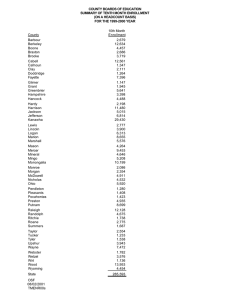

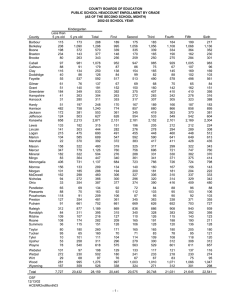

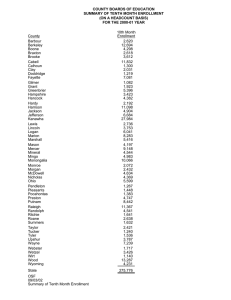

COUNTY BOARDS OF EDUCATION TAXABLE ASSESSED VALUATIONS FOR THE 2008-09 FISCAL YEAR

advertisement

COUNTY BOARDS OF EDUCATION TAXABLE ASSESSED VALUATIONS FOR THE 2008-09 FISCAL YEAR County Class I Assessed Valuations Class II Assessed Valuations Class III Assessed Valuations Class IV Assessed Valuations Total Assessed Valuations Barbour Berkeley Boone Braxton Brooke Cabell Calhoun Clay Doddridge Fayette Gilmer Grant Greenbrier Hampshire Hancock Hardy Harrison Jackson Jefferson Kanawha Lewis Lincoln Logan Marion Marshall Mason McDowell Mercer Mineral Mingo Monongalia Monroe Morgan Nicholas Ohio Pendleton Pleasants Pocahontas Preston Putnam Raleigh Randolph Ritchie Roane Summers Taylor Tucker Tyler Upshur Wayne Webster Wetzel Wirt Wood Wyoming - 133,111,058 3,368,293,930 180,680,464 152,472,594 259,307,073 1,188,644,672 66,481,874 61,529,197 104,346,164 376,050,350 71,760,934 217,872,014 623,901,527 821,943,842 351,468,280 399,550,550 999,656,016 394,434,965 2,568,421,740 3,003,654,846 207,630,760 123,948,172 196,998,636 806,302,134 345,188,333 322,128,846 45,089,276 592,857,264 467,531,739 134,891,363 1,406,135,012 139,904,913 657,840,859 274,750,050 718,452,478 229,586,768 99,152,694 214,685,880 484,089,400 1,219,724,517 846,954,860 356,305,426 153,757,396 155,298,244 140,432,806 241,671,278 135,572,159 116,469,894 328,777,535 355,095,114 45,640,361 179,585,402 63,470,596 1,490,992,174 71,683,502 170,070,248 1,460,494,002 1,229,834,603 279,056,810 94,154,622 715,522,224 138,296,078 230,787,814 270,876,108 519,720,984 221,802,448 462,322,296 642,690,904 502,840,471 308,567,227 255,128,916 1,076,095,501 609,328,746 1,002,329,292 2,303,972,986 589,949,619 310,607,343 980,014,195 594,313,919 913,883,701 663,049,003 691,011,437 555,918,915 302,510,183 788,009,033 1,497,334,488 107,655,913 280,234,904 422,864,829 243,036,792 116,646,504 428,835,001 436,898,665 504,994,342 1,144,441,489 1,181,381,199 423,131,095 218,828,117 173,850,062 156,172,637 190,267,020 282,247,295 196,262,453 379,882,176 554,422,986 215,787,145 267,787,109 46,251,829 789,587,506 743,364,784 48,979,675 468,978,812 59,387,284 40,800,372 410,204,278 1,014,488,838 9,226,418 12,567,422 8,988,450 202,593,512 23,172,725 44,603,745 199,391,648 53,047,024 262,227,929 108,821,918 744,707,769 125,217,383 435,255,769 2,728,979,753 56,654,110 14,399,446 106,498,036 493,718,864 205,516,862 86,938,315 84,281,229 311,664,692 86,446,624 93,207,801 748,451,321 12,814,381 41,476,762 109,951,008 595,293,292 15,535,383 35,048,029 29,584,412 104,923,327 153,748,022 422,959,271 134,752,732 43,121,713 39,142,393 40,301,080 60,474,045 46,190,817 30,762,501 96,113,849 131,802,137 19,977,043 139,394,171 9,111,390 777,493,967 47,017,165 352,160,981 5,297,766,744 1,469,902,351 472,329,776 763,665,973 2,918,655,734 214,004,370 304,884,433 384,210,722 1,098,364,846 316,736,107 724,798,055 1,465,984,079 1,377,831,337 922,263,436 763,501,384 2,820,459,286 1,128,981,094 4,006,006,801 8,036,607,585 854,234,489 448,954,961 1,283,510,867 1,894,334,917 1,464,588,896 1,072,116,164 820,381,942 1,460,440,871 856,488,546 1,016,108,197 3,651,920,821 260,375,207 979,552,525 807,565,887 1,556,782,562 361,768,655 563,035,724 681,168,957 1,094,007,069 2,517,914,028 2,451,295,330 914,189,253 415,707,226 368,290,699 336,906,523 492,412,343 464,010,271 343,494,848 804,773,560 1,041,320,237 281,404,549 586,766,682 118,833,815 3,058,073,647 862,065,451 Total - 28,712,177,931 29,885,325,968 12,426,406,914 71,023,910,813 Source: Levy Order and Rate Sheet submitted by each county board for the 2008-09 fiscal year. OSF2 05/30/08 Taxable Assessed Valuations 09 -6- ATTACHMENT 1 COUNTY BOARDS OF EDUCATION LEVY RATES - CLASS I PROPERTY FOR THE 2008-09 FISCAL YEAR County Current Expense Purposes Barbour Berkeley Boone Braxton Brooke 19.40 19.40 19.40 19.40 19.40 Cabell Calhoun Clay Doddridge Fayette 17.90 19.40 19.40 19.40 19.40 Gilmer Grant Greenbrier Hampshire Hancock 19.40 19.40 19.40 19.40 19.40 Hardy Harrison Jackson Jefferson Kanawha Permanent Improvement Purposes Excess Levy Purposes Bond Purposes Total Levy Rates 22.50 22.95 22.95 98.0% 100.0% 100.0% 7.25 3.03 3.73 5.60 26.65 44.93 42.35 23.13 47.95 22.95 0.53 6.50 22.95 22.95 100.0% 2.3% 28.3% 100.0% 100.0% 6.61 4.74 6.34 - 48.96 24.67 25.90 48.69 42.35 - 8.85 11.475 20.65 38.6% 50.0% 90.0% 3.37 0.37 - 28.25 19.40 34.25 19.77 40.05 19.40 19.40 19.40 19.40 19.40 - 20.33 22.95 22.95 18.23 88.6% 100.0% 100.0% 79.4% 3.25 1.66 19.40 39.73 42.35 45.60 39.29 Lewis Lincoln Logan Marion Marshall 19.40 19.40 19.40 19.40 19.40 - 12.62 22.95 22.95 21.00 22.49 55.0% 100.0% 100.0% 91.5% 98.0% 5.71 32.02 42.35 42.35 40.40 47.60 Mason McDowell Mercer Mineral Mingo 19.40 19.40 19.40 19.40 17.90 1.50 20.48 22.95 22.95 22.95 22.95 89.2% 100.0% 100.0% 100.0% 100.0% 3.88 - 43.76 42.35 42.35 42.35 42.35 Monongalia Monroe Morgan Nicholas Ohio 19.40 17.90 19.40 19.40 19.40 1.50 - 17.21 17.21 19.16 13.31 21.92 75.0% 75.0% 83.5% 58.0% 95.5% 3.18 2.61 2.53 39.79 39.22 38.56 32.71 43.85 Pendleton Pleasants Pocahontas Preston Putnam 19.40 19.40 19.40 19.40 19.40 - 19.06 4.73 22.95 83.1% 20.6% 100.0% Raleigh Randolph Ritchie Roane Summers 19.40 19.40 19.40 19.40 19.40 - 22.95 14.92 - 100.0% 65.0% - 2.98 2.68 - 45.33 19.40 34.32 22.08 19.40 Taylor Tucker Tyler Upshur Wayne 19.40 19.40 19.40 19.40 19.40 - 11.475 1.74 22.95 9.83 22.95 50.0% 7.6% 100.0% 42.8% 100.0% 6.80 - 37.68 21.14 42.35 29.23 42.35 Webster Wetzel Wirt Wood Wyoming 19.40 19.40 19.40 19.40 17.90 1.50 22.95 20.66 18.36 22.95 100.0% 90.0% 80.0% 100.0% 3.74 2.35 19.40 42.35 40.06 41.50 44.70 State 55 4 44 44 21 55 OSF2 05/30/08 Taxable Assessed Valuations 09 - Percent of Maximum (22.95) 1.50 - -7- - 19.40 38.46 19.40 24.13 42.35 ATTACHMENT 2 COUNTY BOARDS OF EDUCATION SUMMARY OF PROJECTED GROSS TAX COLLECTIONS FOR THE 2008-09 FISCAL YEAR County Current Expense Purposes Barbour Berkeley Boone Braxton Brooke 2,216,298 28,041,689 10,705,402 3,073,686 4,919,936 - 32,522,578 12,664,380 5,820,233 828,256 4,379,707 590,972 1,420,188 3,044,554 64,943,974 23,369,782 3,664,658 12,160,357 Cabell Calhoun Clay Doddridge Fayette 16,642,227 1,402,725 2,127,169 2,576,612 7,064,236 1,394,599 - 21,337,381 38,322 712,711 3,048,106 8,356,918 6,145,537 342,727 842,048 - 45,519,744 1,783,774 2,839,880 6,466,766 15,421,154 Gilmer Grant Greenbrier Hampshire Hancock 2,179,439 4,779,089 8,955,298 7,502,829 5,793,068 - 994,229 5,297,013 6,166,332 1,555,637 143,095 - 3,173,668 4,779,089 15,807,948 7,645,924 11,959,400 Hardy Harrison Jackson Jefferson Kanawha 4,374,514 18,008,098 7,230,486 21,121,136 50,709,894 - 18,871,374 8,553,590 24,986,087 47,651,617 3,538,334 4,339,094 4,374,514 36,879,472 15,784,076 49,645,557 102,700,605 Lewis Lincoln Logan Marion Marshall 5,823,252 3,002,972 9,195,690 11,571,586 10,025,880 - 3,788,116 3,552,484 10,878,406 12,525,944 11,622,785 2,950,916 9,611,368 6,555,456 20,074,096 24,097,530 24,599,581 Mason McDowell Mercer Mineral Mingo 7,069,761 6,191,217 9,032,735 4,832,328 6,792,424 569,197 7,463,336 7,324,147 10,685,633 5,716,594 8,708,722 1,413,952 - 15,947,049 13,515,364 19,718,368 10,548,922 16,070,343 Monongalia Monroe Morgan Nicholas Ohio 22,883,102 1,363,427 5,048,906 5,200,681 9,293,038 114,254 - 20,299,907 1,310,870 4,986,444 3,568,096 10,500,175 3,750,941 198,801 1,211,927 46,933,950 2,987,352 10,035,350 8,768,777 21,005,140 Pendleton Pleasants Pocahontas Preston Putnam 1,916,529 3,984,445 4,452,890 6,611,228 14,806,482 - 3,914,614 1,611,913 17,515,916 - 1,916,529 7,899,059 4,452,890 8,223,141 32,322,398 Raleigh Randolph Ritchie Roane Summers 15,735,867 5,711,643 2,629,309 2,255,378 2,069,515 - 18,615,368 2,022,128 - 2,417,158 311,568 - 36,768,393 5,711,643 4,651,437 2,566,946 2,069,515 2,883,436 3,074,700 2,213,617 4,969,386 6,702,876 - 1,705,538 275,772 2,618,686 2,517,994 7,929,434 1,010,688 - 5,599,662 3,350,472 4,832,303 7,487,380 14,632,310 2,006,615 3,856,518 675,884 17,945,602 5,915,762 495,734 4,562,221 719,783 16,983,570 7,584,734 3,459,616 776,650 2,006,615 8,418,739 1,395,667 38,388,788 14,772,880 437,168,512 2,573,784 408,530,201 41,627,812 889,900,309 Taylor Tucker Tyler Upshur Wayne Webster Wetzel Wirt Wood Wyoming Total OSF2 05/30/08 Taxable Assessed Valuations 09 Permanent Improvement Purposes -8- Excess Levy Purposes Bond Purposes Total ATTACHMENT 3 COUNTY BOARDS OF EDUCATION SUMMARY OF LOCAL SHARE CALCULATIONS AT 90% AND CLASS I LEVY RATE OF 19.40c FOR THE 2008-09 YEAR County Total Assessed Valuations Less TIFs Projected Gross Taxes At 90% of Levy Rates Allow. For Uncollectibles & Discounts (5%) Allow. For Assessors' Valuation Fund Allow. For Growth Counties School Facilities Act Local Share Calculations 2008-09 Barbour Berkeley Boone Braxton Brooke Cabell 350,932,860 5,297,766,744 1,469,902,351 472,329,776 762,300,039 2,903,415,669 1,986,130 25,237,520 9,634,862 2,766,317 4,418,403 16,126,707 110,341 1,402,084 535,270 153,684 245,467 895,928 41,929 532,792 203,403 58,400 81,618 340,453 966,130 - 1,833,860 22,336,514 8,896,189 2,554,233 4,091,318 14,890,326 Calhoun Clay Doddridge Fayette 214,004,370 304,884,433 384,210,722 1,101,674,166 1,262,453 1,914,452 2,318,951 6,380,991 70,136 106,358 128,831 354,500 26,652 40,416 48,956 134,710 - 1,165,665 1,767,678 2,141,164 5,891,781 Gilmer Grant Greenbrier Hampshire Hancock 316,736,107 724,798,055 1,219,847,626 1,377,831,337 922,263,436 1,961,495 4,301,180 6,787,316 6,752,546 5,213,761 108,972 238,954 377,073 375,141 289,653 41,409 90,803 143,288 142,554 68,793 - 1,811,114 3,971,423 6,266,955 6,234,851 4,855,315 Hardy Harrison Jackson Jefferson Kanawha 763,501,384 2,788,737,384 1,128,981,094 4,006,006,801 8,036,607,585 3,937,063 16,002,401 6,507,437 19,009,022 45,638,905 218,726 889,022 361,524 1,056,057 2,535,495 83,116 337,828 137,379 200,651 963,488 696,357 - 3,635,221 14,775,551 6,008,534 17,055,957 42,139,922 Lewis Lincoln Logan Marion Marshall 854,234,489 448,954,961 1,283,510,867 1,894,334,917 1,464,455,276 5,240,927 2,702,675 8,276,121 10,414,427 9,022,359 291,163 150,149 459,785 578,579 501,242 110,642 57,056 174,718 219,860 190,472 - 4,839,122 2,495,470 7,641,618 9,615,988 8,330,645 Mason McDowell Mercer Mineral Mingo 1,072,116,164 820,381,942 1,460,440,871 770,590,571 1,016,108,197 6,362,785 5,572,095 8,129,462 3,943,300 6,625,459 353,488 309,561 451,637 219,072 368,081 134,325 117,633 150,169 83,247 139,871 - 5,874,972 5,144,901 7,527,656 3,640,981 6,117,507 Monongalia Monroe Morgan Nicholas Ohio 3,599,762,108 260,375,207 911,351,785 807,565,887 1,389,063,759 20,253,029 1,329,913 4,289,061 4,680,613 7,192,767 1,125,168 73,884 238,281 260,034 399,598 427,564 28,076 90,547 98,813 151,847 961,297 - 17,739,000 1,227,953 3,960,233 4,321,766 6,641,322 Pendleton Pleasants Pocahontas Preston Putnam 361,768,655 563,035,724 681,168,957 1,094,007,069 2,428,372,518 1,724,876 3,586,001 4,007,601 5,950,105 12,950,966 95,826 199,222 222,645 330,561 719,498 36,414 56,778 84,605 125,613 273,409 517,837 1,592,636 3,330,001 3,700,351 5,493,931 11,440,222 Raleigh Randolph Ritchie Roane Summers 2,348,133,882 914,189,253 415,707,226 368,290,699 336,906,523 13,613,440 5,140,479 2,366,378 2,029,840 1,862,564 756,302 285,582 131,465 112,769 103,476 287,395 108,521 49,957 42,852 39,321 - 12,569,743 4,746,376 2,184,956 1,874,219 1,719,767 Taylor Tucker Tyler Upshur Wayne 492,412,343 464,010,271 343,494,848 804,773,560 1,041,320,237 2,595,092 2,767,230 1,992,255 4,472,447 6,032,588 144,172 153,735 110,681 248,469 335,144 54,785 58,419 42,059 94,418 127,355 - 2,396,135 2,555,076 1,839,515 4,129,560 5,570,089 Webster Wetzel Wirt Wood Wyoming 283,615,729 586,766,682 118,833,815 3,056,211,667 862,065,451 1,821,397 3,470,866 608,296 16,137,337 5,770,346 101,189 192,826 33,794 896,519 320,575 38,452 73,274 19,263 306,609 121,818 - 1,681,756 3,204,766 555,239 14,934,209 5,327,953 70,165,064,049 391,093,009 21,727,388 7,934,795 3,141,621 358,289,205 Total OSF2 05/30/08 -9- ATTACHMENT 4 Taxable Assessed Valuations 09 - 10 - ATTACHMENT 4 - 11 - ATTACHMENT 4