PRESERVATION PLAN FOR THE KIRBY HISTORIC DISTRICT A CREATIVE PROJECT SUBMITTED TO THE GRADUATE SCHOOL

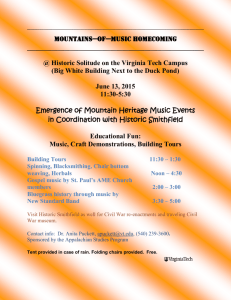

advertisement