Exercises Chapter 4 Statistical Hypothesis Testing Advanced Econometrics - HEC Lausanne Christophe Hurlin

advertisement

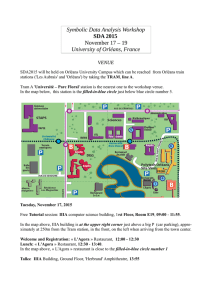

Exercises Chapter 4 Statistical Hypothesis Testing Advanced Econometrics - HEC Lausanne Christophe Hurlin University of Orléans December 5, 2013 Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 1 / 88 Exercise 1 Parametric tests and the Neyman Pearson lemma Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 2 / 88 Problem We consider two continuous independent random variables U and W normally distributed with N 0, σ2 . The transformed variable X de…ned by: p X = U2 + W 2 has a Rayleigh distribution with a parameter σ2 : X Rayleigh σ2 with a pdf fX x; σ2 de…ned by: fX x; σ2 = Christophe Hurlin (University of Orléans) x exp σ2 x2 2σ2 8x 2 [0, +∞[ Advanced Econometrics - HEC Lausanne December 5, 2013 3 / 88 Problem (cont’d) Question 1: we consider an i.i.d. sample fX1 , X2 , .., XN g . Derive the MLE estimator of σ2 Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 4 / 88 Solution fX x; σ2 = x2 2σ2 x exp σ2 8x 2 [0, +∞[ The log-likelihood of the i.i.d. sample fx1 , x2 , .., xN g is `N σ 2 ; x = N ∑ ln fX xi ; σ2 = i =1 N ∑ ln (xi ) N ln σ2 i =1 1 2σ2 N ∑ xi2 i =1 b2 is de…ned as to be: The ML estimator σ b2 = arg max `N σ2 ; x σ σ 2 >0 Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 5 / 88 Solution (cont’d) b2 = arg max σ σ 2 >0 N ∑ ln (xi ) 1 2σ2 N ln σ2 i =1 N ∑ xi2 i =1 FOC (log-likelihood equations) ∂ `N σ 2 ; x ∂σ2 = So, the ML estimator of σ2 is b2 σ b2 = σ Christophe Hurlin (University of Orléans) N 1 + 4 2 b σ 2b σ 1 2N N ∑ xi2 = 0 i =1 N ∑ Xi2 i =1 Advanced Econometrics - HEC Lausanne December 5, 2013 6 / 88 Solution (cont’d) ∂ `N σ 2 ; x = ∂σ2 N 1 + 4 2 σ 2σ N ∑ xi2 i =1 SOC: ∂2 `N σ 2 ; x ∂σ4 = b2 σ = = N b4 σ 1 b6 σ N ∑ xi2 i =1 b2 N 2N σ b4 b6 σ σ N <0 b4 σ 2 b2 . So, we have a maximum. since ∑N i =1 xi = 2N σ Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 7 / 88 Problem (cont’d) b2 ? Question 2: what is the asymptotic distribution of the MLE estimator σ Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 8 / 88 Solution The average Fisher information matrix associated to the sample is: ! 2` 2; X ∂ σ N IN σ2 = Eσ2 ∂σ4 ! N 1 N 2 = Eσ 2 + 6 ∑ Xi σ4 σ i =1 1 N + 4 4 σ σ = N ∑ Eσ 2 i =1 Xi2 σ2 Since (X /σ)2 = (U/σ)2 + (W /σ)2 where U/σ and W /σ are two independent standard normal variables, then X 2 /σ2 χ2 (2) with Eσ 2 Christophe Hurlin (University of Orléans) Xi2 σ2 =2 Advanced Econometrics - HEC Lausanne December 5, 2013 9 / 88 Solution (cont’d) So, we have I N σ2 = 1 N + 4 4 σ σ = N 2N + 4 4 σ σ = N ∑ Eσ 2 i =1 Xi2 σ2 N σ4 Since the sample is i.i.d., the average Fisher information matrix is: I σ2 = Christophe Hurlin (University of Orléans) 1 1 I N σ2 = 4 N σ Advanced Econometrics - HEC Lausanne December 5, 2013 10 / 88 Solution (cont’d) The regularity conditions hold, and we have: p Here b2 N σ p d σ2 ! N 0, I b2 N σ 1 σ2 d σ2 ! N 0, σ4 where σ2 denotes the true value of the parameter. Or equivalently: b2 σ Christophe Hurlin (University of Orléans) asy N σ2 , σ4 N Advanced Econometrics - HEC Lausanne December 5, 2013 11 / 88 Problem (cont’d) Question 3: consider the test H0 : σ2 = σ20 H1 : σ2 = σ21 with σ21 > σ20 . Determine the critical region of the UMP test of size α. Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 12 / 88 Solution Given the Neyman Pearson lemma, the rejection region is given by: ( ) LN σ20 ; x1 , ., xN W = x1 , .., xN j <K LN (σ21 ; x1 , ., xN ) where K is a constant determined by the level of the test α. So, we have `N σ20 ; x () ∑Ni=1 ln (xi ) `N σ21 ; x < ln (K ) N ln σ20 1 2σ20 2 ∑N i =1 xi +N ln σ21 + Christophe Hurlin (University of Orléans) 1 2σ21 ∑N i =1 ln (xi ) 2 ∑N i =1 xi < ln (K ) Advanced Econometrics - HEC Lausanne December 5, 2013 13 / 88 Solution (cont’d) N ln σ21 ln σ20 () with K1 = ln (K ) + 1 σ21 N log σ21 σ20 σ21 σ20 σ21 Christophe Hurlin (University of Orléans) 1 σ20 1 σ21 1 σ20 1 N 2 xi < ln (K ) 2 i∑ =1 1 N 2 xi < K1 2 i∑ =1 log σ20 . or equivalently: 1 N 2 xi < K1 2 i∑ =1 Advanced Econometrics - HEC Lausanne December 5, 2013 14 / 88 Solution (cont’d) 1 N 2 xi < K1 2 i∑ =1 σ20 σ21 σ20 σ21 Since σ21 > σ20 , we have: 1 2N where A = K1 σ20 σ21 / Christophe Hurlin (University of Orléans) σ20 σ21 N ∑ xi2 > A i =1 N is a constant determined by α. Advanced Econometrics - HEC Lausanne December 5, 2013 15 / 88 Solution (cont’d) The rejection region of the UMP test of size α H0 : σ2 = σ20 with σ21 > σ20 is: H1 : σ2 = σ21 n o b 2 (x ) > A W= x :σ where the critical value A is a constant determined by the size α and b2 (x ) is the realisation of the ML estimator σ b2 (the test statistic): σ b2 = σ Christophe Hurlin (University of Orléans) 1 2N N ∑ Xi2 i =1 Advanced Econometrics - HEC Lausanne December 5, 2013 16 / 88 Solution (cont’d) Given the de…nition of the size: b 2 > A H0 α = Pr ( Wj H0 ) = Pr σ Under the null, for N large, we have: b2 σ Then 1 α = Pr Christophe Hurlin (University of Orléans) asy H0 N σ20 , σ40 N b2 σ σ2 A σ20 p0 < p H0 σ20 / N σ20 / N Advanced Econometrics - HEC Lausanne ! December 5, 2013 17 / 88 Solution (cont’d) 1 α = Pr b2 σ A σ20 σ2 p0 < p H0 σ20 / N σ20 / N ! Denote by Φ (.) the cdf of the standard normal distribution: σ2 A = σ20 + p 0 Φ N 1 (1 α) The rejection region of the UMP test of size α H0 : σ2 = σ20 H1 : σ2 = σ21 with σ21 > σ20 is: W= σ2 b2 (x ) > σ20 + p 0 Φ x:σ N Christophe Hurlin (University of Orléans) 1 (1 Advanced Econometrics - HEC Lausanne α) December 5, 2013 18 / 88 Problem (cont’d) Question 4: consider the test H0 : σ 2 = 2 H1 : σ 2 > 2 For a sample of size N = 100, we have N ∑ xi2 = 470 i =1 What is the conclusion of the test for a size of 10%? Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 19 / 88 Solution Consider the test H0 : σ2 = σ20 H1 : σ2 = σ21 with σ21 > σ20 . The rejection region of the UMP test of size α is given by: W= σ2 b2 (x ) > σ20 + p 0 Φ x:σ N 1 (1 α) This region does not depend on the value of σ21 . So, it corresponds to the rejection region of the one-sided UMP of size α : H0 : σ2 = σ20 Christophe Hurlin (University of Orléans) H1 : σ2 > σ20 Advanced Econometrics - HEC Lausanne December 5, 2013 20 / 88 Solution (cont’d) H0 : σ 2 = 2 W= H1 : σ 2 > 2 σ2 b2 (x ) > σ20 + p 0 Φ x:σ N 1 (1 1 (0.9) α) NA: N = 100, α = 10% : W= b 2 (x ) > 2 + x:σ 2 Φ 10 n o b2 (x ) > 2.2563 W= x :σ Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 21 / 88 Solution (cont’d) o n b2 (x ) > 2.2563 W= x :σ 2 For this sample (N = 100) we have ∑N i =1 xi = 470, and as a consequence b 2 (x ) = σ 1 2N N 470 ∑ xi2 = 200 = 2.35 i =1 For a signi…cance level of 10%, we reject the null H0 : σ2 = 2. Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 22 / 88 Problem (cont’d) Question 5: determine the power of the one-sided UMP test of size α for: H0 : σ2 = σ20 H1 : σ2 > σ20 Numerical application: N = 100, σ20 = 2 and α = 10%. Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 23 / 88 Solution The rejection region of the UMP of size α is: o n b 2 (x ) > A W= x :σ with σ20 + Φ 1 (1 p α) σ20 / N. By of the power, we have: power = Pr ( Wj H1 ) = Pr σ2 b2 > σ20 + p 0 Φ σ N 1 (1 α ) H1 Under the alternative hypothesis, for N large, we have: b2 σ Christophe Hurlin (University of Orléans) asy H1 N σ2 , σ4 N σ2 > σ20 Advanced Econometrics - HEC Lausanne December 5, 2013 24 / 88 Solution (cont’d) Then, the power is equal to: power = 1 b2 σ A σ2 σ2 p < p H1 σ2 / N σ2 / N Pr ! =1 Given the de…nition of the critical value A = σ20 + Φ we have: power = 1 Φ σ20 σ2 σ2 p + 02 Φ σ σ2 / N 1 1 Φ σ2 p σ2 / N (1 p α) σ20 / N, A α) 8σ2 > σ20 (0.9) 8σ2 > σ20 (1 NA: σ20 = 2, N = 100 and α = 10% power = 1 Christophe Hurlin (University of Orléans) Φ 2 σ2 2 + 2Φ σ2 /10 σ 1 Advanced Econometrics - HEC Lausanne December 5, 2013 25 / 88 Solution (cont’d) 1 0.9 0.8 0.7 power 0.6 0.5 0.4 0.3 0.2 0.1 0 2 2.2 2.4 2.6 σ Christophe Hurlin (University of Orléans) 2.8 3 2 Advanced Econometrics - HEC Lausanne December 5, 2013 26 / 88 Solution (cont’d) Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 27 / 88 Problem (cont’d) Question 6: consider the two-sided test H0 : σ2 = σ20 H1 : σ2 6= σ20 What is the critical region of the test of size α? Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 28 / 88 Solution Consider the one-sided tests: Test A: H0 : σ2 = σ20 against H1 : σ2 < σ20 Test B: H0 : σ2 = σ20 against H1 : σ2 > σ20 The non-rejection regions of the UMP one-sided tests of size α/2 are: WA = WB = σ2 b2 (x ) > σ20 + p 0 Φ x:σ N σ2 b2 (x ) < σ20 + p 0 Φ x:σ N 1 1 1 α 2 α 2 The non rejection region of the two-sided test corresponds to the intersection of these two regions: W = WA \WB Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 29 / 88 Solution (cont’d) So, the non rejection region of the two-sided test of size α is: W= Since, Φ σ2 x : σ20 + p 0 Φ N 1 (α/2) = W= Φ 1 1 α 2 (1 b 2 (x ) x: σ σ2 b2 (x ) < σ20 + p 0 Φ <σ N 1 1 α 2 α/2) , this region can be rewritten as: σ2 σ20 > p 0 Φ N 1 α 2 1 The rejection region of the two-sided of size α is: W= b 2 (x ) x: σ Christophe Hurlin (University of Orléans) σ2 σ20 < p 0 Φ N 1 Advanced Econometrics - HEC Lausanne 1 α 2 December 5, 2013 30 / 88 Problem (cont’d) Question 7: determine the power of the two-sided test of size α for: H0 : σ2 = σ20 H1 : σ2 6= σ20 Numerical application: N = 100, σ20 = 2 and α = 10%. Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 31 / 88 Solution The non rejection region of the two-sided test of size α is: o n b 2 (x ) < B W= x :A<σ σ2 A = σ20 + p 0 Φ N 1 α 2 σ2 B = σ20 + p 0 Φ N 1 1 α 2 By de…nition of the power: power = Pr ( Wj H1 ) = 1 Pr W H1 So, we have: power = 1 Christophe Hurlin (University of Orléans) b2 < B + Pr σ b2 < A Pr σ Advanced Econometrics - HEC Lausanne December 5, 2013 32 / 88 Solution (cont’d) power = 1 Under the alternative So, we have b2 σ power = 1 Christophe Hurlin (University of Orléans) asy H1 b2 < B + Pr σ b2 < A Pr σ N Φ σ2 , σ4 N σ2 p σ2 / N B σ2 6= σ20 +Φ Advanced Econometrics - HEC Lausanne σ2 p σ2 / N A December 5, 2013 33 / 88 Solution (cont’d) We have Φ power = 1 σ2 A = σ20 + p 0 Φ N 1 σ2 p σ2 / N B +Φ σ2 p σ2 / N A σ2 B = σ20 + p 0 Φ N α 2 1 1 α 2 So 8σ2 6= σ20 , the power function of the two sided test is de…ned by: Φ power = 1 +Φ Christophe Hurlin (University of Orléans) σ2 σ2 p + 02 Φ 1 1 σ σ2 / N 2 2 2 σ0 σ σ α p + 02 Φ 1 2 σ 2 σ / N σ20 Advanced Econometrics - HEC Lausanne α 2 December 5, 2013 34 / 88 Solution (cont’d) NA: N = 100, α = 10% and σ20 = 2. 8σ2 6= 2 power = 1 +Φ Christophe Hurlin (University of Orléans) Φ 2 σ2 2 + 2 Φ 1 (0.95) σ2 /10 σ 2 2 σ2 + 2 Φ 1 (0.05) 2 σ /10 σ Advanced Econometrics - HEC Lausanne December 5, 2013 35 / 88 Solution (cont’d) 1 0.9 0.8 0.7 power 0.6 0.5 0.4 0.3 0.2 0.1 0 1 1.5 2 σ Christophe Hurlin (University of Orléans) 2.5 3 2 Advanced Econometrics - HEC Lausanne December 5, 2013 36 / 88 Solution (cont’d) Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 37 / 88 Problem (cont’d) Question 8: show that the two-sided test is unbiased and consistent. Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 38 / 88 Solution The power function is de…ned as to be: P σ2 Φ = 1 +Φ σ2 σ2 p + 02 Φ 1 1 σ σ2 / N 2 2 2 σ0 σ σ α p + 02 Φ 1 2 σ 2 σ / N σ20 α 2 If σ2 < σ20 , then: lim P σ2 = 1 N !∞ Φ (+∞) + Φ (+∞) = 1 1+1 = 1 Φ ( ∞) + Φ ( ∞) = 1 0+0 = 1 If σ2 > σ20 , then: lim P σ2 = 1 N !∞ The test is consistent. Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 39 / 88 Solution (cont’d) The power function is de…ned as to be: P σ2 = 1 +Φ Φ σ20 σ2 σ2 p + 02 Φ 1 1 σ σ2 / N 2 2 2 σ0 σ σ α p + 02 Φ 1 2 σ 2 σ / N α 2 This function reaches a minimum when σ2 tends to σ20 . lim P σ2 σ2 !σ20 = 1 = 1 = α Φ Φ 1 1 1 α 2 +Φ Φ 1 α 2 α α + 2 2 The test is unbiased. Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 40 / 88 Subsection 4.2 The trilogy: LRT, Wald, and LM tests Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 41 / 88 Problem (Greene, 2007, page 531) We consider two random variables Y and X such that the pdf of the conditional distribution Y j X = x is given by f Y jX ( y j x; β) = 1 exp β+x For convenience, let βi = y β+x 1 β + xi This exponential density is a restricted form of a more general gamma distribution, ρ f Y jX β ρ ( y j x; β, ρ) = i yi Γ (ρ) 1 exp ( yi βi ) The restriction is ρ = 1. We want to test the hypothesis H0 : ρ = 1 versus Christophe Hurlin (University of Orléans) H1 : ρ 6= 1 Advanced Econometrics - HEC Lausanne December 5, 2013 42 / 88 Reminder: the gamma function The gamma function Γ (p ) is de…ned as to be: Γ (p ) = Z∞ tp 1 8p > 0 exp ( t ) dt 0 The gamma function obeys the recursion Γ (p ) = (p Γ 1 2 1) Γ (p = p 1) π So for integer values of p, we have Γ (p ) = (p Christophe Hurlin (University of Orléans) 1) ! Advanced Econometrics - HEC Lausanne December 5, 2013 43 / 88 Reminder: the gamma function (cont’d) The derivatives of the gamma function are ∂k Γ (p ) = ∂p k Z∞ (ln (t ))k t p 1 exp ( t ) dt 0 The …rst two derivatives of ln (Γ (p )) are denoted ∂ ln (Γ (p )) Γ0 = = Ψ (p ) ∂p Γ ∂2 ln (Γ (p )) = ∂p 2 ΓΓ" Γ2 0 Γ2 = Ψ 0 (p ) where Ψ (p ) and Ψ0 (p ) are the digamma and trigamma functions (see polygamma function and function psy in Matlab). Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 44 / 88 Problem (cont’d) Question 1: consider an i.i.d. sample fXi , Yi gN i =1 and write its log-likelihood under H1 (unconstrained model) and under H0 (constrained model). Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 45 / 88 Solution Under H1 , with θ = ( β : ρ)> , we have ρ f Y i jX i β ρ ( yi j xi ; θ) = i yi Γ (ρ) 1 exp ( yi βi ) with βi = 1 β + xi N `N ( y j x; θ) = ∑ ln f Y jX i i =1 i ( yi j xi ; θ) The log-likelihood under H1 (unconstrained model) is: N `N ( y j x; θ) = ρ ∑ ln ( βi ) N ln (Γ (ρ)) + (ρ i =1 Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne N 1) ∑ ln (yi ) i =1 N ∑ yi βi i =1 December 5, 2013 46 / 88 Solution (cont’d) Under H0 : ρ = 1, we have f Y i jX i ( yi j xi ; β) = βi exp ( yi βi ) with βi = 1 β + xi N `N ( y j x; β) = ∑ ln f Y jX i i =1 i ( yi j xi ; β) The log-likelihood under H0 (constrained model) is: `N ( y j x; β) = Christophe Hurlin (University of Orléans) N N i =1 i =1 ∑ ln ( βi ) ∑ yi βi Advanced Econometrics - HEC Lausanne December 5, 2013 47 / 88 Problem (cont’d) Question 2: write the gradient vectors and the Hessian matrices associated to the unconstrained log-likelihood (under H1 ) and to the constrained log-likelihood (under H0 ). Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 48 / 88 Solution Under H1 : N `N ( y j x; θ) = ρ ∑ ln ( βi ) N 1) ∑ ln (yi ) N ln (Γ (ρ)) + (ρ i =1 i =1 N ∑ yi βi i =1 Remarks: ∂βi ∂ (1/ ( β + xi )) = = ∂β ∂β ∂ ln ( βi ) ∂( = ∂β 1 ( β + xi )2 ln ( β + xi )) = ∂β = 1 = β + xi β2i βi ∂ ln (Γ (ρ)) = Ψ (ρ) ∂ρ Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 49 / 88 Solution (cont’d) N `N ( y j x; θ) = ρ ∑ ln ( βi ) N 1) ∑ ln (yi ) N ln (Γ (ρ)) + (ρ i =1 i =1 N ∑ yi βi i =1 The gradient vector under H1 is: gN ( y j x; θ) = with 0 ∂`N ( y j x; θ) =@ ∂θ ∂`N ( y j x; θ) = ∂β ∂`N ( y jx ;θ) ∂ρ N N i =1 i =1 1 A ρ ∑ βi + ∑ yi β2i N ∂`N ( y j x; θ) = ∑ ln ( βi ) ∂ρ i =1 Christophe Hurlin (University of Orléans) ∂`N ( y jx ;θ) ∂β N NΨ (ρ) + ∑ ln (yi ) Advanced Econometrics - HEC Lausanne i =1 December 5, 2013 50 / 88 Solution (cont’d) ∂`N ( y j x; θ) = ∂β N N i =1 i =1 ρ ∑ βi + ∑ yi β2i So, we have: N N ∂2 `N ( y j x; θ) β2i = ρ ∑ 2 ∂β i =1 ∂2 `N ( y j x; θ) = ∂β∂ρ Christophe Hurlin (University of Orléans) 2 ∑ yi β3i i =1 N ∑ βi i =1 Advanced Econometrics - HEC Lausanne December 5, 2013 51 / 88 Solution (cont’d) N ∂`N ( y j x; θ) = ∑ ln ( βi ) ∂ρ i =1 So, we have ∂2 `N ( y j x; θ) = ∂ρ2 ∂2 `N ( y j x; θ) = ∂ρ∂β Christophe Hurlin (University of Orléans) N NΨ (ρ) + ∑ ln (yi ) i =1 NΨ0 (ρ) N ∑ βi i =1 Advanced Econometrics - HEC Lausanne December 5, 2013 52 / 88 Solution (cont’d) The Hessian matrix associated to the log-likelihood under H1 is: 0 2 1 2 with ∂2 `N ( y j x; θ) B =@ HN ( y j x; θ) = > ∂θ∂θ HN ( y j x; θ) = Christophe Hurlin (University of Orléans) 2 ρ ∑N i =1 β i ∂ `N ( y jx ;θ) ∂β2 ∂ `N ( y jx ;θ) ∂β∂ρ ∂2 ` ∂2 ` N ( y jx ;θ) ∂ρ∂β 3 2 ∑N i =1 yi βi ∑N i =1 β i Advanced Econometrics - HEC Lausanne N ( y jx ;θ) ∂ρ2 ∑N i =1 β i NΨ0 (ρ) C A ! December 5, 2013 53 / 88 Solution (cont’d) Under H0 : ρ = 1, the gradient (scalar) is gN ( y j x; β) = ∂`N ( y j x; β) = ∂β N N i =1 i =1 ∑ βi + ∑ yi β2i The Hessian (scalar) is: HN ( y j x; β) = ∂2 `N ( y j x; β) = ∑Ni=1 β2i ∂β2 Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne 3 2 ∑N i =1 yi βi December 5, 2013 54 / 88 Problem (cont’d) Question 3: write the average Fisher information matrices under H1 and under H0 . Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 55 / 88 Solution Under H1 (unconstrained model), the Hessian (stochastic) is ! ρβ2i 2Yi β3i βi Hi ( Yi j xi ; θ) = βi Ψ0 (ρ) The average Fisher information matrice can be de…ned (one of the three de…nitions) as: I (θ) = EX Eθ ( Hi ( Yi j xi ; θ)) I (θ) = EX ρβ2i + 2Eθ (Yi ) β3i βi βi Ψ0 (ρ) ! since βi = 1/ ( β + Xi ) depends on the random variable Xi . Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 56 / 88 Solution ρβ2i + 2Eθ (Yi ) β3i I (θ) = EX βi Ψ0 (ρ) βi ! Consider the score of the unit i. By de…nition, we have: Eθ (si ( Yi j xi ; θ)) = ρβi + Yi β2i ln ( βi ) Ψ (ρ) + ln (Yi ) ! = 02 1 So, we have Eθ (Yi ) = ρ βi where Eθ denotes the expectation with respect to the conditional distribution of Y given X = x. Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 57 / 88 Solution (cont’d) I (θ) = EX ρβ2i + 2Eθ (Yi ) β3i Ψ0 (ρ) βi Eθ (Yi ) = βi ! ρ βi Under H1 (unconstrained model), the average Fisher information is de…ned as to be: ! βi ρβ2i I (θ) = EX βi Ψ 0 ( ρ ) Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 58 / 88 Solution (cont’d) Under H0 (constrained model), we have: Hi ( Yi j xi ; β) = β2i Eβ (si ( Yi j xi ; β)) = Eβ 2Yi β3i βi + Yi β2i = 0 The average Fisher information number is de…ned by: I ( β) = EX Eβ ( Hi ( Yi j xi ; β)) = EX β2i + 2Eβ (Yi ) β3i = EX β2i The average Fisher information number is equal to: I ( β) = EX β2i Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 59 / 88 Problem (cont’d) Question 4: denote b θH 1 the ML estimator of θ = ( β : ρ)> obtained under H1 and b θH 0 = b βH 0 the ML estimator of β obtained under H0 : ρ = 1. Determine the asymptotic distribution and the asymptotic variance covariance matrix of b θH 1 and b θH 0 . Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 60 / 88 Solution The regularity conditions hold. Under H1 (unconstrainded model) we have: p N b θH 1 d θ1 ! N 0, I 1 (θ1 ) where θ1 denotes the true value of the parameters (under H1 ), or equivalently: asy 1 b θH 1 N θ1 , I 1 (θ1 ) H1 N with I (θ1 ) = EX Christophe Hurlin (University of Orléans) ρβ2i βi βi Ψ0 (ρ) Advanced Econometrics - HEC Lausanne ! December 5, 2013 61 / 88 Solution (cont’d) The regularity conditions hold. Under H0 (constrainded model) we have: p θH 0 N b d θ0 ! N 0, I 1 (θ0 ) where θ0 = β0 denotes the true value of the parameter (under H0 ), or equivalently: asy 1 b θH 0 N θ0 , I 1 (θ0 ) H0 N with I (θ0 ) = EX β2i Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 62 / 88 Problem (cont’d) Question 5: Propose three alternative estimators of the average Fisher information matrices under H1 and under H0 . Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 63 / 88 Solution Three alternative estimators of the average Fisher information matrix I (θ) can be used: 1 N b b bI A b θ = Ii θ N i∑ =1 >! N 1 ∂ ` θ; y ∂ ` θ; y x x ( ( ) ) j j i i i i i i bI B b θ = N i∑ ∂θ ∂θ b b θ θ =1 1 bI c b θ = N Christophe Hurlin (University of Orléans) N ∑ i =1 ∂2 `i (θ; yi j xi ) ∂θ∂θ> Advanced Econometrics - HEC Lausanne b θ December 5, 2013 64 / 88 Solution (cont’d) First estimator: actual Fisher information matrix 1 bI A b θ = N Under H1 : Under H0 : bI A N ∑ bI i i =1 b θ 1 0 2 N b b b β β ρ ∑N ∑ 1 i =1 i A i =1 i b θ = @ N b N ρ) ∑i =1 βi NΨ0 (b 1 bI A b θ = N N ∑ bI i i =1 1 b2 b θ = ∑N i =1 β i N where b βi = 1/ b β + xi and where the estimators b β and b ρ are obtained under H1 (unconstrained model) or H0 (constrained model) given the case. Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 65 / 88 Solution (cont’d) Second estimator: BHHH estimator Under H1 : bI B bI B b θ 1 b θ = N = 1 N N ∂`i (θ; yi j xi ) ∂θ ∑ i =1 N 0 ∑@ i =1 ln b βi 2 b ρb βi + yi b βi 2 b ρb βi + yi b βi Under H0 : 1 bI B b θ = N Christophe Hurlin (University of Orléans) b θ ∂`i (θ; yi j xi ) ∂θ N ∑ i =1 Ψ (b ρ) + ln (yi ) ln b βi b θ ! 1 A Ψ (b ρ) + ln (yi ) 2 b βi + yi b βi Advanced Econometrics - HEC Lausanne > 2 December 5, 2013 66 / 88 Solution (cont’d) Third estimator: Hessian Under H1 : Under H0 : 1 bI C b θ = N 1 bI C b θ = N N N ∑ i =1 0 1 bI C b θ = N Christophe Hurlin (University of Orléans) 2 3 b ρb βi + 2yi b βi ∑@ i =1 ∂2 `i (θ; yi j xi ) ∂θ∂θ> N ∑ i =1 b βi b θ b βi Ψ0 (b ρ) 1 A 2 3 b βi + 2yi b βi Advanced Econometrics - HEC Lausanne December 5, 2013 67 / 88 Problem (cont’d) Question 6: Consider the dataset provided by Greene (2007) in the …le Chapter4_Exercise2.xls. Write a Matlab code (1) to estimate the parameters of model under H1 ( unconstrained model) by MLE, and (2) to compute three alternative estimates of the asymptotic variance covariance matrix. Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 68 / 88 Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 69 / 88 Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 70 / 88 Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 71 / 88 Remarks 1 Asymptotically the three estimators of the asymptotic variance covariance matrix are equivalent. 2 But, this exercise con…rms that these estimators can give very di¤erent results for small samples 3 The striking di¤erence of the BHHH estimator is typical of its erratic performance in small samples Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 72 / 88 Problem (cont’d) Question 7: Write a Matlab code (1) to estimate the parameters of model under H0 ( constrained model) by MLE, and (2) to compute three alternative estimates of the asymptotic variance covariance matrix. Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 73 / 88 Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 74 / 88 Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 75 / 88 Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 76 / 88 Problem (cont’d) Question 8: test the hypothesis H0 : ρ = 1 versus H1 : ρ 6= 1 with a likelihood ratio (LR) test for a signi…cance level of 5%. Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 77 / 88 Solution The likelihood ratio (LR) test-statistic is de…ned by: LR = θH 0 ; y j x `N b 2 θH 1 ; y j x `N b In this sample, we have a realisation equal to LR (y ) = 2 ( 88.4363 + 82.9160) = 11.0406 The critical region is W = y : LR (y ) > χ20.95 (1) = 3.8415 where χ20.95 (1) is the critical value of the chi-squared distribution with p = 1 degrees of freedom. Conclusion: for a signi…cance level of 5%, we reject the null H0 : ρ = 1. Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 78 / 88 Problem (cont’d) Question 9: test the hypothesis H0 : ρ = 1 versus H1 : ρ 6= 1 with a Wald test for a signi…cance level of 5%. Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 79 / 88 Solution The null hypothesis H0 : ρ = 1 can be expressed as H0 : c (θ) = 0 with c (θ) = ρ θH 1 Wald = c b 1. The Wald test-statistic is de…ned by: > ∂c ∂θ> Here, we have b asy b b θH 1 θH 1 V ∂c b θH 1 = Wald (y ) = b ρH 1 1 ∂θ> Then, we get Christophe Hurlin (University of Orléans) ∂c ∂θ> b θH 1 > 1 θH 1 c b 0 1 2 Vasy1 b ρH 1 Advanced Econometrics - HEC Lausanne December 5, 2013 80 / 88 Solution (cont’d) ρH 1 Wald (y ) = b 1 2 ρH 1 Vasy1 b Given the estimator chosen for the asymptotic variance, we get: WaldA (y ) = (3.1509 1)2 = 8.0214 0.5768 WaldB (y ) = (3.1509 1)2 = 3.0096 1.5372 WaldC (y ) = (3.1509 1)2 = 7.3335 0.6309 The critical region is W = y : Wald (y ) > χ20.95 (1) = 3.8415 Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 81 / 88 Solution (cont’d) Conclusion: 1 For a signi…cance level of 5%, the Wald test-statistic based on the estimators A and C (actual Fisher matrix and Hessian) of the asymptotic variance covariance matrix lead to reject the null H0 : ρ = 1. 2 For a signi…cance level of 5%, the Wald test-statistic based on the estimators B (BHHH estimator) of the asymptotic variance covariance matrix fails to reject the null H0 : ρ = 1. 3 In most of software, the Hessian (estimator C) is preferred and the Wald test-statistics are computed with this estimator. Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 82 / 88 Problem (cont’d) Question 10: test the hypothesis H0 : ρ = 1 versus H1 : ρ 6= 1 with a Lagrange Multiplier test for a signi…cance level of 5%. Write a Matlab code to compute the three possibles values of the LM test-statistic. Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 83 / 88 Solution The Lagrange multiplier test is based on the restricted estimators. The LM test-statistic is de…ned by: θH 0 ; yi j xi LM = sN b > or equivalently LM = sN b θH 0 ; yi j xi Christophe Hurlin (University of Orléans) > bI N b θH 0 N bI b θH 0 1 θH 0 ; yi j xi sN b 1 sN b θH 0 ; yi j xi Advanced Econometrics - HEC Lausanne December 5, 2013 84 / 88 Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 85 / 88 Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 86 / 88 Solution (cont’d) θH 0 , we have: So, given the estimator chosen for bI b LMA (y ) = 4.7825 LmB (y ) = 15.6868 LMC (y ) = 5.1162 The critical region is W = y : LM (y ) > χ20.95 (1) = 3.8415 Conclusion: for a signi…cance level of 5%, we reject the null H0 : ρ = 1, whatever the choice of the estimator. Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 87 / 88 End of Exercices - Chapter 4 Christophe Hurlin (University of Orléans) Christophe Hurlin (University of Orléans) Advanced Econometrics - HEC Lausanne December 5, 2013 88 / 88