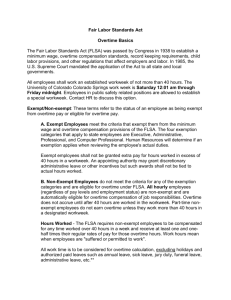

Fair Labor Standards Act Guide to the For West Virginia School Districts

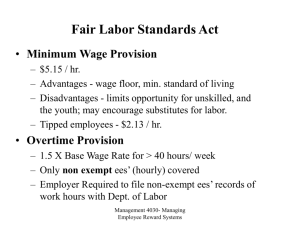

advertisement