A Parametric Bootstrap for Heavy-Tailed Distributions

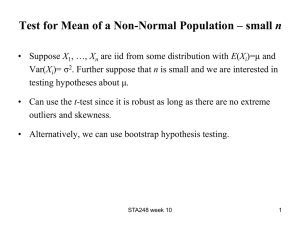

advertisement