RESEARCH DISCUSSION PAPER Currency Misalignments

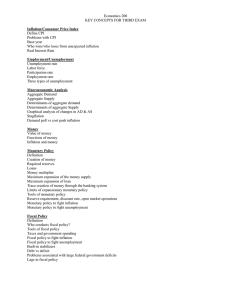

advertisement