Accounting Research Center, Booth School of Business, University of Chicago

advertisement

Accounting Research Center, Booth School of Business, University of Chicago

Information Rents and Preferences among Information Systems in a Model of Resource

Allocation

Author(s): Rick Antle and John Fellingham

Reviewed work(s):

Source: Journal of Accounting Research, Vol. 33, Studies on Managerial Accounting (1995), pp.

41-58

Published by: Blackwell Publishing on behalf of Accounting Research Center, Booth School of Business,

University of Chicago

Stable URL: http://www.jstor.org/stable/2491373 .

Accessed: 12/06/2012 09:39

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at .

http://www.jstor.org/page/info/about/policies/terms.jsp

JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide range of

content in a trusted digital archive. We use information technology and tools to increase productivity and facilitate new forms

of scholarship. For more information about JSTOR, please contact support@jstor.org.

Blackwell Publishing and Accounting Research Center, Booth School of Business, University of Chicago are

collaborating with JSTOR to digitize, preserve and extend access to Journal of Accounting Research.

http://www.jstor.org

Journal of Accounting

Research

Vol. 33 Supplement

1995

Printed in US.A.

Information Rents

and Preferences among

Information Systems in a Model

of Resource Allocation

RICK

ANTLE*

AND

JOHN

FELLINGHAMt

1. Introduction

Using a model in which private information and self-interested behavior induce a socially inefficient allocation of resources, we analyze

the effects of introducing a public information system. A manager of

productive resources has an informational advantage over the owner of

the resources, as in Antle and Eppen [1985]. In this setting, mutually

beneficial production is foregone as the owner attempts to limit the

manager's information rent. We consider the possibility of introducing

a public information system that reduces the manager's information advantage. In particular, we describe conditions under which the social

efficiency of production is enhanced or reduced by the introduction of a

public information system.

In three scenarios, public information is exogenously given, chosen

by the owner and influenced by the manager, and stochastically determined by the manager's actions. We find that regardless of who chooses

* Yale University; tThe Ohio State University. We thank Michael Alles, Anil Arya, Stan

Baiman, Peter Bogetoft, Joel Demski, Harry Evans, Mitch Farlee, Jonathan Feinstein, Jon

Glover, Michael Maher, Nandu Nagarajan, John Persons, Suresh Radhakrishnan,

Doug

Schroeder, Richard Sansing, Andy Stark, Shyam Sunder, Bin Srinidhi, Rick Young; and

Rutworkshop participants at Iowa, Ohio State, Maryland, Stanford, Carnegie-Mellon,

Association

gers, North Carolina, and Yale universities; the 1994 American Accounting

Convention; and two anonymous referees for useful comments.

41

Copyright

?, Institute

of Professional

Accounting,

1996

42

JOURNAL

OF ACCOUNTING

RESEARCH, SUPPLEMENT

1995

a costless, public information system, productive efficiency is attained.

However, the manager's preferred public information system differs in

substantive and describable ways from the owner's choice. By restricting

the analysis to a particular density function for the private information,

we can entirely describe each person's optimal information system.

The existence of contrary preferences over public information systems

raises another set of questions. Will the owner and manager engage in

activities designed to skew the public information system and production schedule toward their private self-interests? Furthermore, will these

activities disrupt the social efficiency results?

We consider the possibility of activities which affect the public information system choice and its use. For example, in one scenario we allow

the owner to commit to ignore information. In another scenario, we allow the manager to coarsify the partitions in the public information system. With these tools at their disposal, we give conditions under which

the actors will attempt to affect the public information system choice for

personal benefit and under which these attempts destroy the efficiency

properties of the resulting allocation of resources. In addition, we characterize conditions under which the actors will engage in more vigorous

influence activities. The greater the profit margins, the greater the incentives for actions which affect the public information system.

While our results are derived using a general characterization of a public information system of varying fineness, some insight can be obtained

about particular accounting systems. For example, an argument in favor

of activity-based costing (ABC) systems is that they supply finer cost information.1 If that is an important attribute of ABC systems, our results

shed some light on when and why it is difficult, from an organization

structure perspective, to design, install, and maintain an ABC system in an

organizations Furthermore, even if a perfectly good system is in place, it

may be economically rational for some users to commit to ignore some of

the output of even a well-functioning

information system.

Section 2 presents the model and section 3 provides the solution to a

benchmark case. Section 4 examines the efficiency consequences

of introducing public information. Section 5 introduces and analyzes two

important special cases. Section 6 contains analyses of two models of

activities that affect the public information

are

system. Conclusions

offered in section 7. Appendix A contains proofs.

1 It is probably more accurate to say that ABC systems are more detailed than traditional

costing systems. As is pointed out in Datar and Gupta [1994], more detail does not guarantee more accuracy or finer information.

2 The textbook literature recognizes

the difficulties involved in changing organizations'

discuss individual

information systems. For example, Atkinson et al. [1995, pp. 592-600]

and organizational

defensive responses, the investment of money and time required to

balance of power as sources of

make changes, and potential shifts in the organization's

difficulties encountered

when installing information systems. We contribute to this literaof

ture by providing explicit assumptions and solutions, as well as a formal exploration

efficiency effects.

INFORMATION

SYSTEMS IN RESOURCE ALLOCATION

43

time

Contract

signed

Manager

reports cost

Manager

learns cost, c

FIG.

Owner

supplies

resources,

x produced

y

time line: no public information.

1.-First

2. The Model

model with linear

The model is an extension of the owner-manager

production technology in Antle and Eppen [1985]. In that model3 the

owner of a production function has the property rights to the cash it

produces. The owner hires a manager whose comparative advantage is

required to implement production.

Production requires cash in addition to the manager's presence. If a

cash flow of x is to be produced, cash of cx is required, where c < 1 is the

cost per dollar of cash flow. Only the manager can put the cash into

production. At the time he does so, he knows the cost, c. The owner

does not. The owner believes c E C, some set of possible costs. Sometimes we take C = {cl, . . . ,cq}, with cl < c2 < . . . < cn < 1. The probability

c= ciis pi. At other times, we take C = [0, 1], with probabilities given by

the densityf

All cash must come from the owner.4 Let y denote the amount of cash

transferred from the owner to the manager. The manager consumes cash

above what he puts into production. Therefore, the manager's utility for

cash transferred, y, production requirement, x, with cost per dollar c is

U(y, x; c) = y - cx. The time line in figure 1 shows the sequencing of

events depicted thus far.

It can be shown that a participative budget scheme is the optimal form

x

}?=, such

of contracting. The owner designs a menu of contracts, {xi,

that the manager selects (xi, yi) when he knows the per dollar cost is ci.5

The owner's objective in choosing among alternative budgets is to maxf7

imize expected

profits:6

E

Pi [xi- Yi.

i= 1

There are five types of constraints on the owner's choice of schemes.

First, the manager must receive an expected utility at least as high as his

next-best alternative. The contract is entered into before the manager

3We use the Antle and Eppen [1985] model, with a finite set of per dollar costs, for

some of our analysis, but we also use a model with per dollar costs from an interval of the

real line. Therefore, we present footnotes that extend the Antle and Eppen model to the

case. Also see Farlee, Fellingham, and Young [1995].

continuous

4 This rules out the manager implementing

on his own and capturing all

production

the rents.

5 In the continuous

version of the model, the owner designs a pair of functions, x(.)

and y(.), that map per dollar cost reports into required output and resources provided,

1

respectively.

- y(c))f(c)dc.

case, the objective function is: f(x(c)

6In the continuous

0

44

RICK ANTLE AND JOHN FELLINGHAM

learns the cost and we assume his beliefs are the same as the owner's.

Let 0 be the manager's opportunity cost in utility terms. Then the contract must satisfy:7

n

E

pi [yi - ci xi]

2

0. To ensure a distributional

issue,

i= 1

we assume throughout that 0 = 0. Second, the contract must respect the

manager's lack of cash,8 so that yj - cixi 2 0, i = 1, . . . n. Third, the

contract must induce a manager who knows the cost is ci to select

(xi, yi):9 y - cixi 2 yj- cixj, i, j = 1. . * * n. Fourth, to ensure a solution

exists we must assume the production of cash flows is bounded. If xmax

denotes the maximum cash,10 xi < Xmax, i= 1, ... ,n. Finally, cash produced must not be negative:11 xi > 0, i = 1 . . . ,n.

3. Solution of Benchmark Case

Antle and Eppen [1985] showed that the optimal amounts of production and resources transferred are given by a simple hurdle strategy. If

the reported cost is above some amount, say c^, nothing is produced and

no resources are given. If the reported cost is cz or below, Xmaxis produced and cash of CzXmaxis given to the manager.

This solution displays the trade-off between productive efficiency and

distributional consequences

that forms the basis of our analysis. Lowering the critical hurdle cost gives up valuable production. But it allows the

owner to capture more of the surplus by reducing the resources he provides when production does occur. Raising the critical hurdle cost increases valuable production but gives more of the surplus to the manager

in the form of excess resources. The owner reduces the manager's surplus

(a distributional effect) by reducing the amount of resources available,

but this reduces the amount of resources produced (an efficiency effect).

The optimal policy strikes the best balance between these factors.12

Consider a candidate for the critical hurdle cost, say ck. The expected

profit with this hurdle must be higher than that with the next lower or

next higher hurdle. If the hurdle is lowered to ck-l, production with an

expected gross revenue to the owner of Pkxmax is lost. But the expected

resources allocated decline by pkCkX1ax +

_________

7 The constraint

in the continuous

case is:

f

k- I

p

- Ck_1)Xmax. If the hurP(Ck

~~

= 1

~~~~~~~~i

(y(c)

-

cx(c))f(c) dc

2

0.

0

8 In the continuous

9 In the continuous

10In the continuous

1 In the continuous

12 In the continuous

tion of the first-order

F is the cumulative

case:

case:

case:

case:

case,

y(c) - cx(c )

y(c)

- cx(c)

x(c)

2

0

Vc E C.

y(~) - cx(C)

x(c) < xmax Vce C.

0

VcE

for the optimal

function

V c, & E C.

C.

the analysis that follows

condition

distribution

2

2

cutoff,

associated

in the text is replaced

ct, where c* =

with the densityf

1-

by examina)

and

INFORMATION

45

SYSTEMS IN RESOURCE ALLOCATION

dle is raised to Ck+1, production with an expected gross revenue to the

owner of Pk + IXmax is created. But the expected resources allocated increase by Pk + 1 Ck+ 1 XIax +

k

E

Pi (ck + 1 -

Xmax. The optimal hurdle is such

COk)

that the value of the decreased production associated with a lower hurdle

offsets the savings in resources allocated, and the additional resources

allocated offset the increased production of a higher hurdle.

The ck hurdle produces

ck)xmaX.The manager's

an expected

expected

profit to the owner of

slack is

k

E

3

pi(1 -

i= 1

p1(c;-

ci)Xlax.

Summing

i= 1

the owner's expected

the total expected

profits and the manager's

expected

slack, we see

surplus produced with a ck hurdle strategy is

k

E

pi(3

-

i= 1

ci) X~nx

The total expected surplus, a measure of productive efficiency, is maximized by the cn hurdle strategy. The difference between the total expected surplus under the optimal hurdle strategy and the total expected

surplus under the cn hurdle strategy is the social cost of the owner's attempts to acquire a higher net expected profit. Thus, it represents a loss

due to concerns over distribution.

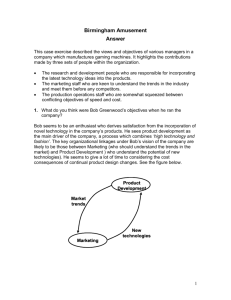

Figure 2 depicts the trade-off between productive efficiency and distributional consequences for the special case of costs uniformly distributed

on [0, 1] and maximum production equal to one. Since production cost

is always less than or equal to revenue derived from production, it is productively efficient to produce in all cases, i.e., set the hurdle cost equal to

one. The owner's profits would be zero because the hurdle cost of one

will always be the amount of resources transferred to the manager. All the

gains from production are captured by the manager in the form of slack.

To retain some of the surplus, the owner can reduce the hurdle cost

below one. Figure 2 shows the effects of setting the hurdle costs equal to

the hurdle is set at 4, the owner's expected profits are16

4. When

This is greater than the zero expected profits obtained with a hurdle of

one but is less than the maximum achievable expected profits. The hurdle

contract which maximizes the owner's expected profits sets the hurdle cost

1

I

equal to and achieves owner's expected profits of

To further improve the situation, note that the initial probabilities enter

into the determination of the optimal hurdle strategy and the resulting

level of the manager's expected slack.13 A system that conveys information

about costs alters these probability assessments. The next section expands

the model to allow the owner and manager to receive information before

13 This may be clearest

in the case of a finite set of possible

costs.

RICK ANTLE AND JOHN FELLINGHAM

46

Example Hurdle Contract

Expected Profit and Expected Slack

1

E(profit)

=

0.25 x (1 - 0.25)

=

0.1875

0.8

0.6

0.4

E(slack) = 0.25 x 0.25 = 0.0625

0.2

45degrees

0

0.25

0.5

cost (uniformly distributed)

0.75

1

FIG. 2.-Expected

profits and expected slack under a contract with a hurdle cost of 4,

on [0, 1], and maximum production

costs uniformly distributed

equal to one. The

of cumulative probability,

horizontal axis plots cost. The vertical axis plots a combination

amount produced, and resources transferred. The amount of resources transferred is equal

to both the probability that costs are less than or equal to the hurdle costs and hurdle cost

itself. Therefore, the 45-degree line gives both the cumulative distribution function of costs

under uniformity and the resources allocated under all possible hurdle costs. The owner's

expected profits are equal to the difference between resources returned, 1, and resources

allocated, I, weighted by the probability that production occurs, 4. The owner's expected

profits of $ p6 are given by the area of the indicated rectangle with base 4 and height -. The

manager's expected slack (assessed before the manager knows the cost) of Il is the area

of the indicated isosceles right triangle with base and height each equal to 4.

the manager learns the cost.14 This information

plans, but because it also alters the distribution

may have incentives to subvert the system.

allows better production

of surplus, the manager

4. Exogenous Public Cost Information

Public information, a subpartition of the initial set of possible costs, C,

is observed by the owner and manager before the manager learns the

14

We model the introduction

of a cost system as producing public information for the

owner and manager. Thus, we assume the owner has access to the output of the organization's formal cost accounting

system but not the system that ultimately generates the

takes place. The manager's primanager's perfect knowledge of cost before production

vate information

system can inprovides his rents. We show that the public information

crease or decrease the value of the manager's private information.

INFORMATION

SYSTEMS IN RESOURCE ALLOCATION

47

time

Public information

structure

revealed

Contract

signed

Public information

observed

FIG. 3.-Second

Manager

learns

cost, c

time line: exogenous

Manager

reports

cost

Owner

supplies

resources,

x produced

y

public information.

exact value of the costs. This model corresponds to the basic setting for

each element of the subpartition, where beliefs over the costs in each

subpartition are derived by Bayes' rule. Thus, a hurdle strategy is optimal

in each element of the subpartition. The time line in figure 3 depicts the

sequence of events.

It is easy to show that the arrival of such information cannot decrease

the owner's expected net profits. Imposing the restriction of the optimal

no-information

hurdle strategy on the set of subpartitions of C is feasible and produces the same expected profits as in the no-information

case. Also, in some cases the only use of the information would be distributive: introduce perfect information (i.e., the subpartition consisting

of singleton elements) into the case in which a cn hurdle strategy is optimal with no information. Total surplus remains the same, but the manager's slack is driven to zero.

However, the manager is not always adversely affected by the arrival of

information, and information does not always result in improved productive efficiency, as manifested in the expected total surplus. Consider

the following examples.

EXAMPLE1. The set of possible costs is C= {0.65, 0.7, 0.71, 0.8, 0.85,

0.91, each element of which is equally likely. Xmax= 100. With no information, the solution is to set the hurdle at 0.71, which yields expected

profits of 141 expected slack to the manager of 1I, and expected total

surplus of 152. Now introduce the partition {{0.65, 0.7, 0.711, {0.8, 0.85,

0.9} 1. In the first element of the partition, the solution is to set the hurdle

at 0.71, which yields conditional expected profits of 29, conditional expected slack of 23, and conditional expected total surplus of 313. In

the second element of the partition, the solution is to set the hurdle at

0.9, which yields conditional expected profits of 10, conditional expected

slack of 5, and conditional expected total surplus of 15. Thus, with information the expected profits are 191, expected slack is 32, and expected

total surplus is 23k.

EXAMPLE2. The set of possible costs is {0.65, 0.7, 0.75, 0.8, 0.85, 0.9},

with corresponding probabilities {0.01, 0.06, 0.01, 0.01, 0.01, 0.9}. With

no information, the ex ante optimal solution is to set the hurdle at 0.9,

which produces expected profits of 10, expected slack of 143, and expected total surplus of 113. Now introduce the partition {{0.65, 0.7,

0.75}, {0.8, 0.85, 0.9} }. In the first element of the partition, the solution is

to set the hurdle at 0.7, which yields conditional expected profits of 261,

conditional expected slack of 5, and conditional expected total surplus

48

RICK ANTLE AND JOHN FELLINGHAM

of 267. In the second element of the partition, the solution is to set the

hurdle at 0.9, which yields conditional expected profits of 10, conditional expected slack of 1S, and conditional expected total surplus of

10 15 . In this example, the expected profits with public cost information

3

are 11 , expected slack is 10, and expected total surplus is 11.

In example 1, the introduction of information increased the owner's

expected net profits, the manager's expected slack, and (consequently)

total expected surplus; there is no conflict between the productive and

distributional consequences

of the information. Both the owner and

manager have incentives to seek out such an information system and

have no incentives to sabotage it.

In example 2, information lowers the cost of reducing production to

increase expected net profits. With no information, full production is

achieved in all circumstances. But the manager captures all the profits

from costs lower than 0.9. With the information, the owner can raise expected net profits, in part by not producing when the cost is 0.75. This is

the familiar use of rationing to reduce slack, now made profitable by the

information system's altering of the probability structure. The effect is

lower total surplus. Also, the manager has incentives to oppose or sabotage this information system, and certainly would not have incentives to

discover and reveal it to the owner.

5. Uniform Distributions and Regular Partitions

Before taking up these incentive issues in more detail in the next section, we present two special cases of interest. The uniform case is described

by Xmax = 1, C = [0, 1], and uniform distribution of the per dollar costs,

c. The regular case is the uniform case under all regular partitions: { [0, 1] },

The uniform case

[1,

{[0,

1]},

{[0,

1),

4),

[4, 1),

[2, 4),

[4, 1]} .

will be analyzed in detail in later sections. We take up the regular case

here, as it allows a precise characterization of when conflicts of interest

exist as a function of the number of elements in the partition.

In the regular case, it can be shown that if there are m elements in a

partition, the total expected surplus is: TS(m) =

surplus is increasing

lim

m

Ts

TSi (m)

in the number

of elements

I. The manager's expected

214-

E[Slack(m)]

2-

12 The total

2 8i2

in the partition,

and

slack is:

= 4m 3(1)

8m2

At m = 1, the manager's expected slack is 8. In this regular case, it

rises to 32 at ma= 2, after which it falls. Its limit is 0.

The owner's expected profits when there are m elements in the partition are equal to the expected total surplus minus the manager's expected slack. This works out to:

INFORMATION

SYSTEMS IN RESOURCE ALLOCATION

E[7 (rm)] =

49

I

- 2m-1

2

4m

E[7(m)] is increasing in m and tends to the total surplus of 2 as m goes

to infinity. We have shown:

PROPOSITION1. In the regular case there is a conflict of interest between the owner and manager if and only if m is greater than 2.

If costs are uniformly distributed and the manager could select any

partition of [0, 1], he will choose a partition that provides some information, as shown in Proposition 2.

PROPOSITION2. (Proof in Appendix A.)The partition of C = [0, 1] in

slack is:

the uniform case that maximizes the manager's expected

=

isfies:

{[2,

2),

lim

,

[4

[2, -),

E[Slack(m)]

liMEE[(i(m)]

mum value of

=

3.

87, ...

}.

= 6.

The

The manager's

owner's

expected

expected

utility sat-

profits

In the limit, the total surplus approaches

satisfies:

its maxi-

2.

As this proposition shows, the manager has natural incentives to provide some information to the owner, because with no information, the

owner allows no production above c = i. The manager gets slack from

the low-cost states, while the owner's expected profits are the same for

all costs for which production takes place. In choosing an information

system, the manager would like to keep the slack from lower costs while

providing information that induces the owner to produce in higher-cost

circumstances. This thinking yields the structure of the manager's most

preferred partition, which pools the most low costs possible without incurring restricted production. Thus, the manager is interested in information systems that only coarsely describe low-cost circumstances and

more accurately describe costs close to the point where production is

not profitable

(c = 1).15

The proposition also implies the manager may be better or worse off

as the result of public cost information and productive efficiency may or

may not be enhanced. Consider starting from a partition of the form:

0, 2),

is better off with

{=[

,

48),

[8, 1]}. The manager

[2, [4),

any subpartition of 's that only subdivides the highest interval and does

that at values greater than or equal to 16. Any subpartition that divides

any other element of 's makes the manager worse off. Also, further partitioning of 'M increases the owner's expected profits by the same

amount it decreases the manager's expected slack. That is, further partitions of 'M have only distributional consequences.

'is

15As an example, in a field study of cost systems in a health-care facility, Maher and

manager,

Marais [1994] suspect the head nurse, whom we would consider a production

has reason to prefer a less precise costing system. Their reasoning is consistent with ours:

A more precise system would provide less opportunity to create slack through careful disclosure of local conditions to higher-level

management.

50

RICK ANTLE AND JOHN FELLINGHAM

We can also characterize the partitions preferred by the owner. In the

limit, the owner prefers perfect information, but his preferences over partitions with two elements, three elements, four elements, etc., take a wellstructured form.

3. The m element partition that maximizes the owner's

PROPOSITION

expected

L

2

profits

3

m+

m+

1 1

in the

rn-i,

uniform

m~+1

case

is: LI?

]. The owner's expected

E[n(m)]

=

jmIjL

'172ii'

profits are:

i

2 (rn + 1)

2 m

2

2 (m + 1)2

Comparing special cases of Propositions 2 and 3 illustrates the conflict

of interest over information systems. For m = 3, the manager's most preferred partition is {[0, I), [2, 3), [3, 111. The owner's most preferred

partition is {[0, ,[,

1), [1, 1]}. As discussed above, the manager prefers to pool the most low costs possible without incurring a loss of production. The owner prefers more accurate identification of low costs and

is more tolerant of restricted production than is the manager.

We can use the characterization of the owner's and manager's most

preferred information systems to gain some insight into how their preferences vary across economic environments. Consider the effects of having per dollar costs uniformly distributed over [0, I], instead of [0, 1].

The important change is not that costs are lower, but that profits are

higher. With no information the owner will select the contract that always produces $1 and gives the manager $0.50. The owner gets the surplus from the excess of price, $1, over the $0.50 maximum total cost,

and the manager gets all the rent from information about costs. The

manager has no incentives to supply information in this very profitable

situation, because restricting output is too costly a way for the owner to

control the manager's slack. Full production always occurs: Information

can only allow the owner to make a more favorable (to him) distribution

of the benefits of producing.

Now consider the effects of moving the upper bound on the distribuI

tion of per dollar costs from to 1. The closer we get to an upper bound

of 1, the lower the profits. Without additional information, the owner's

optimal contract restricts production when the upper bound on cost is

greater than 9. This restriction imposes a cost on the manager, so he

would like to avoid this lost production by supplying information that reveals more when costs are high. For example, when the per dollar cost is

uniformly distributed over [0, 3], an uninformed owner will ration at

2 The manager would like to preserve his slack for costs less than 2

and induce production between 2 and 3. The best (from the manager's

this is {[0, 9), [2, 3]1. The

point of view) partition that accomplishes

The manager's expected

slack is: E[Slack(m)]

INFORMATION

SYSTEMS IN RESOURCE ALLOCATION

51

owner with this information will produce fully for all costs. Continuing

this process leads to thinking of the manager's optimal information system in Proposition 2 as the limit of the optimal information systems as

the upper bound on the distribution of per dollar costs goes to 1 from

below. Our interpretation is that in less profitable situations, the manager has incentives to provide information about costs close to the margin.

As mentioned above, this shows that from the manager's point of view,

"good" information systems for decision making are also "good" from

the point of view of maximizing his slack.

Put somewhat more abstractly, factors external to the firm affect the

information preferences of the participants in the firm to the extent

that they affect the distributional consequences of whatever information

is supplied. Managers typically play a role in designing, implementing,

and maintaining information systems. It seems reasonable, then, to introduce opportunities

for the manager to influence the information

generated. This is the purpose of the next section.

6. Incentives for Influencing Information

This section introduces opportunities for the manager to influence the

information structure he and the owner install before production takes

place. We study two different models of information influencing. They

differ in the owner's ability to observe and provide incentives for the manactivities.16 In model 1, the manager can

ager's information-influencing

join adjacent elements of any given information partition. For example,

if C = {0.6, 0.7, 0.8, 0.9} and the information partition is {{0.6}, {0.7, 0.81,

{0.911, the manager can alter the partition to any one of the following

three: {{0.6, 0.7, 0.81, {0.9}}; {{0.6}, {0.7, 0.8, 0.9)1; {{0.6, 0.7, 0.8, 0.911.

Although the owner observes the results of the manager's informationinfluencing activities, we assume the owner cannot commit to provide incentives for these activities. The time line in figure 4 depicts the sequence

of events.

Model 2 parallels standard moral hazard models. Information production is uncertain, and the manager has an action choice that influences

the probability distribution over information structures. For instance,

consider a set of costs, C, and the two partitions fi and 2. The manager

has two available influence activities, denoted I, and I2. Under II, fi is

realized with probability 1. Under I2, fi is realized with probability p and

12 is realized with probability 1 - p.

In contrast to the first model, the owner is assumed to be able to commit to a contract that depends on the realized partition, thus allowing

for the provision of incentives for information-influencing

activities. The

16 Information

is not the only focus of influence activities in organizations.

Milgrom

[1988] and Milgrom and Roberts [1988; 1992] discuss a wide range of influence activities and organizations'

attempts to limit them.

52

RICK ANTLE AND JOHN FELLINGHAM

S

S

}

Q

Q

M

bl)a sM C

C

b)

X

.C

b

Q

Q

Ct

5o

C

C

CD

CDa

_

C

;

.

bX

OC<a

c) C.

.;~~~~~~~~

t

.2h

,

S

5J

CE

Gn S4 sv

h?

:~~~~~~~~~~~

U~~~~~~

C

hC

t

bb~~~~~~~~~~~~~l

INFORMATION

SYSTEMS IN RESOURCE ALLOCATION

53

time line in figure 5 depicts the sequence of events. We proceed to an exploration of these two models.

In principle, model 1 is straightforward. Given any partition, say Al,we

derive the set of all partitions that are coarsifications of rA.Call this set

set for information

systems. The

H(fl), the manager's opportunity

manager's expected utility for any element in this set is the expected

slack it generates. Since the owner will choose the hurdle strategy optimal

for each member of a given partition, the manager's expected utility for

any member of H(f) is easily calculated. We have the following result for

the regular case:

PROPOSITION 4. In the regular case, if the manager starts from a regular partition with m elements, he will construct:

~(rl)

=

2L0'

The manager's

2

L

21

4

expected

L m-2

~

2

' i2

n-li'

2

L

im-i

2

slack is:

E[Slack((rn(n))]

1-

(2)

The gain from influencing the information is (2) - (1).

In model 1, the owner cannot provide incentives for the manager's information-influencing

activities, even though he would prefer to let the

manager start from the finest possible regular partition. In model 2,

however, the owner can commit to providing information incentives by

restricting production and manipulating the manager's slack.

Specifically, when the owner can commit to contracts before the information partition is received, the payments to the manager and production

targets can depend on the partition observed as well as the manager's subsequent cost report. If the manager controls the partition, information

incentives could be costlessly provided by withholding production unless

the manager chooses the desired partition. Therefore, just as in ordinary

incentive problems, uncertainty in production is a key element of nontrivial analysis, where here information is what is being produced. We report preliminary analysis of two examples from the uniform case.

EXAMPLE

3. Suppose the owner can commit to a contract before the partition is realized. Also, suppose there are two possible partitions: [40, I),

0),

[2, 1]} and {[O,

[3, 111. The first of these is the two-element

partition

most preferred by the manager and the second is the two-element partition most preferred by the owner. Call them rL2 and r2, respectively. We

have already shown there is a conflict of interest. We assume I, leads to

9

with probability 1, and I2 leads to il with probability I.

Because the action is costless, the manager will take the action that

yields the highest probability of his preferred partition, unless given incentives to do otherwise. The most efficient way to give such incentives is

to commit to a contract that leaves the manager indifferent about which

54

RICK ANTLE AND JOHN FELLINGHAM

partition is realized; i.e., to commit to a contract that calls for a cutoff of

0.70547 if the first partition is realized and 0.7589 if the second is realized. This makes the manager's expected slack 0.146109 regardless of the

partition.

These cutoffs reveal the owner's use of restricted production and

slack in providing information incentives. The cutoff of 0.70547 in the

owner's dispreferred partition is strictly below the cutoff of 3 that

would be used without regard to information incentives. The cutoff of

2

that would be used in the owner's pre0.7589 exceeds the cutoff of

ferred partition if information incentives were not an issue. Thus, the

owner offers the manager additional slack and imposes additional production constraints to provide information incentives.

The principal is better off committing to the contract with information incentives than allowing the manager to choose his preferred partition. This conclusion follows from observing that the owner's expected

profits are j5 under the manager's preferred partition with no information incentives, 0.310517 under the manager's preferred partition with

information incentives, and 0.32486 under the owner's preferred partition with information incentives.

EXAMPLE 4. Suppose one of two partitions will be realized, either the

manager's most preferred partition: lM = {[0, I), [I, 3), [ , 7), (7,

1

[

),

], ... } or a partition that the owner prefers: rgo = {[?0, b) [,

1. The owner prefers nlo to flM because flo

[2, 3), [3, 7), (7, 51 ....

subdivides the lowest cost interval. Here, the most efficient way to make

the manager indifferent is to ignore all information if tIM is produced

and set a cutoff of

30 . In iro, the optimum

is to follow the case where

information incentives are not at issue and set cutoffs equal to the upper

limit of each interval. Thus, production always occurs with ro. The manager's expected slack in both flM and rO is 4. The owner is better off

committing to such a scheme if the information alternatives are flM for

sure or nlo with a probability greater than 0.5769, depending on the manager's actions. Under this structure, the owner's expected profits are 3.

These examples demonstrate several points. First, additional distortions in production or extra slack are introduced to provide information

incentives. Additional restrictions of production necessarily reduce social efficiency and have as their aim only a distributive effect. Both these

distortions are exhibited in example 3, whereas example 4 has only restricted production; i.e., the partition the owner is trying to avoid induces full production in the absence of commitment. Any alteration of

contract in such a case necessarily reduces social

the no-commitment

efficiency.

Second, the examples illustrate the role of a commitment to ignore

information if it is not produced by a desired partition. This is particularly vivid in example 4, where all information produced by IM is

INFORMATION

SYSTEMS IN RESOURCE ALLOCATION

55

ignored. The typical theoretical explanation of the role of committing

to ignore information is to provide incentives for communication.

Here

we show it can also provide disincentives for the production of information, if it is not the owner's preferred information.

Third, the provision of incentives requires differentiating the consequences to the manager under the various partitions. It may then appear that the information choice has been delegated to the manager,

who is in turn held responsible for the information. The usual explanation of why managers select the information system is private information (Demski, Patell, and Wolfson [1984]). Our model has no private

information at the point of information selection. Rather, we assume

that efficient production of information gives the manager some opportunity to influence it, and it is costly to insulate against such influence.

7. Conclusion

This paper has examined some issues arising from the ability of managers to influence the information in an organization in order to escape

its distributive effects. We gave necessary and sufficient conditions for the

owner's and manager's preferences over a public cost-reporting system

to be in conflict when costs are uniformly distributed and cost information partitions contain equal length elements. We described the owner's

and manager's most preferred public cost-reporting information systems

when costs are uniformly distributed. The potential for and nature of the

conflict of interest is clear from these results. Managers want to make

public cost information that accurately distinguishes highest costs but

pools low costs. This allows maximum possibility for extracting slack,

while curtailing as much as possible lost production. Owners want information that is more uniform over possible costs to facilitate capturing

slack from the manager in low-cost states.

Limiting production to socially suboptimal amounts is the owner's tool

for controlling the manager's slack consumption.

If the manager can

costlessly implement any information system, he will choose one with socially efficient production and one which allows him to capture as much

of the rents on cost information as possible (Proposition 2). The owner's

optimal strategy obtains a more favorable distribution for him while also

implementing socially optimal production. The owner's preferred information system gives all the rents, both from the firm's underlying technology and from the cost information, to the owner (Proposition 3).

Between these extremes, our analysis shows how socially suboptimal production can be used to affect distribution.

The distributive and productive effects of information interact, and

additional distortions can be created by information-influencing

activities. This was the focus of the analysis of moral hazard in information

acts that influence information systems can

production. Unobservable

RICK ANTLE AND JOHN FELLINGHAM

56

lead to incentive

cost information.

schemes

which commit

to ignore

otherwise

valuable

APPENDIX A

Several lemmas

lemmas all assume

LEMMA 1. Within

hurdle rate chosen

are helpful in proving Propositions

2 and 3. The

costs are uniformly distributed on [0, 1].

any element of a partition (ci, cs+,11 the optimal

by the owner is: min{'(1+ci),

ci,1}.

CH

Proof. The owner chooses a hurdle cost,

cH,

to maximize

f

(1 -

CH) dc =

Ci

(1 - cH)(cH- ci). The first-order condition on cH yields cH = 2(1 + ci)

This equation is valid when CH is interior. Otherwise, cH = ci+i.

LEMMA 2. In an optimal partition

all elements except the highest,

(can, 1], have the following property: ci < (1 + ci -). The statement is

true whether the partition is optimal for the owner or the manager.

Proof. The lemma means there is full production in all elements of

the partition except the last. Suppose the statement is not true, and

there are two adjacent elements of a partition without full production.

Then the manager's expected slack in those two elements of the par- c+1] 2. The

of

tition

is: I[i(1 + c.) - C.]2 + [9(I + C

derivative

the expected slack with respect to ci+l is '(-1 + c-+,) < 0. So expected

slack can be increased by decreasing c-+I to I(I + ci).

Notice the proof was for the case when the hurdle rate in the higher

partition element is interior. If the hurdle rate is on the boundary of

the higher partition element, it is easy to show the derivative of the

expected slack with respect to c,+1 is negative. Therefore, an interior

hurdle rate in the lower partition element is suboptimal. This logic

covers the case in which there is only one interior partition element

without full production.

The proof proceeds in the same way for the owner's partition. When

there are two adjacent elements without full production, the expected

residual is:

[9(1

+ cC-)-

Differentiating:

cj[1

a

+ C-)] [+(1

+

E(slack)

=-

-

+ C-+)c-+,)

< 0.

C-+,] [

-

(

C.+

The owner is made bet-

I + I

ter off by decreasing ci+1 to (1 + Ci).

LEMMA 3. The optimal partition for the manager will have at most

one c- - 9slack can be increased by moving

Proof. Suppose c1 < C

9. Expected

c1 to halfway between c2 and 1. Expected slack below c2 under the old

slack below

-1c + I(C2 - C,)2 =

Ic2

partition is ?2

2 - cl(2 - cl). Expected

SYSTEMS IN RESOURCE ALLOCATION

INFORMATION

57

c1(c2 - c1). Plus the manager

c2 under the new partition is 2c2 > 2c

+ 1) 2.

gets some extra slack at the high end: -(c2

Proof of Proposition 2. Using Lemma 2, the expected slack in the first

is E(Slack) =

optimal

partition

two elements

of the manager's

1 +

- c1)2. The

to c1 is:

with respect

partial derivative

d3ESlk = 2c, - c2. This partial derivative

a3c1

is an affine function

From Lemma 2 the bounda(The left-hand boundary

So we only have to check the boundaries.

ries on c1 for a given c2 are: 2c2 - 1 < ?,

is from the inequality c2 < (1 + c1)12.)

Plugging in the boundaries

gives two cases:

Case 1: c1

= 2-

of cl.

: 2.

for expected

into the expression

Then E(Slack)

=

+ 4-

--

Case 2: c1 = 2c2 - 1. Then E (Slack) =

slack

5C2 -

From Lemmas 2 and 3 we only need to check the

slack is

43. Some algebra reveals Case 1 expected

expected slack. Define g(c2) as the expected slack

expected

slack in Case 2: g(c2) = -2c2 + 5c2-

3c2 + 1.

two cases for 2

greater than Case 2

in Case 1 minus the

;

g(2)

=

g(3)

=

0;

> 0, g'(4)

slack in Case 1, c1 =2

< 0, and g"(c2) < 0. So expected

9'(2)

is always greater than Case 2 for all relevant c2. (For c2 = 2 and 3, the

two cases represent the same partition.) Therefore, the manager's optimal partition must have c1 =

3

Since c1

(halfway to

l = , logic identical to the foregoing yields c2 =

In

limit

the

and

so

forth.

the

C3

=

7,

one),

manager's expected slack is:

E(Slack)

=

-1

2 ((1/l1))

The

+ 1(1)2

2(1)2

amount

=

+ 1(1)2

approaches

produced

1

of 1 -

(

...

+

+

(1) 2 +

(4) 3

+

1-

f cdc

full production

with gains

to

residual

to the owner is

Proof of Proposition 3. Using Lemma 2, the expected

owner of an m element partition is:

residual for the

production

-

2

So the expected

2.

0

_

G

=

3-

E(n(m))

+

.

.+

=

c1(I

- cl)

+

+ * * * +(ci-

c-_.)(1

(Cm

i) (1

Cm

cl)(

(c2-

- ci)

-Cen

) +

-c2)

+ (c-+1

(Ci

-+ll)

+

c2)(1-

(c3-

- c-)(l

-

( 1-

ci+0

-)+1)

c3)

58

RICK ANTLE AND JOHN FELLINGHAM

Differentiating

with respect to c1, ci, and Cm respectively, and setting

equal to zero yields: c2 = 2c1; cI =

+I + ci-1); and cm- Cml =

of the optimal partition.

2(I - Cm), which is an equivalent representation

The owner's expected residual is:

I

1

I-

I

I

1-

)miMm+M+

1

m(m+ 1)

2

(m+ 1)2

2 )+

I

+

(1-m)

m+

ml+

1

)

m

2(m+ 1)

The manager's expected slack is Im(1/(m

ber of elements in the partition.

+ 1))2,

where m is the num-

REFERENCES

ANTLE, R., AND G. EPPEN. "Capital Rationing

and Organizational

Slack in Capital Budget1985): 163-74.

ATKINSON, A.; R. BANKER; R. KAPLAN; AND S. YOUNG. ManagementAccounting.Englewood Cliffs,

N.J.: Prentice-Hall,

1995.

DATAR, S., AND M. GUPTA.'Aggregation,

Specification

and Measurement Errors in Product

Costing." The Accounting Review (October 1994): 567-92.

DEMSKI, J.; J. PATELL; AND M. WOLFSON. "Decentralized

Choice of Monitoring Systems." The

Accounting Review (January 1984): 16-34.

ing." Management Science (February

FARLEE, M.; J. FELLINGHANM;

AND R. YOUNG.

"Properties of Economic Income in a Private Infor-

mation Setting." Working paper, Ohio State University, 1995.

MAHER, M., AND M. MARAIS. "Process-Oriented

Activity-Based Costing." Working paper, University of California at Davis, 1994.

MILGROM,

P. "Employment Contracts, Influence Activities, and Organization Design." Journal of Political Economy (February 1988): 42-60.

MILGROM, P., AND J. ROBERTS. 'An Economic Approach to Influence

Activities in Organizations." American Journal of Sociology (Supplement

1988): 154-79.

. Economics, Organization, and Management. Englewood

Cliffs, N.J.: Prentice-Hall,

1992.