Consumer insight into the breakfast occasion in Republic of Ireland and Great Britain

advertisement

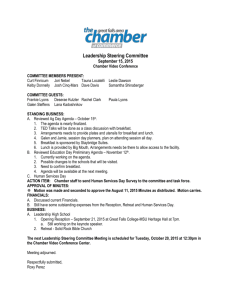

Consumer insight into the breakfast occasion in Republic of Ireland and Great Britain April 2016 Table of Contents 1 Study background – 3 6 2 Setting the scene - 11 7 3 Food and drink choices - 46 4 Changing behaviours - 53 5 Children - 68 Opportunity areas - 75 Appendices - 82 - Respondents breakdown - Categories in depth 2 Study background Background Bord Bia commissioned RED C Research to conduct research to better understand the breakfast occasion from the consumer point of view in terms of how and why they are deciding what to eat and what are the motivations behind the purchases and behaviours. There was a 4-stage methodology to this research project – conducted between February 16th – March 16th 2016. Desk research on trends Looking for global trends on breakfast Quantitative survey in ROI and GB An online survey among 1,640 GB and 1,289 ROI participants across 7 days of the week 30 week long videos 30 participants were involved in the day-to-day documentation of their breakfast habits 8 indepth interviews 8 in-depth interviews were conducted among the various key demographics in ROI and in the GB. 4 Secondary research sourced from: 5 Secondary research sourced from: 6 Current & Emerging trends - Health Healthy breakfast items are of primary importance when shopping for breakfast items…with consumers looking to enhance their own health through food choices “I always read the labels on food packaging and would often compare packs in the supermarket when I am doing the shopping. A few years ago, when I wasn't as conscious about healthy eating, I definitely would not have bothered.” “This time last year I was probably eating something with a lot more sugar. Since switching to better breakfasts like Weetabix and Porridge I found I have more energy and don't get hungry again as quickly. “Breakfast is how I power my day with clean energy. I generally plan my meal the day before, that way I'm never pinched for time and I never skip a meal.” Key Segments 7 Current & Emerging trends – Hand held Breakfast Biscuits for breakfast?! Breakfast at work and out of home is on the rise which has created an increased demand for breakfast options to be convenient, easily storable and portable. “I work 9-5 and have found a readyto -grab convenience food for the last few years that saves me time and thinking about what's appropriate and what works every time, leaves me full, guilt free and reduced 'the bulk' of heaviness I was carrying about.” “I'll eat a slice of toast while walking to college, or try and eat breakfast biscuits when I sop at traffic lights on my bike.” “For me speed is a big factor. I would like to try and cook something more often (like an omelette) but sometimes cereal bars and fruit are just so much faster, especially when I’m running late.” Key Segments 8 Current & Emerging trends - Customisation Mixing it up - customization and personalisation of breakfast foods adds novelty to perceived boring breakfast staples such as porridge and cereals “I try to add different fruits and toppings because porridge can be a bit bland if you jut make it with water!” “Life can be very routine and boring with the same thing everyday so we have a Thursday treat to mix it up so it could be anything, cooked breakfast, pancakes, whatever we fancy.” “I make my own granola which I add to yoghurts or on top of my porridge. It is very tasty and adds an extra bite.” Key Segments 9 Setting the scene Incidence of having Breakfast in morning (Base: GB 1,640, ROI 1,289) Penetration 87% Weekday 87% Weekend 89% Monday Tuesday Wednesday Thursday Friday Saturday Sunday 82% 89% 86% 86% 90% 87% 90% Penetration Monday Tuesday Wednesday Thursday Friday Saturday Sunday 82% 82% 84% 82% 85% 88% 92% 85% Weekday 83% Weekend 90% 12 GB adults more likely to have breakfast at the weekend Frequency of Breakfast Weekday & Weekend ROI GB % Every day MonFri 60 55 3-4 times MonFri 1-2 times MonFri Rarely/Never % 81 Usually on Saturday 78 14 18 10 75 Usually on Sunday 74 9 16 18 9 Neither day usually 14 13 General Breakfast Behaviour Markets (Base: GB 1,640, ROI 1,289) – ROI & GB Which of the following best describes how often you eat breakfast either at home or outside of home? (n=1,289) Everyday – never miss it 53 Almost every day 50 22 More often than not 22 10 Rarely Never (n=1,640) 9 13 16 2 3 1 in 2 never miss breakfast 14 Choices During the Weekday and the (Base: GB, 1640, ROI, 1289) Weekend During the week Tend to have… Same breakfast Small variety At the weekend Tend to have… 41 41 7 31 Same breakfast 32 35 48 Small variety 41 42 7 Lots of variety 18 15 Lots of variety 13 11 Don’t really have breakfast GB Breakfast eaters are more likely to have variety than ROI breakfast eaters during the week 8 8 Don’t really have breakfast ROI Breakfast eaters are more likely to have more variety at the weekend than their GB 15 counterparts Breakfast Dynamics (Base ROI, 1289) Weekend % 1 14 2 30 8-10am 50 51 7-8am Before 7am 26 9 WEEKEND After 12 10-12pm Weekday % WEEKDAY Breakfast Time Time Spent Eating Time Spent Preparing ⁄ Average – 13.6 mins ⁄ Average – 7.5 mins ⁄ 48% Under 10 mins ⁄ 77% Under 10mins ⁄ Average – 16.3 mins ⁄ Average – 10 mins ⁄ 34% Under 10 mins 12 5 ⁄ 60% Under 10mins Ate Breakfast at home Weekday Weekend 87% 96% 35 17 Before 8am (total) 44 19 Before 8am (kids) 1 in 2 eating breakfast between 8 – 10am 16 Breakfast Dynamics (Base: GB, 1640) Weekend % After 12 10-12pm 1 12 2 19 8-10am 46 51 7-8am 28 21 Before 7am Before 8am (total) Before 8am (kids) 12 7 40 28 49 30 1 in 2 eating breakfast between 8 – 10am WEEKEND Weekday % WEEKDAY Breakfast Time Time Spent Eating Time Spent Preparing ⁄ Average – 12.1 mins ⁄ Average – 6.9 mins ⁄ 58% Under 10 mins ⁄ 82% Under 10mins ⁄ Average – 13.8 mins ⁄ Average – 8.1 mins ⁄ 48% Under 10 mins ⁄ 74 % Under 10mins Ate Breakfast at home Weekday 88% 17 Weekend 94% Mood In The Morning- Irish Breakfasts PIC % Reporting ‘Relaxed Mood’ PIC Relaxed 55% 72% Older 69% 54% 39% Kids 54% 39% WEEKDAY Tired & Slow 22% 17% 18-34 35-54 55+ Kids Older Energetic 11% 78% 60% 10% No Kids Kids 76% 70% 74% 55+ Kids No Kids WEEKEND Time Pressure 11% 4% 18-34 35-54 Age of Kids Stressed 5% 2% 38% PIC 45% 51% 58% 63% WEEKDAY MID WEEK WEEKEND 0-6 7-12 13-17 Age and if people have children (and age of) influence mood at breakfast 72% 72% 82% WEEKEND 18+ 18 0-6 7-12 13-17 18+ Mood In The Morning- British Breakfasts PIC PIC Relaxed 61% 68% 47% % Reporting ‘Relaxed Mood’ Older 52% Kids 69% 77% 45% WEEKDAY Tired & Slow 19% 22% 18-34 35-54 55+ Kids Older Energeti c 7% 7% 54% 65% No Kids Kids 79% 62% 71% 55+ Kids No Kids WEEKEND Time Pressure 11% Stressed 5% 5% 18-34 35-54 Age of Kids 5% 42% PIC 37% 44% 57% 52% WEEKDAY MID WEEK WEEKEND 0-6 7-12 13-17 66% 70% 67% WEEKEND 18+ 19 0-6 7-12 13-17 18+ Morning Rituals (Base: GB 1,640, ROI 1,289) TOTAL TOTAL % 46 Check your emails / Social media % 40 Listen to the radio 26 Take vitamins or other supplements 23 Watch TV 45 Check your emails / social media 37 Watch TV 26 Listen to the radio 21 Take vitamins or other supplements Load / empty dishwasher 17 Load / empty washing machine 17 Other household chores 17 Read a newspaper 17 Get the kids ready 16 Other household chores 16 Load / empty washing machine 15 Get the kids ready 14 Read a newspaper 15 Load / empty dishwasher 13 Grab a coffee 12 Grab a coffee 11 Have a cigarette 12 Have a cigarette 11 Social media and checking emails is the number one activity in ROI and GB 20 What We Do Around Breakfast (At Home) Take Vitamins Watch TV Other Household Load Chores Dishwasher Get Kids Ready Radio Emails/ Facebook 41 % WEEKDAY 10 % 12 % 11 8% % WEEKEND Read Newspaper 22 12 21 13 % % % % 14 41 27 13 20 % % % % 14 % 8% 34 % 10 % 37 9% % % Washing Machine 21 Have a Cigarette Incidence of Breakfast at Home/Out of Home (Base: All adults having breakfast today) Total (n=1,124) % At Home Total (n=1,391) % At Home Out of Home Out of Home Weekday (n=797) 87% Weekday (n=970) 88% Weekend (n=327) 95% Weekend (n=421) 94% At Home At Home Out of Home Out of Home Total Total Desk/At work 3% 4% 1% Canteen (School/work) 3% 3% 1% Restaurant/Café/Diner 2% 2% 2% In my car 2% 2% 1% Walking 1% 1% 1% Other 1% 1% 1% (Note: Out of home totals may sum to more than the total out of home % as they may choose multiple items) Desk/At work 3% 4% 1% Canteen (School/work) 2% 2% 1% Restaurant/Café/Diner 2% 2% 2% In my car 1% 1% 1% Commuting 1% 2% 0% Walking 1% 0% 1% Other 1% 2% 1% What We Do Around Breakfast (At Home) Watch TV Take Vitamins Other Household Chores Load Dishwasher Get Kids Ready Radio Emails/ Facebook 18% 20% 19% 22% 38% Read Newspaper 38% 9% 35% 8% 9% 11% 9% 2% Have a Cigarette 12% 11% 14% 11% WEEKEND WEEKDAY 12% 40% Washing Machine 6% 23 Planning Ahead I know what I’m having tomorrow… Certain I know what I’m having tomorrow… 35% Certain Pretty Sure 39% 34% Pretty Sure 37% I have no idea what I’m having tomorrow I have no idea what I’m having tomorrow 21% 21% 3 in 4 are pretty sure / certain what they’ll have tomorrow for predictable 24 Breakfast On The Move (i) (Base: GB 1,640, ROI 1,289) Had Breakfast… Weekday Weekend Weekday Weekend 13% 4% 12% 6% School/Work 8% 2% 7% 2% In the Car 2% 1% 1% 2% Walking/ Commuting 1% 1% 3% 1% ANY “On the move” 1 in 8 breakfasts are eaten out of home Prepared @ Home 38% Taken with no preparation 25% Bought out of home 38% Prepared @ Home Taken with no preparation Bought out of home 41% 28% 32% 25 Breakfast Out of Home Weekday Rush Weekend Treat Usually, midweek breakfasts are eaten as there was no time to have breakfast at home and stress is high. Food choices made at the weekend are also considered less healthy but are justified as the occasion is seen as a treat. Some claim that they make less healthy decisions when eating out in a rush than they would have at home. The mood is much more relaxed, with some having breakfast later in the morning. However even if the day started very early, the meal is much more leisurely. 26 Breakfast On The Move (ii) (Base: ALL ROI & GB having breakfast on the move, n=231) Profile Location – Bought Out Of Home Tends to be… % ⁄ Males School/work canteen/ cafeteria ⁄ Under 44 Coffee shop/café ⁄ Higher social grade ⁄ Single Convenience/forecourts % 29Supermarket 13 Fast Food 2 27 Other 22 7 ⁄ Less regular breakfast eaters Mood Relaxed Tired Lively 21 11 Under Pressure Stresse d 17 8 % 43 Vs At Home Breakfas -16 t +2 +3 Influencers Prepare & eat quickly % 37 Vs At Home Breakfas -3 t I didn’t skip a meal 35 -2 Feel fuller longer 34 -2 I can take on the go 33 +27 BIGGER Influence % Big Influence +7 A healthier choice 28 -8 +4 Energy boost 27 +2 A treat/something tasty 27 +7 27 Out of Home Breakfasts: In Depth Where Food Prepared? Ireland 11% Prepped @ Home Taken from home Weekday – 13% Premade Weekend – 4% Bought out of home GB 38% 41% 25% 26% 38% 32% Where Food Bought? Drinks Chosen Supermarket Work Canteen Coffee 49% Café/Cafeteria Tea 28% Water 12% Convenience Store Coffee Shop Fruit Juice 8% Garage Forecourt Soft Drink 4% Fast Food Mile 3% Key Influencers Didn’t skip a meal Eat Quickly & Easy Healthy Choice On the Go Choice Energy Boost Feel fuller longer Tasty Treat 22% 15% 13% 9% 8% 8% 4% 30% 8% 13% 4% 7% 3% 5% Foods Consumed % Big Toast Influence Porridge 38% (+1) 37% (-2) Bacon/Sausage 35% (-8) Croissant/pastry Fruit 30% (+23) Eggs 30% (=) 29% (-11) Sandwich etc. 28% (+8) 19% 22% 17% 4% 18% 16% 18% 12% 4% 12% 12% 11% 16% 10% Cereal Bar 10% Vs Total At Home Breakfast 28 10% Weekday – 12% Weekend – 6% Drinks Chosen Coffee 45% Tea 25% Water 15% juice 6% Smoothies 5% 5% Energy Drink Key Influencers Full for Longer % Big Influence 36% (+5) Eat Quickly & Easy 35% (-5) On the Go Choice 34% (+30) Didn’t Skip a Meal 32% (-2) Tasty Treat 24% (+6) Who do you have breakfast with? 56 59 I ate alone 28 28 Spouse/partner 15 11 My kids Other family member Colleagues from work/school ROI GB Those who live with flatmate/friend (77%) GB (74%) ROI Over 55 years (40%) GB (34%) ROI With dependent children (35%) GB (33%) ROI 5 4 3 1 1 in 2 eating breakfast between 8 – 10am *Others 1% or less 29 Motivations of Breakfast Choice… Based on % Very Important (% 8-10)…. % ROI GB Easy to prepare 58 58 58 Fills you up for longer 56 61 Energy and vitality 54 Value for money Healthy choice Tastes great, a real treat % ROI GB Can be eaten quickly 33 37 30 53 Specific health benefits 33 40 27 60 49 High protein breakfast 29 35 23 54 55 53 What’s there at the time 27 30 24 52 60 46 Produced in an ethical way 26 32 21 48 50 Can be added to, to create something new 25 23 20 49 Low in sugar 43 49 39 Something new and interesting 18 31 15 Enjoyed by all of the household 41 47 37 Can be Eaten at school or work 18 23 14 Easy to clean up or tidy away 40 42 38 Treat or a reward 16 19 13 Pure and natural 39 47 33 Is “free-from” particular ingredients 15 19 13 37 32 Eaten “on the go” while commuting 15 11 Low in fat or calories 34 = Top 3 Influencer 30 12 Segmenting the Breakfast Motivations… Most Likely to Say… “Can be eaten “on the go” while commuting” “Easy to clean up or tidy away afterward” “Go Getters” “Jugglers” “It can be eaten quickly” “It can be eaten quickly” “It is easy to prepare” “It is a healthy choice” “It can be enjoyed by all of the household” “It has specific health benefits” “Average Joes”“Be Betters” “It tastes great, a real treat” “It is low in sugar” 31 KEY MOTIVATIONS… “Go Getters” Get me going “Average Joes” “Juggler s” Keep me going “Be Betters” Fill me up Eat myself well “Go Getters” Explained Penetration 36% 30% Profile Breakfast Motivations ⁄ Under 44 1. Fills you up longer ⁄ Male ⁄ Single/Co Habiting 2. Gives you energy/ vitality ⁄ Renting/Mortgage 3. Can be eaten quickly ⁄ Working Full Time 4. Eaten at work 5. Eaten on the go Consumed Key Titbits *Clear distinction between weekday and weekends – weekday functionality then more ‘reward’ at weekend Weekday Rituals Toast Fruit Yoghurt Cereal Bar Regular Cereal ⁄ 27% feel they are eating breakfast less often nowadays ⁄ 27% have changed what they eat recently ⁄ Least relaxed segment at breakfast ⁄ Most likely to have breakfast out of home during weekdays (23%) ⁄ 61% want healthier breakfast options out of home Weekend Allowances / More treat element of Eggs and Breakfast Meats apparent in weekend consumption 33 Day in the Life “Fuel to move” – Go Getters Alarm goes off, snooze button is hit 1,000,000 times! Panic, jump out of bed, straight into running gear and head out for morning run. Log route on runtastic, scroll through Facebook, Instagram & twitter, check any over night emails…shower! Running late!!! Check live update for bus, get the iron out and iron shirt. Grab a bowl of Weetabix, no time for high protein omelette!!! Rush to the bus. 34 Go Getters in Action Rory Brennan Lives in Dublin, Ireland Relationship – Single Year of Birth 1983 Works in PWC, Dublin Crazy day ahead, quads day in gym, UK client lead meeting AND have to beat Rovers in semi final tonight…Better get the Weetabix in! #I’vehadmyweetabix Go Getters need to have a breakfast that is quick and also filling to help get them going for their busy day. This target could also benefit from ‘easy’ health being incorporated into their breakfast solution. 35 “Jugglers” Explained Penetration 19% 26% Profile ⁄ ⁄ ⁄ ⁄ ⁄ ⁄ Breakfast Motivations Under 44 Female Renters/Mortgage C1 Social Grade Young Families Majority Working Full Time 1. Ease to prepare 2. Fills you up 3. Easy to clean 4. Can be eaten quickly Consumed Ease and speed motivation driver primarily by weekday activity – more time available at weekend Weekday Rituals Toast Yoghurt Fruit Porridge Regular Cereal Weekend Allowances / Weekend coincides with more time and more ‘treats’. Greater prevalence of Eggs and Breakfast Meats. Key Titbits ⁄ 65% want lower cost options for breakfast ⁄ 59% Want easier to prepare options ⁄ Lowest time spent preparing breakfast ⁄ Most time pressure/stressed breakfast segment. ⁄ Most likely to check emails, get lunch ready, do other household chores. 36 Day in the Life “The Morning Rush” - Jugglers 06:30 Wake up! Get dressed, sort out bags, get breakfast going, get a coffee! 07:00 Wake kids up, get them washed and dressed for school, get everyone to the table for breakfast! 07:10 Dish out breakfast, Explain again that chocolate cake and ice cream is not ok breakfast! 07:20 Grab some breakfast while making lunches, mixing baby bottles, etc. 07:30 Make sure everyone has eaten enough; pack lunches, make sure homework is done!! 07:35 Get on the road to beat traffic! Drop kids to school/creche, go to work. 37 Jugglers in Action Kelly Anne Brande Was running out the door to drop kids off and get to work on time; Pippa decides to go on hunger strike & David will only eat chocolate spread…we would all starve if it wasn’t for belvita bikkies & cocopops!! Lives in London, England Relationship – Married Year of Birth 1978 Works in Ward Nurse at St. Thomas’ Jugglers are under pressure at home and at work as they juggle kids, careers and home life. Easy of preparation on quick consumption are very important to this segment as time is always against them, however the weekend does offer an opportunity to indulge in cooked breakfasts at a more leisurely pace. 38 “Average Joe’s” Explained Penetration 20% 24% Profile ⁄ Over 45 ⁄ Male ⁄ Living with partner/ spouse ⁄ Own home no mortgage/council ⁄ Lower social grade ⁄ Retired/not working Breakfast Motivations 1. Tastes great 2. Good value 3. Enjoyed by all households 4. Fills you up longer Consumed Most consistent food & drink consumption behaviour between weekday and weekend of any segment Key Titbits ⁄ Longest preparation time segment Toast Eggs ⁄ Most likely to watch TV and have a cigarette Real Butter Porridge ⁄ 70% of breakfasts were relaxed Regular Cereal Breakfa st Meats ⁄ 58% want lower cost options for breakfast 39 Day in the Life “Fill your boots” – Average Joes 08:00 Wake up, make tea, turn on the telly and get the breakfast going. 08:15 Kids are up and crashing around, disturbing the peace and getting ready for school. 08:20 No fussy eaters here, lots of lovely hot toast, real butter and tea on the go as bacon sandwiches and bowls of cornflakes are passed around. 08:30 Digest! Have a flick through Sky news while having a smoke, make sure everyone is filled up for the day. 08:40 Everyone who needs to get going in gone, final cup of tea before hitting the road. 40 Average Joe in Action John Kinane Lives in Lucan, Dublin Relationship – Married Year of Birth 1969 Works at Handyman Did the full shop in Aldi this week, never told the young fella…he turned around to me this morning saying it was the best fry I ever made! Sure where would you be going with the value you get in there. Satiety is the main goal for breakfast as this segment is not really motivated by any further needs. Many will be on budgets and will aim to choose items which satisfy the majority of the household which tends to narrow their choice. 41 “Be Betters” Explained Penetration Profile Breakfast Motivations ⁄ 55+ 25% 20% PIC ⁄ Higher social grade Older ⁄ Living with partner/Lady spouse only PIC health 1. A healthy choice 2. Gives energy/ vitality 3. Has specific health benefits ⁄ Own home – no mortgage ⁄ Least Likely to miss breakfast ⁄ Breakfast happens at home Consumed *While primary concern for breakfast is health, they tend to relax it somewhat at the weekends Weekday Rituals Porridge Yoghurt Fruit Tea Muesli Seeds Weekend Allowances / Occasionally let in toast, more regular cereals, and the odd ‘full Irish/ English’ Key Facts ⁄ Most likely to know what's for breakfast tomorrow ⁄ Most relaxed segment at breakfast time ⁄ Most likely to take vitamins/supplements ⁄ Want to see more healthy/health specific benefit options available 42 “Be Betters” Explained Penetration Profile Breakfast Motivations ⁄ 55+ 25% 20% PIC ⁄ Higher social grade Older ⁄ Living with partner/Lady spouse only PIC health 1. A healthy choice 2. Gives energy/ vitality 3. Has specific health benefits ⁄ Own home – no mortgage ⁄ Least Likely to miss breakfast ⁄ Breakfast happens at home Consumed *While primary concern for breakfast is health, they tend to relax it somewhat at the weekends Weekday Rituals Porridge Yoghurt Fruit Tea Muesli Seeds Weekend Allowance s / Occasionally let in toast, more regular cereals, and the odd ‘full Irish/ English’ Key Facts ⁄ Most likely to know what's for breakfast tomorrow ⁄ Most relaxed segment at breakfast time ⁄ Most likely to take vitamins/supplements ⁄ Want to see more healthy/health specific benefit options available 43 Day in the Life “A good start is half the battle” – Be Betters Turn on Radio 1, get up, make the bed and head down to the kitchen. Take cover off the porridge, must have them socking overnight to get the best from them. Put on the kettle and make a pot of tea. Get the Benecol, Activia yoghurt and supplements out while John collects the papers. Get the porridge cooking. Add in flax seeds and new chia seeds we got yesterday. Chop up fruit to add once cooked…tiny drizzle of maple syrup to keep me sweet! Have breakfast with John reading the papers and watching the birds get used to the new bird feeder. No stress, just great food to keep the ticker going. 44 Be Betters in Action Margret Murphy Lives in Cobh, Cork Relationship – Married Year of Birth 1947 Works at Retired Had a lovely breakfast watching the birds in the garden this morning. Really enjoying the new added calcium yoghurts, will need it for our upcoming walking trip to Camino de Santiago! Be Betters are more interested in what their food can do to improve their health and are motivated by health enhancing foods such as porridge. Functional foods such as Benecol are consumed by this segment as they search for products which benefit their overall health and wellbeing. 45 Food and drink choices Ireland’s Top Breakfast: Top 10 Adults Toast Eggs Porridge Regular Cereal Fruit 42% 25% 23% 21% 15% Bacon/Rashers Sausages Yoghurt Sandwich/ Similar Muesli/Granola 13% 10% 9% 6% 5% Toast Porridge Regular Cereal Eggs Fruit 33% 25% 19% 18% 17% Yoghurt 10% Muesli/Granola Breakfast Bar Bacon/Rashers 8% 8% 6% 47 WEEKEND (Base: ROI 1,289) WEEKDAY (At Home) Sandwich/ Similar 6% Sausage 5% GB’s Top Breakfast: Top 10 Adults (Base: GB 1,640) Toast Regular Cereal Eggs 36% 22% 19% Fruit 12% Muesli/Granola Yoghurt 8% WEEKDAY Toast 32% Yoghurt 13% 7% Porridge Bacon/Rashers 15% Sausage 13% Croissant/ Pastry 6% 6% Regular Cereal Porridge 25% WEEKEND (At Home) 17% Fruit Eggs 16% 10% Muesli/Granola Breakfast Bar Bacon/Rashers Croissant/ Pastry 10% 8% 6% 48 5% Top Breakfast Drinks: (At Home) (Base: GB 1,640, ROI 1,289) WEEKDAY WEEKEND WEEKDAY WEEKEND Tea 44% 48% Tea 37% 38% Coffee 28% 31% Coffee 36% 38% Water 12% 11% 9% 12% Fruit Juice (shop) 9% 10% 9% 9% Milk/ Milk substitute Herbal tea 6% 6% 3% 4% 5% 6% 3% 4% Fruit Smoothie (self) Fruit Juice (self) 4% 2% 2% 2% 2% 3% 2% 1% 6% 3% 6% 4% NO DRINK Fruit Juice (shop) Water Milk/ Milk substitute Herbal tea Fruit Smoothie (self) Cordial NO DRINK 49 Perfect Partners: Ireland (Base: ROI 1,289) FOODS *% of all at home breakfasts Toast & Eggs 11% DRINK *% of all at home breakfasts Toast & Tea 21% Egg & Sausage Toast & Fruit 5% 5% Porridge & Tea 12% Eggs & Tea 11% Bacon & Sausage 4% Toast & Coffee 10% Cereal & Tea 9% 50 Perfect Partners: Britain (Base: ROI 1,289) FOODS *% of all at home breakfasts Toast & Eggs 8% Egg & Bacon 5% Yoghurt & Fruit 5% Toast & Cereal Fruit & Cereal 5% 5% DRINK *% of all at home breakfasts Toast & Tea 15% Toast & Coffee 15% Cereal & Tea Cereal & Coffee 8% 9% Porridge & Tea 7% 51 Fruit & Coffee 6% Breakfast On The Move Food & Drink choices (i) Had Breakfast… Main Foods Eaten Toast/bread Weekday School/Work 8% In the Car 2% Weekend 2% 1% Weekday 7% 1% Weekend 21% Bacon/Sausage 17% Croissant/Pastry15% 2% Sandwich 13% Eggs 11% 2% Main Drinks Consume Walking/ Commuting 1% 1% 3% 1% Prepared @ Home 38 % Prepared @ Home 41 % Taken with no preparation 25 % Taken with no preparation 28 % Bought out of home 38 % Bought out of home 32 % Coffee 47% Tea 26% Water 13% Fruit Juices 17% 52 Changing Behaviours Influencing Choice among the Segments… Must adapt to quick paced routine Versatility and Portability Provide a kick start Low Involvement – often quantity over quality Tasty but good value Be the crowd pleaser “Go Getters” “Juggler s” “Average Joes” “Be Betters” Influenced by kids needs – eat healthier as result Need sustained energy Adapt to morning ‘high involvement’ environment Have the time now to take advantage – more exploration Adapt to the slower paced/ healthier choices available 54 Ireland’s Changing Weekday Breakfast Behaviour - I (Base: ROI n=842, GB n=1,042) Have changed what 23% they eat for breakfast recently Who? How? Healthier choice 65% ⁄ Under 45 Having hot/cooked breakfast 26% ⁄ With younger kids Eating instead of tea/coffee 22% Bigger breakfasts 15% Breakfast on the go 12% Breakfast out of home 10% Tend to be… PIC Young Family 16 % ⁄ Working full time ⁄ Have mortgage/ ⁄ renting PIC Health 55 Ireland’s Changing Weekday Breakfast Behaviour - II (Base: ROI 1,289) Have changed what 23% they eat for breakfast recently Having More… Fruit Cereal Bars Yoghurt Doing more…. Want more…. Checking emails/ Social Media Healthy Options 57% Muesli/Granola Smoothie 16% My Jobs 16% Lower Cost Options Herbal Tea Milk/Milk Substitute Exercising 15% Sandwich Bagel Croissant 56 Ireland’s Changing Weekend Breakfast Behaviour - I (Base: ROI and GB n=1,008) Have changed what 22% they eat for breakfast recently Who? How? Healthier choice 63% Having hot/cooked breakfast 34% Bigger breakfasts 21% Eating instead of tea/coffee 20% ⁄ Have mortgage/ Breakfast out of home 8% renting Breakfast on the go 7% Tend to be… ⁄ Under 45 PIC Young Family 15 % ⁄ With younger kids (or pre-settlers) ⁄ Working full time, Low-Mid Income PIC Health 57 Cut it Out: Specific Foods they are trying to Limit/Cut 15% claim to ANY FOOD TYPES have recently changed their breakfast habits to make more 10% claim to have recently changed their breakfast habits to make more 49% healthy choices 44 Carbohydrates 13 Dairy 10 Wheat 8 Gluten 5 I’m a Vegetarian 4 42% healthy choices % of TOTAL MARKET Cutting Back Sugar ANY FOOD TYPES 18-34: 36% 35-54: 44% 55+: 52% % of TOTAL MARKET Cutting Ba Sugar 35 Carbohydrates 10 Dairy 7 Wheat 5 Gluten 4 I’m a Vegetarian 4 58 18-34: 29% 35-54: 32% 55+: 44% Eating Less Breakfast Nowadays? (Base: ROI 1,289) Are Eating 20% Breakfast Less Often Nowadays Who? Tends to ⁄ 18-34 PIC be… Young Famil y ⁄ Young family PIC Man in suit ⁄ First home owner/ renting 18 % Mood & Behaviour Wants In 44% of Breakfast occasions the mood is tired, under time pressure or stressed among those eating less breakfast nowadays ⁄ Better breakfast on the go options. ⁄ Healthier out of home options ⁄ Lower cost options ⁄ Easier to prepare options 59 Mood In The Morning- British Breakfasts PI C Relaxed 61% Tired & Slow 68% Older 47% 52% Kids 77% 69% 45% WEEKDAY 19% 22% 18-34 35-54 55+ Kids Older Energet 7% ic 7% Time Pressure11% 5% Stressed 5% PI C % Reporting ‘Relaxed Mood’ PI C 54% 65% No Kids Kids 79% 62% 71% 55+ Kids No Kids WEEKEND 18-34 35-54 Age of Kids 5% 42% 37% 44% 57% 52% 66% WEEKDAY MID WEEK WEEKEND 0-6 7-12 13-17 70% 67% WEEKEND 18+ 60 0-6 7-12 13-17 18+ An Eye On The Future (Base: ROI 1,289) WHATS HOT To what extent do you think these will become more or less popular in the future? Gluten Free Breads Protein Shakes Homemade Porridge Sauces Oats Smoothies Yoghurt Eggs +37% +35% +31% +28% +26% +24% +14% Honey +6% Healthier options expected to gain further momentum… WHATS NOT Jams Bread Breakfast Meats -66% -65% -61% Cheese Regular Cereal Smoked Salmon Bought Juices Bagels -41% -41% -32% -31% -15% Treats and old-fashioned staples waning for adults Based on NET expected to get more popular – same or less popular 61 An Eye On The Future (Base: GB 1,640) WHATS HOT To what extent do you think these will become more or less popular in the future? Protein Shakes +18% Gluten Free Breads Homemade Sauces +18% +10% Smoothi es Yoghurt +9% +6% Breakfa st Bars +5% In the GB too the momentum is with healthy options WHATS NOT Jams Bread -74% -72% Breakfast Meats -62% Cheese Cooked Meats Smoked Salmon Regular Cereal -60% -59% -54% -53% Likewise more indulgent options are waning Based on NET expected to get more popular – same or less popular 62 Breakfast Food/ Drink Categories Future Momentum - ROI 63 Breakfast Food/ Drink Categories Future Momentum - GB 64 Desire for changes in Breakfast changes (Base: GB 1,640, ROI 1,289) I want… More healthy options 39 Lower cost options 37 Options that are easier to prepare More options with specific health benefits (e.g. cholesterol lowering etc.) More protein options Definitely applies % Somewhat applies % 29 26 NET applies % I want… Somewhat applies % Definitely applies % NET applies % 68% More healthy options 34 22 56% 63% Lower cost options 33 23 56% Options that are easier to prepare 32 More tasty treat options for breakfast More options with specific health benefits (e.g. cholesterol lowering etc.) 31 32 26 58% 33 21 54% 36 17 53% 20 17 29 12 28 12 52% 48% 42% More tasty treat options for breakfast 33 17 50% More options that the whole family can enjoy 31 19 50% More options that the whole family can enjoy 22 13 35% 28 23 50% Healthier options out of home 21 15 35% Healthier options out of home More protein options Better range of “on the go” options 23 13 36% Better range of “on the go” options More free-from options (gluten, dairy free) 21 14 35% Breakfast I can have on the go More options I can prepare the night before 41% 18 9 27% Breakfast I can have on the go 16 10 26% 21 13 34% More options I can prepare the night before 15 8 23% 21 13 34% More free-from options (gluten,dairy free) 13 9 65 22% Desire for Change… Trend Drivers (Base: ROI 1,289) I want more… % Healthy options 68 Lower cost options 63 Easy to prepare 58 Specific health benefits 54 High protein options 53 Want More Healthy Options Options for whole family 50 Tasty treat options 18-34 % 35-54 % 55+ % 81 72 52 50 On the go option 36 “Free-from” options 35 66 Desire for Change… Trend Drivers (Base: GB 1,640) I want more… % Healthy options 56 Lower cost options 56 Easy to prepare 52 Tasty treat options 48 Specific health benefits 42 High protein options 41 Options for whole family On the go option “Free-from” options 35 Want More Healthy Options 18-34 % 35-54 % 55+ % 70 59 43 27 22 67 Children Kids’ Breakfast ROI Many parents claim that one of the main drivers in deciding what the family has for breakfast is health and that they are giving their children the ‘healthiest’ breakfast possible. While all parents have good intentions to give their children the best, the struggle between what is healthy and what the children will eat impacts the final decision. “My kids had Weetabix with strawberries, all with milk and a few spoons of soy yogurt. Again this is a food I want them to eat as it's good for them.” “I always feel he should have more variety, but as all mothers know, you can't make a child eat anything they don't want! I suppose as long as he eats, that’s the main thing.” Eating breakfast together is considered by some parents as an impart part of their day which allows them to connect with their children and sets everyone up for a good day. 69 “Did his usual and left early for his bus he stops at the bakers once he gets to the right town. I thought being a cold morning Travis would have porridge but he wanted toast with jam and chocolate spread.” “He was in a bad mood Most parents claim that the main today and didn't want any motivation was for their children to breakfast. I did manage to get a coco pop bar have breakfast. The actually down him with his milk food eaten is considered though.” somewhat less important. Kids’ Breakfast GB Many claimed that they catered to their children's desires and that their children had a more prominent role in deciding what was eaten for breakfast. Healthy foods have a different meaning for many GB parents, with cereals, cereal bars and toast often considered a healthy option. While ROI parents claim to be much more aware of sugar content in the food they give their children. “My youngest had Nutella on toast with a cup of water and my eldest had Cheerios with milk and a cup of water. They chose these because they enjoy these for breakfast and they are relatively healthy.” “My youngest had Nutella on toast with a cup of water and my eldest had Cheerios with milk and a cup of water. They chose these because they enjoy these for breakfast and they are relatively healthy.” 70 Kids Eating Breakfast (Base: All with kids at home) Kids Breakfast At Home 85% / 44% ate “with you” / 40% ate “with you” / 41% made it themselves / 33% made it themselves 0-7 Years 5% Had breakfast elsewhere (school/Crèche) Don’t have breakfast 0-7 Years 8-14 Years 15+ Years 6% 71% 59% Why Not? (n=99) % 47 24 Wouldn’t eat it Don’t know 80% 8-14 Years 15+ Years 71% 75% Why Not? (n=78) Sick, unwell Kids Breakfast At Home 21 Had breakfast elsewhere (school/Crèche) Don’t have breakfast 12 36 24 Wouldn’t eat it Sick, unwell 7 % 18 7 Don’t know 24 71 Kids @ Breakfast (Base: All with kids at home) Top 10 Drinks Top 10 Foods (n=693) (n=585) Regular Cereal 39% 43% Fruit Juice (Shop) 21% 19% Toast/Bagel 24% 21% Plain Water 20% 16% (35% Porridge/Hot Cereal 19%(31% 0-2 11% 0-2 Tea 19% 10% Fruit 14% 11% Milk/ Milk Substitute 17% 16% Eggs 12% 4% Cordial/Squash 8% 16% Yoghurt 11% 7% Herbal Tea 6% 1% Breakfast/Cereal Bar 7% 8% Homemade Juice 5% 2% Muesli/Granola 7% 3% Coffee 5% 5% Sausages 7% 1% Hot Chocolate 5% 4% Bacon/Rashers 6% 4% Homemade Smoothie 4% 2% years) years) (n=693) 72 (n=585) Key Categories for Kids - (GB & ROI) Eggs (n=119) Scrambled 33% Boiled 32% Fried Poached Other 18% Toast (n=230) Porridge Cereals White sliced 39% Aldi 16% 11% Weetabix Wholemeal sliced 15% Flahavans 12% Aldi PL Wholegrain sliced 11% Brown sliced 9% 10% Brown Soda 9% 7% Home Brown 7% Baguette 4% 3% Flahavans Quick 10% Ready brek 8% Lidl 7% Special K 7% Tesco 7% Odlums 8% Quaker 18% 9% 14% GB: Scotts, Morrisons, M&S, Sainsbury 73 (n=301)(n=230) 18% 7% 13% 5% Cornflakes 9% 5% Rice Krispies 9% 9% Cheerios 6% 5% Other Kelloggs 6% 2% Tesco 6% 8% Lidl 5% 4% Coco Pops 4% 11% Crunchie Nut 4% 8% Shreddies 4% 3% Choice Drivers For Kids (BIG INFLUENCERS) (Base: All Who Prepared Kids Meals; ROI n=313, GB n=341) TOTAL TOTAL % I know they’ll eat it 64 Get a good start 61 % I know they’ll eat it 69 Get a good start 52 52 Healthy choice 50 Get something into them Full for longer 49 Full for longer 45 Energy boost 48 Energy boost 43 Get something into them 46 Quick to prepare Quick to prepare 36 39 Healthy choice 34 A treat/tasty 28 Can eat quickly Refreshment 26 A treat/tasty 21 Doesn’t make mess 25 Refreshment 21 Others less than 25% 74 28 Opportunity areas Evolution of Breakfast Porridge is one example where the product began as being quite labour intensive requiring soaking and cooking on the hob, this evolved to microwaveable pots and flavour infused options responding to changing consumer needs. Where to next for breakfast? 76 Evolution of Breakfast - Opportunities TERRITORY KEY TARGET INSPIRATION MOVING FORWARD PERMISSABLE PLEASURE Reformulate old favourites SMUGGLING GOODNESS Disguise the health, promote the fun! AL DESKO NOURISHMENT Make healthy easier GRAB SOME GOODNESS Real health – not perceived health on the go 77 77 Evolution of Breakfast - Opportunities TERRITORY PERMISSABLE PLEASURE A great number of our breakfast club members claim to be aware of the benefits of cutting down or out certain foods. However some find this difficult suggesting they would be open to a ‘healthier’ variant of their favourites, for example turkey rashers instead or traditional pork rashers SMUGGLING GOODNESS Many ROI parents in our breakfast club were concerned about the level of sugar and salt in their kids’ preferred cereals but were stuck between giving them what is best or what they will eat. Many claim that they would like to see more low sugar/salt options which will ease their concerns and still be attractive to their children. AL DESKO NOURISHME NT With many club members claiming they have to face longer commutes or leave early to beat traffic, the rise of the al desko breakfast is becoming more prominent. Some are preparing breakfast at home and then eating in the office with others finding new and innovative ways to prepare their favourites in the office kitchen. GRAB SOME GOODNESS Many feel time pressure when leaving in the morning. This means having just enough time to grab and go. There is a strong desire to still keep to a healthy diet, with many turning to protein shakes to keep them on track. Current hand held solutions, such as cereal bars are being rejected due to high sugar and fat levels. There is an appetite for true healthy options which can be consumed on the hoof. 78 Evolution of Breakfast - Opportunities TERRITORY KEY TARGET INSPIRATION MOVING FORWARD PIMP MY BREAKFAST Promote cocreation via key ingredients FUEL YOUR BREAKFAST Promote energy boost; Target specific health benefits MAGIC MOMENTS Promote social gathering… sensory stimulation ONE FOR ALL Broader household solution 79 Evolution of Breakfast - Opportunities TERRITORY PIMP MY BREAKFAST Customising basic ingredients, such as yoghurts, and personalising them to specific dietary or taste needs is another growing trend among our breakfast members. There is an opportunity to facilitate this desire to co-creation and make personalisation easier by adding key ingredients, like chia seed, to basic foods which in turn allows for premiumisation of staple products like porridge. SUPERCHAR GE YOUR BREAKFAST Added functionality to benefit overall health and fitness is becoming increasingly popular among the mass market, no longer a secret weapon for fitness fanatics. Added protein in cereals is one such example which allows for those who use food as fuel for their activities to get an added boost of key nutrients. MAGIC MOMENTS For some families, breakfast is becoming the meal around which they gather and spend quality time. It sets the day up in a much more positive note and allows parents to ensure their children get a good start to the day. Positioning the brand as one the family can gather around creates an opportunity to premiumise and differentiate it from other competitors. ONE FOR ALL Many households have several different varieties of breakfast foods to cater to each individual. This can cause a major headache and costly bill for some parents who would love to see products available which cater for more than one family member, while also being healthier and with less sugar. 80 Opportunities – Where are they going? Momentum Establish ed Magic Moments Pimp my Breakfast Permissible Pleasure Grab some Goodness On the way Supercharge your breakfast Smugglin g Goodness One for All Al Desko Nourishmen t Niche Breadth of Interest Mass 81 Appendices Porridge For Breakfast In The Irish Market Penetration Porridge Accompanied By… Weekday – 26% (#2) Food 24% Weekend – 21% (#3) (#2) Key Profile 50% of all porridge consumers at breakfast are 55+ 30% Fruit 21% Eggs 11% A healthy choice 70%(+26) Feel fuller longer 61%(+20) Drink Tea 50% Coffee 24% ( ) = Vs Total Breakfasts Mood % Relaxed Fruit Juice 13% Tired Additions Flahavans ProgressOatlets 32% Aldi Own Label 18% Flahavans Quick Oats 14% Lidl Own Label 12% Other Flahavans 9% % Big Influence Didn’t skip a meal57%(+18) ( ) = Rank of all breakfast foods consumed Brand Toast Key Influencers 65 19 (+4) (-1) Honey 30% Lively 12 (+1) Berries 20% Under Pressure 12 (=) Seeds 20% Stresse 5 d ( ) = Vs Total Breakfasts 84 (+1) Porridge For Breakfast In The GB Market Penetration Porridge Accompanied By… Weekday – 17% (#3) Food Weekend – 15% (#4) 16% (#3) Key Profile 55+ Empty Nesters with no Mortgage Drink 32% 18% 14% 12% 9% 4% 17% Toast 15% Yoghurt 7% Tea 41% Coffee 32% Water Additions Quaker Scott’s Tesco Own Aldi Own Readybrek Flahavans % Big Influence A healthy choice 51%(+22) Feel fuller longer49%(+18) Didn’t skip a meal 40%(+6) ( ) = Rank of all breakfast foods consumed Brand Fruit Key Influencers Honey Berries ( ) = Vs Total Breakfasts Mood % Relaxed 12% 20% 19% 68 Tired 15 (-5) Lively 12 (+5) Under Pressure 10 (+1) Stresse 1 d Dried Fruit 13% ( ) = Vs Total Breakfasts 85 (+5) (-4) Eggs For Breakfast In The Irish Market Penetration Eggs Accompanied By… 21% Food Weekday – 18% (#4) Weekend – 27% (#2) (#3) Boiled Scrambled Fried Poached Other 39% 26% 23% 19% 4% Key Profile 35-55’s Family Lifestages % Big Influence 55% Bacon 25% Sausage 22% Tea 52% Coffee 35% Water Additions/ Complement Type Drink ( ) = Rank of all breakfast foods consumed Toast Key Influencers Feel fuller longer 44%(+4) A healthy choice 43%(=) Savour the moment 39%(+18) ( ) = Vs Total Breakfasts Mood % Relaxed 12% 66 (+5) Tired 17 (-3) Salt/ Pepper33% Lively 17 (+6) Vegetables 13% Under Pressure Berries 10% 8 (-4) Stresse 5 d (+1) ( ) = Vs Total Breakfasts 86 Eggs For Breakfast In The GB Market Penetration Eggs Accompanied By… Weekday – 10% (#5) Food 13% Weekend – 19% (#3) (#5) Toast Key Influencers % Big Influence 64% Bacon 33% Sausage 14% Feel fuller longer 38%(+7) Didn’t skip a meal 32%(-2) Something tasty 29%(+11) Fried Scrambled Boiled Poached Other 36% 27% 23% 17% 2% Key Profile 45+ Males Older Families Tea 45% Coffee 40% ( ) = Vs Total Breakfasts Mood % Relaxed Fruit Juice 16% 72 Tired Additions/ Complement Type Drink ( ) = Rank of all breakfast foods consumed Salt/ Pepper34% Lively Vegetables 11% Under Pressure 17 12 6 Stresse 1 d Dried Fruit 8% ( ) = Vs Total Breakfasts 87 (+9) (-3) (+5) (-3) (-4) Regular Cereals For Breakfast In The Irish Market Penetration Regular Cereals Accompanied By… Key Influencers Weekday – 19% (#3) Food 19% Weekend – 19% (#4) (#4) Key Profile More males Younger Family Lifestages Drink 29% 17% 15% 9% 9% 9% Fruit 12% Eggs 7% Prepare & eat quickly 49%(+10) Didn’t skip a meal 42%(+5) Tea 47% Coffee 22% ( ) = Vs Total Breakfasts Mood % Relaxed Fruit Juice 15% 62 Tired Additions Weetabix Aldi Own Label Kellogg’s Corn Flakes Shredded Wheat Tesco Own Lidl Own 18% Feel fuller longer 37%(-3) ( ) = Rank of all breakfast foods consumed Brand Toast % Big Influence Dried Fruit 15% Sugar 12% Honey 10% 27 (+7) Lively 11 (=) Under Pressure 13 (-1) Stresse 5 d ( ) = Vs Total Breakfasts 88 (+1) (+1) Regular Cereals For Breakfast In The GB Market Regular Cereals Accompanied By… Penetration Weekday – 25% (#2) Food 24% Weekend – 22% (#2) (#2) Key Profile More males Younger Family Lifestages Fruit 15% Yoghurt 8% Didn’t skip a meal 43%(+9) Drink Tea 38% Coffee 31% 35%(+6) ( ) = Vs Total Breakfasts Mood % Relaxed Fruit Juice 13% 67 Tired Additions Weetabix 19% Kellogg’s Corn Flakes 11% Kellogg’s Crunchy Nut 8% Tesco Own 8% Kellogg’s All bran 7% Shredded Wheat 6% 15% % Big Influence Prepare & eat 47%(+7) quickly Healthy Choice ( ) = Rank of all breakfast foods consumed Brand Toast Key Influencers 21 (+4) (+1) 12% Lively 7 (=) Dried Fruit 10% Under Pressure 7 (-2) Stresse 6 d (+1) Sugar Berries 8% ( ) = Vs Total Breakfasts 89 Fruit For Breakfast In The Irish Market Penetration Fruit Accompanied By… Weekday – 17% (#5) Food 16% Weekend – 13% (#5) (#5) 34% Porridge 32% Yoghurt 29% Drink Tea 38% Coffee 33% Additions Water Females 2534 and Females 55+ Higher social grade % Big Influence Healthy choice Mood % Relaxed Other Fruit 35% 24% Honey 17% 38%(+8) ( ) = Vs Total Breakfasts 22% Berries 63%(+20) Didn’t skip a meal 49%(+12) Energy boost ( ) = Rank of all breakfast foods consumed Key Profile Toast Key Influencers 63 Tired 19 (-1) Lively 22 (+11) Under Pressure 10 Stresse 4 d ( ) = Vs Total Breakfasts 90 (+2) (-2) (=) Fruit For Breakfast In The GB Market Penetration Fruit Accompanied By… Weekday – 16% (#4) Food 15% Weekend – 12% (#6) (#4) Yoghurt 27% Healthy choice Prepare & eat quickly 20% 49%(+20) 37%(-3) Didn’t skip a meal 37%(+3) Drink ( ) = Rank of all breakfast foods consumed Coffee 42% Tea 28% Water ( ) = Vs Total Breakfasts Mood % Relaxed 15% 63 Tired Additions Females 2534 and Females 65+ Higher social grade % Big Influence Regular Cereal 24% Toast Key Profile Key Influencers Other Fruit 28% Berries 22% Honey 13% 18 (-2) Lively 10 (+3) Under Pressure 11 (+2) Stresse 6 d ( ) = Vs Total Breakfasts 91 (=) (+1) Yoghurt For Breakfast In The Irish Market Penetration Yoghurt Accompanied By… Key Influencers 10% Weekend – 9% (#8) (#6) Food Weekday – 10% (#6) Fruit Toast % Big Influence 47% Healthy choice 40% Didn’t skip a meal 48%(+11) Porridge 25% Prepare & eat quickly ( ) = Rank of all breakfast foods consumed Aldi Own Lidl Own Glenisk Muller Yoplait Tesco Own Activia Glenilen Key Profile 25-44’s Younger Family Life-stages 22% 22% 16% 15% 13% 11% 11% 9% Tea 47% Coffee 38% Water Additions Low fat/ Diet 39% Natural/ Organic29% Regular Pots 21% Greek/ Greek Style 21% Big Pots 14% Kids 9% Corners 8% Drink Brand Type 58%(+18) 44%(+5) ( ) = Vs Total Breakfasts Mood % Relaxed 16% Other Fruit 24% 66 Tired 21 (+1) Lively 18 (+7) Honey 20% Under Pressure Berries 20% Stresse d 11 (-1) 9 (+5) ( ) = Vs Total Breakfasts 92 (+5) Yoghurt For Breakfast In The GB Market Penetration Yoghurt Accompanied By… Key Influencers 8% Weekend – 7% (#8) (#6) Food Weekday – 10% (#6) Fruit % Big Influence 49% Regular Cereal 24% Toast 23% Key Profile Female Over 45’s Higher social grade 13% 10% 10% 10% 9% 9% 8% 7% Coffee 43% Prepare & eat quickly 47%(+7) Tea 31% ( ) = Vs Total Breakfasts Mood % Relaxed Fruit Juice19% 67 Tired Additions Yeo Valley Tesco Own Asda Own Muller Activia Muller Light Aldi Own Lidl Own Drink Brand Low fat/ Diet 33% Greek/ Greek 29% Style 22% Natural/ Organic13% Big Pots 13% Regular Pots 8% Corners 3% Kids 49%(+20) Didn’t skip a meal 45%(+11) ( ) = Rank of all breakfast foods consumed Type Healthy choice Honey 17% Berries 16% (+3) 7 (-2) Stresse 6 d (+1) Under Pressure ( ) = Vs Total Breakfasts 93 (+2) 10 Lively Other Fruit 18% 22 (+4) Coffee For Breakfast In The GB Market Penetration Key Profile Weekday – 36% (#2) 37% Weekend – 38% (#1) Mood Fresh Instant Instant % (#1) Relaxed ( ) = Rank of all breakfast drinks consumed Brand Type Instant Roast & Ground Decaf Espresso/ Cappuccino Sachets/ Pods 68% 13% 10% 7% 5% Nescafe 25% Kenko 13% Douwe Egberts 10% Aldi Own 6% Tesco Own 6% Others <5% 55+’s Lower social grade 25-54’s Higher social grade Instant Fresh Toast 36% 44% Cereal 24% 12% Fruit 14% 23% Eggs 13% 19% 12% 16% 4% 12% Bacon/ Sausage Yoghurt 61 Tired Main Foods Eaten… 94 Fresh % 72 24 17 Lively 7 6 Under Pressure 9 9 Stresse d 4 1 Coffee For Breakfast In The Irish Market Penetration Key Profile Weekday – 28% (#2) 29% Weekend – 31% (#2) Mood Fresh Instant (#2) Instant % Fresh % 54 56 Relaxed ( ) = Rank of all breakfast drinks consumed Brand Type Instant Roast & Ground Espresso/ Cappuccino Decaf Sachets/ Pods 60% 23% 13% 9% 7% Kenko 18% Aldi 16% Nescafe 13% Lidl 12% Maxwell House9% Levazza 8% Bewleys 7% Robt. Roberts 4% Females 45-64’s Lower social grade Males 25-44’s Higher social grade Tired Main Foods Eaten… Instant Fresh Toast 32% 34% Eggs 17% 34% Porridge 15% 26% Fruit 15% 20% Cereal 15% 13% 27 Lively 10 20 Under Pressure 10 17 4 12 Stresse d 95 22 Toast/ Bread For Breakfast In The Irish Market ( ) = Rank of all breakfast foods consumed Brand Type White sliced pan Brown sliced pan Brown soda/ spelt Brown (homemade) Wholegrain pan Wholemeal pan 30% 20% 20% 13% 12% 8% Brennans 22% Aldi Own 14% Tesco Own 11% Lidl Own 7% SuperValu Own7% Irish Pride 7% McCambridge 7% Pat the Baker 6% Key Profile Under 35’s and Older Family Life-stages Food (#1) Drink Weekday – 33% (#1) Weekend – 40% (#1) Key Influencers % Big Influence Eggs 32% Porridge 21% Didn’t skip a meal 38%(+1) Fruit 15% Healthy choice Tea 60% Feel fuller longer 35%(+5) Coffee 27% 36%(-5) ( ) = Vs Total Breakfasts Mood % Fruit Juice 13% Additions 35% Toast Accompanied By… Spreads Penetration Relaxed Marmalade 23% 66 (+5) Jam 15% Tired 21 (-2) Honey 11% Lively 18 (+1) 33% Under Pressure Real butter Stresse d Dairy spread 29% Low fat spread 17% 11 (-3) 9 (+1) ( ) = Vs Total Breakfasts 96 Toast/ Bread For Breakfast In The Irish Market Brown / Spelt White Key Profile Food Accompaniments Spreads used Wholegrain / Wholemeal Eggs 34% 35-54 established families & higher social grade Eggs 36% Sausage 22% Porridge 32% Porridge Bacon 19% Fruit 28% Muesli / Granola 26% Dairy Spreads 40% Real Butter 37% 34% Low fat spread Real Butter Dairy Spreads26% Dairy Spreads22% Under 35 males General lower social grade 37% Established families, 55+, females & higher social grade Eggs 44% 32% * Cholesterol Spreads 16 Additional Accompaniments Key Influencers Marmalade 21% Marmalade 25% Marmalade 35% Jam 18% Honey 18% jam 20% 38% Prepare & eat quickly Healthy choice 36% Didn’t skip a meal 33% Feel fuller longer 35% * Also Energy boost and Treat Didn’t skip a meal53% Healthy choice * Also Feel fuller longer * Also Treat 97 51% Juice For Breakfast @ Home ADULTS 11% Weekday – 11% Weekend – 13% 81% 19% Ireland Toast 36% Porridge 33% 15% Eggs 27% 20% Cereal 30% 32% 20% 17% Muesli/Granola 15% 10% Bacon OR Sausage 13% 11% Fruit Ireland Weekday – 25% Weekend – 27% Type Shop Bought Home-made 10% 80% 20% Weekday –9% Weekend –12% Type Shop Bought Home-made Main Foods Eaten… KIDS 26% GB 48% Type Shop Bought Home-made ADULTS Main Foods Eaten… 88% 12% KIDS GB Cereal 48% 60% Toast 31% 26% Porridge 23% 13% Yoghurt 23% 9% Fruit 20% 12% Eggs 19% 21% Weekday –21% Weekend –22% Type Shop Bought Home-made 8% Cereal Bar 14% 98 90% 10% Bacon and Sausage: A Real Treat Bacon/Rasher Sausages 8% 7% Bacon/Rasher (#9) (#7) Weekday Weekend Weekday Weekend 5% 13% 11% 6% (#13) Weekday Weekend Weekday Weekend 5% 2% 13% 6% ( ) = Rank of all breakfast foods consumed 4% of Breakfasts included Bacon and Sausage 2% of Breakfasts included Bacon and Sausage 3% Weekday, 6% Weekend 1% Weekday, 4% Weekend Perfect Partners ( ) = V All Breakfasts Eggs Bacon 63% (+42) Eggs Sausage 69% (+48) 60% Fried (+36) Toast 60% (+25) Toast 69% (+34) 50% White (+20) Sausage 51% (+44)Bacon 61% (+53) Tea 60% (+15) 57% (+12) Coffee 40% (+11) 40% (+11) Fruit Juice17% (+6) 69% (+8) “A Real Treat” is lead driver: 55% Bacon and 62% Sausages V just 20% for All Breakfasts Food ( ) = V All Breakfasts Drink Food (#7) 3% ( ) = Rank of all breakfast foods consumed Perfect Partners Drink 8% Under 35’s and Men, but also younger family Sausages Eggs Bacon 55% (+42) Eggs Sausage 62% (+49) 65% Fried (+2 Toast 50% (+17) Toast 64% (+31) 56% White (+18) Sausage 22% (+14)Bacon 56% (+48) Tea 42% (+5) 30% (-7) Coffee 45% (+8) 60% (+23) Fruit Juice15% (+5) 15% (+5) In GB too it is “A Real Treat” : 41% Bacon and 34% Sausages V. 18% for All Breakfasts 99 Tea For Breakfast @ Home Penetration Penetration Weekday – 44% (#1) Weekend – 48% (#1) 45% Weekday – 37% (#1) Weekend – 38% (#2) 37% (#1) (#1) Main Foods Eaten… Main Foods Eaten… ( ) = Rank of all breakfast drinks consumed Brand Lyons Barry’s Aldi Own Lidl Own Bewleys Tesco Own Punjana Others 46% Porridge 27% Eggs 32% 26% 19% 8% 6% 5% 4% <3% Key Profile Toast 45’s + Older families 24% Mood Relaxed 66 (+5) Tired Under Pressure 20 Toast ( ) = Rank of all breakfast drinks consumed Regular Cereal 25% Brand PG Tips Tetley Aldi Own Typhoo Tesco Own Others Porridge 29% 18% 12% 9% 6% <5% (-2) Lively 9 (-1) Relaxed Stressed 4 (=) 68 (+5) Tired Key Profile 18% Mood (=) 11 39% 45’s + Older families 100 20 (=) Under Pressure 8 (-1) Lively 6 (-1) Stressed 4 (-1) Week long videography (15 in ROI) Life stage Age Social Class Gender Children Age of Children Secondary/College Student 16-18 C1C2 Male No N/A Third level/university student 19-24 ABC1 Female No N/A Third level/university students 19-24 C1C2 Male No N/A Third level/university students 19-24 C2DE Female No N/A Early Settlers No Kids 21-29 ABC1 Male No N/A Early Settlers No Kids 21-29 C2DE Female No N/A Early Settlers No Kids 21-29 C1C2 Male No N/A Young Family Kids 2-11 29-39 C2DE Female Yes > 11 years Young Family Kids 2-11 29-39 C1C2 Female Yes > 11 years Young Family Kids 2-11 29-39 C1C2 Female Yes > 11 years Older Family Kids 12+ 40-49 ABC1 Female Yes 12+ years Older Family Kids 12+ 40-49 C1C2 Male Yes 12+ years Older Family Kids 12+ 40-49 C2DE Female No 12+ years Empty Nester No kids 50+ C1C2 Male No N/A Empty Nester No kids 50+ C2DE Male No N/A 101 Week long videography (15 in GB) Age Social Class Gender Children Age of Children Secondary/College Student 16-18 C1C2 Male No N/A Third level/university student 19-24 ABC1 Female No N/A Third level/university students 19-24 C1C2 Male No N/A Third level/university students 19-24 C2DE Female No N/A Early Settlers No Kids 21-29 ABC1 Male No N/A Early Settlers No Kids 21-29 C2DE Male No N/A Early Settlers No Kids 21-29 C1C2 Male No N/A Young Family Kids 2-11 29-39 C2DE Female Yes > 11 years Young Family Kids 2-11 29-39 C1C2 Female Yes > 11 years Young Family Kids 2-11 29-39 C1C2 Female Yes > 11 years Older Family Kids 12+ 40-49 ABC1 Male Yes 12+ years Older Family Kids 12+ 40-49 C1C2 Female Yes 12+ years Older Family Kids 12+ 40-49 C2DE Male No 12+ years Empty Nester No kids 50+ C1C2 Female No N/A Empty Nester No kids 50+ C1C2 Male No N/A Life stage 102 Breakfast Club In Depth Interviews (8) Profile of Individual Age Social Class Life Stage Breakfast Type Location Pre Family Professional 30 – 39 ABC1 Early Settler Out of Home ROI New Family 35 – 45 C1C2 At Home ROI Established Family 35 – 45 C1C2 At Home ROI Post Family 49 – 59 C1C2 At Home ROI Pre Family Professional 30 – 39 ABC1 At Home GB New Family 35 – 45 C1C2 At Home GB Established Family 35 – 45 C1C2 Post Family 49 – 59 C1C2 Young Family; Kids 2 – 9 Young Family; Kids 8 - 13 Empty Nester; Older Kids Early Settler Young Family; Kids 2 – 9 Young Family; Kids 8 - 13 Empty Nester; Older Kids Out of Home At Home 103 GB GB The Breakfast Club For further information on this study please contact info@bordbia.ie or Tel: +353 (0)1 668 5155 DID YOU KNOW? You can also request professional library searches for market information from our team of qualified librarians at any time. Typical searches include requests for market information on –markets, categories, NPD, brands, companies, channels: retail, foodservice, trends and consumers .... Simply fill in our enquiry form or e-mail info@bordbia.ie. to request a professional library search and we will endeavour to get back to you, in a timely manner with relevant market information resources, adhering to copyright and licensing agreements. 104 Go raibh maith agat