Document 11032619

advertisement

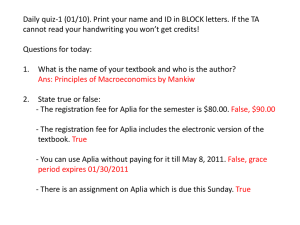

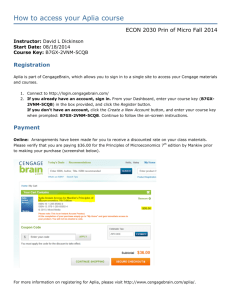

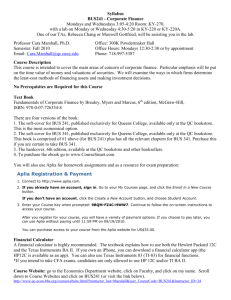

Accounting and MIS 3400: Tax Accounting I Course Syllabus – Spring 2013 Mon/Weds 11:10 – 12:30 pm – Converse Hall 139 Instructors: Stephanie L. Lewis; Xiaoli (Shaolee) Tian Office: 342 Fisher Hall; 432 Fisher Hall Phone: 614-292-3903; 614-292-2118 lewis.1819@osu.edu; tian.241@osu.edu E-mail: Office Hours: Mondays & Wednesdays 2:30-3:30 pm TA: TA e-mail: Location: Tutor hours: Stephanie Paxton paxton.59@osu.edu 011 Fisher Hall (outside of room) Monday through Friday 10:00-11:00 am Tuesdays, Thursdays and Fridays from 2:30p-4:30p Note: The course tutor will be available starting Thursday, 1/10. There will be no hours February 27th – March 1st or the week of April 22nd Team Teaching Format: This will be a semester course taught by two instructors. All classroom sessions and related material covered from January 7 - February 27 are the responsibility of Stephanie Lewis, while all classroom sessions and related material covered from March 4 – April 22 are the responsibility of Professor Tian. Any questions/concerns that you have throughout the course should be addressed to the relevant faculty member for that part of the course. Course Materials: Required - Hoffman, Smith, 2013 ed. South-Western Federal Taxation: Individual Income Taxes, ISBN 1-285-04224-7 (or ISBN 1-133-60078-6). Note: You must have access to the online tool Aplia to submit homework. Purchasing access to the website will also give you access to the online version of the required textbook. Course Description: This course covers the fundamentals of federal income tax and how it influences taxpayer decisions. Emphasis is on individuals and businesses organized as proprietorships, but the rules generally applicable to all taxpayers are covered. Prerequisite: AMIS 3200 (521) or equivalent. Course Objectives: This course is designed to acquaint the student with the workings and concepts of the federal tax law, especially as it pertains to individuals and business entities and to introduce the student to the workings of the U.S. tax system. Emphasis will be on learning the concepts underlying the tax law, using the current tax formula and its elements, applying tax law to decision models and incorporating tax planning principles into decision-making opportunities. Students are assumed to be interested in becoming business advisors, with an emphasis on financial and accounting subject matters. No previous tax education is assumed. The course will not turn the student into a tax expert, nor is it designed to prepare one for the taking of professional examinations. The concepts and work habits acquired will form a solid foundation for further study and practice. Course Methods: AMIS 3400 is conducted primarily in lecture/discussion format. Our job is to help you understand key concepts and issues. We will explain and illustrate important concepts in a lecture-like format and will engage you in dialogue through answering questions and working through problems in class. Your job is to be prepared for every class by reading (in advance) the relevant chapter and completing the assigned problems. Class sessions will be most productive if you come to class with a basic understanding of the concepts being covered. Lecture time is intended to help you focus on the details and technicalities needed to do well on the exams. You are encouraged to ask questions and be actively involved in class discussions. Due to the shorter 80 minute class sessions and the need to clear out the room for the next class, there will be no time to ask questions after the lecture has ended. You are responsible for everything said in class (in addition to the required reading and assignments). If you miss class, be sure to get the notes from a classmate. No accommodations will be made for late arrivals or absences. Regular class attendance will improve your chances of meeting the course objectives. Course information and assignments will be communicated via Carmen and university e-mail, so it is important that you regularly check your accounts. Office Hours: The instructors’ office hours are on Mondays and Wednesdays during the times listed on the front page of the syllabus. We will not routinely schedule office hours to accommodate absences from class or last minute questions prior to exams. It is your responsibility to keep up with the course material and to ask questions in a timely manner. Please keep in mind that our time is not a substitute for completing the required readings. In consideration of other students’ needs, you should limit your visits during office hours to 10 minutes. Professionalism/Participation: Attendance and being actively engaged in class is expected in the business world and it is expected in this course. Questions will routinely be asked of the class. Responding with the “right” answer is not the objective, but rather being prepared for and engaged in class is what is important. Behaving as a professional is also expected in this course. Inappropriate behavior, comments and language is not tolerated. Cell phones and laptops must be turned off and remain out-of-sight during lectures. You can expect that we will, at random, take attendance throughout the semester. If you are late or absent on an attendance day, you will lose points; the point deduction will increase with each subsequent absence/tardiness. If you are unable to attend a particular class due to a university-excused absence, you should notify the appropriate instructor via e-mail to minimize the chance you will lose points due to this policy. Absences for job interviews, vacations, etc., are not considered excused absences, so there is no need to notify us of these situations. You may only attend the section of the course you are enrolled in, unless you obtain prior approval from the instructor. Lack of professionalism and lack of preparedness will be considered on a student-by-student basis. Failure to attend class and interruptions of class by arriving late and/or leaving early, talking, or other disruptive/unprofessional behavior (including use of cell phones and laptops) will result in a reduction of the total possible points in determining your final grade. All point reductions are at the instructors’ sole discretion and are final. In addition to a point reduction, failure to follow this policy (including tardiness) may result in you being asked to leave the classroom with no return until the next scheduled class session. 2 Homework: Graded homework assignments will be administered online using Aplia. (Instructions for access to Aplia will be provided during the first day of class and posted on Carmen.) These assignments are technical in nature and are like textbook problems. The homework assignments must be completed on your own without assistance of any individual or any materials other than your class notes and the textbook. The individual homework assignments are to be completed online using Aplia by 7:00 p.m. on the due dates listed on the assignment schedule (Sundays). Each assignment will be available approximately one week before the assignment due date. Assignments completed with 60% accuracy will receive full credit; assignments completed with less than 60% accuracy will receive no credit. If you are unable to submit your homework ON TIME and electronically, no credit will be given for the assignment. No hard-copy submissions will be accepted and make-up assignments will not be given under any circumstance. Your lowest homework grade will be dropped. If you have to miss a homework deadline for any reason, you will receive zero points for that assignment, and you may drop that grade. You can obtain your results after the deadline through your Aplia account. On occasion, we may assign homework for in-class discussion. These assignments will generally not be collected. However, we reserve the right to collect assigned problems during the semester. Failure to vigorously attempt the homework problems will not only affect your exam performance, but it may also cause you to lose points from the participation portion of your final grade. Determination of what constitutes an adequate attempt of assigned problems is left to our sole discretion Discussion Board: You are encouraged to use the Discussion Board on Carmen to post your questions and to answer questions posted by other students. If you are the first student to provide the correct answer to a question, you will earn 0.5, 1 or 2 point(s) as extra credit, depending on the difficulty of the question and the thoroughness of your answer. The maximum points a student can earn (by providing the first correct answer) on the Discussions Board is 50 extra credit points. The Teaching Assistant will monitor the Discussion Board. We reserve the right to cancel the Discussion Board. We also reserve the right to revoke credit for students who appear to be regularly colluding with the same group of students and using the Discussion Board for other than its intended purpose, which is to have legitimate course-related questions answered in a timely and efficient manner. Course Assistance/Tutor: To aid the learning process, we have a dedicated Teaching Assistant and tutor for this course, Stephanie Paxton. She will hold regular, weekly tutor hours to answer questions about topics covered in class and to guide you through issues you have in completing the homework. These tutor hours are listed on the front page of the syllabus. To help you utilize the resources allocated to your learning, we recommend you take the following steps: 1. Ask questions during regularly scheduled class time. This not only benefits your learning, but also makes the classroom experience more beneficial to everyone. 2. If you have a question related to a section of the textbook you have not yet read, READ THE TEXTBOOK! Many questions can be resolved through careful reading and through the examples provided in the textbook. Remember, it is highly recommended you read the chapters prior to the lecture on that chapter. 3. If you still have questions about topics covered in class, consider using the discussion board in Carmen. That is probably the fastest way you can find an answer to your question. 4. If you still have questions, particularly related to basic course concepts or to the homework assignments, visit the course tutor during the hours listed on the syllabus. While the tutor will not provide you with answers to graded homework assignments, she can clarify assignment wording or answer questions on how to input solutions. 5. Any questions not resolved through the above means should then be addressed to the instructor covering that particular chapter, either through e-mail or a visit to regular office hours. 3 Exams: Two exams will be given on the dates indicated on the assignment schedule. The exams may consist of multiple choice, essay questions, and problems. The exams will test the application of knowledge acquired from class lectures, reading assignments, homework assignments and class discussions. You may bring one 8 ½” x 11” sheet with notes to each exam, and this sheet must be turned in with your exam. Your note sheet may include notes that are typed, handwritten or photocopied, and notes may be on the front and back of the page. You MAY NOT include any textbook examples, problems or in-class exercises/problems sets on your sheet. An alternate midterm exam will be given to those students that have a schedule conflict on the midterm exam date (2/27). The only schedule conflicts that will be considered are conflicts with another class or exam on the student’s schedule. If you have a known conflict, you must notify Stephanie Lewis via e-mail no later than Friday, February 1st. This email should include a copy of your class schedule. You may also be asked to provide a copy of the course syllabus that creates the conflict. You will only be permitted to take the alternate exam with prior written permission of the instructor. The instructor reserves the right to schedule the alternate exam on a Thursday or Friday evening or a Saturday morning, depending on the availability of the class. For those students taking the exam on the alternate date, no questions will be answered by the instructor or the TA relative to the exam material after the originally scheduled exam date (2/27). If you miss an exam for a university-excused absence (e.g., sickness, death in immediate family) and provide sufficient documentation to support your situation, you will receive an excused absence. Absences for any reason not listed above must be approved by the relevant instructor in advance, in writing, in order to be treated as an excused absence. (Vacations do not constitute a valid reason for missing an exam, and you must take the final exam on the date/time noted on the syllabus.) Those students receiving an excused absence will be given a make-up exam. The make-up exam will be scheduled within one week of the original exam date. Make-up exams are often different than the exams given during the normally scheduled time and may be more difficult than the original exam. If you receive an excused absence from the final examination, you will receive an incomplete grade until you complete a make-up exam. Unexcused absences from exams will result in a grade of zero. Tardiness to an exam may result in a point deduction of up to 20% of your exam grade. Course Grade: With the exception of the discussion board, there will be no additional extra credit work. Your final grade in this course will be determined by the total points you earn. The maximum points you can earn from each are as follows: Professionalism/Participation Homework Midterm exam Final exam Total 75 points 125 points 450 points 350 points 1,000 points Final grades will be determined based upon a student’s relative performance to his or her peer group and without regard to the percentage of total points earned. Any student who is routinely absent from class or fails to complete the final exam for unexcused reasons may receive a final grade of “E,” regardless of the student’s performance on other graded material. Grade Disputes: It is your responsibility to ensure grades posted on Carmen reflect your score on any particular assignment. Any concerns or questions about grading on a quiz or exam must be resolved within one week after the graded quiz or exam is returned in class (or the grade is posted on Carmen). These disputes must be submitted IN WRITING to the instructor. This time frame applies whether or not you were present in class to receive your graded quiz or exam. Individual grading issues will be handled outside of normal class time. 4 Notification of Scores and Final Grades: The results of any graded materials, including final grades, will not be given by the instructor to individual students via phone, e-mail or prior to the initial returning of the assignment in class. Final grades will be available online from the Registrar within one week following the final exam. Academic Misconduct: Academic misconduct will not be tolerated. According to University Rule 3335-31-02, all suspected cases of academic misconduct will be reported to the Committee on Academic Misconduct. This includes receiving assistance on ANY graded assignment from any outside source or individual other than your instructor. Restricted and Permitted Course Materials: Use of inappropriate study materials, including previously prepared solutions and copies of (or files containing) homework and/or test questions used during previous terms compromises the concept of equal opportunity for all students and therefore is prohibited. You may use materials that generally are available to all students provided that they maintain the spirit of the learning objectives. Materials distributed to students via Carmen or in class may be used only by students enrolled in AMIS 3400 this quarter. You may not distribute any of these materials to any others at any time, or be subject to disciplinary action. Disability Services: The Office of Disability Services verifies students with specific disabilities and develops strategies to meet the needs of those students. Students requiring accommodations based on identified disabilities should contact the instructor at the beginning of the quarter to discuss his or her individual needs. All students with a specific disability are encouraged to contact the Office of Disability Services to explore the potential accommodations available to them. Disenrollment: University Rule 3335-8-33 provides that a student may be disenrolled after the third instructional day of the quarter, the first Friday of the quarter, or the student’s second class session of the course, whichever occurs first, if the student fails to attend the scheduled course without giving prior notification to the instructor. 5 Teaching Plan and Assignment Schedule: The following schedule is subject to change; changes will be announced in class and posted on Carmen. Items listed in the assignment column of this schedule are action items necessary to prepare for class on the corresponding day. FIRST HALF OF THE SEMESTER Date(s) 1/7 1/9 Chapter/Topic Course Introduction / Introduction to Taxation Ch 3, Tax Formula and Tax Determination; An Overview of Property Transactions 1/14 Ch 3, Tax Formula and Tax Determination; An Overview of Property Transactions (continued) Ch 4, Gross Income and Inclusions Assignment Read Chapter 3 Read Chapter 4 1/16 Ch 4, Gross Income and Inclusions (continued) 1/20 APLIA CHAPTER 3 ASSIGNMENT DUE 1/21 MARTIN LUTHER KING DAY – UNIVERISTY CLOSED 1/23 Ch 5, Gross Income: Exclusions 1/27 APLIA CHAPTER 4 ASSIGNMENT DUE 1/28 Ch 5, Gross Income: Exclusions (continued) Read Chapter 5 Ch 6, Deductions and Losses: In General Read Chapter 6 1/30 Ch 7, Deductions and Losses: Certain Business Expenses and Losses Read Chapter 7 2/3 APLIA CHAPTER 5 & 6 ASSIGNMENTS DUE 2/4 Ch 7, Deductions and Losses: Certain Business Expenses and Losses (continued) Ch 8, Depreciation, Cost Recovery, Amortization, and Depletion 2/6 Ch 8, Depreciation, Cost Recovery, Amortization, and Depletion (continued) 2/10 APLIA CHAPTER 7 & 8 ASSIGNMENTS DUE 2/11, 2/13 Ch 9: Deductions: Employee and Self-Employed Related Expenses 2/17 APLIA CHAPTER 9 ASSIGNMENT DUE 2/18, 2/20 Ch 10, Deductions and Losses: Certain Itemized Deductions 2/24 APLIA CHAPTER 10 ASSIGNMENT DUE 2/25 NO CLASS No regular office hours MIDTERM EXAM (7:30 pm – 9:15 pm; Dreese Lab, Room 113) 2/27 No regular office hours, no tutor hours 2/28 & 3/1 NO TUTOR HOURS 6 Read Chapter 8 Read Chapter 9 Read Chapter 10 Teaching Plan and Assignment Schedule (continued): The following schedule is subject to change; changes will be announced in class and posted on Carmen. Items listed in the assignment column of this schedule are action items necessary to prepare for class on the corresponding day. SECOND HALF OF THE SEMESTER Date(s) 3/4 Chapter/Topic Ch 11, Investor Losses Assignment Read Chapter 11 3/6 Ch 13, Tax Credit and Payment Procedures 3/10 APLIA CHAPTER 11 ASSIGNMENT DUE 3/11, 3/13 SPRING BREAK – NO CLASS 3/18, 3/20 Ch 13, Tax Credit and Payment Procedures (continued) 3/24 APLIA CHAPTER 13 ASSIGNMENT DUE 3/25, 3/27 Ch 14, Property Transactions: Determination of Gain or Loss and Basis Consideratons 3/31 APLIA CHAPTER 14 ASSIGNMENT DUE 4/1, 4/3 Ch 15, Property Transactions: Nontaxable Exchanges 4/7 APLIA CHAPTERS 15 ASSIGNMENT DUE 4/8, 4/10 Ch 16, Property Transactions, Capital Gains and Losses 4/14 APLIA CHAPTER 16 ASSIGNMENT DUE 4/15, 4/17 Ch 17, Property Transactions: Section 1231 and Recapture Provisions 4/21 APLIA CHAPTER 17 ASSIGNMENT DUE 4/22 FINAL EXAM (during regular class time) No regular office hours; no tutor hours 7 Read Chapter 13 (pgs 2-5; 16-48) Read Chapter 14 Read Chapter 15 Read Chapter 16 Read Chapter 17