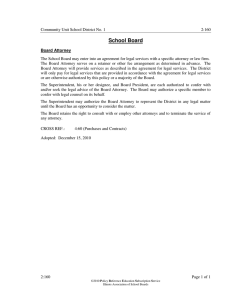

Combating Corrupt payments in Foreign investment ConCessions:

advertisement