THE NATIONAL WATERMELON PROMOTION BOARD CONSUMER REPORT (DOMESTIC) THE NATIONAL WATERMELON

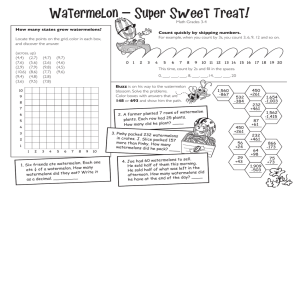

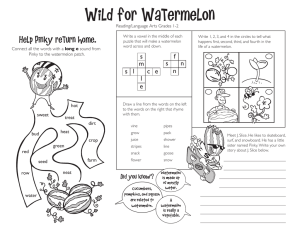

advertisement