Industrial Sector Stock Presentation Ryan Moore Jordan Winters

advertisement

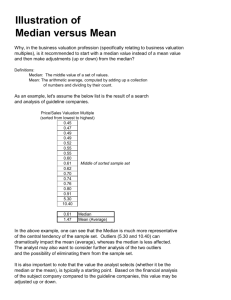

Industrial Sector Stock Presentation Ryan Moore Jordan Winters Tony Lovell James Murray Kimberly Chianese Recap Current Holdings • S&P Sector Weight = 10.64% • SIM Weight = 12.99% • Overweight = 235 bps Current Weights •Own 530bps •Own 391bps •Own 391bps •Do Not Own • Do Not Own • Do Not Own Sector Overview Recap Absolute Basis High Low Median Current P/E 26.9 9.2 17.2 14.6 % Current to LT Median -15.11% P/B 5.6 1.4 3.2 2.5 -21.88% P/S 1.9 0.6 1.4 1.1 21.43% P/CF 16.4 6.0 11.5 10.2 -11.3% Relative to SP500 High Low Median Current P/E 1.2 0.82 1.1 1.1 % Current to LT Median 0.00% P/B 1.4 0.9 1.1 1.2 9.09% P/S 1.1 1.8 1.0 1.0 0.00% P/CF 1.2 0.8 1.1 1.1 0.00% Key Drivers • Geopolitical • Increase in international defense spending • Emphasis on alternative energy resources • Industrialization • Industrial growth in emerging markets • Shift in Asia from agriculture to industrialized economy • Global infrastructure growth • Technological • Economies of scale allowing for greater spread • Global sourcing and manufacturing Recommendations • Sell 100 bps • Sell 391bps • Buy 100bps • Buy 391bps • Do Nothing • Do Nothing Covanta Corporation Market Cap: $2.27 billion Total Revenue: $1.55 billion Div. Yield: 0.30% Segments: 1. Waste to Energy 2. Electric and Steam Energy Generation Covanta Corporation Stock Price: $14.67 DCF Target Price: $18.39 Valuation Target Price: $17.33 Final Target Price: $18.39 Upside: 25.3% Recommendation: Do Not Buy Bucyrus International Inc. • Recommendation: Sell 100bps • Current Price: $59.35 • DCF Value: $76.50 • Stock Valuation: $65.82 • Analyst Median Price Target: $80.00 • Average Percent Upside: 24.8% • Recent Developments • Analysts recommending Hold or Buy (no Sell recommendations) • 30% Order backlog growth – 12 month outlook $1.6B additional Sales • 2011 Estimated growth of 35.20% Oshkosh Corporation • Recommendation: Sell all 391bps • Current Price: $27.62 • DCF Value: $43.87 • Stock Valuation: $38.68 • Average Percent Upside: 29% • Recent Developments • Heavily reliant on U.S. Department of Defense • Sales consensus decreases roughly 30% in 2011 and 2012 • Arbitrage opportunity related to market sell-off Tyco Int’l Market Cap: $18.2 billion Total Revenue: $17.2 billion Div. Yield: 2.30% Segments: 1. ADT Worldwide 2. Flow Control 3. Fire Protection Services 4. Electrical and Metal Products 5. Safety Products Tyco Int’l Positives: 1. Diversified, global revenue base 2. Recurring service revenue up to 33% of total revenue 3. Strong balance sheet and cash conversion 4. Potential inclusion into S&P 500 5. Broadview acquisition creates dominant share in security industry 6. TEMP spin-off removes highly cyclical segment 7. Share repurchase program could provide upside to earnings estimates Negatives: 1. No obvious catalyst 2. More attractive names Tyco Int’l Stock Price: $36.48 Target Price: $45.00 Upside: 23% Recommendation: Do Not Buy Flowserve Corp. Market Cap: $5.3 billion Total Revenue: $4.3 billion Div. Yield: 1.20% Segments: 1. Flow Solutions Group Engineered Products Industrial Products 2. Flow Control Division Flowserve Corp. Positives: 1. Diversified, global revenue base with strong presence in Middle East 2. High margin aftermarket business represents 40% of revenue 3. Strong balance sheet and cash conversion 4. Fragmented markets allow FLS to gain share and do acquisitions 5. Secular growth story in water desalination 6. Top notch management Negatives: 1. Bookings can be erratic, but 8 quarters in a row ~$1 billion 2. Very little news flow between quarters Multiple Pricing Current Value Price Multiples Target Price DCF Target Price Average Target Price Target Price $138 $136 $137 Flowserve Corp. Stock Price: $96.22 Target Price: $137 Upside: 41.3% Recommendation: Buy 391 bps General Dynamics Market Cap: $22.9 billion Total Revenue: $32.0 billion Div. Yield: 2.78% Industry: • Aerospace and Defense Primary Markets: Combat Systems • Defense & National Security Marine Systems • Business Aviation Information Systems and Technology Industry Valuation 20.0 18.0 16.0 14.0 12.0 Median 10.0 Current 8.0 6.0 4.0 2.0 0.0 P/Trailing E P/Forward E P/B P/S P/CF DCF Model Analyst: Kimberly Chianese 7/14/2010 Year Revenue 2010E 33,770 % Grow th EBIT EBT Margin Interest Interest % of Sales Taxes Tax Rate Discontinued Operations, Net Net Income % of Sales 35,668 5.6% 3,891 4,073 11.5% 11.4% (125) -0.4% 1,167 31.0% 11.0% 3.5% 2012E 2015E 37,802 6.0% 4,284 2013E 40,070 6.0% 4,408 11.3% 11.0% (132) (140) (148) -0.4% -0.4% -0.4% 1,222 31.0% 1,285 31.0% 1,320 31.0% 2014E 42,474 6.0% 4,460 10.5% 45,022 6.0% 4,727 2016E 47,273 5.0% 4,727 2017E 49,637 5.0% 4,964 2018E 51,871 4.5% 5,187 53,946 4.0% 5,395 55,834 3.5% 5,583 10.0% 10.0% (340) (360) (473) (496) (519) (539) (558) -0.8% -0.8% -1.0% -1.0% -1.0% -1.0% -1.0% 31.0% 1,354 31.0% 1,319 31.0% 1,385 31.0% 1,447 31.0% 10.0% 2020E 10.5% 1,277 10.0% 2019E 1,505 31.0% 10.0% 1,558 31.0% 37 3 3 - - - - - - - - 2,636 2,722 2,863 2,939 2,843 3,013 2,936 3,082 3,221 3,350 3,467 % Grow th Add Depreciation/Amort 2011E Terminal Discount Rate = Terminal FCF Growth = 3.3% 5.1% 2.7% 439 464 491 521 425 1.3% 1.3% 1.3% 1.3% 1.0% 6.0% -2.6% 5.0% 4.5% 4.0% 3.5% 450 473 496 519 539 558 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% (67) (76) (132) (140) (149) (156) (164) (171) (178) (184) 0.4% -0.2% -0.2% -0.3% -0.3% -0.3% -0.3% -0.3% -0.3% -0.3% -0.3% Subtract Cap Ex 371 392 416 441 425 450 473 496 519 539 558 Capex % of sales 1.1% 1.1% 1.1% 1.1% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% Plus/(minus) Changes WC % of Sales Free Cash Flow 122 -3.3% 2,825 % Grow th Current Price Implied equity value/share Upside/(Downside) to DCF 2,727 -3.5% $ 61.51 $ 84.89 38.0% 2,862 5.0% 2,887 0.9% 2,703 -6.4% 2,865 6.0% 2,780 -3.0% 2,919 5.0% 3,050 4.5% 3,172 4.0% 3,283 3.5% Stock Valuation Relative to the Industry Relative to the S&P 500 1.4 1.2 1.2 1 1 0.8 0.8 0.6 0.6 Median 0.4 0.2 Current 0.4 0.2 0 0 Median Current Multiple Pricing Current Value Price Current Target Target Price P/Forward E 8.8 6.6 57.99 P/S 0.7 87.0 60.93 P/B 1.8 32.9 59.20 P/EBITDA 5.34 11.1 59.21 P/CF 7.9 7.5 59.21 Median: 59.21 Median Value Price Median Target Target Price P/Forward E 15.2 6.6 100.17 P/S 1.2 87.0 104.45 P/B 3.1 32.9 101.96 P/EBITDA 9.6 11.1 106.44 P/CF 13.9 7.5 104.18 Median: 104.18 Weighted Target Price Median Multiple DCF Target Price 104.18 84.89 0.25 0.75 26.05 63.67 89.00 Potential Price Drivers • Valuation failing to price in a recovery in business jet demand. • Morgan Stanley estimates global passenger air traffic declined 3.5% in 2009, however growth of approximately 6% is expected in 2010. • Opening of Chinese markets. • Continuation of best in class results for GD franchises in combat vehicles and ships. • Need to repair/replace conventional military equipment (planes, ships, tanks, etc.) • Increased funding for New Virginia Class Submarines and DDG 1000 Destroyers. • Continuation of low interest rates. Potential Risks • Slower than expected economic recovery. • Cuts in military budgets/government spending. • U.S. withdrawal from Iraq and an eventual withdrawal from Afghanistan. • Failure to perform well on existing contracts. Recommendations Stock Price: $60.10 Target Price: $89.00 Upside: 32.4% Recommendation: Buy 100bps Recommendations • Sell 100 bps • Sell 391bps • Buy 100bps • Buy 391bps • Do Nothing • Do Nothing