move away from food preparation – more working women Ø Product safety & traceability key issues Ø Growing singles & ethnic markets Consumer Food Expenditure 2007 Meat 9% 3% 3% 23% Dairy 11% Fruit & veg Bread & cereals Beverages 19% 15% 17% Fish Retail Trends ØFresh and ambient dominate with frozen gaining ground ØIncrease in discounters share; 2015 – 15% ØPrivate label expanding, now at 12% ØConsolidation among multiples – growing foreign presence Carrefour/ Auchan/ Rewe ØGrowth in Category Management principles ØValue for money, discounts, demand for promotions – strong influences ØOrganic, fairtrade, locally-produced and GM-free growing Grocery Market Share by Retailer Type Supermarket Chains 40% 17% Hypermarket Chains Local /Conv. Store Traditional Discounters 14% 7% 6% Source: Agra Annuario 2007 16% Superstore The Top 5 Retailers Top Retailers Share of Grocery Market Esselunga Auchan-Rinascente Carrefour Conad Coop Italia 0 5 10 Top 5 control 55% of grocery market Source: AC Nielsen 2007 15 Red Meat Market Share by Retailer Type (value) Total Red Meat Retail Market 405,353 tonnes - €3,850m • Decline in butcher share has slowed – constant 33% • Hypermarket share in slight decline • Average retail margins dropping – average 15% Red Meat Segments by Price Position • 7% of all red meat sales now in “value-added” format • Rise in own label brand penetration from “value” to “premium” Logistics ØFragmented distribution, in particular for chilled ØOver 4,000 food distributors operating regionally ØGrowing sophistication in retail multiple distribution ØRise in integrated logistics – key competitive advantage ØGrowing number of groupage companies operating nationally Foodservice Overview Ø Market size: €63 billion (est. 2008 : €65 billion) Ø Steady growth since 1990 Ø 200,000 commercial outlets Ø Largely family owned businesses Ø Tightening margins Ø Chain restaurants: relatively small market share (8%) Key Trends in Foodservice Sector Ø Growth in functional meals - particularly lunch Ø Top restaurants, pizzerias and modern selfservice outlets faring best Ø Systemized fast food not particularly successful – YUM! & Burger King not present Ø Cost and service key success factors Ø Growing market for sandwiches and prepared or partly prepared meals Ø Home delivery not yet developed Foodservice Overview Market Breakdown by Turnover 11% 3% Profit €52.8 bill. Cost €7 bill. Vending €1.7 bill. 86% Source: Catering & Ingrosso in Italia 2008 Foodservice Overview Commercial Sector Breakdown Profit Sector Breakdown Profit Sector Breakdown 8% 14% 36% Traditional restaurants Bars and cafés Hotels Pizzerias 16% Chains 26% Source: Catering & Ingrosso in Italia 2008 Foodservice Overview Institutional Sector Cost Sector Breakdown Breakdown 8% 33% 23% 36% Business Healthcare Education Contract catering Leading Companies in Cost Sector 1. 2. 3. 4. 5. 6. Sodexho Onama-Compass Gemeaz Cusin Camst CIR Pellegrini 5 control 55% grocery market TopTop 9 companies holdof25% of total market Leading Companies in Profit Sector 1. 2. 3. 4. 5. 6. 7. 8. Autogrill McDonalds Cremonini My Chef Camst CIR Finifast srl Ristop srl Top 10 companies hold just 4% of total market Foodservice: Routes to Market 19% Distributors Manufacturers Cash and Carries 17% 64% Why Target Italy? Ø Ø Ø Ø Ø Ø Italian consumers will pay for quality Market open to new ideas/ products Ireland enjoys a positive clean image – scope for adding value Growth in centralised distribution opportunity for Irish producers Trade has experience with Irish suppliers (eg. beef) Speciality foods of particular interest Main Challenges in Supplying Italy Ø Ø Ø Ø Ø Competitiveness Fragmented Market Challenging distribution Credit management - slow payments Personal relationships & market knowledge essential Bord Bia Services in 2009 ØCustomised Services ØMarket Research ØDairy products (Italy) ØMarket profile (Greece) ØFoodservice networking events ØJournalist events-raise consumer profile of Irish Food.