Stock Recommendation Information Technology Sector Team Members:

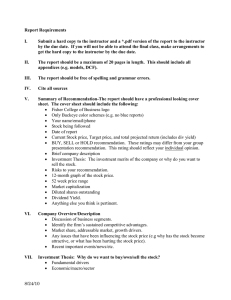

advertisement

Finance 724/824 Winter 2010 Information Technology Sector Stock Recommendation Team Members: Hanh Bui Vamsi Namburi Hang Nguyen Tejaswi Ponnada Jonathan Schick Agenda • Recap of Sector Presentation • Stock Recommendation: – Sell – Buy • Q&A Recap Recommendation Sell Buy Q&A Weight Recap Recommendation Sell Buy Q&A Recap • As of 02/28/2010, IT is overweight by 90bp – S&P500: 18.77 % – SIM: 19.67 % • Class voted: to increase 26bp Recap Recommendation Sell Buy Q&A Recommendation • • • • Sell 430bp of IBM Buy 350bp of RIMM Buy 50bp of HPQ Buy 56bp of INTC Recap Recommendation Sell Buy Q&A Current and Proposed Weights Recap Recommendation Sell Buy Q&A Research In Motion Life On Blackberry Recap Recommendation Sell Buy Q&A Background • Canadian company founded in 1984 • Leading designer, manufacturer and marketer of innovative wireless solutions for the worldwide global communications market. • Primary revenue driver: BlackBerry wireless solution • Traditional B2B focus: sales to carriers and services revenues from infrastructure access fee paid by carrier/distributor. Recap Recommendation Sell Buy Q&A Competitive Advantage • International expansion • Increasing carrier customer base in NAM with 63% revenues generated in United States. • Expect sales to increase in Europe and Asia (China). • Device portfolio • Segmented by multiple price points and feature sets versus Apple’s premium web/application experience offered at a high-end price point. Recap Recommendation Sell Buy Q&A Competitive Advantage • Innovation – BlackBerry Bold (RIM’s first HSDPA smart phone) – BlackBerry Storm (RIM’s first touch-screen with smart phone with the awardwinning SurePress technology) – BlackBerry Pearl Flip (RIM’s first “clam-shell” smartphone) – BlackBerry Curve 8350i (iDen-based smart phone with Push-to-Talk) – BlackBerry Curve 8900 (based on a next generation platform) 2009 R&D expenditure of $684.7 million with 5000 employees and 2 new centers in U.S. and Germany Recap Recommendation Sell Buy Q&A Competitive Advantage • Unique industry position – The only company to provide network infrastructure as part of an optimized enterprise solution – Vertically integrated and provides both hardware and software (UI, bundled applications) and related services. – Yields strong gross and operating margins with recurring revenue. Recap Recommendation Sell Buy Q&A Risks • Competition – Intense competition: Google’s Nexus One, Motorola Droid and HTC Eris – Apple moving toward non-exclusive distribution strategy – Well-positioned within existing enterprise accounts but increased competition by Apple, Microsoft, Android and other platforms • International exposure – U.S. sales account for 63% of total revenue, any changes in competitive, economic or regulatory environment could affect sales. Recap Recommendation Sell Buy Q&A Risks • Increased B2C focus – Consumers demand low security requirements and are unwilling to pay price premium for RIM features – Consumer focus on Internet browsing and “apps” and currently RIM offers sub-par browsing and apps experience. Future success depends on strengthening these offerings • Increased Capital expenditure – Capital spending increased from $350M in fiscal 2008 to $834M in 2009 – Expect to increase- due to new products and “outsourcing” of fundamental research via spending on IP rights Recap Recommendation Sell Buy Q&A Revenue Growth Recap Recommendation Sell Buy Q&A EPS Recap Recommendation Sell Buy Q&A 3 month performance Recap Recommendation Sell Buy Q&A 1 year performance Recap Recommendation Sell Buy Q&A 5 year performance Recap Recommendation Sell Buy Q&A Valuation Stock Valuation Relative to Industry P/Trailing E P/Forward E P/B P/S P/CF Relative to S&P 500 P/Trailing E P/Forward E P/B P/S P/CF High Low Median Current 3.4 2.2 4.8 4.2 4.4 .65 .68 .4 .8 .7 1.4 1.2 2 2.0 1.6 .87 .84 1.6 .9 .9 High Low Median Current 4.8 2.9 7.4 9.8 7.7 .84 .81 .7 2.2 1.0 1.8 1.6 2.7 4.8 2.6 1 .96 2.1 2.3 1.4 Recap Recommendation Sell Buy Q&A Price Target Absolute Valuation High Low Median Current A. B. C. D. E. F. G. H. P/Forward E 45.7 10.8 25.6 14 25.6 3.3 84.48 P/S 13.7 2.4 6.3 2.7 3.5 26.99 94.465 P/B 22.7 2 6.3 4.7 6.3 14.79 93.177 P/EBITDA 90.01 7.21 23.88 11.99 17 5.79 98.43 P/CF 85.9 10 27.2 14.1 19 4.93 93.67 • • • • #Your Target *Your Target Multiple E, S, B, etc/Share Your Target Price (F x G) Current price: $73.39 Multiples Average: $92.84 DCF Target Price: $110.10 50% Multiples + 50% DCF = $101.47 or 38.2% upside Recap Recommendation Sell Buy Q&A DCF Terminal Discount Rate:= 12.0% Terminal FCF Growth= Year 2010E 2011E 15,161 Revenue 18,478 21.9% % Grow th 3,601 Operating Income 24% Operating Margin 29 Interest and Other 0.19% as % of Sales Taxes 893 Tax Rate 25% Net Income 2,737 % Grow th Add Depreciation/Amort 546 3.60% (200) -1.32% % of Sales Plus/(minus) Changes WC % of Sales Subtract Cap Ex 561 4,188 23% 45 2012E 21,118 14.3% 4.5% 2013E 2014E 2015E 2016E 2017E 24,075 27,445 31,287 35,042 38,546 14.00% 14.00% 14.00% 12.00% 10.00% 2018E 42,015 2019E 45,376 9.00% 8.00% 2020E 47,645 5.00% 4,808 4,808 6,312 7,196 8,060 8,866 9,663 10,437 10,958 22.77% 23.00% 23.00% 23.00% 23.00% 23.00% 23.00% 23.00% 23.00% 105.13 115.64 126.05 136.13 142.94 72.22 82.33 93.86 0.24% 0.43% 0.30% 0.30% 0.30% 0.30% 0.30% 0.30% 0.30% 0.30% 1,036 1,180 1,184 1,558 1,776 1,989 2,187 2,384 2,575 2,704 25% 90 25% 25% 25% 25% 25% 25% 3,197 3,719 3,696 4,837 5,514 6,176 6,794 16.8% 16.3% -0.6% 30.9% 14.0% 12.0% 10.0% 915 684 3.70% (200) 0.00% 9.0% 7,998 8.0% 25% 8,397 5.0% 1,098 1,251 1,402 1,542 1,681 1,815 1,906 3.80% 4.00% 4.00% 4.00% 4.00% 4.00% 4.00% 4.00% (200) 0.00% (200) 0.00% (200) 0.00% (200) 0.00% (200) 0.00% (200) 0.00% (200) 0.00% (200) 0.00% 1,083 1,235 1,408 1,577 1,735 1,891 2,042 2,144 3.70% 4.00% 4.00% 4.50% 4.50% 4.50% 4.50% 4.50% 4.50% 4.50% 4.50% Free Cash Flow 2,522 2,942 3,455 3,328 4,500 5,158 5,801 6,401 6,995 7,571 7,959 16.6% 17.4% -3.7% 35.2% 14.6% 12.5% 10.3% NPV of Cash Flows $ 27,488.53 NPV of terminal value $ Projected Equity Value $ 63,194.83 35,706.30 845 7,405 25% Capex % of sales % Grow th 739 781 3.70% (200) 0.00% 25% 43% 57% 100% 8.2% Terminal Value Free Cash Flow Yield Free Cash Yield Current P/E Projected P/E Current EV/EBITDA Projected EV/EBITDA 14.80 12.67 10.89 23.09 19.77 16.99 9.56 8.14 7.10 15.04 12.80 11.16 574 Shares Outstanding Current Price $ 70.55 Implied equity value/share $ 110.10 Upside/(Downside) to DCF 9.3% 56% Terminal P/E Terminal EV/EBITDA 5.1% $ 110,898.34 7.18% 13.21 8.56 HP – Buy 50 basis points • Best performing IT company this month in SIM at 7.9% • Continues to grow through acquisitions – EDS 2008 – 3com 2009 • Becoming the first full service provider • Revised guidance upward for 2010 – Revenues of $121.5-$122.5B vs $118-$119B – EPS of $4.37-$4.44 vs $4.25-$4.35 Recap Recommendation Sell Buy Q&A DCF Analyst: Jonathan Schick Terminal Discount Rate = 11.0% Terminal FCF Grow th = 4.0% Date: 1/26/10 Year 2009E Revenue 2010E 114,552 2011E 123678 % Grow th 7.97% Operating Income Operating Margin Interest and Other 7.34% 138066 4.00% 2014E 143589 4.00% 2015E 149332 4.00% 2016E 155306 4.00% 2017E 161518 4.00% 2018E 167979 4.00% 2019E 174698 181686 4.00% 4.00% 9415 13419 16727 14911 15508 16128 16773 17444 18142 18867 19622 10.9% 12.6% 10.8% 10.8% 10.8% 10.8% 10.8% 10.8% 10.8% 10.8% 0 -1% Taxes 132756 2013E 8.2% -721 Interest % of Sales 2012E -1,755 0 0.0% -2684 0 0.0% -3345 0 0.0% -2982 0 0.0% -3102 0 0.0% -3226 0 0.0% -3355 0 0.0% -3489 0 0.0% -3628 0 0.0% -3773 0.0% -3924 Tax Rate 19% 20% 20% 20% 20% 20% 20% 20% 20% 20% 20% Net Income 7660 10735 13382 11929 12406 12902 13418 13955 14513 15094 15698 40% 25% -11% 4% 4% 4% 4% 4% 4% 4% % Grow th Add Depreciation/Amort 4,773 % of Sales 4.2% Plus/(minus) Changes WC (2,034) % of Sales Subtract Cap Ex Capex % of sales Free Cash Flow 4,576 3.7% 1,420 Upside/(Dow nside) to DCF 0 5,007 3.1% 0 5,039 3.0% 0 5,066 2.9% 0 5,087 2.8% 0 0.0% 0.0% 3695.00 3710.35 3650.79 4832.31 4882.02 4927.97 4969.78 5007.05 5039.36 5066.23 5087.20 3.2% 3.0% 2.8% 3.5% 3.4% 3.3% 3.2% 3.1% 3.0% 2.9% 2.8% 6704 13021 15058 11929 12406 12902 13418 13955 14513 15094 15698 94% 16% -21% 4% 4% 4% 4% 4% 4% 4% 49% Terminal Value Free Cash Yield 16.0 11.4 9.1 21.2 15.1 12.1 8.6 6.8 5.7 11.5 9.0 7.6 2,437 50.15 $ 3.2% 0.0% 5.49% Current Price 0 4,970 0.0% 51% Shares Outstanding 3.3% 0.0% 100% Projected EV/EBITDA 0 4,928 0.0% 162,263 Current EV/EBITDA 3.4% 0.0% 82,137 Projected P/E 0 4,882 0.0% 80,126 Current P/E 3.5% 0.5% NPV of terminal value Implied equity value/share 681 4,832 1.1% NPV of Cash Flow s Free Cash Flow Yield 3.5% -1.8% % Growth Projected Equity Value 4,646 66.58 32.8% 233,222 6.73% Terminal P/E 14.9 Terminal EV/EBITDA 9.4 Sensitivity Analysis Terminal Discount Rate Terminal FCF Growth $ 66.58 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% 9.0% 87.11 92.50 99.09 107.33 117.92 132.05 9.5% 79.95 84.26 89.43 95.76 103.66 113.83 10.0% 73.88 77.39 81.53 86.49 92.56 100.15 10.5% 68.69 71.57 74.93 78.91 83.67 89.50 11.0% 64.19 60.24 56.77 66.58 62.26 58.47 69.35 64.56 60.41 72.58 67.22 62.62 76.39 70.32 65.17 80.97 73.98 68.15 11.5% 12.0% Recap Recommendation Sell Buy Q&A Valuation - multiples Relative to S&P 500 High Low Median Current P/Trailing E 1.5 .63 1.0 .67 P/Forward E 1.6 .64 .88 .77 P/B 1.4 .5 .9 1.3 P/S 1.4 .4 .7 .9 P/CF 1.8 .6 1.0 .8 Relative to Industry High Low Median Current P/Trailing E 1.1 .54 .79 .74 P/Forward E 1.2 .57 .75 .81 P/B .7 .3 .6 .6 P/S 1.0 .5 .7 .6 P/CF 1.2 .5 .8 .7 Recap Recommendation Sell Buy Q&A Valuation - multiples Absolute Valuation High Low Median Current #Your Target Multiple A. P/Forward E P/S P/B P/EBITDA P/CF B. 37.9 3.0 6.9 49.79 29.1 C. 7.8 .5 1.3 5.07 5.5 D. 15.2 1.0 2.5 11.93 11.5 E. 10.8 1.0 2.7 6.86 8.0 F. 15.54 1.0 2.5 10.0 11.5 *Your Target E, S, B, etc/Share G. 4.27 49.19 17.96 7.07 6.06 Your Target Price (F x G) H. 66.36 49.19 44.91 70.70 69.72 Price for multiples - $60.53 DCF Target Price - $66.58 50% multiples, 50% DCF - $63.55 or 22.21% Recap Recommendation Sell Buy Q&A Intel- Buy 56bp • Market Cap: $113.4bn • World largest semiconductor chip maker, market share of over 70% • 80% international sales • 2009 Q4 revenue jumped 28% year-overyear • Benefit from IT spending rebound Recap Recommendation Sell Buy Q&A DCF Hanh Bui 3/8/2010 Terminal Discount Rate:= Terminal FCF Growth= Year 2010E Revenue Operating Margin G/L on equity investment, net; Interest and Other as % of Sales Taxes Tax Rate Net Income 2018E 2019E 64,540 8.00% 69,703 8.00% 74,582 7.00% 80,176 7.50% 11,602 29% 13,012 31% 14,532 31% 14,789 29% 16,046 29% 17,330 29% 18,717 29% 20,214 29% 21,629 29% 23,251 29% 319 0.81% (116) -0.27% (33) -0.07% (51.00) -0.10% (55.33) -0.10% (59.76) -0.10% (64.54) -0.10% (69.70) -0.10% (74.58) -0.10% (80.18) -0.10% 3,576 30% 3,482 27% 3,915 27% 4,155 28% 4,508 28% 4,869 28% 5,259 28% 5,679 28% 6,077 28% 6,533 28% 8,345 9,414 12.8% 10,584 12.4% 10,583 0.0% 11,483 8.5% 12,401 8.0% 13,393 8.0% 14,465 8.0% 15,477 7.0% 16,638 7.5% 4600 10.79% 285 0.67% 4,900 11.50% 4700 10.05% 163 0.35% 5,000 10.69% 5,202 10.20% 0.00% 5,100 10.00% 5,644 10.20% 0.00% 5,533 10.00% 6,095 10.20% 0.00% 5,976 10.00% 6,583 10.20% 0.00% 6,454 10.00% 7,110 10.20% 0.00% 6,970 10.00% 7,607 10.20% 0.00% 7,458 10.00% 8,178 10.20% 0.00% 8,018 10.00% 9,399 10,447 10,685 11,593 12,521 13,522 14,604 15,626 16,798 7,804 20.4% $ 70,438.28 $ 81,012.42 $ 151,450.70 11.1% 47% 53% 100% 2.3% 8.5% 8.0% 8.0% 8.0% 7.0% 7.5% Terminal Value Free Cash Yield Current P/E Projected P/E Current EV/EBITDA Projected EV/EBITDA 13.86 18.15 6.53 8.75 Shares Outstanding 5,578 Current Price Implied equity value/share Upside/(Downside) to DCF 2017E 59,759 8.00% % Grow th NPV of Cash Flows NPV of terminal value Projected Equity Value Free Cash Flow Yield 2016E 55,332 8.50% Free Cash Flow % of Sales Subtract Cap Ex 2015E 50,998 9.00% Capex % of sales Plus/(minus) Changes WC 2014E 46,787 9.8% 4500 11.44% (241) -0.61% 4,800 12.20% % of Sales 2013E 42,617 8.4% % Grow th Add Depreciation/Amort 2012E 39,331 % Grow th Operating Income 2011E 12.0% 4.5% $ 20.74 $ 27.15 31% 12.29 16.09 5.97 8.00 10.93 14.31 5.47 7.33 Terminal P/E Terminal EV/EBITDA Sensitivity Analysis $ 29.66 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% $ $ $ $ $ $ $ 9.0% 38.67 40.97 43.73 47.11 51.32 56.75 63.97 $ $ $ $ $ $ $ 9.5% 35.49 37.36 39.56 42.21 45.45 49.49 54.70 $ $ $ $ $ $ $ 10.0% 32.76 34.30 36.09 38.21 40.75 43.86 47.74 $ $ $ $ $ $ $ 10.5% 30.41 31.69 33.16 34.88 36.92 39.36 42.34 Recap $ $ $ $ $ $ $ 11.0% 28.35 29.42 30.65 32.07 33.72 35.67 38.02 $ $ $ $ $ $ $ 11.5% 26.54 27.45 28.48 29.66 31.02 32.61 34.48 Recommendation $ $ $ $ $ $ $ 12.0% 24.94 25.71 26.59 27.58 28.71 30.02 31.54 Sell $ $ $ $ $ $ $ 12.5% 23.50 24.17 24.92 25.76 26.71 27.80 29.05 Buy $ $ $ $ $ $ $ 13.0% 22.22 22.80 23.44 24.16 24.96 25.88 26.92 Q&A Valuation Absolute Valuation High A. P/Forward E P/S P/B P/EBITDA P/CF • • • • B. 67.5 16.9 15.3 33.5 43.8 Low Median C. D. 11.9 1.8 1.8 5.72 6.6 21.3 4.3 3.7 10.44 12.4 Current #Your Target Multiple E. 12.7 3.3 2.7 8.51 10 *Your Target E, S, B, etc/Share F. 1.50 7.05 7.40 2.43 2.15 Your Target Price (F x G) H. 31.87 23.27 27.38 25.37 26.66 Buy Q&A G. 21.3 3.3 3.7 10.44 12.4 Current price: $20.79 Multiples Average: $26.91 DCF Target Price: $27.58 50% Multiples + 50% DCF = $27or 31% upside Recap Recommendation Sell Sell IBM • International Business Machines – core focus on providing IT strategy and consulting services to business domains • Competition in all business lines from offshore companies • Increasing dollar value a concern for their revenue from offshore consulting • No sign of potential breakthrough technologies (growing through acquisitions) Recap Recommendation Sell Buy Q&A Financial Valuations Price Target from Valuation: $135.28 Recap Recommendation Sell Buy Q&A DCF IBM Analyst: Vamsi Namburi Date: 03/07/2010 Year Revenue Terminal Discount Rate = Terminal FCF Grow th = 2009E 95,727 % Grow th Operating Income Operating Margin Interest and Other Interest % of Sales Taxes Tax Rate Net Income % of Sales Plus/(minus) Changes WC % of Sales Subtract Cap Ex Capex % of sales Free Cash Flow 17,248 Current P/E Projected P/E Current EV/EBITDA Projected EV/EBITDA Shares Outstanding Current Price Implied equity value/share Upside/(Dow nside) to DCF Debt Cash Cash/share 18,838 2011E 102,238 3.5% 20,519 2012E 106,328 4.0% 22,329 107,391 1.0% 22,552 109,002 1.5% 23,435 111,182 2.0% 24,460 113,739 2017E 116,583 2.3% 25,023 2.5% 25,648 2.1% 26,187 1.5% 24,163 757 744 752 763 778 796 816 833 846 0.7% 0.70% 0.70% 0.70% 0.70% 0.70% 0.70% 0.70% 0.70% 13,400 13,413 0.1% 4,940 5,137 14,526 8.3% 5,316 6,152 28.5% 15,433 6.2% 5,316 6,213 28.5% 15,587 1.0% 5,370 6,462 28.5% 16,211 4.0% 5,450 6,749 28.5% 16,932 4.5% 5,559 6,905 7,077 28.5% 17,322 28.5% 17,755 2.3% 5,687 2.5% 5,829 22.0% 120,817 0.7% 26.5% 22.0% 119,031 2019E 711 5,237 22.0% 2018E 0.6% 26.0% 22.0% 2016E 531 4,713 21.5% 2015E 20.1% 26.0% 21.0% 2014E 19.1% 4,708 21.0% 2013E 18.0% 7,226 28.5% 18,128 2.1% 5,952 20.0% 6,646 28.5% 16,672 -8.0% 3,624 5.2% 5.2% 5.2% 5.0% 5.0% 5.0% 5.0% 5.0% 5.0% 5.0% 3.0% 800 400 52 (532) (107) 218 556 455 933 595 121 0.8% 0.4% 0.1% -0.5% -0.1% 0.2% 0.5% 0.4% 0.8% 0.5% 3,509 3.7% 15,631 % Grow th NPV of Cash Flow s NPV of terminal value Projected Equity Value Free Cash Flow Yield 98,781 3.2% % Grow th Add Depreciation/Amort 2010E 11.0% 4.0% 3,621 3.7% 15,329 -1.9% 101,933 84,075 186,008 9.45% 12.3 13.9 11.2 12.2 1,300 $ 127.25 $ 143.08 12.4% 98,000 14,000 10.77 3,747 3.7% 16,147 5.3% 55% 45% 100% 3,934 3.7% 16,284 0.8% 4,296 4.0% 16,554 1.7% 4,033 3.7% 17,846 7.8% 4,225 3.8% 18,823 5.5% 4,550 4,314 4.0% 18,914 3.7% 20,203 0.5% 6.8% 4,166 3.5% 20,508 1.5% Terminal Value Free Cash Yield 12.3 13.9 10.4 11.3 11.4 12.8 9.7 10.5 0.1% 4,349 3.6% 16,068 -21.7% 238,725 6.73% Terminal P/E 14.3 Terminal EV/EBITDA 11.6 Discount Rate Sensitivity Analysis 143 9% 9.5% 10% 10.5% 11% 11.5% 12% Terminal FCF Growth 3.5% 4.0% 4.5% 5.0% $ 184.01 $ 194.36 $ 207.01 $ 222.81 $ 169.86 $ 178.14 $ 188.07 $ 200.20 $ 157.84 $ 164.56 $ 172.50 $ 182.03 $ 147.49 $ 153.02 $ 159.47 $ 167.10 $ 138.48 $ 143.08 $ 148.39 $ 154.59 $ 130.56 $ 134.43 $ 138.85 $ 143.95 $ 123.55 $ 126.82 $ 130.54 $ 134.78 5.5% $ 243.14 $ 215.37 $ 193.68 $ 176.25 $ 161.91 $ 149.90 $ 139.68 Price Target from DCF: $143.08 Overall Price (50% from both DCF and Valuation) : 0.5*143.08+0.5*135.08 = $139.08 Recap Recommendation Sell Buy Q&A Stocks Analyzed • Researched stocks in Telecom Sector with focus on low-medium market caps and growth potential Recommendation • Sell 430bp of IBM • Buy 350bp of RIMM • Buy 50bp of HPQ • Buy 56bp of INTC Recap Recommendation Sell Buy Q&A Q&A NCR •Discount Rate: 13.2% •Terminal FCF Growth: 5% Analyst: Hang Nguyen Date: Jan 18, 2010 Year Revenue (Millions $USD) % Growth Terminal Discount Rate = Terminal FCF Growth = 2010E 4,833.59 2011E 2012E 2013E 2014E CAPM Beta Rf MRP 13.20% 5.00% 2015E 2016E 1.5 4.50% 5.8% 2017E 2018E 2019E 2020E 5,124.78 5,508.49 5,938.16 6,377.58 6,824.01 7,274.40 7,725.41 8,173.48 8,614.85 6.02% 7.49% 7.80% 7.40% 7.00% 6.60% 6.20% 5.80% 5.40% 9,045.59 5.00% •Current : $13.06 Operating Income Operating Margin 228.79 4.73% 264.09 5.15% 311.85 5.66% 356.29 6.00% 369.90 5.80% 382.14 5.60% 392.82 5.40% 401.72 5.20% 408.67 5.00% 413.51 4.80% 434.19 4.80% •DCF Target: •Upside: $18.14 Interest and Other % of Sales 142.11 2.94% 99.93 1.95% 52.88 0.96% 59.38 1.00% 63.78 1.00% 68.24 1.00% 72.74 1.00% 77.25 1.00% 81.73 1.00% 86.15 1.00% 90.46 1.00% 39% Taxes Tax Rate 23.40 27.00% 62.38 35.00% 77.69 30.00% 83.13 28.00% 85.71 28.00% 87.89 28.00% 89.62 28.00% 90.85 28.00% 91.54 28.00% 91.66 28.00% 96.25 28.00% 63.28 101.77 60.84% 181.28 78.12% 213.77 17.92% 220.41 3.10% 226.01 2.54% 230.45 1.97% 233.62 1.37% 235.40 0.76% 235.70 0.13% 247.49 5.00% 140.00 2.90% (86.73) -1.79% 220.00 4.55% 245.99 4.80% (61.85) -1.21% 250.00 4.88% 220.34 4.00% (49.31) -0.90% 220.34 4.00% 207.84 3.50% (59.38) -1.00% 207.84 3.50% 191.33 3.00% (63.78) -1.00% 127.55 2.00% 136.48 2.00% (68.24) -1.00% 136.48 2.00% 145.49 2.00% (72.74) -1.00% 145.49 2.00% 154.51 2.00% (77.25) -1.00% 154.51 2.00% 163.47 2.00% (81.73) -1.00% 163.47 2.00% 172.30 2.00% (86.15) -1.00% 172.30 2.00% 180.91 2.00% (90.46) -1.00% 180.91 2.00% 159.61 128.00% 230.59 44.47% 273.16 18.46% 347.96 27.39% 294.25 -15.44% 303.20 3.04% 310.87 2.53% 317.13 2.01% 321.85 1.49% 337.94 5.00% Terminal Value 4,665.27 Net Income % Growth Add Depreciation/Amort % of Sales Plus/(minus) Changes WC % of Sales Subtract Cap Ex Capex % of sales Free Cash Flow % Growth NPV of Cash Flows NPV of terminal value Projected Equity Value Free Cash Flow Yield Current P/E Projected P/E Current EV/EBITDA Projected EV/EBITDA 70.00 1,474.95 1,350.24 2,825.19 3.44% 32.11 44.65 4.27 6.42 Shares Outstanding 155.72 Current Price Implied equity value/share Upside/(Downside) to DCF 13.05 18.14 39.02% Debt Cash Cash/share 25.00 483.36 3.10 52.21% 47.79% 100.00% 19.97 27.76 3.09 4.64 Free Cash Yield 11.21 15.58 2.96 4.45 7.24% Terminal P/E 18.85 Terminal EV/EBITDA 6.84 EPS consensus EPS guidance Revenue consensus Revenue guidance 0.48 .41 - .51 N/A N/A NCR 18.14 4.50% 4.60% 4.70% 4.80% 4.90% 5.00% 5.10% 5.20% 5.30% 5.40% 5.50% 13.00% 18.05 18.16 18.26 18.37 18.47 18.59 18.70 18.82 18.94 19.06 19.19 Absolute Valuation A. P/Forward E P/S P/B P/EBITDA P/CF 13.10% 17.85 17.95 18.05 18.15 18.25 18.36 18.47 18.59 18.70 18.82 18.94 13.20% 17.64 17.74 17.84 17.94 18.04 18.14 18.25 18.36 18.47 18.59 18.71 13.30% 17.45 17.54 17.63 17.73 17.83 17.93 18.03 18.14 18.25 18.36 18.47 13.40% 17.25 17.34 17.43 17.53 17.62 17.72 17.82 17.92 18.03 18.14 18.25 13.50% 17.06 17.15 17.24 17.33 17.42 17.52 17.61 17.71 17.81 17.92 18.03 13.60% 16.88 16.96 17.05 17.13 17.22 17.32 17.41 17.51 17.61 17.71 17.81 13.70% 16.69 16.78 16.86 16.94 17.03 17.12 17.21 17.31 17.40 17.50 17.60 High Low Median Current #Your Target Multiple B. 26.8 1.0 5.1 13.1 13.6 C. 5.3 .10 .50 1.61 1.5 D. 9.9 .40 1.4 4.85 5.5 E. 26.8 .40 4.5 4.94 9.3 F. 9.9 .40 1.4 4.85 5.5 13.80% 16.52 16.60 16.68 16.76 16.84 16.93 17.02 17.11 17.20 17.30 17.39 *Your Target E, S, B, etc/Share G. .406 31.04 2.9 2.64 1.4 13.90% 16.34 16.42 16.50 16.58 16.66 16.74 16.83 16.92 17.01 17.10 17.19 14.00% 16.17 16.25 16.32 16.40 16.48 16.56 16.64 16.73 16.82 16.91 17.00 Your Target Price (F x G) H. 4.023 12.42 4.06 12.8 7.7 Oracle Discount Rate 12% Terminal Growth 4% Current $24.76 Price Target $32.84 Upside 33.1% Oracle Absolute Valuation High Low Median Current #Your Target Multiple *Your Target E, S, B, etc/Share Your Target Price (F x G) A. B. C. D. E. F. G. H. P/Forward E 117.9 10.6 25.0 13.5 21 1.55 32.55 P/S 27.5 2.7 6.2 5.0 5.3 6.1 32.33 P/B 61.9 3.4 9.9 3.8 5.2 6.26 32.57 P/EBITDA 97.13 8.06 16.27 8.81 12 2.7 32.42 P/CF 151.5 11.1 27.3 15.5 21 1.53 32.25