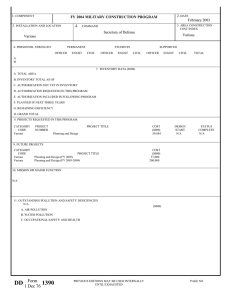

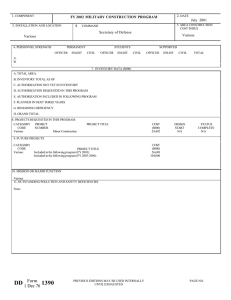

DEFENSE WORKING CAPITAL FUND FEBRUARY 2006 CONGRESSIONAL DATA DEFENSE-WIDE

advertisement