77

advertisement

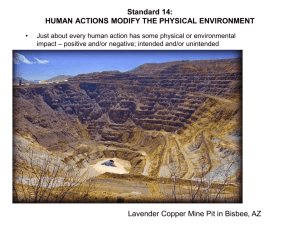

N E W MEXICO BUREAU OF MINES AND MINERALRESOURCES OPEN FILE REPORT 77 COSTOFURANIUMMINING D o n a l d B. I N NEW MEXICO Buddecke RELATIONOFCOSTS AND TAXES FOR NEW M E X I C O ' S URANIUMPRODUCTION ChristopherRautman Frank K o t t l o w s k i . !IJ) . OPEN FILE REPORT 77 . ~ COSTS OF URANIUM M I N I N G IN NEW MEXICO A t the request of Frank E. Kottlowski, director f o r t h e Energy ResourcesBoard, a study wasmade of t h e NMSM&K?, o f . t h e c o s t of uranium ex- writer has no f i n a n c i a l i n t e r e s t i n t r a c t i o n i n New Mexico.The acting uranium companies o r p r o p e r t i e s i n New Mexico, nor has he any.uranium clients. 1 This report attempts to present costs future, extending i n the reasonable foreseeable t o a t l e a s t 1980, f o r a presently operating "typical" i n northwestern New Mexicoand the cost of bringing on s t e b mine a new uranium mine i n t h a t a r e a . Sources of i n the references; additional cozt the cost data are listed information was obtained from equipment suppliers, underground miners, cont r a c t o r s , andfrom my experience as amine contractor and mine operator. The operating costs and pre-production costs of in the past year far above a normal r a t e . a new mine have increased The writer believes the unusual i n c r e a s e s i n p o s t e d p r i c e s of yellow cake had an adverse effect,on good mining practices'which increased the costs and decreased t h e e f f i c i e n c y of operations. COST OF PROCURING LEASES To acquire a l a n d p o s i t i o n i n t h e known Grants Mineral B e l t , which extends. from t h e Fdo Puerco on t h e e a s t t o Church Rock on the west, difficult. A l l known f e e ,r a i l r o a d ,I n d i a na l l o t m e n t ,s t a t e i s presently very and f e d e r a ll a n d s have been leased and e s s e n t i a l l y t h e oilly way t o a c q u i r e a n a r e a i n t h e p a s t years has been t o buya block of land 3 from another lease holder. For an exploration target zone t o have some p o t e n t i a l of success, a block of from 5 , 0 0 0 t o 10,000 acres would be needed, although only portion may be of value. per acre T h i s acreage i n a favorable area up t o $150 per acre for front-end costs, plus a small would c o s t from $50 a yearly rental. The e -2- acreage probably would not be i n one block, but blocksthroughoutthe add suchoverhead Belt. To t h e above front-endcosts,the c o s t s as l e g a l f e e s , a b s t r a c t s , Uranium land leases acquired during five-year period would be s c a t t e r e d i n s e c t i o n company m u s t ' ' and geological research. a standard exploration program over a would cost a mining company i n cash bonus, y e a r l y r e n t a l s , and i n l e g a l and overhead charges approximately: Low p o s i t i o n , a small company High p o s i t i o n , a major company $500,000 $1,500,000 COST OF EXPLORATION AND DISCOVERY OF THE ORE BODY The c o s t of exploration and discovery of an ore bodywould geological staff, contract drilling holes, assay include the. of the exploration holes, logging of t h e work, surveying, mapping surface location work, clean-up en- vironmental work,and possibly the use of consultants, both geologic and engineering. The d i r e c t c o n t r a c t d r i l l i n g c o s t i s t h e major item and depends on t h e depth drilled, difficulty in penetrating the drilled material, as well added items as d r i l l i n g mud and casing. $50,000 t o $75,000 p e f h o l e f o r d e p t h s about 1,500 and clean upwork C odnr$ tir5 lal.ci0nt0g/ f t . . Lagging $1.20/ft. Assaying report Geological Location and ,clean up To d r i l l a 10,000-acre block s i z e o r e bodywould Mt. Taylor may c o s t below 3,000 feet.Standard feet in depth should average logged with location D r i l l holes near as drill holes $10,000 t o $20,000 per completed hole as follows: $7,500 $1,800 $ 200 $ 500 $1,000 $11,000 p e r d r i l l e d h o l e on 500-fOOK c e n t e r s and d r i l l - o u t a m i l l - require a minimum of approximately 500 d r i l l holes. This would r e q u i r e a period of about four years of exploration and development -3drilling. The mining company's exploration budget during this period would be approximately: 1 , 0 0 0 t o 1,500 f ed e rt i l l i ndge p t fho t,or teaxl p l o r a t i o n 3,000 f e e t and below d r i l l i ndge p t ht o ; t aelx p l o r a t i ocno s t FRONT-END COST OF The front-end cost $4,000,000 $10,000,000 SETTING UP AN UNDERGROUND M I N E of s e t t i n g a complete mine operation would include dual mine s h a f t s , v e n t i l a t i o n s h a f t s / h o l e s , s u r f a c e p l a n t , underground haulage development d r i f t s and workings, power, haulage equipment, and a l l mine equipment and supplies needed i n t h e mine operation. depth t o t h e o r e body, ground conditions, water h o i s t i n g equipment, and type ofmining The mine c o s t s depend on t h e pumping, v e n t i l a t i o n , size of methods t o be used. For shallow shafts less than 700 f e e t , t h e c o s t c o u l d m i l l i o n andbelow 3,000 f e e t as much as $150 million. a t about 1,500 feet depth, the costs a 3-year period: This ' be a s much a s $2.5 For a mine operation would be between $ 2 5 ' t o $50 million over assumes a mill-size o r e body, with the mine hoisting capacity of 1,000 t o 1,500 tonsperday, l i s t i n g of costs could be and w i t h f i r s t - c l a s s equipment. The as follows: 1,500 contracted shaft, a t $1,50O/ft. Headframe, surface buildings, shaft steel Underground haulage and development workings V e n t i l a tdiho ro inllle s , secondary escapeway plant surface Power plant, Mine equipment and supplies Administration and supervision Engineering and consultants . . $3,000,'000 $2,000,000 $4,000,000 $1,000,000 $6,000,000 $8,000,000 $1,000,000 $1,000,000 $26,000,000 The cost estimates range fromalow of $10 m i l l i o n t o a high of $50 million, depending on conditions and s i z e of operation. COST OF M I N I N G The c o s t of mining normally i s c a l c u l a t e d i n c o s t p e r t o n dire:: c o s t which includes labor, of o r e a s a overhead on labor, mine supplies such as -4- explosives and drill steel, mine equipment, ventilation, power, safety and supervision. The cost per ton an older has been in done in per tona new in mine, the process direct mining cost. In a new pre-production, Examples are and as since hence of mine, mine is much much of the extracting however, development ore; most would be a capitalized higher the thancost and may development cost to be work in an thus be counted work would of uranium cost per may per be calculated pound depends on the in per grade, or . pound the Per Pound U 0.15% $7.50 Supplies 7 Equipment 4 Power 2 Haulage of . contained number of pounds 3.50 *0.10% .2.33 1.33 2-00 -67 - ventillation 1 Supervision __ 1 Administration $30/ton Total 1.00 -33 -50 .33 .50 $10.00/lb. increase 0 $5.00 Safety the be ton of ore. Representative costs might be: Labor Note cost ore per ton of ore & a follows: In the GMB, costs The m amortized. Old Mine, developed & operating' .$20-30/ton New Mine, small, at shallow depth $30'40 New Mine;large, at deep depth $40-50 uranium. old in the cost grade drops from .15%(3.%/tOn) to per pound of . $15.00/lb. yellowcake which occurs as or -10% (2%/ton). The grade.determined for an ore body is an in-place value, and not the recoverable value. The recoverable pounds/ton = is alowas than the in-place value, and costs per recoverable pound are correspondingly higher. The recovery rate on depends many factors including ground conditions, distribution of uranium in the host Large rock, mines and the must skill operate of in the lower individual grade ore miners. in order to keep production high and to pay-out the large capital cost. Cut-off grades in stopes may be -5I as low as -07% U;08, A misnomer the uranium and has down been mines may to - 0 5 % in development drifts. applied "high to uraniummining grade" the ore when it has been stated deposits a higher to ship grade uranium concentrate and to decrease the operating cost. The term "high grading" refers to the Later it was stripping practice applied off to higher of miners the in gold practice, values along in one mines small wall of stealing mines and with leaving gold from the vein-type of deposits, lower grade materia the mine. It is not practical to "high grade" uranium oreofdeposits the sandstone tributed zone.. type because throughout The tration higher of the the grade higher contained mining zone with material is not percentage of uranium a ton in of grades ore is unevenly from - 0 5 % to .20% in located in the dis- same such a manner that a.concen- uranium aoxide ton of in ore could be , mined differently from the rest of the ore body. The operators mine to the economic ' cut off, During which the is 'process, material, so that the mine-run retreat the the grade both the mine-run at which higher average , the 3 of sible . stopes except material the shipping is mining left costly to both and collapse, 'The costs Yearly per-day cost is taken grade (but with to the not owing of to uranium mill. the dangerous high retreat thus any grade system and low presently lo If of mining, unmined'areas redevelopment of drift grade would mater roofs not be tunnels. COST OF SETTING UP MILLS setting aup uranium mill are well known. They are increasing inflation mill would in equipment cost and engineeringA costs. 2,000 ton- around $30 million a t 1977 prices, -including of land, power, tailings pond, water, interest on loan, and taxes. Some mills pr the . FRONT-END . are.covered 8 uranium are by costs grade left will be lost to any future mining. In the of all off U 0 percentage is raised to meet added cost,on then the cut system the are quoted $15,000 et per-ton-day but that figure is low and a -6- probably does not The mill usually captive include mine,so that outside is the fed a company by mine-mill economic feasibility the body is not custom- or tolled-mill, a cost ore a ore cost study of able overhead. .. and of uranium supply owned complex inplace is normally value. . If the to a mill, carrythen which calculated an economic the then fromits ore must feasibility must be in be of processed in considered as,toits total feasibility. custom miUing cogts about $6.00 per milling cost are pound, but by a company cost mining-milling run the and costs of from $2.00 to .$5.00 per in ores future ore, on.0.20% or ore crude capacity be must available. URANIUMORE INCLUDING but are ton milling range uranium complex mill These of excess mill COST OF MILLING Milling about $25 per are large environmental poundof U 0 3 8' ENVIRONMENTAL the' COST lowest of the expense part increases are Direct of the in expected fuel to costs. between $10 to $ 2 0 per ton for a company mill including haulage expenses from the mine. This would be approxmately $2.00 to $5.00 per pound heads 1 for 0.15% mill OPEN Costs unlikely Grants foran that except'some the cost be mine any new low-grade type MINES are difficult'to It is estimate. open-pit in operations the future of near operations with of a cut-off 3 8 near per uranium will very URANIUM With the low-grade material, the cost per pound U 0 of 3 8' be pit there around .04% U 0 would open PIT that ton of underground would be much operation lower. costs Examples with are higher grade, althoug uranium theTexas open-pit deposits, where shipping-mill heads costs are about $25/lb -04%for U 0 ore. 3 8 The Wyoming, in New cost of Texas and Mexico; operating Colorado, there is in other seem very by little uranium my proQucinq states, calculations, to be similar difference in cost to such as those between states.various * 1. . . .. -7- SUMNARY costs t.o mine operations OF uranium in areat'nearmaximum URANIUM New OPERATION Mexico cost, COSTS cover a large range. Pr .esently, mainly owing to the higher posted price, which affects labor, efficiency, and speed of extraction, all of which add to the,operating duction cost then Mineral Belt, average mill new to cost. Old uranium mines ahave much lower mines.a new For operationin the discover a mill-size grade 0of .14% U 0 for 3 8 uranium ore body 3of million production Grants pounds in 1980 would pro- with an require: $ 1 $ 6 millioninlandleasecost $ 0.30/lb. million in exploration cost $ 2.00/lb. $25 million in front-end mine costs $ 8.00/lb. $30 million in front-end mill costs $10.00/lb. $20.30/lb. capital and interest cost Mining production cost Milling extraction cost Total fora new of $ 4.00/lb. $17.00/lb. undiscovered mine to be put on stream with mine-mill. 1980's thus is $37.3O/lb. in 1977 dollars. REFERENCES ERDA USBM - ERDA NMEI Survey of US Uranium Statistical Data Uranium 1976 in UNM - Uranium at of Marketing the Acitivity, uranium Sandia . . Industryin'NewMexico Exploration Steel Kerr-McGee United Todilto Company Corp. Nuclear Corp. Exploration and Development Corp. > Reserve . . Oil and Minerals Inc. 1976 Industry, 1, January 1976 Sohio L-bar Ranch Mine (nameJ.isJ. No. 1) operations Ranchers April by mid spot -8- Jones Drilling Various miners, contractors, and suppliers in Grants area References from Chemical Engineering, BACKGROUND Mining Engineering and Mash & Stevens DATA Donald B. Buddecke, Consultant Mining Engineer, Registered Professional Engineer, New MexicoPE 4040, member Society of Mining Engineers, AIME,Newand Mexico Mining Association. Graduated B. S. in Mining Engineering, UTEP, School of Mines, El Paso, Texas. Twenty years of experience in mining in USA, Latin America, Greece and Africa. Past 8 years Part owner and manager of small have gold-silver .been mine independent with mill Mine near Consultant, Winston in Sierra County, New Mexico. Instructor in Mining Engineering at New Mexico Institute of Mining and Technology in Socorro. Mine Contractor in underground development in New Mexico, Washington, and Latin America. &J*,+., e 0 mLATION OF COSTS AND mLATI0N TAXESFOR,NEWMEXICO'S ,/Pe..L&W'k. /Pe..L&w'k.,w 4/&4 / 4 5 $ . URANIUM PRODUCTION 1. Gross value taxes, such as severance taxes, add to direct costs in uranium mining and production. The higher the tax, the higher the cost, uranium and that the more will be uranium lost that in can mining not the mined --profitably . be higher grade ore. A net income or profit tax would encourage mining of more 2. uranium, and thus entail less l o s s of resources. Major expenditures in producing uranium (exploration, sinking 3. shafts, on building loans) are mills, buying front-end mining costs, equipment and incurred a before single part pound of of the interest yellowcake is sold. These costs need to be recovered, as well as the actual mining and costs, as part of the selling price U when 0 is produced. production 3 8 4. ERDA's uranium reserve calculations, used to suggest the possibility ofa high severance tax rate, are on based forward costs (capital and required donot include for future development as well sunk costs such ERDA reports 5. that 50% of yellowcake will period through1985, less as as much operating of the costs) front-end through 1980 and in1984 and 1985 more be sold at than18% of less $20 than per pound, all uranium will and be expenditures. than in sold the at prices more than $30 per pound in any one year. Costs of production .range from slightly The uranium ceptions less than following mined of . has a large persons pound not in to New the proposed Mexico are familiar with ERDA's reserve estimates high-grade uranium ore, of of $30 per more thanpound. to relative processed view amount per comments and/or A simplistic . $10 mining tax to increases on clear up miscon- operations. suggests which New Mexico supposedly could be mined to yield high profits. Unfortunately, ERDA's cost estimates are only on "forward costs" which are those costs yet to be spent in mining and milling the ore. ERDA's calculations do not include "sunk costs" of exploration develop the and land mines, leases, or capital interest on investments these to front-end build the mills and costs, yet these sunk t 2 I .. . -2- c o s t s m i l s t be 'recovered o r amortized a t some point. not include, for The forward c o s t s do exarrgle, t h e m i l l i o n s o f d o l l a r s a l r e a d y s p e n t t o d i s c o v e r o r e bodies, build m i l l s , and sink expensive deep shafts. and discovery of an o r e body to On the average, fro= exploration mining of t h e f i r s t ore, t & e s 8 years before the stock holder on o r e mined, m i l l e d . company can be paid a dividend a of andsold-, The s e l l i n g p r i c e o f Yne uranium concentrate, "yellowcake", must not only cover the ERDA forwzrd c o s t s ol' o r e mining and milling, b u t also the previous 8 years of front-end costs, and i n t e r e s t on t h a t c a p i t a l i z a t i o n . Thus, t h e ERD3 reserves data must be u t i l i z e d . o n l y w i t h full knowledge of exploration, develoLm%t, mining The "spot market" price and processing costs. of uranium has been highly publicized. d e s p i t e news z r t i c l e s of s a l e s of "yellowcake" per pound, over one-half Zesearch and Deirelopent Administration p r i c e p e r pound of yellowczke through 1985. Datafrom $40 at prices t h e U. S. Energy (ERDA) semi-annualmarketingsurvey 1. of J u l y 1, 1976 a r e s c m a r i z e d a s F i g u r e each year!s corniaents a t prices greater than of t h e n a t i o n ' s uranium w i l l be sold of $20 per pound o r l e s s each yearthrough Yet, These d a t a show the average 1985, a s well as the percentage Q € to be delivered i n $5 price increments. 1985, only 10% of tine uraniurn s o l d i n t h e Even in United Stafes w i l l bring more than $30 p e r poun&. Estimation of t h e c o s t t o produce a pound of yellowcake i s exceedingly difficult. The d a t a is of a proprietary nature, conpany to company, de?ending on of mineralization, type geologic facets, from many factors such as depth to ore, grade of h o s t r o c k , e x i s t i n g c a p i t a l f a c i l i t i e s , d i f f e r i n g and type of mining. p e r pound for older, shallower C o s t s a r e n o t much lowerthan $10 mines, and a r e i n e x c e s s of $20-30 p e r imund f o r newer deezer m i n e s i n hTew xexico. XexicoEnergy and t h e c o s t s v a r y A recent' study for the New Rssources Board by Mining Engineer Donald Buddecke gave an estimated cost of 537 p e r pound to bring into production by the mid-1980's a 2 ore'bodjj t h a t can y i e l d 3 million pounds of U 0 3 8Uraniun orebodias are ccmplex e n t i t i e s , w i t h h i g h e r and lower grade material intermixed i n a.more or less unpredictable fashion. frequently s e v e r a l - l e v e l sv e r t i c a l l y . Ezch orebodycanonlybe mined a s a whole, on ' .. -3- under a'pining plan deveioped for that body., under specified engineering at and economic conditions. It emphatically cannot be mined for one.grade economic cut-off conditions"X", and grade The when steps later economic involved reworked conditions in the for material below the first change "Y". to development and mining of an orebody may be helpful in understanding the problem. Essentially all moderately deep uranium ore bodies are found 100-150 foot centers (Figure 2). ore mass must mine appears ment drifts be delineated by surfaceon roughly drilling Evaluation of the profitability of the made on the basis of this density of information. If a feasible, a shaft are and driven is into sunk ain suitable the location, ore 3 (Figure ) , segmenting the and develop- ore into large pillars. As the development drifts extend toward the margins t h e of mineralized area,a decision is made as to what of grade material willbe mined and what will be left as waste. This decision must bea made at point in time under the then existing economic conditions. Once the cut-off grade is determined, and the extent of "ore" ("ore" is only that mineraliz material margins which of can the be mined at a profit) orebody are delineated, the piecemeal, with removed pillars on the mining slowly retreati toward the shaft. As the pillars are extracted, the unsupported roof caves-falls in-(Figure4 ) , rendering it extremely hazardous and essentially impossible to return for lower grade material at a future date. In terms of time, retreat mininga developed of orebody may occupy the bulk of the mine life. However, price increases during the retreat stage'can allow only minor changes in the mining plan as determined prior to than the beginning retreat. If economic conditions dictate a cut-off grade higher grade at which the "ore" is largely continuous, the efficiency of the extraction decreases rapidly, Figure 5' shows the and considerable grade material is forever distribution a of hypothetical lost mineralized due to caving- area. Figures 6, I , 8 , and 9 show the extent of "ore" at various economic conditions which dictate cut-off grades of .05%, .15%, .25%, and .35% U 0 3 3' a' Note the changes which occur in the geometry of the orebody. In9, Figure the shape of the economic will is so irregular ore feasibility reveal only and and a mine certain patchy was pockets that even constructed, of ore; if surface underground much uranium drilling indicated development will remain undis -4- I n addition, the z a t e r i a l is l a r g e l y l o s t as mining proceeds and lower grade t& ground caves(Figure10). P o s s i b l e w i n d f a l l p r o f i t s have been predicted because of t h e u r a n u im 1973. priceescalationsince mination argues for However, t h e formula f o r c u t - o f f g r a d e d e t e r - a t a x based onincome or profit, rather than a severance and/or processing tax. s u l ~of c o s t s (mining,hauling, cut-offgrade (8) = milling, r o y a l t i e s i, n t e r e s t g , r o s sv a l u et a x e s ) . s e l l i n g p r i c e x . m i l l recovery x s c a l e f a c t o r I f any cost item increases, the cut-off grade must'increase as well,,unless compensated by an increase i n the selling price. are increased by an order of If t h e g r o s s v a l u e magnitude, then the cut-off grade must be increased by a l i k e amount, since many s a l e s c o n t r a c t s c o n t a i n no provision for taxes tax pass-through. Such a l a r g e i n c r e a s e i n t h e c u t - o f f grade would i n e v i t a b l y l e a d t o t h e s i t u a t i o n shown i n F i g u r e s 6 tlrcoagh 10. T h i s would r e s u l t i n h i g h l y i n e f f i c i e n t e x t r a c t i o n of uranium ore, and a corresponding loss of uranium reserves from the national energy country can ill afford such losses l i t t l e or bank- This a t t h i s time. Conversely, a t a x based on n e t income o r p r o f i t g u a r a n t e e s t h a t , w i t h care, a companymaymake t h u s encourage t h e e f f i c i e n t a p r o f i t , andwould e x t r a c t i o n of mineralized material. greater time period, gross payroll As more o r e would be mined over a. incomeand i n New Mexico w i l l be increased, as well as equipment and supply purchases more workers employedand more income, property, and sales taxes paid. Christopher Rautman Frank Kottlowski KeW Mexico Bureau of Mines & Mineral Resources d i v i s i o n of New MexicoTech This b r i e f r e p o r t i s a summary of material requested by the h'ew Mexico Energy Resources Board t o e v a l u a t e c o s t s New 1,Iexico. Costs are based of uranium mining i n l a r g e p a r t on a review and m i l l i n g i n by Donald Buddecke, Mining Engineer a t Ne% Mexico Tech. 2 1 February 1977 O m c) B 0 e Q 0 0 0 f) ” .. 2 !3” ffi 5 ”_ .. . I. I I .I .... .... . .- .. I .. a .. e W U 9 w 0 I .w 0 w . . FIGURE 9. Possible d e v e l o p m e n t of hypotheticax orebody under 0.35% cut-off grade. Compare with Figure 5 and note pockets of u n d i s c o v e r e d o i e - g r z d e material. Efficiency of e x t r a c t i o n is poor. area affected . by roof collapse 5 4 r- * non-disco-. vexed ore *. pod. L / , >‘ v J- A 1 - FIGURE 10. X i c e shown i n F i g u r e 9 f o l l o w i n g e x t r a c t i o n of material p i l l a r s a n d roof c o l l a p s e . N o t e o r e - g r a d e lost b e c a u s e of caving and non-discovery, \? .. ’ _ 1. ': - 3. Telegraph mining d i s t r i c t , Grant County, New Mexico.The being mrked i s 5 miles deposit now north and west of the RedRock post Office. FromRed.Rock post office it i s reached over a rather poor road for autos and trucks, RedRock, New Mexico, post office i s reachedover goodimproved gravel roads from Silver City, New Mexico, a distance of 53 miles, andfrom Lordsburg, New Mexico, a distance of 23 miles. Silver City i s shipping point on Santa Fe railroad and Lordsburg i s shipping point on Southern Pacific railroad. Actual di'stance of truck haul from deposit to Silver City i s 58 miles and from Lordsburg 28 miles. The deposit and nearby camp are on w hat i s known as Alder Creek, a tributary of the G i l a River. ELT?VATION The elevation of the deposit is between 5,000 and 5,500 f e e t abow sea level. TOPOGRAPHY The topography of the area i s mountainous,and i s very rugged. Erosion has cut a deep narrow crooked canyon gorge across the deposit and eventually the drainage reaches the G i l a River. WATER - TIMBER - POMER Water f o r domestic purposes only is available a t a spring just below the deposit of ricolite. It is not thought tha . t. enough water i s con- tinuously available that would furnish a processing plant on the ground. Timber is absent in the area, except i n the bottom of the canyon, . . and this i s not of quantity or q u a l i t y t h a t can be used for any purpose whatever except minor f u e l requirements for camp. There is no available electric power i n the area. f o r power must be planned for. A l l provisions