LifeMap Assurance Company 100 SW Market Street P.O. Box 1271, MS E-3A

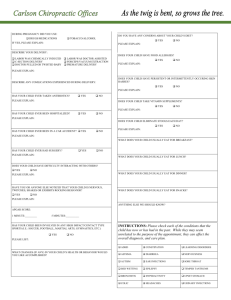

advertisement