EXPLANATORY NOTES FOR FINANCIAL INSTITUTIONS GENERAL GUIDELINES

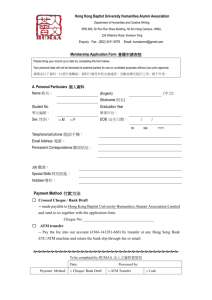

advertisement