The M.I.T. Endicott House A Study in Highest and Best Use by

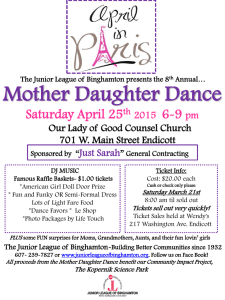

advertisement