AMIS 6202 – Accounting Policy and Research Spring 2016 (Term 1)

advertisement

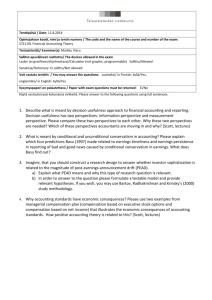

AMIS 6202 – Accounting Policy and Research Fisher College of Business, The Ohio State University Spring 2016 (Term 1) Course Objective This course is designed for students in the Masters of Accounting program (MACC). The course exposes students to important academic research in accounting and the primary methods underlying it. This course will enable students to develop their knowledge and appreciation of current debates that surround the accounting profession. Students will sharpen their critical thinking skills in the context of these issues and form and defend opinions about contemporary regulatory and market issues. The course will have a lot of reading material. Your learning will depend on your reading and your class participation. Instructor Professor Tzachi Zach Office: Fisher Hall 450 Phone: 614-292-4101 E-mail: zach.7@osu.edu Contact Email: The most efficient means to contact me is through email: zach.7@osu.edu. Please write down “6202” in the subject line whenever you are emailing me. Office hours: Wednesday 3:00 p.m. – 4:30 p.m. (or by appointment) Required Course Materials Course material is available on Carmen, mostly through pdf files, categorized by topic. There will be two optional Harvard Cases to be purchased by students. Page 1 of 8 Grading The final grade in the course will be a function of several components as described in the table below: % of Total Date Grade Topic Write-ups & Assignments Project Class Participation Final Exam (Take Home) Total Throughout the semester Last week of semester Throughout the semester 30% 25% 15% 30% 100% Topic write-ups: Students are expected to hand in four write-ups during the semester. The write-ups are due on the dates listed below and as outlined in the course schedule. The write-ups should not be longer than one page (maximum of 750 words) and should be worked on and handed in groups of two. For every write-up, you will be paired with a random student. I will announce these groups a week before a writeup is due. The write-ups should address the following questions: Writeup 1 Date 1/25 Questions How would you characterize a market in which the PEAD persists over a long period of time? That is, PEAD exists for many years. Writeup 2 2/1 Summarize articles 13 & 14. How are they related to each other? Provide at least one possible extension to them. Writeup 3 2/8 Compare and contrast Accrual Earnings Management and Real Earnings Management. Writeup 4 2/15 Discuss the evidence that supports the allegations of options backdating. What is, in your opinion, the most convincing piece of evidence and why? These write-ups are meant to force you to think critically about the weekly readings and, as importantly, to improve your writing skills. These skills are critical for your future success in anything that you do. The write-ups are due by the beginning of the relevant class (08:30 or 10:00) by uploading them to the dropbox section on Carmen, and handing one hardcopy per group in class. Please do not write your name on the writeup. Instead, use your student ID. Page 2 of 8 Group project: Students are required to conduct an event study on an event of their choosing. I will assign students to groups of four at random. Groups are expected to submit a project proposal to me no later than Monday, January 25. The actual data analysis can be conducted on a platform called Eventus which is available at the Wharton Research and Data Services (WRDS) web site (http://wrds.wharton.upenn.edu). We have a class account in there and you need to use it to log in. I will post the username and password in a separate file on Carmen. You will need to learn how to use Eventus on your own. The WRDS web site contains detailed explanations on how to use Eventus. Each group will present its project in class for about 10 minutes during the last week of classes. In addition, a 3-page summary of the project (a maximum of 2000 words) is due on Wednesday, February 24. The summary should also include references to relevant studies that do similar things to the exercise your group did. You can use Google Scholar and the Social Science Research Network (www.ssrn.com) as resources for your searches. Grading will be based on the research summary and on class presentations. In addition, each group member is expected to email me the weights based on which I should allocate the grade amongst the rest of the group members (excluding him/her self). Participation: You are expected to read the papers assigned to each class, as outlined in the course schedule. You should be prepared to be called on and participate in class discussion of issues described in the papers. Your participation is extremely important to your and your classmates’ learning. Final Exam: The final exam will cover all the material we discuss in class. It will be a take-home exam. You will have 24 hours to respond. The exam is due on March 1, 2016. Carmen: All relevant course material will be available on Carmen, except for the two optional Harvard cases which you should obtain on your own. Also, you are required to use the dropbox in Carmen to submit your write-ups, projects and final exam. Page 3 of 8 AMIS 6202 Course Schedule Spring 2016 (Term 1) Articles denoted by * are optional reading. CLASS/DATE Class 1 Monday January 11 Class 2 Wednesday January 13 Class 3 Friday January 15 Class 4 Wednesday January 20 Class 5 Friday January 22 Class 6 Monday January 25 Class 7 Wednesday January 27 Class 8 Friday January 29 Class 9 Monday February 1 Class 10 Wednesday February 3 Class 11 Friday February 5 Class 12 Monday February 8 Class 13 Wednesday February 10 Topic Readings Assignment Introductions Event studies 1*, 2*, 3 Event studies - Example 4, 5 Market Efficiency (General) 6, 7 Behavioral Finance (General) 8, 9 Market Efficiency & Behavioral Finance (PEAD) 10 Market Efficiency & Behavioral Finance (PEAD) 11 Market Efficiency & Behavioral Finance (Limited Attention) 12 Market Efficiency & Behavioral Finance (Accrual Anomaly) 13, 14 Incentives and earnings management (General) 15, 16 Incentives and earnings management 17 Real Earnings Management 18 Social Media and Disclosure 19 Page 4 of 8 Writeup 1 Writeup 2 Writeup 3 CLASS/DATE Class 14 Friday February 12 Class 15 Monday February 15 Class 16 Wednesday February 17 Class 17 Friday February 19 Class 18 Monday February 22 Class 19 Wednesday February 24 Class 20 Friday February 26 Tuesday March 1 Topic Readings IFRS 20, 21 Options backdating SOX 22, 23, 24 Assignment 21 Writeup 4 25 Audit Fees 26 Projects Presentations Project writeups Projects Presentations Projects Presentations Final Exam due Page 5 of 8 1. Regression Background* (Optional for students with sufficient statistical background) 1. **Frei, F., Campbell, D., Simple Regression Mathematics, Harvard Business Case 9-605- 061. (Optional) 2. **Dranove, D., Practical Regression: Regression Basics, Harvard Business Case. (Optional) 2. Event Studies 3. MacKinlay, C., 1997, Event Studies in Economics and Finance, Journal of Economics Literature 35(1), 13-39. 4. Nelson, K., Price, R., Rountree, B., 2008, The Market Reaction to Arthur Andersen’s Role in the Enron Scandal: Loss of Reputation or Confounding Effects?, Journal of Accounting and Economics 46, 279-293. 5. Chaney, P., Philipich, K., 2002, Shredded Reputation: The Cost of Audit Failure, Journal of Accounting Research 40(4), 1221-1245. 3. The Efficient Markets Hypothesis 6. Ball, R., 1995, The Theory of Stock Market Efficiency: Accomplishments and Limitations, Journal of Applied Corporate Finance 8, 4-17. 7. Ball, R., 2009, The Global Financial Crisis and the Efficient Market Hypothesis: What Have We Learned, Journal of Applied Corporate Finance 21(4), 8-16. 4. Behavioral Finance 8. Thaler, R., 1999, The End of Behavioral Finance, Financial Analyst Journal 55, 12-17. 9. Shiller, R., 2003, From Efficient Markets Theory to Behavioral Finance, Journal of Economics Perspectives 17, 83-104. 5. Accounting Applications of Efficient Markets and Behavioral Finance PEAD 10. Bernard, V., Thomas, J., 1990, Evidence that Stock Prices Do Not Fully Reflect the Implications of Current Earnings for Future Earnings, Journal of Accounting & Economics 13, 305-340. (Skip section 3.2, pages 324-331). 11. Hirshleifer, D., Myers, J., Myers L., Teoh, S., 2008, Do Individual Investors Cause PostEarnings Announcement Drift? Direct Evidence from Personal Trades, The Accounting Review 83(6), 1521-1550. Page 6 of 8 Limited Attention 12. Hirshleifer, D., Lim, S., Teoh S., 2009, Driven to Distraction: Extraneous Events and Underreaction to Earnings News, Journal of Finance 64(5), 2289-2325. Accrual Anomaly 13. Sloan, R., 1996, Do Stock Prices Fully Reflect Information in Accruals and Cash Flows About Future Earnings?, The Accounting Review 71, 289-315. 14. Bradshaw, M., Richardson, S., Sloan, R., 2001, Do Analysts and Auditors Use Information in Accruals, Journal of Accounting Research 39 (1), 45-74. 6. Incentives and earnings management General 15. Dechow, P., and D., Skinner, 2000, Earnings Management: Reconciling the Views of Accounting Academics, Practitioners, and Regulators, Accounting Horizon 14(2), 235250. 16. Graham, J., Harvey, C., and S., Rajgopal, 2005, The economic implications of corporate financial reporting, Journal of Accounting & Economics 40, 3-73. (Skip sections 5 & 6, pages 44-65). Individuals 17. Jiang, J., Petroni, K., Wang, I., 2010, CFOs and CEOs: Who Have the Most Influence on Earnings Management?, Journal of Financial Economics 96, 513-526. Real Earnings Management 18. Roychowdhury, S., 2006, Earnings Management through Real Activities Manipulation. Journal of Accounting and Economics 42, 335–70. 7. Social Media and Disclosure 19. Lee, L., Hutton, A., Shu, S., 2015, The Role of Social Media in the Capital Market: Evidence from Consumer Product Recalls. Journal of Accounting Research 53(2),367404. Page 7 of 8 8. International Financial Reporting 20. Ball, R., 2006, International Financial Reporting Standards (IFRS): Pros and Cons for Investors, working paper, University of Chicago. 21. Daske, H., Hail, L., Leuz, C., Verdi, R., 2013, Adopting a Label: Heterogeneity in the Economic Consequences Around IAS/AFRS Adoptions, Journal of Accounting Research 51(3), 495-547. 9. Options Backdating 22. Yermack, D., 1997, Good timing: CEO stock option awards and company news announcements, Journal of Finance 52(2), 449-476. 23. Lie, E., 2005, On the timing of CEO stock option awards, Management Science 51(5), 802-812. 24. Heron, R., and E. Lie, 2007, Does backdating explain the stock price pattern around executive stock option grants? , Journal of Financial Economics 83, 271-295. 10. Sarbanes-Oxley 25. Zhang, I., 2007, Economic Consequences of the Sarbanes-Oxley Act of 2002, Journal of Accounting and Economics 44, 74-115. 11. Auditing 26. Badertscher, B., Jorgensen, B., Katz, S.. Kinney, W., 2014, Public Equity and Audit Pricing in the United States, Journal of Accounting Research 52, 303-339. Page 8 of 8