Document 10868407

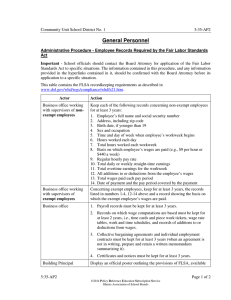

advertisement