Stocker Number of Head 320 Pay Weight

advertisement

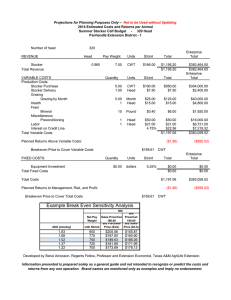

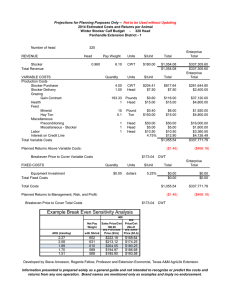

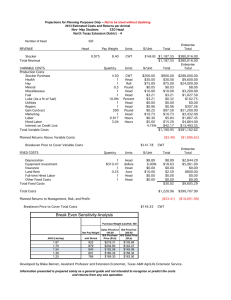

Projections for Planning Purposes Only -- Not to be Used without Updating 2016 Estimated Costs and Returns per Animal November- February Stockers - 320 Head North Texas Extension District - 4 Stocker Number of Head 320 REVENUE Head Stocker Total Revenue 0.975 VARIABLE COSTS Production Costs Stocker Purchase Grazing Acre Lease Gain Contract Health Health - Stocker Feed Bermuda Hay Salt & Minerals -Stockers Miscellaneous Miscellaneous - Stocker Fuel Lube (As a % of fuel) Repairs Marketing Labor Interest on Credit Line Total Variable Costs Pay Weight or Amount $/Unit CWT $165.00 Units $/Unit CWT $225.00 $1,057.50 $338,400.00 Acre Pounds $12.00 $0.25 $3.00 $46.99 $960.00 $15,035.90 1 Head $30.00 $30.00 $9,600.00 1 12 Roll Pound $70.00 $0.20 $70.00 $2.40 $22,400.00 $768.00 1 1 10.0% 1 0.975 1 Head Head Percent Head Head Head $10.00 $3.21 $3.21 $0.96 $11.00 $15.33 4.75% $10.00 $3.21 $0.32 $0.96 $10.73 $15.33 $24.89 $1,275.33 $3,200.00 $1,027.50 $102.75 $307.36 $3,432.00 $4,906.02 $7,965.57 $408,105.11 6.70 Quantity 4.70 0.25 187.95 Planned Returns Above Variable Costs: Total $1,077.86 $1,077.86 Total ($197.47) Breakeven Price to Cover Variable Costs FIXED COSTS $190.35 Quantity Depreciation Equipment Investment Total Fixed Costs Enterprise Total Units 1 $162.97 Units Head dollars $/Unit $8.89 6.00% Total Costs Planned Returns to Management, Risk, and Profit: $193.13 ($63,189.11) CWT Total Enterprise Total $8.89 $9.78 $18.67 $2,844.29 $3,129.00 $5,973.29 $1,293.99 $414,078.40 ($216.13) Breakeven Price to Cover Total Costs $344,916.00 $344,916.00 Enterprise Total ($69,162.40) CWT Example Break Even Sensitivity Purchase Analysis Weight (Lbs/Hd): Net Pay Weight ADG (Lbs/day) with Shrink 1.49 1.37 1.24 1.12 0.99 710 690 670 650 630 470 Sales Bid Price/Cwt Price/Cwt 165.00 225.00 B/E Sales B/E Purchase Price Price ($/CWT) ($/CWT) $192.71 $185.86 $179.01 $172.17 $165.32 $186.93 $192.34 $198.09 $204.18 $210.66 Developed by Blake Bennet, Associate Professor and Extension Economist, Texas A&M AgriLife Extension Service. Information presented is prepared solely as a general guide and not intended to recognize or predict the costs and returns from any one operation. Brand names are mentioned only as examples and imply no endorsement.