Summary of Proposed Revisions to the Accounting Procedures Manual

advertisement

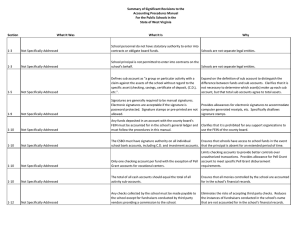

Summary of Proposed Revisions to the Accounting Procedures Manual For the Public Schools in the State of West Virginia Section What It Was 1-3 Not Specifically Addressed 1-4 Not Specifically Addressed 1-5 Not Specifically Addressed 1-9 Not Specifically Addressed What It Is Why School personnel do not have statutory authority to enter into contracts or obligate board funds. Schools are not separate legal entities. School principal is not permitted to enter into contracts on the school's behalf. Schools are not separate legal entities. Defines sub account as "a group or particular activity with a claim against the assets of the school without regard to the specific asset (checking, savings, certificate of deposit, (C.D.), etc.". Any funds deposited in an account with the county board's FEIN must be accounted for in the school's general ledger and must follow the procedures in this manual. Signatures are generally required to be manual signatures. Electronic signatures are acceptable if the signature is password protected. Signature stamps or pre-printed are not allowed. 1-9 & 1-37 Not Specifically Addressed 1-9 If current check stock does not contain the pre-printed name of the school, the fund, the school address, the check number, and two blank signature spaces, current stocks of checks may New check stock must be obtained if current check stock does be used until exhausted. not meet the requirements. 1-9 Not Specifically Addressed 1-9 Not Specifically Addressed Expand on the definition of sub account to distinguish the difference between funds and sub accounts. Clarifies that it is not necessary to determine which asset(s) make up each sub account, but that total sub accounts agree to total assets. Clarifies that it is prohibited for any support organizations to use the FEIN of the county board. Provides allowances for electronic signatures to accommodate computer generated receipts, etc. Specifically disallows signature stamps. Eliminates allowance to use current stock. These requirements and the allowance to use current check stock have existed for several years such that if any "current" check stock does still exist, it is so old that the ink is probably faded. Limits checking accounts to provide better controls over unauthorized transactions. Provides allowance for Pell Grant Only one checking account per fund with the exception of Pell account to meet specific Pell Grant disbursement Grant accounts for vocational centers. requirements. The total of all cash accounts should equal the total of all Ensures that all monies controlled by the school are accounted activity sub-accounts. for in the school's financial records. 1-10 Not Specifically Addressed 1-11 Periodic profit and loss statements 1-11 Sample profit and loss forms provided 1-11 Not Specifically Addressed Any checks collected by the school must be made payable to the school except for fundraisers conducted by third party vendors providing a commission to the school. Profit and loss statements at a minimum must be prepared at the end of the activity or the end of the semester. Alternate profit and loss forms allowed as long as the information is substantially the same as the sample form. All profit and loss forms must be signed by preparer and school principal. Eliminates the risks of accepting third party checks. Reduces the instances of fundraisers conducted in the school's name that are not accounted for in the school's financial records. Provides specific definition of "periodic" to improve accountability for concession sales. Provides flexibility to use software generated or vendor provided forms to reduce manual and/or double entries. 1-12 Not Specifically Addressed Vending machine items must comply with State Board Policies and federal regulations governing nutritional guidelines. Ensures compliance with federal regulations. Provides accountability for fundraisers. Summary of Proposed Revisions to the Accounting Procedures Manual For the Public Schools in the State of West Virginia Section What It Was What It Is 1-13 75% of profits from sale of soft drinks and healthy beverages in 75% of profits from sale of soft drinks in high schools allocated high schools, regardless of the location of the machine, by faculty senate and 25% allocated by principal. allocated by faculty senate and 25% allocated by principal. Fund raiser defined as a school activity which will potentially generate a profit for the school or a specific school group or Not Specifically Addressed club. 1-13 Not Specifically Addressed 1-14 Not Specifically Addressed 1-14 1-14 1-15 Why Fund raising activities must be covered by liability insurance. Expands the scope of beverage sales in vending machines to include healthy beverages as well as soft drinks for 75% profit allocation by the faculty senate. Provides specific definition of "fundraiser" and gives examples to ensure that all fundraising activities are properly accounted for. Minimizes school's liability in the event of an accident or injury during a fundraiser. Not Specifically Addressed Unused ticket stock for events must be kept in secure location and issued to ticket collectors immediately prior to the event. No individual should be used to collect tickets more than five times per year. Provides physical control over ticket stock to minimize fraudulent activity. Provides rotation of responsibilities to reduce the risk of collusion. Not Specifically Addressed Not Specifically Addressed Cash disbursements not allowed from event collections. Event Maintains separate accountability for ticket sales. Eliminates proceeds must be deposited intact into the school account. payment of wages in cash. Receipts must show the form of payment. Provides audit trail when reconciling receipts to deposits. 1-15 Not Specifically Addressed Receipts must have a valid signature. Electronic signatures are acceptable only if the signature is password protected. Signature stamps and pre-printed signatures are not allowed. Establishes responsibility for cash receipts. 1-15 1-16 Not Specifically Addressed Current stock of deposit slips may be used even if they do not contain all of the required information. 1-18 Not Specifically Addressed Tuition must be remitted to the school board at least semiannually and must be reconciled to course registration listing. New deposit slips must be ordered if current stock does not contain all of the required information. Schools are required to follow the bid thresholds outlined in State Board Policy 8200, Purchasing Procedures for Local Educational Agencies. Not Specifically Addressed Authorizes use of purchasing cards as an alternative form of Purchasing Cards are permitted by State Board Policy 8200 and payment. County policies could be more restrictive but not all requirements for use are outlined in the policy. less restrictive than State Board Policy 8200. Expenditures for gifts, banquets or service awards for employees prohibited. Schools may not make charitable contributions unless a fundraiser is conducted specifically for that purpose. WV Code section 18-5-13 allows expenditures for student, parent, teacher and community recognition programs. Funds must be raised specifically for that purpose, publicized as such, Provides means to recognize parents, teachers, and and accounted for in a separate account in the General Fund. community members as well as students. Eliminates any actual or implied provision to make charitable Not Specifically Addressed contributions not supported by WV Code. 1-12 1-18 1-19 1-19 Provides detailed supporting documentation for tuition receipts to ensure that all tuition is collected and remitted. Eliminates allowance to use current stock. Same as check stock. After several years, it's just time. Establishes minimum guidelines for bid thresholds. County policies could be more restrictive but not less restrictive than State Board Policy 8200. Summary of Proposed Revisions to the Accounting Procedures Manual For the Public Schools in the State of West Virginia Section What It Was 1-20 Not Specifically Addressed 1-21 Not Specifically Addressed 1-21 Not Specifically Addressed 1-21 Not Specifically Addressed What It Is Remove and destroy the signature on a voided check prior to retaining the check. Invoices must include address and phone number of vendor. If the vendor is on an approved board office vendor list, the phone number is not required on the invoice. Schools are permitted to make "deposit" payment for items such as charter buses or destinations for field trips, etc. Deposit payments require written documentation from the vendor indicating the amount of the deposit and terms. Use a "verification" stamp and initials to prove that invoice was verified for accuracy. 1-21 Not Specifically Addressed Schools must pay all invoices in a timely manner. 1-22 Schools must send a completed W-9 form to the board office Not Specifically Addressed for any vendors required to receive a 1099 form. Schools may pay reasonable and necessary travel expenses for Schools may pay reasonable and necessary travel expenses for chaperones on school trips. employees on school trips. If a staff member purchases a prepaid credit card in lieu of carrying cash on a school trip, all receipts and documentation must still be maintained and unused cash returned to the Not Specifically Addressed school. 1-22 Not Specifically Addressed 1-23 Not Specifically Addressed 1-25 1-27 Maximum amount of starting cash per event is $500. All checks must be posted to the General Journal in a timely manner. If a check is cancelled in a subsequent year from which it was issued, a receipt must be written for the amount of the check and posted to the transaction journal. 1-27 Not Specifically Addressed 1-28 Not Specifically Addressed 1-21 1-22 1-26 All credit cards must comply with State Board Policy 8200, Purchasing Procedures for Local Educational Agencies. All independent contractors, including game officials must complete a W-9 form. Maximum amount of starting cash per event is $500 per gate. Anything above this amount must be approved in writing by the county's chief school business official. All checks must be posted to the General Journal daily. If the school utilizes an electronic accounting system, this process may be accomplished through journal entries. Any unclaimed property must be reported to the Unclaimed Property Division of the State Treasurer's Office. The total of all cash and investment accounts should equal the total of all activities in the sub-accounts. Why Provides additional security measure for checking account(s). Ensures that all vendor contact information is provided. Establishes procedures for reserving vendor services for a future date and time. Provides additional guidance for proof of verification of invoices. Establishes requirement for timely payment of invoices. Ensures that W-9 forms are completed for all 1099 vendors. Narrows the definition of chaperone to employee to eliminate payment of parent expenses with school funds. Authorizes use of prepaid credit cards as an alternative form of payment to reduce the risk of lost or stolen cash. Ensures compliance with State Board Policy. County policies could be more restrictive but not less restrictive than State Board Policy 8200. Ensures that W-9 forms are completed for all 1099 vendors. Increases total starting cash for events when multiple gates are used. Narrows the definition of timely to daily to provide specific guidelines for posting checks. Provides allowances for journal entries to accommodate electronic accounting systems. Ensures compliance with WV State requirements. Ensures that all school monies are accounted for the school's financial records. Summary of Proposed Revisions to the Accounting Procedures Manual For the Public Schools in the State of West Virginia Section 1-28 1-28 1-29 1-30 1-35 2-8 3-2 3-2 3-2 What It Was What It Is Bank statements must be signed by the preparer of the bank reconciliation and the principal. Banks must provide cancelled check images with both front and back of the check. Why Bank reconciliations must be signed by the preparer and the principal. Banks must be able to provide an image of the cancelled check with both front and back upon request. Submit monthly financial statement along with balance page of all bank, CD and investment account statements to board Submit monthly financial statement to board office. office. Alternate form allowable for annual financial statements so long as the information contained is substantially the same as Submit annual financial statement on form provided by WVDE. the WVDE form. Annual examinations for schools that receive $25,000 in federal funds must be conducted in accordance with OMB Annual examinations of school financial records must be Circular A-128. conducted in accordance with applicable federal guidelines. Employees should execute wage garnishment agreement prior to being allowed to charge meals provided by the child Not Specifically Addressed nutrition program. $50 of the total $200 Faculty Senate allowance is allocated to $100 of the total $200 Faculty Senate allowance is allocated to each individual classroom teacher. each individual classroom teacher. Changes signature from bank statement to bank reconciliation to ensure that reconciliation is completed and reviewed. Provides more latitude for check image requirements and potentially reduces bank fees. If faculty senate wishes to allow individual teachers to carry over balances, a vote must be taken at the beginning of the new school year and recorded in the minutes to reestablish the Not Specifically Addressed balances. Faculty senate funds issued to teachers by check at the Faculty senate funds issued to teachers by check at the beginning of the year must be refunded if itemized receipts are beginning of the year must be refunded if itemized receipts are not submitted. not submitted by the deadline established by the county. Provides procedure to reestablish individual teacher balances in faculty senate. Must be voted on at the beginning of the new year rather than the end of the old year because of potential membership changes. Changes the deadline from the end of the year to a deadline established by the county to improve the efficiency of year end procedures. New Section Not Specifically Addressed Provides additional supporting documentation for monthly financial statements. Provides allowances for alternate forms to accommodate electronic accounting systems. Ensures compliance with current federal requirements. Authorizes garnishment of employee wages if they become delinquent in payment. Updates amount allocated to each teacher. When a sub-account for a particular class of students is established in the General Fund, the remaining balance in the sub-account when the class is no longer at the school must be accounted for in one of three ways: 1. Use for general operations of the school 2. Use for specific purpose at the Provides specific guidance on accounting for funds allocated to school 3. Transfer to a subsequent class of students. a specific class of students.