H EALTH CARE SECTOR Suyang Yang Huiting Wang

advertisement

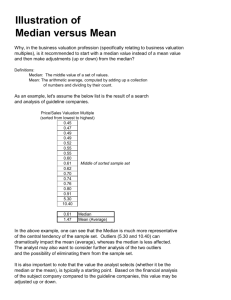

HEALTH CARE SECTOR Suyang Yang Huiting Wang AGENDA Sector Overview Business Analysis Financial Analysis Valuation Analysis Recommendation Q&A HEALTH CARE SECTOR Stocks relates to medical & healthcare goods or services Health Care Sector includes: Hospital management firms Health maintenance organizations (HMOs) Biotechnology Medical products SECTOR SIZE Sector Number of Constituents Adjusted Market Cap. In $ Mil Energy 40 1,127,143 Materials 30 309,561 Industrials 59 920,442 Consumer Discretionary 78 830,996 Consumer Staples 41 1,089,057 Health Care 53 1,153,936 Financials Information Technology Telecommunications Services Utilities 79 76 1,337,608 1,737,657 9 35 281,594 336,174 SECTOR WEIGHT S&P 500 SIM Utilities; 3.68% Telecomm , 3.51% Telecomm 3.09% Materials; 3.39% Energy; 12.35% IT; 19.04% Industrials ; 10.09% Consumer Discretion ary; 9.11% Financials; 14.66% Health Care; 12.65% Consumer Staples; 11.94% Utilities, 3.19% Materials, 4.52% Energy, 12.80% IT, 21.97% Industrials, 11.97% Financials, 6.59% Health Care, 13.13% Consumer Discretionary, 7.51% Consumer Staples, 12.23% SECTOR WEIGHT Sector S&P 500 Weight SIM Weight Change Energy 12.35% 12.80% 0.45% Materials 3.39% 4.52% 1.13% Industrials Consumer Discretionary 10.09% 11.97% 1.88% 9.11% 7.51% -1.60% Consumer Staples 11.94% 12.23% 0.29% Health Care 12.65% 13.13% 0.48% Financials Information Technology 14.66% 6.59% -8.07% 19.04% 21.97% 2.93% Telecom Services 3.09% 3.51% 0.42% Utilities 3.68% 3.19% -0.49% HEALTH CARE INDUSTRIES Biotechnology Account for 78% of the sector Health Care- Distribution/Service Health Care-Equipment 2.97% 12.49% Health Care-Facility 14.52% Health Care-Managed Care 51.68% Health Care-Service 6.87% 1.56% Health Care-Supplies Health Care-Technology 6.01% Life Science Tools Pharmaceuticals 3.28% 0.39% 0.23% HEALTH CARE INDUSTRY Pharmaceutical is the KEY driver of the sector Represent 51.7% of Health Care Sector & 6.6% of S&P 500 by Mkt. Cap Industry develops, produces, and markets drugs licensed for use as medications Pharmaceutical Sales include: Prescribed drugs OTC medications TOP HEALTH CARE COMPANIES Company Ticker % of S&P500 Industry Market Cap (In $ Bil) Johnson & Johnson JNJ 1.79% Pharmaceutical 163.9 Pfizer PFE 1.49% Pharmaceutical 136.7 Abbott Laboratories ABT 0.86% Pharmaceutical 78.7 Merck & Co. MRK 0.72% Pharmaceutical 65.9 Amgen AMGN 0.58% Biotechnology 53.2 Teva Pharmaceutical Industries Ltd. TEVA Pharmaceutical 47.1 Schering-Plough SGP 0.51% Pharmaceutical 46.4 Medtronic MDT 0.44% HealthCareEquipment 40.0 Gilead Sciences GILD 0.42% Biotechnology 38.6 SIM HOLDINGS Company Ticker % of Asset Industry Market Cap (In $ Bil) Cardinal Health Inc. CAH 2.05% HC-Distributor 10.3 CareFusion Corp. CFN 0.81% HC-Equipment 5.0 Gilead Sciences Inc. GILD 3.12% Biotechnology 38.6 Johnson & Johnson Co. JNJ 3.73% Pharmaceutical 163.9 Teva Pharmaceutical Industries Ltd. TEVA 3.42% Pharmaceutical 47.1 JNJ & TEVA are two top holdings of SIM Portfolio BUSINESS ANALYSIS Overall, Health Care sector is in Maturity stage of life cycle Pharmaceutical Industry(51.7%) is in the grey area between Growth and Maturity Health Care-Equipment(14.52%) is in Maturity stage Biotechnology Industry(12.5%) is in Growth stage 5 FORCE Concentrate on several large companies: JNJ, PFE, MRK,ABT (40%) Low- no buyer has any particular influence on product or price Rivalry Buyer Power Substitutes Generic Drugs Barriers to Enter High barriers to enter, due to huge demand for R&D Costly Regulations Patent Supplier Power Low- Major supplier is chemical industry and have competitive suppliers PATENT EXPIRATION & GENERIC DRUGS 20 YR Patent Length, 10 yr avg for FDA approval 2009-2014, expires @ the rate of 3 drugs/year Generic Drugs: cost-saving alternative 5 FORCE Concentrate on several large companies: JNJ, PFE, MRK,ABT (40%) Low- no buyer has major influence on product or price Rivalry Buyer Power Substitutes Generic Drugs Barriers to Enter High barriers to enter, due to huge demand for R&D Costly Regulations Patent Supplier Power Low- Major supplier is chemical industry and have competitive suppliers FACTORS INFLUENCES HEALTH CARE SECTOR Demographic National Health Expenditure Health Care Reform Exchange Rate DEMOGRAPHICS & BABY BOOMERS Demographic trend shows that there is a very big potential market for Health Care Sector in the near future. Also, Baby boomers are getting older. NATIONAL HEALTH EXPENDITURE $ in Mil 4,500,000 4,000,000 3,500,000 3,000,000 2,500,000 2,000,000 1,500,000 1,000,000 500,000 0 2002 2004 2006 2008 2010 2012 2014 Health Expenditure is in an up trend, which indicate future market of Health Care Sector 2016 EXCHANGE RATE Euro/USD Ratio Chart HEALTHCARE REFORM Period of controversy (UNCERTAINTY) Worst-case scenario are priced in Sector is over-sold 25.0% % of S&P 500 20.0% 16.0%-12.7% 15.0% % of SIM 10.0% 21.0%-13.1% 5.0% 0.0% Oct/08 Dec/08 Feb/09 Mar/09 May/09 Jul/09 Aug/09 Oct/09 Dec/09 FINANCIAL ANALYSIS-NPM Net profit marginsector and industries SPX: 8.0% 35.0% HCX: 10.0% 30.0% DRUGS: 22.0% 25.0% HCX 20.0% SPX DRUGS 15.0% BIOTK HCDIS 10.0% HCEQP 5.0% 0.0% 2004 2005 2006 2007 2008 2009 current BIOTK: 30% for 3 years FINANCIAL ANALYSIS-NPM Net Profit MarginsMajor companies 50.0% 40.0% 30.0% 20.0% JNJ 10.0% GILD 0.0% CAH 2004 2005 2006 2007 -10.0% -20.0% -30.0% -40.0% -50.0% 2008 2009 current TEVA SPX Due to purchased inprogress research and development expenses. This is a unusual expense. FINANCIAL ANALYSIS-ROE ROE 30.0% 25.0% 20.0% HCX SPX 15.0% DRUGS BIOTK 10.0% HCDIS HCEQP 5.0% 0.0% 2004 2005 2006 2007 2008 2009 current HCX:24.1% SPX: 11.0% DRUGS: 28.5% BIOTK: 23.7% HCDIS: 17.0% HCEQP: 19.2% FINANCIAL ANALYSIS-CF Cash Flow Per Share 90.00% 80.00% 70.00% Good job: BIOTK 60.00% HCX 50.00% DRUGS BIOTK 40.00% HCDIS 30.00% HCEQP 20.00% 10.00% 0.00% 2004 2005 2006 2007 2008 2009 current Stable: DURGS FINANCIAL ANALYSIS-EBITDA EBITDA 60.0% Current 2009: 50.0% 40.0% HCX HCX: 16.9% SPX 30.0% DRUGS BIOTK HCDIS 20.0% HCEQP 10.0% 0.0% 2004 2005 2006 2007 2008 2009 current SPX: 17.4% FINANCIAL ANALYSIS-Revenue Growth HCX Revenue is increasing at average 9% for the past 5 years. VALUATION ANALYSIS VALUATION ANALYSIS-Sector fP/E Absolute Price to Earnings Ratio Price to Earnings Relative to S&P 500 High: 39.7 Low: 10.0 Median: 17.9 Current 11.6 High: 1.6 Low: 0.69 Median: 1.1 Current 0.71 VALUATION ANALYSIS-Industry fP/E Drugs Price to Earnings Relative to S&P 500 Biotk Price to Earnings Relative to S&P 500 High: 1.1 Low: 0.64 Median: 1.0 Current 0.65 High: 3.2 Low: 0.78 Median: 1.5 Current 0.78 VALUATION ANALYSIS-Industry fP/E Hcdis Price to Earnings Relative to S&P 500 Hceqp Price to Earnings Relative to S&P 500 High: 1.6 Low: 0.65 Median: 0.99 Current 0.82 High: 1.8 Low: 0.79 Median: 1.3 Current 0.84 VALUATION ANALYSIS-Sector P/S Absolute Price to Sales Ratio Price to Sales Relative to S&P 500 High: 4.7 Low: 1.0 Median: 2.0 Current 1.2 High: 2.4 Low: 1.1 Median: 1.3 Current 1.1 VALUATION ANALYSIS-Industry P/S Drugs Price to Sales Relative to S&P 500 Biotk Price to Sales Relative to S&P 500 High: 3.9 Low: 2.1 Median: 2.5 Current 2.3 High: 10.5 Low: 3.8 Median: 5.5 Current 4.0 VALUATION ANALYSIS-Industry P/S Hcdis Price to Sales Relative to S&P 500 Hceqp Price to Sales Relative to S&P 500 High: 0.4 Low: 0.1 Median: 0.2 Current 0.1 High: 3.6 Low: 1.8 Median: 2.7 Current 2.3 VALUATION ANALYSIS-Sector P/B Absolute Price to Book Value Ratio Price to Book Value Relative to S&P 500 High: 10.1 Low: 2.2 Median: 4.2 Current 2.9 High: 2.5 Low: 1.2 Median: 1.4 Current 1.4 VALUATION ANALYSIS-Industry P/B Drugs Price to Book Relative to S&P 500 Biotk Price to Book Relative to S&P 500 High: 3.3 Low: 1.2 Median: 1.5 Current 1.4 High: 4.9 Low: 1.2 Median: 1.8 Current 1.5 VALUATION ANALYSIS-Industry P/B Hcdis Price to Book Relative to S&P 500 Hceqp Price to Book Relative to S&P 500 High: 1.5 Low: 0.5 Median: 0.9 Current 0.9 High: 2.6 Low: 1.2 Median: 1.9 Current 1.3 VALUATION ANALYSIS-Sector P/CF Absolute Price to Cash Flows Ratio Price to Cash Flow Relative to S&P 500 High: 163.1 Low: 7.6 Median: 14.4 Current 9.4 High: 9.8 Low: 0.9 Median: 1.3 Current 0.9 VALUATION ANALYSIS-Industry P/CF Drugs Price to Cash Flow Relative to S&P 500 Biotk Price to Cash Flow Relative to S&P 500 High: 2.0 Low: 0.8 Median: 1.2 Current 0.8 High: 3.8 Low: 1.1 Median: 2.0 Current 1.1 VALUATION ANALYSIS-Industry P/CF Hcdis Price to Cash Flow Relative to S&P 500 Hceqp Price to Cash Flow Relative to S&P 500 High: 2.0 Low: 0.7 Median: 1.3 Current 0.8 High: 2.0 Low: 1.1 Median: 1.6 Current 1.1 VALUATION ANALYSIS-Sector Summary Absolute Basis High Low Median Current Difference Under/Over P/Trailing E 19.6 9.9 17.8 12.0 (5.8) Under P/Forward E 18.6 10.0 16.7 11.6 (5.1) Under P/B 4.3 2.2 3.8 2.9 (0.9) Under P/S 2.0 1.0 1.8 1.2 (0.6) Under P/CF 15.5 7.6 13.3 9.4 (3.9) Under Relative to SP500 High Low Median Current Difference P/Trailing E 1.2 0.7 1.1 0.7 (0.4) Under P/Forward E 1.2 0.7 1.1 0.7 (0.4) Under P/B 1.6 1.2 1.3 1.4 0.1 Over P/S 1.6 1.1 1.2 1.1 (0.1) Under P/CF 1.4 0.9 1.2 0.9 (0.3) Under Under/Over Recommendations Current SIM Weight Current S&P 500 Weight 13.13% 12.65% • Short Term: Increase 52 basis point bring the SIM portfolio 100 basis point overweight relative to S&P 500. • Long Term: Decrease weight when economy shows definite signs of improvement due to the defensive nature of Health Care sector. Questions? Thank You!