DEPARTMENT OF THE NAVY FISCAL YEAR (FY) 2006/FY 2007 BUDGET ESTIMATES

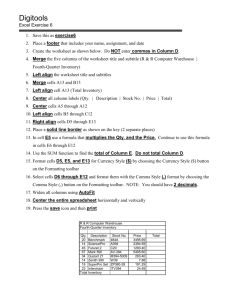

advertisement