School Finance Hot Topics

advertisement

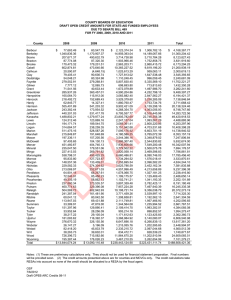

School Finance Hot Topics FY13 State Aid OPEB ARC Credits: The draft FY13 State Aid OPEB ARC credits were emailed to the listserv on June 18, 2013. A copy of the schedule is attached as Attachment 1. These credits apply to county boards of education and MCVCs only – the RESAs do not receive any portion of the credits. The amounts shown on Attachment 1 for MCVC fiscal agent counties include both the county and MCVC portion of the credits. It is the responsibility of the fiscal agent county to appropriately split the amount of the credit between the two entities. The accounting entry to record the FY13 State Aid OPEB ARC credits will be the same as FY12. There is no revenue recorded – the credits are simply a reduction of the OPEB liability and OPEB ARC accrual (object 217). In order to compare the credits in Attachment 1 with the PEIA RHBT online system, you will need to click on the small excel icon in the get details column to download the detail transactions for the month of June. The amount of the credit in the schedule will not agree to the June total in the summary monthly view in the PEIA RHBT online system. When reviewing the detail transactions for the month of June, you may see other credits being applied to your county by PEIA. The following explanation was provided by April Taylor of PEIA: If you are an employee of a State agency or a BOE (or an eligible employee of a local agency) with coverage through a PEIA plan and have accrued sick and/or annual leave when you retire, you may use that accrued leave to extend your employer-paid insurance coverage. You must be enrolled in a PEIA plan or a PEIA-sponsored managed care plan or a group life insurance plan offered by PEIA prior to your retirement to qualify. This extended coverage must be for full months. Employees hired on or after July 1, 2001, are not eligible for this benefit. GASB Statement Number 45: Accounting and Financial Reporting by Employers for Postemployment Benefits Other Than Pensions Conversion of a terminating employee’s unused sick leave credits to an individual account to be used for payment of postemployment benefits on the person’s behalf is a termination payment. When a terminating employee’s unused sick leave credits are converted to provide or to enhance a defined benefit OPEB, such as postemployment healthcare benefits, the resulting benefit or increase in benefits should be accounted for in the calculation. 1 As a result of GASB 45 determining the leave conversion used to enhance OPEB benefits is included in the calculation for the total OPEB liability valuation and PEIA’s policy to bill the employer the value of extended employer paid insurance coverage for leave conversion, PEIA has determined employers are eligible to have the value of retiree health leave conversion billed credited off their annual OPEB liability. LEAs should review the coding for PEIA and OPEB expenses for FY13 to ensure that the proper object codes were used. Please make any necessary corrections to the coding, as proper coding is critical for indirect cost calculations, MOE calculations, and federal reports prepared by the Office of School Finance. Object 211 – Regular Health/Accident/Life PEIA Premiums Object 217 – OPEB ARC Object 218 – OPEB Paid (the pay-as-you-go amount) CPRB Change – HB 2800: HB 2800, as passed during the 2013 legislative session, specifies that “gross salary” is to be allocated and reported in the fiscal year in which the work is done as it pertains to the Teacher’s retirement system. Per discussion with Darden Greene, CFO of CPRB, the annual retirement reports are officially due on July 15th each year. Given that this new requirement will cause manual adjustment of the retirement reports for virtually all counties, Darden said that counties unofficially have until July 30th to submit the reports to CPRB. As long as the report is submitted by July 30th, county boards should be “okay.” The programmers in the Office of Information Systems are working to make a change to assist counties in reporting gross salary on an accrual basis. The system will prompt counties for additional payroll run numbers that need to be included or excluded from the standard program build. Kim Harvey will notify counties when the programming changes are complete. Pay for work performed in June but paid during July should be made on its own separate payroll run. It should not be comingled with contract pay for services after July 1. Having its own payroll run number will allow counties to utilize the new prompts to add that payroll run to the FY13 report. Payroll runs that are added to the FY13 annual report will need to be subtracted from the FY14 annual report so the wages are not reported twice. Kim Harvey sent an email recommending that LEAs indicate on the retirement report coversheet which payroll runs were being added. This should assist in preparation of the report for the 2 subsequent year as it will be easy to identify the payroll run numbers that need to be subtracted from the standard report build. CPRB Change – Submission of Retirement File: Effective July 1, 2014, county boards of education no longer need to send paper copies of the retirement file to CPRB in addition to the electronic submission. Because the paper reports are no longer required, county boards must ensure that ALL changes are made in the WVEIS maintenance file before submitting the electronic retirement file to CPRB. Some counties have been making the changes on the paper copies only – that will no longer be acceptable. PEIA Change - New Field on Retirement Maintenance Screen: Per request from PEIA, WVDE has modified the retirement maintenance screen to include an annual salary field. This field is calculated in the same manner as the annual salary reported on the certified list of personnel. As a result of this change, other fields were slightly rearranged. This additional information that will be sent to PEIA with each report will assist PEIA in tracking whether employees with annual salary increases have been moved into the proper tier for PEIA premium purposes. Proper Coding for Services Purchased from a RESA: As it is becoming more common for county boards of education to purchase services from a RESA, proper coding of those expenditures is becoming more critical. The proper object codes per the LEA Chart of Accounts is as follows: Object 511 is for Student Transportation purchased from another LEA in the state, including RESAs. Object 564 is for Tuition paid to an LEA within the state, which would include a RESA. Object 591 is for any other purchased service from an LEA within the state (including RESAs). Please review the coding of such transactions in your county and ensure that the proper object codes are utilized. 3 COUNTY BOARDS OF EDUCATION OPEB CREDIT AMOUNTS FOR STATE-AID FUNDED EMPLOYEES DUE TO SENATE BILL 469 FOR FY 2013 County Barbour Berkeley Boone Braxton Brooke 2013 $ 16,230.27 1,224,350.47 212,923.75 68,716.42 151,701.04 Cabell Calhoun Clay Doddridge Fayette 623,900.22 33,747.49 77,962.19 39,304.92 206,924.72 Gilmer Grant Greenbrier Hampshire Hancock (16,902.99) 36,009.26 240,184.80 201,726.47 219,604.10 Hardy Harrison Jackson Jefferson Kanawha 92,870.95 538,798.18 273,725.03 489,288.99 1,529,824.05 Lewis Lincoln Logan Marion Marshall 86,361.77 159,453.21 264,579.12 466,736.95 164,982.81 Mason McDowell Mercer Mineral Mingo 219,815.83 (32,554.04) 451,311.98 235,048.81 222,779.04 Monongalia Monroe Morgan Nicholas Ohio 506,107.74 50,827.90 150,170.02 198,391.13 158,170.10 Pendleton Pleasants Pocahontas Preston Putnam 34,281.48 76,949.22 44,534.59 223,279.63 553,764.27 Raleigh Randolph Ritchie Roane Summers 613,806.59 181,326.24 36,159.98 94,119.19 38,576.66 Taylor Tucker Tyler Upshur Wayne 99,135.78 43,491.93 15,478.12 134,871.08 389,305.78 Webster Wetzel Wirt Wood Wyoming 2,682.76 35,134.79 36,985.64 801,847.78 159,663.62 Total $ 13,178,467.83 Notes: (1) These are the draft allocations that will be reviewed by PEIA's auditors. (2) The credit amounts presented above are for counties and MCVCs only. The credit calculations take RESAs into account so none of the credit should be allocated to a RESA by the fiscal agent. OSF 6/18/2013 OPEB ARC Credits 13 ATTACHMENT #1