Document 10982250

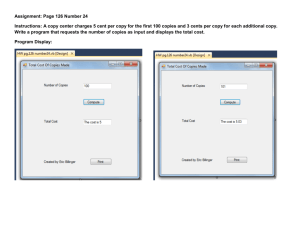

advertisement