Document 10895200

advertisement

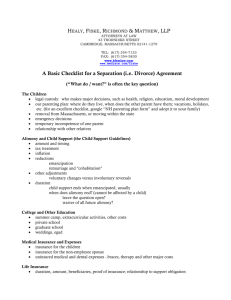

Presentation: Federal Income Taxation Chapter 17 Taxation and the Family Professor Wells November 2, 2015 1 Chapter 17 Whose Income is It? p.983 Class Syllabus (page 7) has the following organizing questions: 1. 2. 3. 4. 5. Is a particular item income or does it give rise to a tax deduction? When is the proper time period for recognizing an item of income or expense (including the capitalization of expenses)? What is the character of the item of income (e.g., capital gains and losses)? Who is the “true taxpayer” for reporting the item of income or expense? What is the type of taxpayer that must report the item of income or expense (individual, corporation, partnership, limited liability company, trust, estate, resident or nonresident) and are their special rules for this type of taxpayer? Corollary Questions: 1. What are the guiding legal principles for determining “who” is the taxpayer? whose income? whose deductions? 2. How can one have “multiple runs up the bracket ladder”? 3. When can one attribute income/deductions to another taxpayer? 2 Choices for Identifying the Taxpayer Unit p.917 Choices for possible income/deduction shifting: 1) spouses; 2) children; 3) other family members; 4) family entities (trusts, corporations & partnerships) Alternative: the entire family (how defined?) Cf., perspective of other cultures 3 Comparing Income Tax Rates p.917 Rate Brackets and Marginal Rates for individuals - Code §§1(a)-(d) & (h) Marginal rates - tax rate applicable to the last taxable dollar. Cf., effective rate (or average rate). Tax rates for corporations: Code §11. 4 Assignment of Income Who is the Taxpayer? p.983 Tax planning objective: Deflect income to a lower bracket taxpayer. Lucas vs. Earl, p. 983 - A contractual agreement concerning allocation of wages of spouses after their marriage. Held: income is taxable to the person earning the wages (not the “legal” owner). Note: the “fruit and tree” doctrine. NOTE: §704(e) permits recognition of those partners who have a capital interest in the partnership where capital is a “material income-producing factor.” 5 Community Property Law to Husband & Wife Poe v. Seaborn p.984 Facts: The Seaborns lived in Washington, which was a community property state. Mrs. Seaborn reported on her tax return half of the community income, including half of Mr. Seaborn’s salary. The Commissioner took the position that all of the income must be reported by Mr. Seaborn. Held: The Commissioner’s determination is rejected. Mrs. Seaborn, under Washington law, had a “vested right in the community property . . . including salaries.” Lucas v. Earl is distinguished by stating, “The very assignment in that case was bottomed on the fact that the earnings would be the husband’s property, else there would have been nothing on which it could operate,” whereas here “by law, the earnings are never the property of the husband, but that of the community.” 6 Same-Sex Couples (Windsor & Rev. Rul. 2013-17) p.991 1. Historically, the IRS stated that the Defense of Marriage Act prevented the IRS from allowing same-sex couples from filing tax returns as married couples. C.C.A. 200608038 consistent with this position. 2. California changed its law to allow community property between same-sex couples, and the IRS said that they would respect this income-splitting in C.C.A. 201021050. 3. In U.S. v. Windsor, the Supreme Court held that section 3 of DOMA violates the principles of equal protection. 4. In Rev. Rul. 2013-17, issued on August 29, 2013, the IRS ruled that post-Windsor that marriage would be construed to include same-sex marriages if the marriage were entered into in a state that recognized such marriages. Once entered into, that married status would be respected for federal tax purposes regardless of the laws of the state where the couple resides. 7 Considering the Marriage Bonus/Penalty p.999 Effect of joint return income tax status – twice the tax on 1/2 of combined income. Objective: To enable equality with community property jurisdictions – where an automatic split of the income occurs under state law. 8 Marriage Penalty/Bonus: Code §1 (2015 Rates) Bonus (only one earner): Single taxpayer & married taxpayer have taxable income of $464,850 – 140,420 tax (single) vs. 129,997 (married); $10,423 benefit for marrieds. Penalty (two equal earners): Two single taxpayers & each married taxpayer has income of $232,425 – single taxpayers have 60,306 tax each (total – $120,612); married taxpayers have $129,997 of tax; $9,385 penalty for marrieds. 9 Reasons to Treat Married Couples Differently Costs of children (limited to marriage?). But, imputed income of the “non-working” spouse; provide deduction for the second wage-earner? Costs of working for both spouses (rather than collecting investment income). Should the “ability to pay” tax liabilities be based on the wealth accession for the “family unit”? Should parents be required to include income of minor children? §73 provides for separate taxpayer treatment of the child. 10 Marriage Penalty/Bonus: Mapes v. United States p.999 Mapes argues that tax rates create a marriage penalty and that this is unconstitutional. Court upheld existing tax rates as constitutional. Court noted that “[T]here cannot be a ‘‘marriage-neutral’’ tax system. The policy of taxing all couples with equal incomes equally, a major factor in the 1948 income-splitting provision, is not unreasonable. Nor is it unreasonable to attempt to tax the household economies enjoyed by married people. . . . In short, the foregoing serves to illustrate that tax disparities will exist no matter how the rates are structured. This is simply the nature of the beast. The tax law is complicated enough already without the added complexity a full solution to this problem would apparently require. We in the judiciary, are neither equipped nor inclined to second guess the legislature in its determination of appropriate tax policies.” 11 Boyter v. Commissioner p. 1013 Taxpayers got divorced in Haiti in December 1975 and came back home and got remarried in January 1976. Taxpayer then got divorced in Dom. Rep. in November 1976 and got remarried in February 1977. Taxpayers claim they were unmarried at the end of 1975 and 1976 and filed as single taxpayers. IRS argued that the taxpayers were taxable as married individuals regardless of what state law would say. Court upheld IRS determination. The court applied the sham transaction doctrine to find that the divorces were shams and should not be given any tax significance. 12 Children and Dependents p.1025 “Kiddie Tax” under §1(g). Dependent Personal Exemptions available under §152 if parent provides more than half of the child’s support for the year. §152. Standard Deduction allowed under §63. Child Tax Credit under §24. 13 Bernatschke v. United States p.1031 FACTS: Taxpayers get divorced and husband transferred annuity to wife. Issue: Is this annuity payment alimony (subject to §71) or is it an annuity payment made to the owner of the annuity (subject to §72)? Held: This was a property settlement and wife became owner of annuity and thus entitled to §72 treatment. Subsequent events: 1. Alimony is now deductible by payor and taxable to payee. 2. No longer have need to prove amount is subject to legal obligation to be alimony but parties can now designate whether an amount is or is not alimony. 14 Current Divorce Tax Principles p.1037 Code §71(a) & (c) now apply: “alimony” is received as gross income. A federal definition of “alimony” applies. A deduction is available to the payor - Code §215. No deduction for child support. 15 Alimony & Support PaymentsIncome Tax Treatment p.1037 No deduction and no income inclusion for child support and all other payments. All non-alimony payments (as alimony is defined in the tax code) made to the former spouse are: (1) not income to the recipient, and (2) are not deductible to the payor. These items do constitute an accession to the wealth of the recipient (former) spouse. Custodial parent entitled to child’s dependent personal exemption but parent’s can agree otherwise. 16 Indirect Alimony Payments Example: Sally and Harry divorce. She pays (1) his mortgage payments on his residence and (2) premiums on a life insurance policy on her life & he owns the policy. Question: Is this taxable alimony? Is this “cash paid.” Answer: Yes, taxable alimony to Harry if Harry owns (1) the house and (2) the life insurance policy. Remember the Old Colony Trust Co. case. But, if Sally’s payment is not “cash,” then the answer is different. 17 “Alimony” Requirements Inclusion & Deduction Code §71(b) specifies the following “alimony” requirements: 1) Cash payments (not property). 2) Payment received under “an instrument.” 3) Payments must not be agreed to be nontaxable to the payee and nondeductible by the payor. Can opt out per §71(b)(1)(B). 4) Payments cannot be among members of same household 5) Terminate the obligation at the death of the payee. §71(b)(1)(D). 6) No disguised child support Also, no excessive front-loading. §71(f). 18 Disguised Child Support? Alimony being paid is gross income to wife. Can some of this amount really be disguised child support? §71(c)(2). If total payment is insufficient in amount – issue is what “ordering rule” is applicable in identifying the type of payment. Ordering rule of §71(c)(3) - payments are considered as first being child support before being deductible alimony. 19 Questions 1. Max and Winifred were divorced last year. To avoid a hassle, Winifred agrees orally to pay him $2,000 per month as spousal support. Will Winifred be allowed a deduction for the payments? Must Max report the payments as income? 2. Suppose Manuel and Wanda have decided to dissolve their marriage. Manuel and Wanda have decided that for each of the next two years Manuel should pay Wanda $60,000, while she finishes law school; that he should pay her $5,000 per year for the succeeding two years; and that at the end of four years there should be no more payments. If the terms of this agreement are incorporated in a decree of divorce, what will be the tax consequences to Manuel and Wanda? 3. Suppose the facts are the same as in Problem 2, except that Wanda has a father, Fred, who lives with Manuel and Wanda and is dependent on them, and that the agreement provides that if Wanda dies during the four-year period in which payments are required, the payments will be made to Fred. Moreover, during the four years, Manuel is required to pay for an insurance policy on Wanda’s life, with Fred as beneficiary. What are the tax consequences to Manuel, Wanda, and Fred? 4. Suppose Mike and Wilma have a son, Carlos, who is two years old. Mike is a successful lawyer. Wilma was also a successful lawyer, but quit practice when Carlos was born, with the understanding that she would care for him until he reached age 12 and then would return to work. Mike and Wilma have decided to end their marriage and have agreed that Mike will pay Wilma $40,000 a year for ten years, but with the obligation to terminate if Carlos should die sooner. What will be the tax consequences to Mike and Wilma? 5. Suppose that the marriage of Nancy and John is dissolved by a judicial decree that requires that Nancy pay John spousal support (alimony) of $10,000 per year. When the payment becomes due in the first year after the decree is entered, Nancy offers to transfer to John, in settlement of her obligation to pay the spousal support, shares of stock of IBM with a fair market value of $10,000 and a basis in her hands of $1,000. Suppose that John would be legally entitled to insist on payment in cash and that no other form of payment had been contemplated at the time of the dissolution. If John accepts the IBM stock in satisfaction of Nancy’s obligation, what are the tax consequences to him and to Nancy? What if the same events occur in the second year following the dis- solution of the marriage? Regs. §1.1041-1T, A-7 provides that “[a] transfer of property is treated as related to the cessation of the marriage if the transfer is pursuant to a divorce or separation instrument . . . and the transfer occurs not more than 6 years after the date on which such marriage ceases.” 20 United States v. Davis p.1041 Issue: Is transfer of separate property to estranged spouse taxable? Holding: Transfer of appreciated property to spouse (pursuant to a separation agreement that was later incorporated in a divorce decree) was a taxable disposition on which the husband realized and recognized gain equal to the excess of the property's fair market value over its adjusted basis. Subsequent Events: the Davis case was largely supplanted by Congress in 1984, when it enacted§1041 to provide nonrecognition of realized gains and losses on transfers of property between spouses or, if the transfer is incident to a divorce, between former spouses. Remaining Validity: Davis continues to control transactions between spouses that fall outside the aegis of § 1041 (e.g., transfers to a nonresident alien spouses and an antenuptial transfers of property in settlement of any later-arising marital rights is not expressly covered by § 1041). 21 Pre-nuptial Agreements p.1046 Farid-Es-Sultaneh v. Commissioner Issue: The tax basis for shares received in pre-nuptial transfer. What timing of (1) stock delivery and (2) agreement? Effective as of the pre-nup? Why was a tax basis step-up permitted to her for the stock she received (and not a transferred tax basis attributable to a gift transfer, i.e., §1015)? Held: FMV basis at time of receipt of stock. What did she transfer as consideration? Treatment to him on the stock transfer? 22 Property Settlements Transfers between Spouses p.1051 Code §1041 concerns transfers of property between divorced spouses. Davis case as the predecessor - treating the property transfer in the divorce context as a gain recognition event. Code §1041 provides (1) no recognition occurs to the transferor on the property transfer, and (2) a transferred tax basis applies to property held by the recipient. 23 Questions p.306 1. In each of the hypotheticals, assume that Ann is obligated to pay Bob $10,000 pursuant to a court order for child support issued on their divorce. (a) In lieu of $10,000 cash, Bob accepts from Ann shares of stock of IBM for which she had paid $1,000 and that are worth $10,000 at the time of transfer. Bob later sells the shares for $9,000. See §§1001, 1012. (Assume that §1041 does not apply.) (b) Ann borrows $10,000 from Thelma and pays Bob. Ann defaults on the debt to Thelma. Bob invests the $10,000 in IBM stock, which he later sells for $9,000. What are the tax consequences not only to Ann and Bob but also to Thelma? See § 166. (c) Ann pays Bob $10,000. Two days later, pleading a medical emergency, Ann borrows the $10,000 back from Bob. Shortly thereafter, Ann dies, totally destitute (though she had a good job at the time of her death). (d) Ann, having failed to pay Bob the $10,000 child support obligation when it became due, executes, and delivers to Bob a negotiable promissory note, pay- able in three months and bearing interest at the market rate of 1 percent per month. Shortly thereafter, Ann dies, totally destitute. (e) Same as (d), except that before Ann dies, Bob sells the note to Thelma for $9,000. (f) What are the implications of the court’s statement that “the taxpayer had no basis in the debt”? Suppose, again, that Ann owes Bob $10,000 for child sup- port. If she pays him the $10,000, it is excluded from Bob’s gross income under §71(c). Basis seems to be irrelevant because of the statutory exclusion. But what ifBob sells or assigns his claim against Ann to a third party for $9,000? 24 Final Thoughts Alimony being paid is gross income to payee spouse. Can some of this amount really be disguised child support? §71(c)(2). If total payment is insufficient in amount – issue is what “ordering rule” is applicable in identifying the type of payment. Ordering rule of §71(c)(3) - payments are considered as first being child support before being deductible alimony. 25