Document 10954435

advertisement

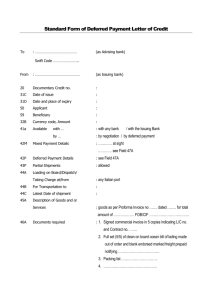

Basics of Export Finance Practical Application Chris Pilkington Manager, International Division FirstMerit Bank 1 Challenges and Risks in Export • Getting Paid – – – – – Country Risk Customer Credit Risk Bank Risk Foreign Exchange Transaction Risk Shipping Risk – Marine Cargo Insurance • Protectionism and Bureaucracy – – – – – – Duties and Fees Quotas and Visa’s VAT, Withholding and other taxes Anti-Terrorism Programs Packaging, labeling, certifications(CE) “Covert” Protectionism 2 Payment Methods • Cash in Advance • Letter of Credit • Documentary Collection • Open Account Terms Favor Seller Terms Favor Buyer Moving Money Around the World – Cash in Advance or Open Account • Wire Transfers (Telegraphic Transfer, TT, Cable) – – – – Two day settlement or less Good funds as soon as received SWIFT No global clearing house, large banks maintain accounts with other large banks. Clearing banks for each currency are listed in various bank directories. • Collecting foreign checks/drafts – With the exception of Canada, extremely costly and time consuming. Can take weeks to process the check. – A customer may be given provisional credit, but you won’t know for weeks if the check cleared properly. – In general, never accept a paper item for an international transaction, use a wire transfer. 4 Moving Money Around the World – Cash in Advance or Open Account • Unfortunately fraud is running rampant – – – – – Overpayment fraud Forged items Hacked emails or right fax programs Vendor bank change scams Numerous others • Credit Card is quite acceptable for international transactions. – Charge back rules are slightly different than domestic transactions, but not onerous. – Not aware of large scale fraud – Should have some knowledge of your customer, not a total stranger – Buyers in many countries can’t make a USD purchase with a credit card due to capital controls 5 Credit Insurance • Available from Export-Import Bank of the United States and several private insurers. • In general, Eximbank is best for newer and small to medium-size exporters. Minimum cost is much lower than private insurers. Policies are standard. • Private insurance can be better for larger exporters as policies are custom written. • Can cover default by a customer for commercial or political reasons. • Can take several months to make a claim and receive a settlement. • Trade disputes always an issue. Dealing in Foreign Currencies • Before we talk about FX, remember this only applies in developed countries. Many large markets cannot pay in their local currencies. (India, China are changing slowly) • Are there in-market competitors for your product? • Do other competitors offer local currency pricing? • If your company is not open to dealing in other currencies, it will restrict your exporting opportunities. • Most times, exporters overestimate the risk and difficulty in managing the risk. A simple “forward contract” is all most exporters need. • Quoting properly is the hardest part! 7 Documentary Collections • Letters of Credit will cost the two parties several hundred dollars minimum for any size transaction. • A lower cost alternative is a Documentary Collection. • The banks protect the title documents until the payment has been made, or draft/promissory note has been signed. – Works best with Ocean shipments and Bills of Lading – Air Waybills are not title documents • There is non-acceptance risk – You ship the goods around the world and the buyer doesn’t pick them up. 8 Letters of Credit § Two Common Types § Documentary / Commercial § Active payment instrument § Active financing tool § Standby § Passive payment instrument § Passive financing tool § In Exports – Seller provides to the buyer § Bid Bond § Advance Payment Guarantee § Performance/Warranty Bond Advised Letters of Credit Beneficiary: • Bears credit risk of the issuing bank • Bears full country risk of the transaction • Responsible for ensuring compliance with expectations Advising Bank: • Responsibility limited to authentication • Has no payment obligation • Advocate for beneficiary Role of the Advising Bank • Verify the authenticity of the Letter of Credit, thereby protecting the beneficiary from fraud • Advocate for the beneficiary – No conflict of interest • Other benefits of using your bank – Commitment to Customer Service – Relationship Pricing – Consistency in Processing If you want more protection the next step is to consider having the letter of credit confirmed Confirmed Letters of Credit • Confirmation eliminates: – Commercial credit risk of issuing bank – Country risk of issuing bank • Confirmed credit means payment obligation moves to the confirming bank and its country However: • Confirmation is location specific – Verify country of confirming bank • Confirmation by branch or subsidiary of issuing bank – May shift country risk – May not shift commercial What to do When the LC Arrives • • • • • • Read the letter of credit Compare to your Letter of Credit Instructions Ensure you can comply with the terms Send copy of L/C to your freight forwarder Ask about anything you don’t understand If incorrect: – – – – Stop Shipment Stop Manufacturing Contact the Buyer Immediately If necessary, request the buyer amend the Letter of Credit • Case Study • Questions??? Chris.Pilkington@firstmerit.com 614-429-7440 14