Affording The Investment of a Lifetime GRADUATE FINANCIAL ASSISTANCE INFORMATION

advertisement

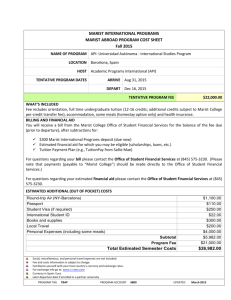

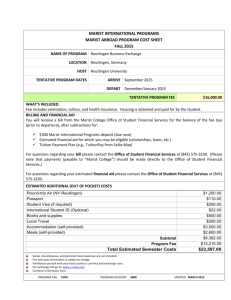

Affording GRADUATE FINANCIAL ASSISTANCE INFORMATION The Investment of a Lifetime Table of Contents Welcome 3 The Value of a Graduate Education 4 The Marist Graduate Degree 5 Sources of Financial Aid 6 Applying for Financial Aid 10 Payment/Loan Options 11 Smart Borrowing/Repaying Your Loans 13 Student Billing 15 eRefund 15 Note: Information subject to change. Refer to our Web site for updated information regarding institutional, state, and federal student aid programs. Dear Student, Thank you for your interest in Marist College. The Office of Student Financial Services recognizes that financing your college education is an essential factor in your decision to attend college, and we are dedicated to providing the information and support you need to make this investment of a lifetime. Marist College offers payment plans and financing options to enable you to more comfortably manage college costs. This guide discusses the various aid programs and student financial services offered by the College, explains the process by which you apply for financial aid, and reviews the types of aid available for graduate students. The Free Application for Federal Student Aid (FAFSA) is required for financial aid consideration. Complete details on the aid application process can be found on page 10. On behalf of the Office of Student Financial Services, we look forward to working with you to make Marist an affordable option. Sincerely, Joseph R. Weglarz Executive Director, Student Financial Services Helpful Web Site Addresses www.marist.edu/sfs Marist College Office of Student Financial Services www.marist.edu/currentstudents Student Financial Services www.marist.edu/graduate Marist College Office of Graduate Admission www.facebook.com/maristcollegesfs Marist College Student Financial Services Facebook Page www.studentaid.ed.gov Federal Student Aid Programs www.fafsa.gov Free Application for Federal Student Aid (FAFSA) www.hesc.ny.gov Veterans Tuition Award www.irs.gov/pub/irs-pdf/p970.pdf The American Opportunity Tax Credit and Lifetime Learning Tax Credits www.irs.gov/pub/irs-pdf/p970.pdf Studuent Loan Interest Deduction Value The of a Graduate Education A graduate education is an investment that requires patience, planning, and perhaps some sacrifice; but it is an investment that will reward you with a lifetime of intelligent living, responsible citizenship, and a higher standard of opportunity for career and social success. Individuals with a graduate education have better job opportunities, earn more money, and develop skills and knowledge that are in high demand. A Marist education unlocks doors to economic and career opportunities. Marist College has developed extensive research partnerships with leaders in today’s science, information technology, and business industries. This means you’ll have the opportunity to work hands-on with some of the most advanced technologies and applications in the world, and be introduced to the companies and people who are making their mark on today’s workplace. Marist offers graduate programs designed with professionals in mind that build skills, increase earning potential, and strengthen your marketability. Marist College has a longstanding commitment to providing educational opportunities that accommodate the unique needs of working professionals such as flexible scheduling, online and on-campus courses, and various program delivery locations. Students must carefully consider the commitment it demands, but a Marist College education is the investment of a lifetime. Median Weekly Earnings by Education Level Advanced Degree Bachelor's Degree Associate's Degree High School Graduates $0 $500 $1,000 $1,500 $2,000 Sources: Bureau of Labor Statistics, 2014, Current Population Survey 4 The Marist Graduate Degree Marist takes great pride in the quality of its academic programs and is equally proud of the value-oriented educational environment that supplements the formal classroom experience. The Marist College degree is increasingly recognized throughout the country and the world, and with good reason: The academic profile of the student body is one of the most competitive in higher education. Students applying for graduate and professional schools are accepted at high rates and continue their education at some of our country’s finest schools. The employment rate, starting salaries, level of community service, leadership roles, and long list of successful careers enjoyed by the majority of Marist’s alumni all provide evidence of the value of the Marist degree. The Princeton Review named Marist among the top 50 elite colleges and universities “That Launch Careers by Going Beyond The Classroom,” one of "The Best 380 Colleges" in the country, and our School of Management one of the top 296 business schools in the world. Forbes and The Princeton Review call Marist one of the “25 most connected campuses” in America. U.S. News & World Report consistently places Marist in its top tier. Kiplinger’s Personal Finance Magazine and Barron’s call us one of the nation’s best buys in college education. Yahoo! Internet Life magazine selected Marist for its list of the 100 most wired campuses in the nation. The John Templeton Foundation places us on its elite honor role of only 100 academic institutions noted for teaching character development. Careers and Colleges magazine picked Marist as one of 14 “schools that rule,“ providing “strong academic programs, terrific professors, a vibrant student life, (and) other opportunities for personal development.” Located in the heart of the historic Mid-Hudson River Valley ... ... with a branch campus in Florence, Italy! Sources of Financial Aid Financing is a major concern for many people, but there are several options available. In addition to traditional sources, including personal income, savings, and family/employer assistance, programs are available to assist both full-time and parttime students in meeting the cost of their education. For eligibility, students must be matriculated in a program at Marist College and maintain satisfactory academic progress each semester. For information on the Satisfactory Academic Progress Policy, please refer to www.marist.edu/financialaid/pdfs/satacadprog.pdf. Marist College also awards assistance based on demonstrated financial need. To apply for need-based financial assistance, full-time and part-time students must complete the FAFSA. The Marist College preferred deadline for FAFSA completion is May 15 for new fall students, June 15 for returning students, and November 15 for new spring students. Annual renewal of financial aid requires completion of the FAFSA, satisfactory academic progress, and a completed registration. Students can access their financial aid information online at my.marist.edu. GRADUATE GRANTS Marist Graduate Grant There are grants for part-time or full-time graduate study. These are awarded each year to students who have completed the FAFSA. The award amount varies in accordance with need and registration, and students must re-apply each year as it is not automatically renewed. To qualify, recipients must maintain a 3.0 or higher cumulative grade point average. 6 FEDERAL GRANTS TEACH Grant Program The Teacher Education Assistance for College and Higher Education (TEACH) Grant Program provides grants up to $4,000 per year to students who intend to teach in a public or private elementary or secondary school that serves students from low-income families. In exchange for receiving a TEACH Grant, you must agree to serve as a full-time teacher in a high-need field in a public or private elementary or secondary school that serves low-income students. If you do not complete the required teaching service obligation, TEACH Grant funds you receive will be converted to a Federal Direct Unsubsidized Stafford Loan that you must repay, with interest charged from the date of each TEACH Grant disbursement. If you are interested in learning more about the TEACH Grant Program, visit http://studentaid.ed.gov. SCHOLARSHIPS AND ASSISTANTSHIPS McCann Fellowship Marist College provides McCann Fellowship awards for individuals employed by public sector and not-for-profit organizations that are interested in pursuing graduate studies in Public Administration. Fellowship awards are available to both new and returning students. Applications should be obtained from and submitted to the School of Management. In order to be eligible, students must be employed by a public sector or not-for-profit agency in the Mid-Hudson region, be a parttime student in the MPA program at Marist College, and not receive full tuition assistance from their employer. In order to retain the award, McCann Fellows must maintain academic progress toward their degree and re-file a McCann Fellowship application each year. Awards are based on availability of funds. Graduate Merit Scholarships The Office of Graduate Admission awards merit-based scholarships upon acceptance into a qualified graduate program at Marist. Awards are based on the applicant’s cumulative GPA from their undergraduate degree-granting institution or most recently earned graduate/professional degree. Merit awards are given at the discretion of the scholarship committee. General eligibility for a scholarship does not guarantee admission. Marist alumni are eligible to receive a scholarship upon acceptance for a minimum of $150/course. Graduate Scholars Award Eligibility Requirements: 3.5 GPA or higher Award Amount: $250/course Graduate Academic Award Eligibility Requirements: 3.2 - 3.49 GPA Award Amount: $150/course Marist Alumni Scholars Award Eligibility Requirements: 3.5 GPA or higher Award Amount: $250/course Marist Alumni Academic Award Eligibility Requirements: Upon acceptance Award Amount: $150/course Graduate Assistantships Graduate Assistantships are awarded on a competitive basis to a select and limited number of full-time students who have demonstrated a strong academic record. Graduate Assistants work with faculty and staff to perform administrative and research tasks as well as other duties such as monitoring labs, tutoring, and assisting with student activities. Assistantships are comprised of a partial tuition waiver and stipend. The assistantship value and nature of work involved varies by program. For more detailed information, contact the director of the respective graduate program. 7 PRIVATE SCHOLARSHIPS Web sites for private scholarship searches are found on the Internet. Many of these sites offer legitimate, free search opportunities for students seeking additional financial resources to meet their educational costs. We support student use of these services; however, there are a few items you should be aware of when completing private scholarship searches: 1. The private scholarship may not replace the opportunities a student receives by completing the regular financial aid application process in a timely manner. 2. Outside scholarships may affect other types of financial aid due to various program requirements and private donor specifications. If a private scholarship is received, contact the Office of Student Financial Services as early as possible to help maximize what is received from all sources. The Marist College Office of Student Financial Services Web page (www.marist.edu/sfs/ scholarsearch.html) has links to various scholarship search pages. VETERANS AND MILITARY PERSONNEL Students who have served or are serving in the U.S. Armed Forces, may have additional sources of aid. Since 2009, G.I. Jobs magazine has named Marist College as a Military Friendly School. Qualified students can use any Chapter of the Montgomery GI Bill – including the Post-9/11 GI Bill that pays 100% of Marist tuition for every 100% eligible graduate student. In addition, students can use military tuition assistance and New York State Veteran Tuition Awards to earn a degree. Furthermore, Active Duty and Reserve service members and their adult undergraduate dependents, admitted through the Office of Graduate Admission, receive a 25% discount on tuition for most Marist programs. ADDITIONAL SOURCES OF AID Tuition Employer Deferment Students eligible for tuition deferment from their employers may, with the appropriate documentation, defer payment until after the conclusion of the semester. Students must supply the Office of Student Financial Services with documentation from their employers verifying deferment eligibility. Students have the option of full tuition deferment if the employer is covering the total balance. Any charge not covered by the employer must be paid by the student on or before the billing due date. Applications are required each semester and can be found at www.marist.edu/sfs/ forms.html. Marist Graduate and Graduate International Student Employment Program College student employment is funded through Marist College’s Campus Employment Program. There are opportunities for employment with various academic and administrative offices within the College. Students are not allowed to work more than 20 hours per week during the regular academic term and 40 hours per week during vacation periods. Visit our Web site, www.marist.edu/sfs/studentemployment, for additional information. Corporate and Organizational Partnership Discounts Marist College partners with certain employers and organizations. Organizational partnerships can be found on the application for admission or by visiting www.marist.edu/admission/ graduate/partnerships.html. Students with an affiliation to one of Marist’s partners should indicate so on the application at which point they will be contacted about applicable discounted programs. Members of an organization that would like to affiliate with Marist should contact the Office of Graduate Admission at 888.877.7900. Applying for Financial Aid 1. FAFSA: The first step to applying for financial aid is to fill out the Free Application for Federal Student Aid (FAFSA), which is available online at www.fafsa. gov. Please remember to use the Marist College school code. To electronically sign the FAFSA, students must create an FSA user ID and secure password at Marist College’s Federal School Code is 002765 2. Student Aid Report: Within several days, the student will receive a Student Aid Report (SAR). The SAR will give information regarding eligibility for financial aid based on the Expected Family Contribution and Cost of Attendance. The SAR will also indicate if there is any additional information that needs to be submitted. If the Department of Education selects the student for verification, the student must complete the Marist Application for Financial Aid and all other required documentation listed on the student's My.Marist account.The financial aid application is available online at www.marist. edu/currentstudents under the Student Financial Services "forms" section. Graduate Financial Aid Timeframe • November/December: Apply for FAFSA PIN • March/April: Complete the FAFSA • Mid-June: Deposited students who have received a financial aid package will need to log on to my.marist.edu to view their electronic award package 3. Financial Aid Award and Aid Eligibility: The Office of Student Financial Services will send an award notification to each student based on his/her eligibility and anticipated enrollment. Marist College determines aid eligibility using the Federal Needs Analysis System established by the federal government. The formula that the federal government uses to determine eligibility is: The Cost of Attendance consists of educational expenses such as tuition, fees, living expenses, books and supplies, transportation, and other related expenses. The Expected Family Contribution is the amount that the government determines the student can contribute toward their education. This amount is determined with a standard formula that uses the financial information supplied by the student, and provided on the SAR. What is "Financial Need?" College Cost — Family Contribution (EFC) = Financial Need 4. MyMarist: Please click the "Student Financial Services" tab to review the "Financial Aid Award" and "Financial Aid Requirements." The Student Financial Services tab will also enable you to manage your billing account, review policies and procedures, and see important reminders listed by Student Financial Services. Graduate International applicants should submit the CSS PROFILE by mid-December for the Spring term and mid-July for the Fall term. International Applicants Although international applicants are ineligible for federal financial assistance, they should complete the CSS PROFILE at http://student.collegeboard. org/profile for institutional grant consideration. Graduate International applicants should submit the CSS PROFILE by mid-December for the Spring term and mid-July for the Fall term. The PROFILE school code is 2400. 9 Payment/Loan Federal Direct Loan Federal Direct Loans (unsubsidized) are lowinterest, long-term loans available for graduate students enrolled in at least 6 credits. The unsubsidized loan borrowers are responsible for interest that accrues during all in-school, grace, and deferment periods. Additional terms, subject to revision by federal law, include: • Current interest rate is a fixed rate of 5.84% through June 30, 2016. New rates will be determined by June 30 for the upcoming award year. • Loan Fee: 1.068% • For new borrowers, repayment begins six months after the student graduates or drops below half-time (6 credits) enrollment. The standard repayment term is 10 years, although one can get access to alternate repayment terms. The annual Direct Loan limit for graduate students is $20,500. Annual loans are further limited by the student’s cost of attendance. The lifetime loan limit for graduate students is $138,500. The graduate debt limit includes all federal loans received for undergraduate study. Detailed information about the Federal Direct Loan can be found at: www.marist.edu/sfs/ graduate/directloan.html Fifth-Year Undergraduate Loan Program – For Prerequisite Undergraduate Classes A student may apply for a Federal Direct Loan for up to 12 months of coursework taken in a single, consecutive, 12-month period if the school has documented that the coursework is necessary in order for students to enroll in a graduate or professional program. This category of students may borrow at the fifth-year undergraduate loan level, and the loan limit is not prorated if the program is less than an academic year. 10 Options Federal Direct GradPLUS Loan Graduate students who qualify for federal financial aid and are creditworthy borrowers will be eligible to borrow through the GradPLUS Loan program. Students are required to complete the FAFSA application. The maximum amount a student may borrow on a Federal Direct GradPLUS Loan each academic year is the cost of attendance minus other financial aid received. In addition, students must have exhausted their annual Federal Direct Loan eligibility. • Current interest rate is set at a fixed rate of 6.84%. (Determined June 30 for upcoming award year.) • Loan Fee: 4.272% • Standard replayment period 10 years Detailed information for the Federal Direct GradPlus Loan can be found at: www.marist. edu/sfs/graduate/gradpluslender.html. Apply at www.studentloans.gov. Entrance Counseling You must complete entrance counseling before the College can make the first disbursement of your loan. This helps you to understand your responsibilities regarding your loan. Counseling can be completed at www.studentloans.gov The Master Promissory Note To take out a Direct Loan for the first time, you must complete a Master Promissory Note (MPN). You can complete the MPN online at www.studentloans.gov. The MPN is a legal document in which you promise to repay your loan(s) and any accrued interest and fees to the Department. It also explains the terms and conditions of your loan(s). You'll receive a disclosure statement that gives you specific information about any loan that the College plans to disburse under your MPN, including the loan amount, fees, and the expected disbursement dates and amounts. Payment/Loan Summary Program Annual Limits Tuition Pay Full cost of Monthly tuition minus Payment Plan student aid Direct Unsubsidized $20,500 Graduate PLUS Loan Full cost of tuition minus student aid • • Aggregate Limit Repayment Period Fee In-School Interest Repayment Grace Interest Period $45 (Annual) 0 0 None 10 months $138,500 1.068% (includes sub- origination fee sidized and undergraduate loans) Fixed rate 5.84% through June 30, 2015 Fixed rate 5.84% through June 30, 2015 6 months 10 years 4.272% origination fee Fixed rate 6.84% through June 30, 2016 Fixed rate 6.84% through June 30, 2016 None 10 years Congress has passed and the President has signed the Bipartisan Student Loan Certainty Act of 2013, which ties federal student loan interest rates to financial markets. Under this Act, interest rates will be determined each June for new loans being made for the upcoming award year, which runs from July 1 to the following June 30. Each loan will have a fixed interest rate for the life of the loan. Repayment on both principal and interest begins six months after the student ceases to be enrolled in school on at least a half-time (6-credit) basis, generally extending over a 10-year period. MONTHLY PAYMENT PLANS Features: • 10-12 monthly payments • No interest charges • Low cost-only a $45 annual application fee • No credit review • Payment by ACH or check Easy to Apply and Renew Both the first–time application and annual renewal are fast, simple, and can be easily completed online at www.marist.edu/sfs, under the important links section. Any parent, guardian, or student at Marist College is eligible for the Monthly Payment Plan. Upon receipt of your application and fee, the payment plan will be established with Marist College. 11 Smart Borrowing SMART BORROWING Marist College makes every effort to ensure that students who invest in their education by borrowing loans graduate with reasonable debt levels. SFS encourages students to meet with counselors throughout their college career, and students are offered personalized loan counseling sessions at the time of graduation. It is important to be aware that all types of student loans will need to be repaid in the future. As you make your plans, give serious consideration to the loan amounts needed throughout your entire education. You should ensure that you are able to manage your student loan indebtedness. • Tip: Student loan payments should be 10 percent or less of a student’s net monthly income after graduation. Visit the Bureau of Labor Statistics at www.bls.gov/bls/blswage.htm for infromation regarding estimated starting salary for various careers. It is important to determine how much student loan debt you can manage based on your starting salary upon graduation. Repaying Your Loans Repayment on most federal student loans will begin after you leave college or drop below half-time enrollment. Your loan servicer provides you with a loan repayment schedule that states when your first payment is due, the number and frequency of payments, and the amount of each payment. For a history of your student loans, visit http://www.nslds.ed.gov. The National Student Loan Data System (NSLDS) is the U.S. Department of Education's (ED's) central database for federal aid. NSLDS Student Access provides a centralized, integrated view of Federal loans and grants so that recipients of Federal aid can access and inquire about their loans and/or grant data. FEDERAL LOAN FORGIVENESS AND CANCELLATION PROGRAMS Public Service Loan Forgiveness Program In 2007, Congress created the Public Service Loan Forgiveness Program to encourage individuals to enter and continue to work full-time in public service jobs. Under this program, borrowers may qualify for forgiveness of the remaining balance due on their eligible federal student loans after they have made 120 payments on those loans under certain repayment plans while employed full-time by certain public service employers. For more information visit: http://www.myfedloan.org/ Direct Loan Teacher Forgiveness Program If you have five complete and consecutive years of qualifying teacher service which began on or after Oct. 30, 2004, please note the following: You may receive up to $5,000 in loan forgiveness if you were a highly qualified full-time elementary or secondary school teacher. You may receive up to $17,500 in loan forgiveness if certified by the chief administrative officer of the school where you were employed. For more information please visit: http://studentaid.ed.gov/repay-loans/ forgiveness-cancellation/charts/teacher#whatare-the-eligibility Please visit http://studentaid.ed.gov/repay-loans for loan repayment options. Did You Know? A key measure of student success, the student loan default rate, is significantly better for Marist College than the rate for peer institutions. The 2012 cohort-default rate, the most recent available, was 2.1% for Marist College, compared with an average rate of 7.2% for all private, four-year colleges and universities nationally. Private Loans for Students Alternative financing is available to assist students with educational expenses, and eligibility for private loans is not based on need. However, Marist College policy does not allow the certification of any private loan for more than the cost of attendance, minus any other aid. Please also note that time is required to obtain and review credit reports, obtain enrollment certification from the College, and for processing of the disbursements. For additional information, please refer to http://www.marist.edu/financialaid/loans. html and click on the Private Loans link. WHAT WILL THE MONTHLY PAYMENT BE? Did you know that $20,000 in loans can be paid off in monthly installments as low as $225? To see a loan payment schedule and get an idea of monthly costs, go to www.marist.edu/sfs/graduate/loans.html. Student Debt Management If you have any concerns, we advise you to speak with a financial aid counselor regarding debt management. If you have incurred significant debt, please speak with us before you consider additional borrowing. Loans may be your only choice, but you should clearly understand the total aggregate loan limitations and repayment schedules. Call the Office of Student Financial Services at 845.575.3230 to speak with a financial aid advisor. TAX INCENTIVES FOR EDUCATION Students and parents should be aware that there are federal education Tax Credits, such as the American Opportunity Credit and the Lifetime Learning Credit. The American Opportunity Tax Credit (AOTC) grants a credit worth up to $2,500 per eligible student during the taxable year to be applied toward tuition, required enrollment fees, and course materials that a student needs for course of study whether or not the materials are bought at the educational institution as a condition of enrollment or attendance. The Lifetime Learning Credit provides a credit of up to $2,000 per return for all years of post secondary education and for courses to acquire or improve job skills. There are income limits and other limits based on the actual amount of tuition and fees paid to the college. For additional information regarding education credits, please refer to www.irs.gov/ pub/irs-pdf/p970.pdf. You may also be eligible to deduct the interest on your tax return, once repayment begins on a student loan. For additional information, http://www.irs.gov/publications/p970/ch04.html. STUDENT BILLING The Office of Student Financial Services is the department responsible for administering all transactions related to a student’s account at Marist College. Student Financial Services issues billing statements, processes payments, credits, electronic refunds, and charges that students may incur during their enrollment at Marist. Marist College provides electronic billing and payment services. Electric payment services include ACH payments from your checking or savings account. Students may obtain additional payment information via www.marist.edu/sfs/billing. html. Billing dates vary depending upon your program. Information is available by contacting Student Financial Services or in your respective program registration guide. Billing statements list basic semester charges for tuition and fees. Additional statements are issued for miscellaneous charges during the semester. All tuition statements are accessed through the students my.Marist account eREFUND Students are encouraged to enroll in our eRefund process, which will enable Marist to directly deposit your refund quickly, securely, and confidentially into your bank account. Student Financial Services staff members are available to discuss aid opportunities, payment options, and financing plans. If you have any questions or would like to come in for an individual meeting, just call 845.575.3230 or 800.436.5483 to schedule an appointment. INTERNATIONAL STUDENT PAYMENT METHODS Marist College has partnered with PeerTransfer to streamline the tuition payment process for our international students. PeerTransfer allows you to pay from any country and any bank. They also offer excellent foreign exchange rates, allowing you to pay in your home currency (in most cases) and save a significant amount of money, compared to traditional banks. You will be able to track the progress of your payment throughout the transfer process via a student dashboard and you will also be notified via e-mail when your payment is received by Marist College. Click or go to: pay.flywire.com to begin the payment process. International students are able to make tuition payments via cash or check in the office as well. TUITION REFUND INSURANCE Tuition Refund Insurance can help refund the cost of attendance, up to the policy limits, if a student is unable to complete classes for the semester due to a covered medical reason or death of the primary tuition payer. Covered medical reasons can include illness, accident, injury, or mental health issues. For enrollment information visit, www. salliemaeinsurance.com/school-search. Things to Remember... It is important to keep the following points in mind as you familiarize yourself with the financial aid process: • It is recommended that you file for aid before you are accepted by Marist (FAFSA Code 002765). • File the necessary forms: do not assume you are ineligible. • File the FAFSA as early as you can (but not before January 1), using the IRS Data Retrieval Process. • Send written documentation to the Office of Student Financial Services if there are unusual financial circumstances. • Please be sure to work with your program director regarding the format of your program and to develop a course plan. Then review the plan with Student Financial Services to determine your eligibility for financial aid. • You must be enrolled in at least 6 credits to be eligible for Federal Direct Loans. • If you add or drop a class, please contact Student Financial Services to see if/how your aid would be adjusted. • Please be sure to check your Foxmail (Marist e-mail) account as that is how the Student Financial Services Office sends notifications regarding changes and/or updates to your financial aid account. The Foxmail login is located at https://foxmail.marist.edu/imp/login.php • Meet all deadlines. 15 NEW YORK ∙ ITALY Student Financial Services www.marist.edu/sfs Office of Student Financial Services Marist College Donnelly Hall, Room 200 3399 North Road Poughkeepsie, NY 12601 E-mail: studentfinancialservices@marist.edu Telephone: 845-575-3230 Fax: 845-575-3099 Other useful contact information: College Main Number: 845.575.3000 Office of Graduate Admission: 888.877.7900 Registrar: 845.575.3250 Revised 2/16 For consumer information related to Financial Aid, Health and Safety, including campus crime reporting and statistics, Student Life, and Student Outcomes, please visit www.marist.edu/ir/ consumerinformation.html. For further information or to request a printed copy of any of the disclosures, please contact the Office of Institutional Research and Planning at 845.575.3000, x2478