immigration labor HandBook

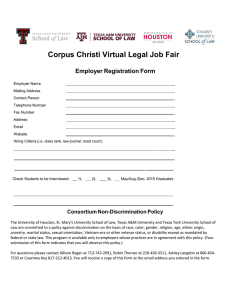

advertisement