Document 11002330

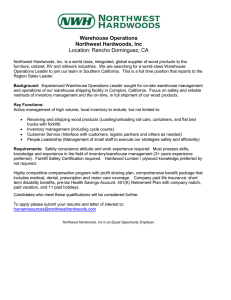

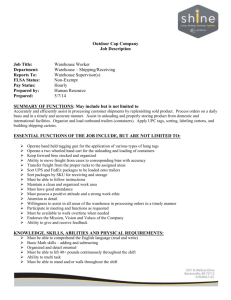

advertisement