STOCK ANALYSIS- INDUSTRIALS SECTOR The Ohio State University: SIM

STOCK ANALYSIS- INDUSTRIALS SECTOR

GARRETT GANDEE, SHI TING GU, STEVEN ROEHLIG

The Ohio State

University: SIM

Program

FIN 824 - Industrials Sector Overview

AGENDA

Overview of Industrials & Class

Recommendation

Review of Current SIM Holdings

Recommendations

Conclusion

FIN 824 - Industrials Sector Overview

INDUSTRIALS OVERVIEW

Sector Size

Market Cap = 1.2 Trillion

Industries

Air Freight & Logistics

S&P Sectors

Airlines

Building Products

Commercial Printing

Construction / Engineering

Electrical Components

Industrial Conglomerates

Industrials

Railroads

Industrial & Construction Machinery

Data Processing, Environmental Services

Farm Machinery

FIN 824 - Industrials Sector Overview

CLASS RECOMMENDATION

2/7/2012 – Despite “Increase to Market Weight” recommendation by industrials

team, class voted to maintain current underweight status.

FIN 824 - Industrials Sector Overview

CURRENT SIM HOLDINGS - INDUSTRIALS

• 2.23% of SIM Portfoloio

• Unit Cost $77.76

• Current Price $83.78 (8%)

• 3.98% of SIM Portfolio

• Unit Cost $97.17

• Current Price $118.56 (22%)

• 3.57% of SIM Portfolio

• Unit Cost $50.53

• Current Price $52.43 (4%)

FIN 824 - Industrials Sector Overview

RECOMMENDATIONS

• 2.23% of SIM Portfoloio

• Unit Cost $77.76

• Current Price $83.76 (8%)

• Target Price $85.00 (1% Upside)

• 3.98% of SIM Portfolio

• Unit Cost $97.17

• Current Price $118.56 (22%)

• Target Price $111.14 (-6%)

• 3.57% of SIM Portfolio

• Unit Cost $50.53

• Current Price $52.43 (2%)

• Target Price $56.40 (7.6% Upside)

UTX OVERVIEW

United Technologies Corporation provides technology products and services to the building systems and aerospace industries worldwide.

Business Consists of Six Segments:

Otis segment designs, manufactures, sells, and installs passenger and freight elevators, escalators, and moving walkways, as well as provides maintenance and repair services.

Carrier segment offers heating, ventilating, air conditioning, and refrigeration systems, controls, services, and energy-efficient products

UTC Fire and Security segment provides electronic security products comprising intruder alarms, and access control and video surveillance systems

Pratt and Whitney segment supplies aircraft engines for the commercial, military, business jet, and general aviation markets

Hamilton Sundstrand segment supplies aerospace products and industrial products

Sikorsky segment manufactures military and commercial helicopters

FIN 824 - Industrials Sector Overview

JUSTIFICATION – SELL UTX

FIN 824 - Industrials Sector Overview

JUSTIFICATION – SELL UTX

52 Week Range: $91.83 - $66.87

Current Price: $83.78 (2/17/2012)

Our Target Price: $85.00 (1% Undervalued)

Standard & Poor’s “Fair Value Calculation”

Key Business Drivers

Defense Spending, Aerospace, New Construction (Otis, Carrier)

Review of ROE for UTX

ROE

1 Year

24.84

3 Years 5 Years

22.41 22.85

FIN 824 - Industrials Sector Overview

9 Years

22.42

UTX

Analyst: Shi Ting Gu

Date: 01/23/12

Year

Terminal

Discount

Rate = 10.5%

Terminal

FCF

Growth = 3.0%

2011E 2012E 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2020E 2021E

Revenue

% Growth

Operating Income

Operating Margin

Interest and Other

Interest % of Sales

Taxes

Tax Rate

58,432 62,090 71,025

6.3%

73,866

14.4% 4.0%

76,082 78,365

3.0%

80,716

3.0%

83,137

3.0%

85,631

3.0% 3.0%

88,200 90,846

3.0% 3.0%

7,685 8,469 9,772 10,329 10,639 10,959 11,287 11,626 11,975 12,334 12,704

13.2% 13.6% 13.8% 14.0% 14.0% 14.0% 14.0% 14.0% 14.0% 14.0% 14.0%

526 745 845 591 609 627 646 665 685 706 727

0.9% 1.2% 1.2% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8%

1,933 2,240 2,392 2,610 2,688 2,769 2,852 2,938 3,026 3,116 3,210

27.0% 29.0% 26.8% 26.8% 26.8% 26.8% 26.8% 26.8% 26.8% 26.8% 26.8%

Net Income

% Growth

Add Depreciation/Amort

% of Sales

Plus/(minus) Changes WC

% of Sales

Subtract Cap Ex

Capex % of sales

4,926 5,146 6,215 7,069 7,282 7,503 7,730 7,963 8,204 8,452 8,707

4.5% 20.8% 13.7% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0%

1,300

2.2%

-1.8%

900

1.5%

1,400

2.3%

1,500

2.1%

1,699

2.3%

1,750

2.3%

1,802

2.3%

1,856

2.3%

1,912

2.3%

1,970

2.3%

2,029

2.3%

2,089

2.3%

(1,078) (600) (1,965) (1,256) (1,293) (1,332) (1,372) (1,413) (1,456) (1,499) (1,544)

-1.0% -2.8% -1.7% -1.7% -1.7% -1.7% -1.7% -1.7% -1.7% -1.7%

950 1,000 1,108 1,141 1,175 1,211 1,247 1,284 1,323 1,363

1.5% 1.4% 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% 1.5%

Free Cash Flow

% Growth

NPV of Cash Flows

NPV of terminal value

Free Cash Flow Yield

Projected Equity Value

4,248 4,995 4,749 6,404 6,598 6,797 7,003 7,215 7,433 7,658 7,890

17.6% -4.9% 34.8% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0%

38,511 49%

39,922

78,433

51%

100%

Terminal

Value 108,352

5.50%

Free Cash

Yield 7.28%

Current P/E

Projected P/E

Current EV/EBITDA

Projected EV/EBITDA

15.7

15.9

12.2

12.3

15.0

15.2

11.1

11.2

12.4

12.6

9.7

9.8

Terminal

P/E 12.4

Terminal

EV/

EBITDA 9.5

Shares Outstanding 923

Current Price $ 83.78

Implied equity value/share $ 85.00

Upside/(Downside) to DCF 1.5%

Debt

Cash

Cash/share

38,033

5,966

6.47

FIN 824 - Industrials Sector Overview

STOCK VALUATION

FIN 824 - Industrials Sector Overview

JUSTIFICATION – SELL UTX

Our Target: $85.00

FIN 824 - Industrials Sector Overview

DEFENSE BUDGET CUTS

Company’s performance greatly affected by foreign market.

Sales for 2011 from outside the United States were 61% of its total segment sales.

Potential reduction in military demand: U.S. pulled out army force from Iraq in 2011, and President Barack Obama is signaling he wants to get out of Afghanistan.

FIN 824 - Industrials Sector Overview

ADDITIONAL UTX CONCERNS

In September 2011, UTX acquired Goodrich Corp for $18.4 billion which is a global supplier of systems and services to the aerospace and defense industry.

Economist criticized that UTX was paying too much to buy GR when the market is in a far worse shape.

This acquisition will not be accretive to profit at least until fiscal 2013. But expected revenue 2012 will still be in the range of estimated revenue 2012.

FIN 824 - Industrials Sector Overview

FLOWSERVE OVERVIEW

Global manufacturer of industrial pumps and related equipment for the chemical, oil, gas, and power industries

Market Cap: $6.587 Billion

Sub-Industry: Industrial Machinery

FIN 824 - Industrials Sector Overview

JUSTIFICATION – SELL 50% FLS

52 Week Range: $135.72 - $66.84

Current Price: $118.56

Our Target Price: $111.14 (6% Overvalued)

Standard & Poor’s “Fair Value Calculation”

Key Business Drivers

Capital Expenditures in Oil & Gas, Chemicals, and General Industrials

Review of ROE for FLS

ROE

1 Year

19.94

3 Years 5 Years

26.75 22.90

FIN 824 - Industrials Sector Overview

9 Years

15.50

FIN 824 - Industrials Sector Overview

JUSTIFICATION – SELL 50% FLS

• Price ratio valuation

FIN 824 - Industrials Sector Overview

JUSTIFICATION – SELL 50% FLS

FIN 824 - Industrials Sector Overview

Our Target: $111.14

JUSTIFICATION- SELL 50% FLS

Time to take profits off the table. FLS has returned 22% over its unit cost of $97.17.

FLS is currently 6% over our target price of $111.14

However, our model differs greatly from analysts’ consensus estimates

(target of $135 - $145).

Flowserve is highly correlated with the price of oil. ( )

Increased capital expenditures on oil and gas in the US (shale plays), and in emerging markets will benefit FLS. ( )

Let’s keep 50% of our FLS shares in the game.

FIN 824 - Industrials Sector Overview

DANAHER OVERVIEW

Designs, manufactures and markets professional, medical, industrial and commercial products and services.

Operates in five business segments:

Test & Measurement

Environmental

Life Sciences & Diagnostics

Dental

Industrial Technologies

Growth is derived from segment core expansion and frequent external acquisitions.

FIN 824 - Industrials Sector Overview

DANAHER OVERVIEW

Positives:

Increasing sales in foreign markets, notably those with growing economies.

Strong sales and margin growth, including digit core margin growth in Industrial Technologies and

Test & Measurement segments. Margins now above 20% in both segments.

Gross margin has been higher than its industry average for each of the past five years.

The company has targeted acquisitions of companies with gross margins above 50%.

FIN 824 - Industrials Sector Overview

JUSTIFICATION – HOLD DHR

52 Week Range: $56.09 - $39.34

Current Price: $52.43

Our Target Price: $56.40 (7.6% Undervalued)

Standard & Poor’s “Fair Value Calculation”

Key Business Drivers

Segment core expansion and frequent external acquisitions

Review of ROE for DHR

ROE

1 Year

12.64

3 Years

12.51

5 Years

13.38

9 Years

15.42

FIN 824 - Industrials Sector Overview

DANAHER VS. S&P 500

FIN 824 - Industrials Sector Overview

FIN 824 - Industrials Sector Overview

JUSTIFICATION- HOLD DHR

• Price ratio valuation

FIN 824 - Industrials Sector Overview

JUSTIFICATION- HOLD DHR

Our Target: $56.41

FIN 824 - Industrials Sector Overview

JUSTIFICATION- HOLD DHR

• On 1/31/12, the company announced quarterly earnings of 0.81 per share, a positive surprise of 3.5% above the consensus 0.78.

• Over the past 4 quarters, the company has reported 4 positive, 0 negative, and 0 in-line surprises.

FIN 824 - Industrials Sector Overview

DANAHER CONCERNS

Over 70% of sales growth in the last 5 years has come from acquisitions.

Increasing sales in foreign markets may slow down with rising concern in foreign markets.

FIN 824 - Industrials Sector Overview

NEW STOCK RECOMMENDATION

Industry

Diversified Machinery

Aerospace and Defense Products and Services

Industrial Electrical Equipment

Farm & Construc@on Machinery

Industrial Equipment & Components

Waste Management

General Building Materials

Metal Fabrica@on

Aerospace & Defense – Major Diversified

Heavy Construc@on

Residen@al Construc@on

Machine Tools & Accessories

Small Tools & Accessories

Cement

General Contractors

Tex@le Industrial

Pollu@on & Treatment Controls

Lumber, Wood Produc@on

Manufactured Housing

FIN 824 - Industrials Sector Overview

NEW STOCK RECOMMENDATION

A large number of the industries we assigned a positive outlook to will greatly benefit from an upturn in new construction

Construction Sub-

Industries

BUILDING MATERIALS

FARM & CONSTRUCTION

MACHINERY

RESIDENTIAL CONSTRUCTION

CEMENT

GENERAL CONTRACTORS

LUMBER/WOOD PRODUCTION

MANUFACTURED HOUSING

FIN 824 - Industrials Sector Overview

NEW STOCK RECOMMENDATION

Of those sub-industries, our recommendation would be to target Construction & Farm Machinery & Heavy

Trucks.

Improving global economy since 2010

Global nonresidential construction markets are improving

Domestic housing market bottoming

Robust construction growth in emerging nations

Aging equipment in mature economies

Farm income (primary driver for agricultural equipment sales, rose by 28% in 2011.

FIN 824 - Industrials Sector Overview

NEW STOCK RECOMMENDATION

Caterpillar, Inc. is the world’s largest producer of earthmoving equipment, and a big maker of electric power generators and engines used in petroleum markets, and mining equipment

Caterpillar construction machines are in service in nearly every country in the world. 65% of sales derived outside North

America.

FIN 824 - Industrials Sector Overview

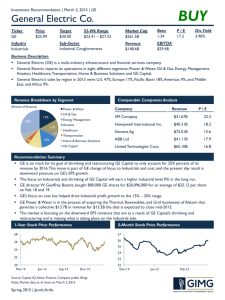

NEW STOCK RECOMMENDATION

Current Price: $113.95

52-Week Range: $116.55 - $67.64

Market Capitalization: $72.26 Billion

Our Target: $136.78 (20% Upside)

S&P “Fair Value Calculation”

FIN 824 - Industrials Sector Overview

NEW STOCK RECOMMENDATION

FIN 824 - Industrials Sector Overview

NEW STOCK RECOMMENDATION

FIN 824 - Industrials Sector Overview

Our Target: $136.78

FIN 824 - Industrials Sector Overview

JUSTIFICATION – BUY CAT

• Price ratio valuation

FIN 824 - Industrials Sector Overview

SIM INDUSTRIALS PORTFOLIO CHANGES

Class Voted to Keep Industrials Sector Underweight, and stay at 9.78% of total SIM portfolio.

SELL 223 bps of UTX (100% of UTX in SIM Portfolio)

SELL 200 bps of FLS (50% of FLS in SIM Portfolio)

BUY 423 bps of CAT

HOLD 198 bps of FLS

HOLD 357 bps of DHR

SIM Industrials Weight

10%

Industrials

90%

Rest of

Portfolio

FIN 824 - Industrials Sector Overview

SIM INDUSTRIALS PORTFOLIO CHANGES

Old Holdings

SIM Industrials

New Holdings

SIM Industrials

36%

23%

41%

UTX

FLS

DHR

37%

20%

43%

CAT

FLS

DHR

FIN 824 - Industrials Sector Overview

RECOMMENDATIONS SUMMARY- INDUSTRIALS

SELL 223 bps (ALL) of

SELL 200 bps (HALF) of

BUY 423 bps of

HOLD Current Position of

HOLD 198 BPS of

FIN 824 - Industrials Sector Overview