TEXAS INCOME PROTECTION FACTS

advertisement

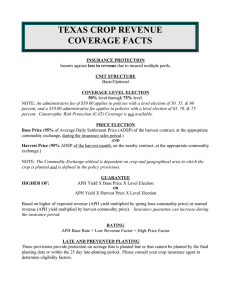

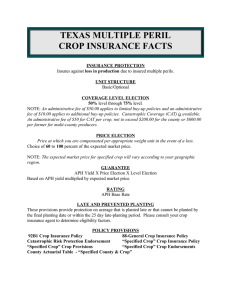

TEXAS INCOME PROTECTION FACTS INSURANCE PROTECTION Insures against loss in revenue due to insured multiple perils. UNIT STRUCTURE Enterprise Unit is all insurable acreage of the crop in the county in which you have a share on the date coverage begins. COVERAGE LEVEL ELECTION 50% level through 75% level. NOTE: An administrative fee of $50.00 applies to policies with a level election of 50, 55, & 60 percent, and a $10.00 administrative fee applies to policies with a level election of 65, 70, & 75 percent. Catastrophic Coverage (CAT) is available. An administrative fee of $50 for CAT per crop, not to exceed $200.00 for the county or $600.00 per farmer for multi-county producers. PRICE ELECTION Projected Price and Harvest Price (100% of policy defined average commodity contract price traded on the Commodity Exchange as defined in the policy provisions.) GUARANTEE APH Yield X Projected Price X Level Election Based on APH yield multiplied by projected price (spring commodity price). RATING New rating model incorporating yield and price variability. LATE AND PREVENTED PLANTING These provisions provide protection on acreage that is planted late or that cannot be planted by the final planting date or within the 25 day late-planting period. Please consult your crop insurance agent to determine eligibility factors. CROP/COUNTY AVAILABLE Grain Sorghum - Armstrong, Bailey, Carson, Castro, Cochran, Dallam, Deaf Smith, Gray, Hale, Hansford, Hartley, Hockley, Hutchinson, Lamb, Moore, Ochiltree, Oldham, Parmer, Potter, Randall, Runnels, Sherman, Swisher, Terry, Yoakum. 92B1 Basic Policy Provisions Acknowledgment of Differences POLICY PROVISIONS Income Protection “Specified Crop” Provisions