Thank you for reading my comment. There are lots of... provide my suggestion separately. This version can be used by...

advertisement

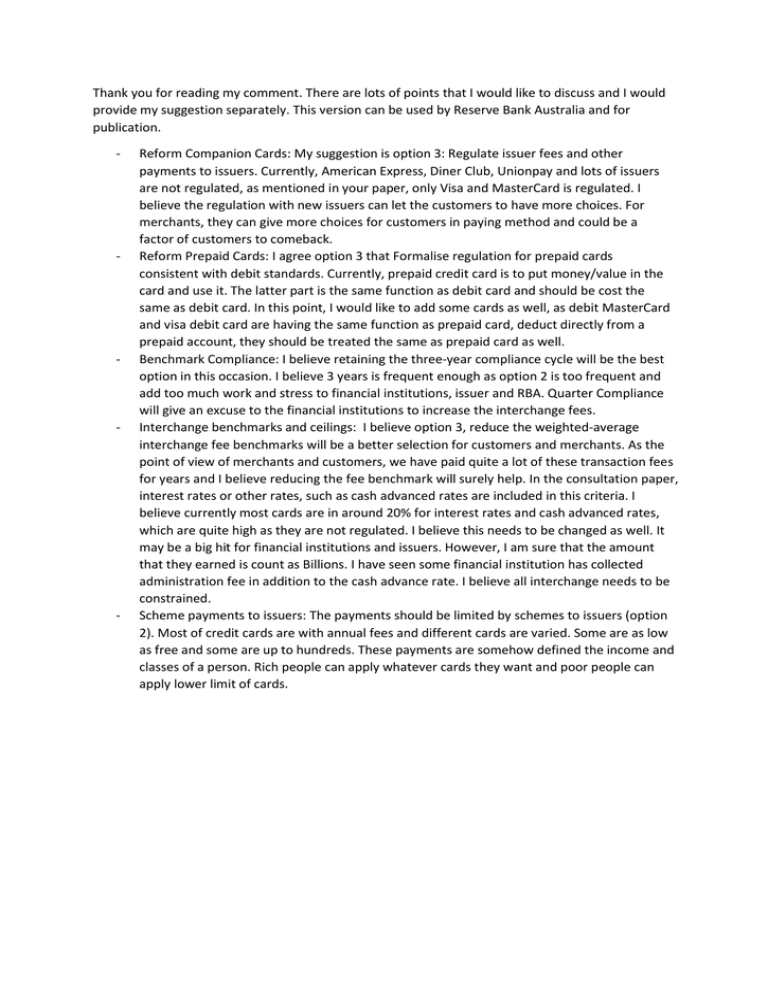

Thank you for reading my comment. There are lots of points that I would like to discuss and I would provide my suggestion separately. This version can be used by Reserve Bank Australia and for publication. - - - - - Reform Companion Cards: My suggestion is option 3: Regulate issuer fees and other payments to issuers. Currently, American Express, Diner Club, Unionpay and lots of issuers are not regulated, as mentioned in your paper, only Visa and MasterCard is regulated. I believe the regulation with new issuers can let the customers to have more choices. For merchants, they can give more choices for customers in paying method and could be a factor of customers to comeback. Reform Prepaid Cards: I agree option 3 that Formalise regulation for prepaid cards consistent with debit standards. Currently, prepaid credit card is to put money/value in the card and use it. The latter part is the same function as debit card and should be cost the same as debit card. In this point, I would like to add some cards as well, as debit MasterCard and visa debit card are having the same function as prepaid card, deduct directly from a prepaid account, they should be treated the same as prepaid card as well. Benchmark Compliance: I believe retaining the three-year compliance cycle will be the best option in this occasion. I believe 3 years is frequent enough as option 2 is too frequent and add too much work and stress to financial institutions, issuer and RBA. Quarter Compliance will give an excuse to the financial institutions to increase the interchange fees. Interchange benchmarks and ceilings: I believe option 3, reduce the weighted-average interchange fee benchmarks will be a better selection for customers and merchants. As the point of view of merchants and customers, we have paid quite a lot of these transaction fees for years and I believe reducing the fee benchmark will surely help. In the consultation paper, interest rates or other rates, such as cash advanced rates are included in this criteria. I believe currently most cards are in around 20% for interest rates and cash advanced rates, which are quite high as they are not regulated. I believe this needs to be changed as well. It may be a big hit for financial institutions and issuers. However, I am sure that the amount that they earned is count as Billions. I have seen some financial institution has collected administration fee in addition to the cash advance rate. I believe all interchange needs to be constrained. Scheme payments to issuers: The payments should be limited by schemes to issuers (option 2). Most of credit cards are with annual fees and different cards are varied. Some are as low as free and some are up to hundreds. These payments are somehow defined the income and classes of a person. Rich people can apply whatever cards they want and poor people can apply lower limit of cards. - Surcharging: This is one of the most arguable points for general public because of some furious actions done by some companies. I would like to clarify one thing on option 2. It said remove regulation and merchants may be prevented from surcharging at all. However, if the merchants claimed that they cannot prevent the surcharge, what is the surcharge cost and who will pay for the surcharge? The best solution is no surcharge at all from card issuers and financial institutions, and this will be a win for both merchants and customers. However it will be a challenge for RBA as it will definitely be opposed by card issuers and financial institutions. Option 3 will probably be less arguable. One suggestion I would like to make is to put a ceiling on the surcharge fee, fixed dollar or percentage rate, whichever is lower. For example, if I purchase a product or service that costs 1000, according to current (normal) rate, 3% means 30 dollars which is too high. However, if a fixed dollar appears, say 10 dollars, should be able to cover the transaction cost by both merchants, card issuers and financial institutions. I believe the above transaction cost that is per transaction, not per item, should be high enough. An electronic transaction cost should be the same, no matter the product is costed less than a hundred or up to thousands. I believe card schemes could have no-surcharge rules. This can attract customers to purchase certain kinds of products or services. If a merchant needs to surcharge to their customers, they will need to list out what is the amount for, for example 3% for the financial institution, and it should be per transaction, not per item. The merchant will also need to confirm that the cost is to the financial institution or issuer, not to the merchant themselves. I also agree that lower the surcharge for taxi from 10% to 5%. To conclude, I would like to answer a few questions: 1. Is the proposed approach appropriate? Does it meet the public interest? At this stage, I believe most of them are appropriate. I believe it has in purposely meeting some of the public interest. For example, taxi, Airline Companies. 2. Is the proposed approach enforceable? I would like the proposed approach to be enforceable. However, my next question is who enforce the regulation and how? 3. Do the draft standards achieve what is intended? At this stage, I will say yes. However, if it is not enforced, it cannot achieve the original intention. 4. Are there factors that have not been properly addressed or considered, either in the general approach or the specific drafting? Some definitions are still blur, and need to be clarified. For example, how do we know the exact cost by merchants, financial institutions and issuers? Is that true and trustable about how they claim their cost? The word “Cost of acceptance” and “reasonable cost” will need to be identified before the regulation is introduced. Otherwise, different entity will have different explanation. My suggestion is to define these terms in the regulation, just like the rates defined in the consultation paper. I am not sure if “foreign transaction fee” has been included in this consultation paper. The current rate is about 3% extra charge for visa and MasterCard and 3.5% for American Express. I believe this can be put in the regulation if it is not. I believe they should be the same and 3 % is still too high. My suggestion is less than 2%.and have a ceiling (say 10 dollars) on it. 5. How long should be allowed between the time that any final decisions are made on the regulatory framework and the effective date of any new or revised standards? What factors are relevant to the length of this implementation period? I believe the final decision can be made within 3 months from the conclusion of the consultation period to ensure all ideas have been listened, considered, and if possible, altered, unless there will be another consultation period after this paper has been altered. I believe June should be a good time to introduce and 1st January, 2017 should be a good time to enforce. 6. Would transitional arrangements be necessary for any of the changes embodied in the draft standards? As in previous question, once it is introduced in June, there will be half a year for the general public, including issuers, financial institutions, merchants and customers to arrange their transition period. 7. Possible approaches where merchants wish to surcharge to cover the potential cost of chargebacks arising from the insolvency of a third party? Base on the definition of chargeback, the majority reasons of chargeback does not carry out by the customers and most likely carried out by or because of the merchant itself. If this is the case, I don’t believe that customers should be the one who pay the cost. This surcharge should be paid by the merchants themselves. 8. The approach to the taxi industry and whether there are other industries operating on a non-standard payment model that warrant further consideration? I do not think of any at the moment. If there is, please put in the regulation or the final paper.