Denmark Market Overview

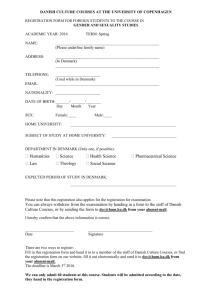

advertisement

Denmark Market Overview General Facts – Area: 43,090 sq. km – –Capital City: Copenhagen – National Currency: Danish Krone (DEK) – Population (2007): 5.45 million Density 126.48 people/km – Head of the State: Queen Margrethe II – Prime Minister: Anders Fogh Pasmussen Source: CIA – Ruling Party: The Venstre Party (Liberal) The New Denmark Denmark is split into five regions: 1. Nordjylland 2. Midtjylland 3. Syddanmark 4. Hovedstaden 5. Sjælland The regions were created on 1 January 2007 as part of a reform to replace the country’s 13 traditional counties. Additionally, smaller Danish municipalities (kommuner) were merged into larger units reducing the number from 240 to 98. Population Split By Region (2006) Region Capital Population Area (Sq. km) Population Density (people per sq. km) Copenhagen 1,633,565 2,561 637 Vlborg 1,219,741 13,053 93 Syddanmark (South Denmark) Vejle 1,185,840 12,191 97 Sjælland (Zealand) Sorø 811,511 7,273 112 Alborg 57,802 8,020 7 Hovedstaden (Capital Region) Midtjylland (Mid Jutland) Nordjylland (North Jutland) Source: Denmark Statistik, 2006 The 10 Largest Cities In Denmark Capital Population Copenhagen 1,084,885 Århus 228,674 Odense 152,060 Aalborg 121,540 Esbjerg 71,886 Randers 55,909 Kolding 55,045 Horsens 50,983 Vejle 49,928 Roskilde 45,807 Source: Denmark Statistik, 2006 85% of the Danish population is urbanised. Approximately a third of the population live in Copenhagen. Copenhagen has a population more than four times larger than Århus, the second largest city in Denmark. Political Outlook Prime Minister Anders Fogh Rasmussen was elected in February 2005. He is the leader of the Venstre (Liberal) party, and the first Danish Liberal leader to win a second consecutive term in office. The government has made concessions to the populist Danish People’s Party (DF) to pass its legislative programme and will have to continue to pay attention to the DF’s views, particularly on immigration. Strong budget surpluses will allow the government to maintain a moderately expansionary fiscal policy in 2007-08. On April 1st 2007, there was a reform of corporate taxation, with a reduction in the rate of tax from 28% to 22%. Integrating the immigrant population will remain a focus for Anders Fogh Rasmussen. Danish Politics • Head of state - Queen Margrethe II • Denmark voted to stay outside the Eurozone • Government – Coalition between the conservative party the Venstre and the Danish People’s party – Prime Minister - Mr Anders Rasmussen Denmark in Figures • Unemployment 5.8% • Population Density Denmark 124/Sq.Km – Versus Ireland 53/SqKm • % private consumption spent on food, beverages 17.3% • Main trading partners – – – – – • Germany Sweden UK France Norway Vat rates – Services 25% – Food 25% – Alcohol 25% Irish Food & Drink Exports 2007 Meat €30.6 million Beverages €7.2 million Dairy €9.3 million Seafood €12.1 million Other foods €9.4 million Total Irish Food & Drink Exports €68.6 million Irish Export Performance 2007 • In 2007 total Irish exports of food and drink increased 10% • Meat exports increased 17% to over €30m – Beef €17.3m – Pigmeat €8.5m • There was a 52% increase in fish exports to €12m • Dairy products – predominantly cheese and butter increased to €9.4m • Alcoholic beverages – mainly non-whiskey spirits, declined by 11% to €7.2m Danish Meat Imports • Although Self Sufficiency is 94% for beef, imports are substantial at over 100,000t pa • Predominantly female (cow hinds) and young beef • Lamb imports are 7,000t • Import suppliers of beef are : – – – – – Germany and Holland 70% of total Ireland 7-8% share Brazil, Argentina, Uruguay Poland Australia Meat Imports to the Foodservice & Manufacturing Sectors • Brazilian beef is returning to hotels and restaurants • NZ dominates for frozen lamb • Institutional or cost sector buy full range of meats from local Danish companies • Leading companies are Emborg, Dagrofa Catering Engros, Caterfood, Tulip Catering, Caterfood • Manufacturing meat is generally imported at lowest cost The Retail Market The Danish Retail Market • Highly concentrated like Sweden – Dansk Supermarket, Coop and Dagrofa are market leaders • Food retail accounts for an estimated €16.8 billion. • No. of traditional independent stores has halved since 1995 • Centralised purchasing/independent decision making • Growth in convenience & forecourt retailing Key Retail Players • Danske Supermarket – Regarded as the most progressive retailer / Netto, Fotex chains – Prestigious and expanding its market share at pace • Co-op – The second largest retail group - Irma, Kvickly stores • Supergros – Is privately owned and has undergone rapid transformation across its retail, wholesale distribution & foodservice divisions – Superbest chain is now 220 stores Retail Market – Structure By Format Convenience Hard & Soft Discount Superstore/Supermarket Hypermarket 3,500 100 3,000 98 99 1,089 100 Store Numbers 2,500 1,075 1,070 1,096 1,500 1,000 1,093 98 997 2,000 100 869 1,024 1,088 712 704 2004 2005 1,168 1,215 959 992 2006 2007e 954 500 517 539 2002 2003 0 Source: IGD Datacentre www.igd.com/analysis/datacentre The Grocery Retail Market – Structure By Format The Danish grocery market is dominated by supermarkets and hard/soft discounters. Denmark has one of the largest portfolio of discount operators in Europe, and continues to grow at a rate that is faster than any other sector in the market. This has been led by market leader Netto. Between 2002 and 2006, IGD estimates a 34% increase in the number of hard/soft discount stores operating in Denmark. Expansion of the hypermarket sector has been fairly static in recent years, as retailers move back into the city centre. The number of convenience/forecourt stores amongst the major grocery retailers increased dramatically in 2006 following Reitangruppen’s acquisition of the Hydro Texaco chain in Denmark. Top Danish Retailers 2006 Retailer Total Sales (€m) Grocery Sales (€m) Grocery Retail Market Share (%) No. of Stores Sales Area (sqm) Dansk Supermarked 5,185 4,770 29.85% 467 570,100 Coop Danmark 4,579 3,942 24.67% 1,157 1,261,450 Reitangruppen 917 917 5.74% 466 183,800 Spar Danmark 864 864 5.41% 485 141,710 Aldi 520 520 3.25% 242 169,400 3,326 388 2.43% 43 83,600 Edeka Danmark 289 289 1.81% 347 177,343 Metro Group 235 235 1.47% 4 31,000 Lidl & Schwarz 120 120 0.75% 45 67,500 Dagrofa Source: IGD Datacentre, 2006 estimates Note: Data is for grocery formats only except Total Sales which includes non-grocery if applicable. Total Sales & Grocery Sales are Net. Data includes franchised operations where appropriate. Banner Total Sales (€m) Format No. of Stores Sales Area (sqm) Av. Sales Area (sqm) Bilka 1,600 H 14 175,000 12,500 Føtex 1,825 S/S 78 210,600 2,700 Netto 1,310 H/SD 360 180,000 500 35 C/F 15 4,500 300 Døgn Netto Key: H = Hypermarket S/S = Superstore/Supermarket H/SD = Hard/Soft Discount • Dansk Supermarked is jointly-owned by A.P. Møller (Maersk Group) and F. Salling A/S. Source: IGD Datacentre, 2006 estimates. Data is for grocery formats only. Total sales are Net. www.igd.com/analysis/datacentre Bilka in Hundige and Netto in Frederiksundsvej • Dansk has successfully overtaken Coop Danmark as the No.1 grocery retailer in Denmark, with the Netto chain of discount stores acting as a 'growth engine' for the group. • Denmark remains Dansk's only operating market in which it offers more than a discount format. • It operates the Bilka chain of hypermarkets, Føtex supermarkets, Netto discounters as well as A-Z department stores and Tøj and Sko footwear. • Dansk has launched Døgn Netto format which are smaller than typical Netto stores, discount / convenience hybrid, with stores open til 10 p.m. Source: Retail Analysis photo gallery Banner Total Sales (€m) Format No. of Stores Sales Area (sqm) Av. Sales Area (sqm) Kvickly Xtra 231 H 14 126,000 9,000 Kvickly 867 H 68 238,000 3,500 1,068 S/S 266 372,400 1,400 Irma 269 S/S 74 81,400 1,100 Dagli Brugsen 532 S/S 346 173,000 500 Lokal Brugsen 56 S/S 48 15,900 331 Coop Brugsen 6.44 S/S 4 2,000 500 Fakta 912 H/SD 337 252,750 750 Super Brugsen Key: H = Hypermarket S/S = Superstore/Supermarket C/F = Convenience/Forecourt H/SD = Hard/Soft Discount Source: IGD Datacentre, 2006 estimates. Data is for grocery formats only. Total sales are Net. • . www.igd.com/analysis/datacentre Fakta and Irma City on Vesterbrogade, Copenhagen • Coop Danmark operates a multi format portfolio of stores, including convenience, discount, supermarket and hypermarket stores. • Coop Danmark's Fakta discount chain is well placed to capitalise on the growing pressure on price and expansion of the discount sector. • Irma stores have adopted a different pricing and merchandising strategy compared to the large European mainstream discounters in Denmark, offering more upscale locally sourced products. • Coop Danmark plans to open an additional 70 Fakta stores in Denmark by the end of 2008. Source: Retail Analysis photo gallery Banner Total Sales (€m) Format No. of Stores Sales Area (sqm) Av. Sales Area (sqm) Rema 1000 744 H/SD 156 124,800 800 7 Eleven 68 C/F 60 9,000 150 YX 104 C/F 250 50,000 200 Key: C/F = Convenience /Forecourt H/SD = Hard/Soft Discount Entered the Danish market in 1993. Sales in Denmark accounted for approximately 22% of group sales in 2006. Reitangruppen holds the 7 Eleven franchise license in Denmark. Source: IGD Datacentre, 2006 estimates. Data is for grocery formats only. Total Sales are Net. www.igd.com/analysis/datacentre 7 Eleven and Rema 1000 in Copenhagen Rema 1000 accounted for over 80% of Reitan's total turnover in Denmark in 2006. In July 2006, Reitan acquired the Hydro Texaco chain of forecourt stores in Denmark. The stores were consolidated into Reitan's accounts in the beginning of the third quarter 2006. Reitangruppen is set to invest €50 million on refurbishing the forecourt stores into the YX banner in the years ahead. Reitangruppen has teamed up with airline SAS to sell flights and package holidays in its stores across Scandinavia. The new service, which is named "Go“, has been integrated into 7 Eleven stores, Rema 1000 stores and YX forecourt sites. Source: Retail Analysis photo gallery Banner Total Sales (€m) Format No. of Stores Sales Area (sqm) Av. Sales Area (sqm) 864 C/F 485 141,710 292 Spar Key: C/F = Convenience/Forecourt Spar Danmark A/S is part of Dagrofa. Source: IGD Datacentre, 2006 estimates. Data is for grocery formats only. Total Sales are Net. www.igd.com/analysis/datacentre Denmark is the second largest market in Scandinavia for Spar, behind Norway. Spar in Denmark The Glostrup store in Copenhagen was jointly developed as a new concept store with Spar International. The convenience store focuses specifically on Food to Go and convenience products. Although there has been a decline in store numbers in recent years, total retailer sales area has increased, with average store size increasing by 10%. Spar Danmark has focussed on better serving its younger customers through branding activities and developing strong links with the local community. Source: Retail Analysis photo gallery Banner Total Sales (€m) Format No. of Stores Sales Area (sqm) Av. Sales Area (sqm) 520 H/SD 242 169,400 700 Aldi Key: H/SD = Hard/Soft Discount Aldi Nord entered Denmark in 1977, with its entry prompting the domestic operators to launch their own competing discount formats. Sales in Denmark accounted for approximately 1.3% of total group turnover in 2006. Source: IGD Datacentre, 2006 estimates. Data is for grocery formats only. Total Sales are Net. www.igd.com/analysis/datacentre Denmark is Aldi’s only market in Scandinavia. Compared to other European countries, Aldi’s new store development programme in Denmark has been fairly static. Aldi’s Danish business is managed through two regional divisions, at Kolding (West Division) and Karlslunde (East Division). Aldi in Denmark Banner Total Sales (€m) Format No. of Stores Sales Area (sqm) Av. Sales Area (sqm) ISO 160 S/S 12 27,000 2,250 Dreisler 128 S/S 9 12,600 1,400 SuperBest 99 S/S 22 44,000 2,000 Key: S/S = Superstore/Supermarket Dagrofa A/S is a private holding company owned by tobacco company Skandinavisk Tobakskompagni A/S, Aps KFI-Figros, and A/S KFI-Detail. Source: IGD Datacentre, 2006 estimates. Data is for grocery formats only. Total Sales are Net. www.igd.com/analysis/datacentre Banner Total Sales (€m) Format No. of Stores Sales Area (sqm) Av. Sales Area (sqm) Merko 81 S/S 97 38,800 400 Activ Super 73 S/S 126 100,800 800 Focus Focus 43 C/F 78 11,700 150 Complet 12 C/F 36 5,400 150 Coma 5 H/SD 10 3,500 350 Key: S/S = Supermarket/Superstore C/F = Convenience/Forecourt H/SD = Hard/Soft Discount Note: Excludes Rema 1000 stores Edeka entered the Danish market in 1990. Source: IGD Datacentre, 2006 estimates. Data is for grocery formats only. Total Sales are Net. www.igd.com/analysis/datacentre Outlook • Continued growth of soft & hard discounter • Growth in Private label • Retailers willing to look at niche opportunities to differentiate • Opportunities in private label (premium & speciality) Market Characteristics • The supermarket is the principal store format in the Danish market • Centralised purchasing but independent purchasing decision making • Excellent logistics, RDC’s • Private label low, but growing • Growth in convenience & forecourt retailing Attractions of Exporting to Denmark • • • • • • • Growing economy Affluent consumer English widely spoken Ireland’s image Good logistics Concentrated retail market Good niche opportunities Bord Bia Services • Market Information & Trade Contacts • Research tailored to company requirements • Mentoring Service to enter and grow the market • Contact Bord Bia Head Office: – Frank.murray@bordbia.ie – Mobile +353 87 7680567