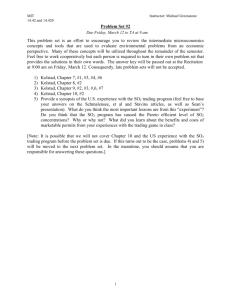

Ex Post Evaluation of Tradable Permits: The U.S. SO Cap-and- Trade Program by

advertisement