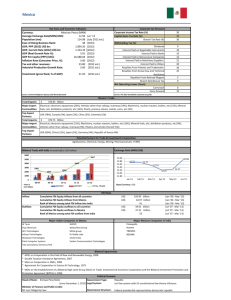

Patterns of FDI in Mexico after NAFTA— the Role of... Markets and Geographical Determinants Claudiu Tunea February 16

advertisement

Patterns of FDI in Mexico after NAFTA— the Role of Export Markets and Geographical Determinants Claudiu Tunea∗ † February 16th , 2006 Abstract I study the patterns of FDI in a developing country (Mexico) that forms an FTA with more developed countries (US and Canada) and identify that location choice for foreign investment differs across economic sectors. A simple economic geography model’s predictions are used to interpret a ‘gravity equation’ for FDI which is estimated using Mexican state-level data for 8 economic sectors between 1999 and 2003. Estimation results for the tradeable goods sector (manufacturing) show that investment is positively correlated with the foreign demand in the rest of NAFTA and clustering at the border with the US is present. For non-tradeable goods sectors (financial services, communal services, transport and communications), foreign investment is driven by local demand and clustering is around Mexico City. I would like to express my gratitude to Banco de Mexico for its hospitality during the Summer Internship 2005 and to its staff for support in the development of this project. Dr. Daniel Chiquiar Cikurel has provided me with kind supervision and I remain indebted to him for his advice and guidance. Sara Castellanos Pascacio, Rodrigo Garcia Verdu and Nuria Quella have been instrumental in my accessing and understanding Mexican data bases and surveys, and Othon Moreno has provided useful research support. Remaining errors are mine. ∗ † Department of Finance, Ottawa, Canada. E-mail: Tunea.Claudiu@fin.gc.ca ; phone: +1-613-992-5675. 1 1 Introduction. NAFTA’s enactment in 1994 was followed by a sharp increase of foreign investment in Mexico, from almost US$4 bill. in 1993 to more than US$10 bill. in 1994 and to levels closer to the latter number in subsequent years (Waldkirch, 2003). This has prompted several authors to attempt to identify the implications of these inflows of foreign capital for Mexico’s economic growth, income distribution and productivity. In contrast, this paper focuses on the causes determinants of FDI flows in Mexico and attempts to answer a different question: “How does location choice of foreign investors differ across sectors?”. It finds that one critical factor affecting location choice is the type of the firm’s output, i.e. tradeable versus non-tradeable. The present research builds on previous work but pays closer attention to geographic factors as determinants of the magnitude of FDI flows and their location. While the empirical studies until now have only employed state- and country-level data on FDI, in this paper I use sector-level investment data for the Mexican states to identify the driving forces behind FDI in a given state. I first construct an economic geography model of the choice of a new plant location (i.e. new investment) by a multinational firm supplying two markets of different size and which are geographically separated. The model highlights the cost effect of the border between two regions or countries (with different levels of development) which have segregated labor markets. This effect consists of a discontinuity of the input cost profile of a firm and is caused —among other things— by immobile inputs such as labor. The main implication of the cost effect for the location choice of a plant producing a tradeable good is an agglomeration of firms on the side of the border where input costs are lower. For the case of non-tradeable goods, this model predicts that the optimal strategy of the firm is to open two plants, each located in the market it supplies. The model’s predictions are then used to interpret the results of the empirical analysis. Mexican state-level data for FDI flows for 8 economic sectors are used along with measures of labour costs and of domestic and foreign market potential (constructed for the 31 states and for Distrito Federal) to identify the determinants of investment flows into the Mexican states. These data allow one to distinguish between export-platform versus horizontal investment FDI. The export platform story of FDI is that foreign investment is for production which is exported to foreign markets located in the proximity of the recipient state or region. By contrast, the horizontal investment theory conjectures that investment is meant to supply the domestic 2 market. In both cases, optimal plant location choice is driven by firm’s desire to minimize costs, such as labor and transportation, and by the relative market sizes of the trading entities. Therefore, in the empirical analysis one needs a couple of measures to capture a region’s (or state’s) demand for firm’s output. These measures are the foreign and domestic market potential offered by a recipient state and are built using gravity type of elements used in the international trade literature. Foreign market potential for each state is constructed as a weighted average of foreign-trade partners’ GDP, where weights are given by the inverses of the distance between the capital cities of the home state and the of the states/ regions in Canada and the US, respectively. Domestic market potential is constructed in the same manner but uses Mexican states’ GDP rather than the foreign states’. The ideal measures of demand are the export flows —at firm level or state level— between Mexican states and their domestic and foreign trade partners, but export data disaggregated at this level are not available for Mexico. In the absence of state-level export data for the 32 federative entities of Mexico and for the inter-state flows of goods and services, these market potentials are proxies for the export flows between each Mexican state and their trade partners. Two of the explanatory variables in the regression specification are (log-) state GDP and average skill premium. Previous studies have shown that such variables are endogenous to the model, since foreign investment contributes to growth and impacts individuals’ labor-leisure choice, as well as their investment in human capital. Therefore the estimates of an OLS regression are not consistent, and Instrumental Variables regressions will be employed in the estimation, using as instruments an index of electricity consumption for each state and state dummy variables. My results show that foreign investment in the tradeables sector (manufacturing) is driven by the foreign market potential and that the clustering in the border states (located in the north and being close to the US) is present for the firms in this industry. For the non-tradeables goods sectors the proximity to the border is not important for the location choice of foreign investment, and the foreign market potential is not significant. In this case, the own state GDP turns out to be the most important factor for investment in a specific state, since such investment is meant to serve local markets. Domestic market potential here enters with negative (and often not significant) signs, which is indicative of the high transportation costs that are characteristic for non-tradeable goods and services. In the case of manufacturing sector in Mexico I find support for the export platform hypothesis, and for sectors whose outputs are essentially non-tradeables 3 (e.g. financial services, commerce and transportation) the latter hypothesis is shown to be true. To my knowledge, this is the first paper using state-level data on FDI to characterize economic sector’s pattern of (inward) investment while considering ‘gravitational’ factors that might drive the location choice by foreign firms. Previous studies have only used aggregate FDI data to identify either the implications or the determinants of capital movements across borders. Moreover, the dichotomy between tradeable and non-tradeable goods sectors has not been explored in previous works but receives due attention in this paper. Among the authors who investigate the consequences of foreign investments are LopezCordova (2002) and Tornell et al. (2004). They show that foreign investment in Mexico helped improve productivity, while not having a strong impact on the overall economic growth. Chiquiar (2004, 2005) studies the changes in wage differentials and finds that states which are more exposed to international trade have experienced increased wages. At the same time, he finds there is a regional pattern of wage increases and that the skill premium has decreased for these states. Another strand of empirical literature is concerned with the impact of government expenditure and infrastructure on states’ (or provinces’) capacity to attract foreign investment. Mollick, Ramos and Silva (2005), Mayer (2004) and De Propis, Driffield and Menghinello (2005) use regional flows aggregated across industries for Mexico, France and Italy, respectively, to study the determinants of FDI. They thus ignore the possibility that foreign investment in different sectors might be driven by totally different factors, failing to account for differences between tradable- and non-tradable goods sectors. This paper proceeds with a brief overview of the relevant literature in Section 2, while Section 3 develops a simple economic geography model of plant location. Section 4 outlines the econometric model used in the hypothesis testing, and Section 5 describes the data and methodology. Section 6 presents the estimation results and a brief Conclusion sums up the findings of the paper. 2 Literature on FDI and with reference to Mexico. The present research contributes to the international trade literature concerned with the underlying determinants of movements of capital across countries. In particular, it belongs to the area of empirical works studying the patterns of inward foreign direct investment. The recent literature on FDI aims at explaining the flows of investment across borders in a manner similar 4 to the gravity models which explain the flows of traded goods, and one can identify two broad strands or directions of research. First, there are empirical studies that aim at identifying determinants of outward FDI flows originating in the same country. Blonigen, Davies, Waddell and Naughton (2004) employ spatial econometric techniques to find support (or reject) alternative theories for the FDI. They find that the pattern of US outward FDI to 20 OECD countries confirms the “export platform FDI” theory —their regression analysis uses a gravity type specification and yields negative coefficients on the spatial lag (i.e. investment levels across different regions, weighted by a measure of distance) and positive coefficients on the market size of the recipient’s neighbours. Such studies leave out of the picture the distribution of FDI within each country and the sectorial distribution of the inward FDI, as well as the role played by trade barriers between the countries they consider. A similar study by Head and Mayer (2004) is on the Japanese outward FDI. A second strand of FDI literature examines the geographic distribution of inward foreign investments and test whether foreign firm’s choice of location for their investment is affected by public policies and environmental regulations. Mayer (2004) and De Propis et alii (2005) find that FDI flows across France and Italy, respectively, are driven by the usual considerations pertaining to agglomeration and market potential, and are not significantly correlated with regional development policies like infrastructure improvement or skill upgrading.With the exception of Head and Mayer (2004) who justify their use of a gravity equation by deriving it from a theoretical model, most studies in the aforementioned categories employ a certain form of the gravity equation for FDI by paralleling it with the trade-flows gravity equation. Authors add to the regression equation (or remove from it) terms that are considered relevant for the question they want to answer1 . 1 A third strand of literature is theoretical and aims at building the foundations of the gravity equation for FDI flows. Ekholm, Forslid and Markusen (2003) and Carr, Markusen and Maskus (2001) build models of trade between 3 countries, with imperfect competition. Carr et alii (2001) also introduce a third type of good —an intermediate good— in addition to the final goods (1 homogeneous and 1 horizontally differentiated). They develop the model and ultimately employ numeric methods to solve it, due to the complexity level and non-linearities. The FDI flow is basically the residual in the current account balance when the trade between a pair of countries is not balanced. The equilibrium of a country’s accounts is with the other two countries and involves the flows of investment between countries. While not deriving a closed form solution for the FDI flows, these models are used by their authors to explain various puzzles, or contradictions, that emerged from previous two-country & two-goods models of MNE (Markusen and others, in 1980’s and 1990’s). Along the same lines, Bergstrand and 5 As a major recipient of FDI among developing countries (alongside with China, India and Eastern Europe), Mexico has been the subject of numerous studies that explored both the causes and implications of FDI flows that have increased in the wake of institutional reforms it implemented beginning in the mid-1980’s, and more intensely, after the country joined Canada and the US to form NAFTA. Numerous studies have explored the implications of foreign investment flows for growth, productivity, income inequality etc. Lopez-Cordova (2002) finds that increased competition and foreign capital penetration had a positive impact on the Mexican productivity at the firm level, while Mollick, Ramos and Silva (2005) find that regional infrastructure (e.g. the network of paved roads and the number of telephone lines) is important in attracting foreign investments to a region. Chiquiar (2004) shows that FDI flows and international exposure have benefited northern states to a larger extent than the central and southern ones and that the impact on wages and returns to schooling is therefore different across the Mexican states. Waldkirch (2003) studies the impact of NAFTA formation on the distribution of investment flows into Mexico across the origin countries. Using aggregate data from 1980 to 1998 for FDI flows originating in 9 OECD countries, he finds that the case of Mexico supports the hypothesis that a developing country benefits from a FTA with a more developed country in the sense that it becomes more attractive for international capital. Moreover, his results show that FDI flows from Canada and the US have increased more than flows from non-NAFTA countries and the estimate is that the FDI coming from the US and Canada would have been 42% lower in the absence of the Agreement. Less explored in this literature are the ways in which FDI flows to different regions or states have evolved over time, and one of the interesting questions is how NAFTA’s coming to effect has changed the pattern of investment across recipient states. A first step in this direction of research is to identify the determinants of the regional distribution of FDI across regions and by economic sector, and thus to determine which economic sectors and states have benefitted from increased investments from NAFTA countries. The present research paper takes this first step and examines to what extent geographic and socio-economic state characteristics have been instrumental in the ability of Mexican states to attract foreign capital in different economic sectors. Egger (2005) build a 3x3x3 model and provide justifications for why the FDI-gravity equation is reasonable (i.e. it is qualitatively close to the trade-gravity equation). 6 3 The model. When discussing the determinants of inward foreign investment, it is useful to have a simple theoretical model of a (foreign) firm’s location decision for a new plant which is meant to supply two geographically separated markets —possibly located in different countries— with a certain good. This section outlines such a model of FDI and location choice for the case of a tradeable good and then expands it to the case of non-tradeables. The model is then used in the interpretation of empirical results. Consider the optimal location problem of a firm producing a (final, tradeable) good that is sold in two markets and in the presence of transportation costs. These markets are of different sizes and separated geographically, and without loss of generality, the distance between the final good markets is normalized to 1. Let the two markets be B and M (say, Boston and Mexico City) and the demand in each market be constant price elastic with the elasticity ε. Therefore, the inverse demand functions take the following form pB = aB q −ε pM = aM q −ε and aB > aM (i.e. the market for this good is larger in Boston). Per unit transportation costs from the plant location to either market are t (per unit of distance), and the firm is a monopolist in each market2 . Production requires two factors, capital K and labor L. Capital is supplied by the firm in the form of the investment required to set up the production plant (therefore it enters the profit function as a fixed cost K) and is mobile across regions and countries. Labor is the immobile factor and one unit of labor is required for the production of each unit of output. Local labor markets are indexed by x ∈ [0, 1] —having market B located at x = 0 and market M at x = 1; and the firm can hire a many workers as it needs at the prevailing wage rate in that region, w(x). Production technology and the labor market conditions thus imply a constant marginal cost and a declining average cost for the firm. 2 The assumption here is that the firm produces a good which is an (imperfect) substitute to other goods produced by the rest of the industry. One can therefore derive the demand for a specific variety from CES preferences, and the producer of a certain variety is de facto a monopolist. However, the type of competition between producers is not critical for the model’s predictions. Firm behaviour (with respect to the location choice) will be the same when the firm operates in a perfectly competitive market. 7 The wage rate differs across regions in the sense that labor is paid a higher wage the closer the market is to a metropolitan area (in this case, the closer it is to either B or M)3 . For tractability, I assume that the relationship between wage and location is described by a quadratic equation w(x) = γ − βx + αx2 (1) where x ∈ [0, 1], α, β, γ > 0 and α < β < 2α. This captures the trade-off between factor prices and proximity to locations (i.e. urban agglomerations) with intense economic activity, in which firms compete for resources and bid up the input prices. Locating the plant in a region farther away from one of the markets implies however that the firm will incur higher transportation costs when shipping the goods to that particular market. Therefore, each plant location is characterized by a trade-off between production costs and transportation costs to the two markets supplied by the plant. The benchmark model is for a firm (or industry) whose output is tradeable, and therefore transportation costs represent a relatively small fraction of the good’s cost. Sufficiently low transportation costs for this good enter the model via the assumption that t < β. Firm’s de facto marginal cost in supplying each market from a location x will then be given by cB (x) = γ − (β − t)x + αx2 cM (x) = (γ + t) − (β + t)x + αx2 The profits earned by a firm located at x ∈ [0, 1] and selling in markets B and M will then be Π(x) = ε 1 (1 − ε)1− ε − 1−ε aM cM ε 1 ε − 1−ε + aB cB ε 1 ε −K where cB and cM are functions of location x. Note that the profit maximization problem is equivalent to minimizing a weighted average of the two marginal costs, and that a relative increase in the size of a market causes the firm to locate the plant closer to that market, ∗ i.e. d(dxaB ) < 0. (See Appendix for an algebraic treatment.) Then it is easy to show that the aM optimal location of the firm will be between arg min cM and arg min cB , i.e. ∗ x ∈ 3 β−t β+t ; 2α 2α Economic geography models suggest that higher concentration of businesses in urban centers drives up the price of labor and land. 8 Fig. 1 provides a diagrammatic illustration of these facts. (All figures are at the end of the paper.) This analysis is simplified by the assumption that the two regions served by the firm are located in the same country and the wage is only a function of location x. If markets B and M are located in two different countries and there is a border or a certain point of separation between countries, firms’ behaviour in choosing the plant locations would take into account differences between the labor markets on the two sides of the border4 . In this context, the border will induce different costs for a firm depending on which side of the border it locates— the so-called border effect. A simple and very unrestrictive way of modelling the cost effect of the border in this model is to assume that there is a fixed effect on wages (or equivalently, on other input prices): wB (x) = γ B − βx + αx2 wM (x) = γ M − βx + αx2 and γ B > γ M . Therefore, the border induces a discontinuity of the marginal cost profile across regions. In other words, wages in the more developed and larger country (where B is located) are ceteris paribus higher than in the less developed country, host to a smaller market. With this assumption, the diagram changes as in Fig. 2 and the optimal location will be now given h which represents a location in the border region of the poorer country. by d, This simple model incorporates elements which are relevant for the case of trade and in- vestment in a FTA comprising one developed and one developing country. By asumption, the developed country is capital abundant while the developing country is capital scarce. Consider for instance the case of a firm from the developed country which owns a certain amount of capital (and expertise) and plans to build a new plant in order to supply market B, as well as the smaller market M, with a (tradeable) good. The two markets are located in different countries, but there are no trade barriers between them, and therefore, transportation and wages are the only costs the firm incurs once the investment (K) in the plant is completed. The location decision for the plant balances labor costs and the costs of shipping the good to the two markets. Given that market B is larger than M and everything else being equal, the firm locates the plant closer to B. The developing country is however labor abundant and 4 Immediate examples would be trade barriers between the two countries, different technical standards or sanitary requirements. Such things are assumed not to matter when two countries form a free trade area, because they will eventually harmonize their laws. 9 wages are substantially lower than in the developed country, and thus a specific location in the developing country but close to the border is preferred. Labor cost savings are substantial and outweigh the increase in overall transportation costs associated with a location closer to the smaller market. A significant wage differential (which may be due to the fact that labor is immobile across borders) generates an outcome like the one shown in Fig. 2. Extending the model to the case when the firm produces a non-tradable good is relatively simple. A non-tradeable good is defined as a good for which transportation costs per unit of distance are very high, possibly infinite. This definition would translate into a de facto cost the firm has to incur when shipping the goods across regions which is larger than the fixed cost of setting up the plant. In this situation, firm’s optimal strategy is to open two plants. Each plant is located close to (or in) one market and it supplies only to that market. The underlying assumption is that capital is cheap for a multinational company and the two markets are large enough for the firm to make a profit in each market even in the case when wages are very high. Therefore with sufficiently high transportation costs, the outcome is that the firm will set up the two plants, where firms’ location in each country is in the market it supplies. Although there are no trade barriers, the firm will find it optimal to supply the two market by setting up one plant in each country. Relatively high costs —requiring the weak assumption of t > β in this model— make de facto costs cM and cB increasing in the distance from the production site to the market supplied by the plant. The optimal location of the plants will then be at the two extremes of the segment. (See Fig. 3 for illustration.) The case of a non-tradable good corresponds to the horizontal type of FDI: investment meant to serve a market will be located in that market, as close as possible to its consumers. Investment in a country does not cater to foreign markets and thus is of horizontal type. 4 Econometric model. The economic geography model in Section 3 is capable of explaining manufacturing firm clustering in the northern regions of Mexico close to the border with the U.S. (the maquiladoras), and it also provides theoretical support for the agglomeration of firms in the industrial zones in western Czech Republic and Poland even before those countries joined the EU. The extension of the model for the case of non-tradeable goods provides intuition for why large (foreign) capital flows into the financial sector (and in other service industries) have been directed to Mexico 10 DF or to neighbouring regions in central Mexico. In this paper, the econometric analysis to explain the location choice of FDI is conducted such that the focus is on economic sectors and on recipient regions. The model above suggests that —other than location— several variables are of relevance for a state’s ability to attract foreign investment. First are variables conveying information about the input prices faced by a new investor locally. Information about the labor market in that state is conveyed by the skill premium, while information about other inputs whose prices differ from state to state is captured by the state dummy variable and the constant in the regression equation. Skill premium, rather than state-average wages, is used in the regressions as a relative price of inputs (labor) since previous studies have shown that FDI is linked to increased wage spreads between skilled and unskilled labor. Moreover, average wages at the state level seem to be uncorrelated with the investment flows across the eight economic sectors considered in this study. Second, the demand for the firm’s output in the local market as well as in neighbouring markets weighs in the firm’s decision to invest in a given state. To capture the effect of demand on the location decision by firms, in the econometric model I use the state’s GDP and several measures of market potential as proxies for the actual trade flows. The ideal measures of demand are the export flows —at either firm or state level— between Mexican states and their domestic and foreign trade partners, but export data disaggregated at this level are not available for Mexico. In the absence of state-level export data for the 32 federative entities of Mexico and for the inter-state flows of goods and services, two market potential measures are constructed. The domestic market potential for a state (the recipient of FDI) is a weighted average of the other Mexican federative entities’ gross domestic product, where the weights are the inverse of the distances between the capital cities of the recipient state and all the other states, respectively. By the same rule, the foreign market potential for that state is a weighted average of the GDPs of the NAFTA entities beyond the Mexican borders— that is the 50 US states and the Canadian provinces. The general form of the regression equation is log FDI = const + α1 log StateGDP + α2 log SkillPremium + +β 1 log DomesticMarketPotential + β 2 log ForeignMarketPotential + +γ (year dummies) + δ (and state dummies) where F DI stands for the investment received by a certain state in a certain year. The same 11 form of regression specification is used for every industry or economic sector. All variables enter in log form, and investment, GDP and market potentials are expressed in constant USD. Data series. The present study uses state-level data on foreign investment in Mexico’s 32 federative entities between 1999 and 2003 to assess the differences in the location choice by foreign firms across severeal economic sectors. An equally interesting question is whether firm behaviour has also changed after 1994 when NAFTA was enacted, but the poor availability of the required data series prior to 1994 prevents one from investigating the matter. Moreover, since Mexico only started recording the FDI data according to the IMF & OECD methodology in 1999, the current research uses data after that year5 . A positive aspect of shifting the period of analysis away from the moment NAFTA was implemented is that most of the tariff reductions (which came in successive stages under the Agreement), as well as the reforms of the Mexican legislation regarding investments and financial services, have already been in effect by 1999 and any volatility caused by such changes would be smoothed out. The period under scrutiny is 1999 to 2003. Although FDI data disaggregated by both sector and federal entity are available for year 2004 and the first quarter of 2005, other data series for the Mexican gross state product and the labor statistics necessary to estimate average wages and skill premium averages by state are not available for year 2004 and afterwards6 . For the aforementioned period, FDI data series for eight economic sectors7 (agriculture and fisheries, commerce, construction, manufacturing, mining, transport and communications, financial services, and other services) and for the 31 states plus Distrito Federal8 are used as dependent variables in the regression analysis, in logarithm terms. The data series for a 5 Starting in 1999, the new methodology has been used by the Registro Nacional de Inversion Extranjera of the Secretaria de Economia for the calculation of investment flows. This methodology is compliant with the definition outlined in the OECD Benchmark Definition of Foreign Direct Investment (third edition, 1999) and in the IMF’s revision of the Balance of Payments Manual (1999), and data series by economic sector and federative entity are available after 1999 using this methodology. 6 When these data series are made available by the Mexican statistical office (INEGI), I plan to expand the period of my analysis to incorporate the additional information. 7 Due to scarcity of observations for the sector labelled “Electricity and water”, it has been eliminated from the analysis. 8 Table 4 presents the grouping of the states by region. 12 ninth sector, electricity production and distribution, is also available but it only contains 23 observations that could be used effectively —due to the presence of negative or zero values in the raw FDI data. This is a problem that affects the other series as well, but to a lesser extent. The definition of FDI incorporates new investment, re-investment of profits, transfers between subsidiaries of firms, the importation of fixed assets, change in capital stock and the repatriation of profits. Therefore, one explain FDI values for certain states and in certain years which are negative or zero, since repatriation of profits and lowering the capital stock of the firm are deemed capital flows from the federal entity for which they are reported. The values of zero are explained by the absence of FDI-related activities in a given state and year. Using log-FDI as the dependent variable in the regression specification, one is compelled to drop such observations from the panel. The measures of domestic and other host variables have been constructed using data from Instituto Nacional de Estadistica, Geografia y Informatica (INEGI), which sometime reports data originally collected by Banco de Mexico and Secretaria de Economia. Domestic market potential for a given state S is the sum of the other Mexican states’ GDP weighted by the inverse of the distance between the state’s capital city and the other capital cities in the Mexican federation. In order to incorporate the own market potential of the a state, its GDP enters with a weight given by half of the distance to the closest neighboring capital city. Foreign market potential is constructed in a similar way: it is a weighted average of GDPs of the 51 US states and of the Canadian provinces9 . Gross state product for the US federal entities were extracted from the BEA databases, while the domestic product of the Canadian provinces were provided by Statistic Canada —in both cases the information being accessed through the organization’s website. For all measures of market potential and for the FDI amounts, original figures were converted to constant USD, base year being 2000. The average skill premium for each Mexican state is estimated using the ENEU10 survey data 9 Canadian provinces were grouped in two regions according to their location: Western Canada (comprising British Columbia, Alberta, Saskatchewan, Manitoba and the three territories) and Eastern Canada (comprising Ontario, Quebec and the Atlantic provinces). For the purpose of constructing the weights for the two regions, the capital cities were considered Vancouver and Toronto, respectively. 10 The National Survey of Urban Employment (ENEU) 1987-2002 covers the 32 federative entities, with respondents located in (a changing sample of) urban areas. For the present exercise, 34 urban and metropolitan 13 on labor employment for 1998 to 200211 . Yearly averages of the skill premium are calculated by simple average of the quarterly estimates for each state. The skill premium is here defined as the sum of the estimated coefficients for schooling and experience (i.e. α4 + α5 ) in a regression whose full specification is log wage = const + α1 gender + α2 age + α3 age 2 + α4 schoolyears + α5 experience + ε where experience is defined as the product of the years of education and years spent working after the age of 16, and wage is the hourly earnings in the week prior to the date of the survey (or the future hourly earnings for unemployed respondents who declared that they would start a job soon after the date of the interview). The basic regression for each state and each quarter pools all the observations for the urban area(s) in the state. An index of the electricity delivery and consumption, mean log-wages, state population and the set of state dummies have been chosen as proxies for the intensity of the economic activity that took place in a given state and year. While better proxies would include the number of employees in every state or the total value of a state’s trade with the rest of Mexico and with the world, these series are not available12 . One can argue that beside the effects captured by the constant term and the year dummies there are state features that may factor in in firm’s decision to locate in a specific state, or not. State characteristics like paved roads and the number of telephone lines are captured as fixed effects in the regression. Over the short period of time covered by this study (five years) and for the given disaggregation level of the data, one expects the changes in these variables for each state are minor and including state dummies in the regression specification improves fitness. There are, however, important differences between states according to their geographic location. In a study of Mexico’s income convergence, for instance, Chiquiar (2005) shows that regional characteristics are important and that a state’s growth performance is inversely correlated with the distance to the US border. States grouped in five regions (border, north-central, Mexico City, south-central and south) display differences with respect to infrastructure endowareas have been selected such that there is every state is represented in each period and the urban areas are surveyed in each of the years of interest, 1998- 2003. 11 The ENEU data series for 2003 exist but were not available. Due to this situation, a lagged value of the constructed skill premium will be used in the main part of the regression analysis. 12 Export and import data series for Mexico are only reported at country level. The estimates of population size are computed using the popuplation census data for 1995 and 2000 and the population growth rates over this period. 14 ments, economic orientation and basic human capital indicators. Therefore, region dummies have also been included in the regression specification, and the grouping criterion is the same as in Chiquiar (2005). Using the set of state dummies in the IV regressions and then applying an F-test for the equality of the coefficients that correspond to states from the same region, one cannot reject the null hypothesis, and therefore, using the set of state dummies instead of state dummies is appropriate and brings clarity to results. 5 Discussion of results. This section features a discussion of the results emerging from the econometric analysis outlined in the previous section. As mentioned above, the present research focuses on eight of the nine economic sectors and employs state level data on foreign investment received by the 32 federative entities of Mexico. Table 1 shows the distribution of FDI received by the nine sectors from 1999 until 2004. It is remarkable that most of the investment has taken place into just two sectors —manufacturing and financial services— while agriculture and construction each received less than 1% of the FDI in Mexico. (All tables and graphs are placed at the end of the paper.) Manufacturing is, in the data series, a broad category which aggregates industries such as machinery and equipment, pulp and wood, chemicals, electrical and electronics, steel and others13 . It accounts for about 47% of inward FDI in Mexico over the period of study14 . The output of these industries is tradeable and the data observations on investment are relatively numerous. Therefore, the manufacturing sector is the ideal candidate to test the predictions of the model above. According to the benchmark model of FDI and tradeable goods, foreign investment in a developing country that forms an FTA with a developed country (i.e. Mexico and US, respectively) is driven by the firm’s desire to supply foreign markets (i.e. markets in the rest of NAFTA) and will locate in the border region neighbouring the large market. The other major recipient of inward FDI in Mexico is the financial services sector, with about 27% of the total. It is a sector that provides a non-tradeable good to the state (or the country) in which it is located and is one of the sectors used when testing the model predictions. The other sectors (whose outputs are essentially non-tradeable, at least at the 13 Data series for FDI disaggregated at the level of industry and sub-sector has been made available recently, and the author plans to expand the analysis in the near future and incorporate this new information. 14 It accounts for an average of 53.2% over the period 1994 to 2004. 15 country level) are commerce, construction and other services —and to some extent, transport and telecommunications. One can also argue that the output for the agricultural sector and for mining also fall in the category of non-tradeables, to the extent that most of their production is meant to supply local markets (be that consumers or other industries). In addition to representing a bare 1% of the total, these economic sectors pose a real problem in the interpretation of the econometric results in the sense that location choice of investment is in fact highly dependent on geographic (and climate) factors like location of mineral resources, soil quality, altitude and temperature —none of which is economic in nature and for which there are no controls specified in the regression equation. For each of the eight sectors under consideration, Instrumental Variables regression is employed to estimate the following equation log F DI = const + α1 log stateGDP + α2 log skill + β 1 log dommktpot + (2) +β 2 log formktpot + γ (year dummies) + δ (region dummies). Since the measure of skill premium and the state’s own GDP are endogenous and thus correlated with the error term, instruments have been used to remove such dependence. The chosen instruments include the mean log-wage, population and the index of electricity consumption (at the state level) as well as the state dummies. Year dummies and region dummies are meant to capture the fixed effects at the state level and for every year, and they account for characteristics such as the length of paved roads, number of telephone lines, size of the labour force etc. Data series for these characteristics are either not available or it is likely that they change little over time. As mentioned above, a version of the regression equation (2) using dummy variables for 31 states that has also been tested using the IV regression with the aforementioned list of instruments. The outcome of those regressions indicated a very strong correlation between the state dummies corresponding to states belonging to the same region (border, north-central, southcentral, Mexico city and south)15 . The F-tests performed on the coefficients corresponding to the dummy variables have not rejected the null hypothesis that the coefficients are equal at either 5% or 10%, and this result holds for every sector and for all groups of states16 . 15 16 See Table 3 for the grouping of states by region. The only exception is in the regression corresponding to manufacturing and for the states in the north-central region. 16 As a result of having essentially a common fixed effect for states in the same region, state dummies have been replaced with region dummies. An immediate consequence of using region dummy variables is improved significance of the other coefficients and improved fit of the regression, as measured by R-squared. Regression results for this specification are reported in Table 4. In the rest of this section, I will discuss the results obtained for individual sectors grouping them according to the type of output —i.e. tradeables and non-tradeables. 5.1 Tradeables sector. In order to assess the support conferred by data to the hypothesis that investment received by the developing country in the sector of tradeable goods tends to cluster near the border with the developed country, I analyse the pattern of FDI received by the manufacturing sector in Mexico. The model in Section 3 predicts that the size of foreign demand (relative to domestic demand) and proximity to the border are important in a firm’s decision location. It is then expected that foreign market potential and the dummy variable for the border region enter with a positive coefficient in the regression equation. The measure of the local demand in a state is given by the state’s own GDP and it should be negative, or not significant, according to the model. The same holds for the demand for the firm’s output by other Mexican states, which is captured by the variable called domestic market potential. Regression results shown in Table 4 lend support to the hypothesis of firm clustering at the northern border of Mexico and of investment driven my demand in the US and Canada. Foreign market potential enters with a coefficient which is both positive and significant while domestic market potential is significant but negative. The latter means that ceteris paribus domestic demand (coming from the rest of Mexico) actually works toward the firm locating the plant in a different federative entity, and it matches the model predictions. (The recipient state’s GDP enters with a positive sign but it is not significant, at 10% level of confidence, which is an indication that the ‘gravity force’ of its own market size relative to other markets is negligible.) Labor costs (and other input prices, in a broad sense) are an important factor in the investors’ decision to invest in a given state. Using average wages as proxy for the labor cost in the regression equations for the eight sectors mentioned above, one finds that its coefficient is not significant. This means that the heterogeneity of labor cost across states is entirely picked 17 up by the state dummies (and therefore, by the region dummies in the current specification). While tests show there is low correlation between FDI flows and average wages across Mexican states, previous studies have shown that FDI had an impact on the skill premia over time and therefore, it is natural to include the average skill premium for each state as a control variable that might also convey information about the abundance of certain factors (i.e. unskilled labor). In the regression for the manufacturing sector, log-skill premium —which is a measure of the relative cost of skilled and unskilled labor in the recipient state— has a positive sign and is significant and thus shows the firms’ preference for locations where unskilled (or low-skilled) labor is in high supply and, thus, relatively cheap. Regression results also lend support to what is called the export platform hypothesis by Blonigen et al. (2004). In their paper, this hypothesis says that FDI flows from the source country (the US) to another country is driven by foreign firms’ desire to export the goods and services to neighbouring regions or countries rather than for supplying the local maket. Thus firms in the source country of FDI use the recipient country as an export platform which is located in the proximity of the markets they serve. The present research is focused on inward, rather than outward, flows of FDI and the export market hypothesis implies that the motivation of a foreign firm’s investment in a (Mexican) state is to supply markets in the rest of the FTA, mainly in the US. In the case of manufacturing, the sign and significance of the coefficients for foreign market potential, border region and domestic market potential support the export platform market hypothesis as motivation for FDI in Mexico’s manufacturing sector. Estimation results for manufacturing show the importance of geographic proximity to the US (and Canadian) market, as the coefficient for the border region dummy is positive and significant at 10%. However, the coefficients corresponding to the south-central and the Mexico City regions are also positive, fact which can be explained by the concentration of industries and economic activities Mexico inherited from the pre-NAFTA period17 . In the light of these results, one can conjecture that states in the south-central region and the area surrounding Mexico City might have comparative advantage in different types of inputs as compared with the states in the border region. Since firm level data for FDI and their shipments are not available, identifying this comparative advantage more precisely is not possible. As it will be highlighted in the next sub-section, in the case of the non-tradeable goods 17 See for example Livas Elizondo and Krugman (NBER 1992) on the concentration of industrial activity and metropolis creation in developing countries. 18 sectors the corresponding coefficients on border region is either negative or not significant. That stands in sharp contrast with the manufacturing sector: the latter is the only one displaying a positive and significant coefficient for the border region dummy. 5.2 Non-tradeables. The main non-tradeable goods sectors are financial services, commerce and other services (also called communal services)18 . For all three industries, regression estimation yields positive and significant coefficients for the state GDP, while the coefficient on domestic market potential is negative and significant. This result comes as a strong indication that the FDI in these three sectors is driven by the motivation of being close to (or actually to be located in) the market the firm supplies. Foreign market potential is of no importance for financial and other services sectors. For commerce, however, this variable has a positive and significant coefficient which might be explained by the fact that commerce inherently has an international component. For example, due to importation of both consumer goods and of intermediate goods which are inputs for other economic sectors. Equally likely, this sector might provide other sectors with export related services, and therefore demand in foreign markets is important. In any case, investment in the non-tradeables sectors is not drawn primarily to the border or the north-central regions (unlike manufacturing). Most of such investment is concentrated in Mexico City, fact reflected by positive and significant coefficients for that dummy variable. For the other services —which incorporates real estate and tourism— region dummies enter with a negative sign and the variation seems to be best explained by the differences in the state GDPs and by the timing of investment (i.e. the year dummies). Agriculture and mining, which excludes oil industry, are (cautiously) treated as non-tradeable sectors, and their share in total investment is very small (around 1% of the total inward FDI in Mexico). Although geographic and climate factors are probably the main factors in choosing the location of the investment, regression results indicate that a state’s own market size is a significant factor19 . 18 Transport and communications can be considered a sector whose output is non-tradeable only to some extent. Moreover, a low number of observations might be the cause of poor significance of the regression coeffcients and there seems to be a high degree of concentration of investment in Mexico City (explained by transport and telecommuncation firms having the national headquarters in Distrito Federal). 19 Regression results for agriculture and mining are not reported in Table 4, but can be made available by the 19 Another way of contrasting the tradeables and non-tradeables sectors is by means of comparing the distribution of the investment received by a sector across the states and across regions. Figure 4 shows the shares of sectorial FDI for each region. Financial services, transportation and commerce display a pattern of high concentration of investment in the metropolitan area of Mexico City. The manufacturing sector, on the other hand, displays a weaker concentration in Mexico City and has the highest concentration in the border states. Comparison of results. The analysis of FDI flows into Mexico’s 31 states and Distrito Federal is conducted at sector level, and regression results presented in the previous subsections indicate that the pattern of investments differ across sectors depending on the type of a sector’s output, i.e. tradeables and non-tradeables. In order to test for the robustness of results, a joint regression of the pooled data across sectors including sector dummies has been used to assess the significance of the differences between same coefficients across the 8 economic sectors. The benchmark sector has been chosen to be manufacturing, and the complete specification of the regression equation also includes the products of the (non-tradeable goods) sector dummies and of the variables used in the original specification for the individual analysis of the sectors. The pooled regression yields significant coefficients for the same variables as in the regression for the manufacturing sector (i.e. foreign market potential, border region, Mexico City region etc). This regression also produces coefficients that are negative and significant for all the products of sector dummies and foreign market potential, as well as for the products of the border and sector dummies, respectively. In other words, the border region and the size of foreign demand are significantly more important for the manufacturing sector than for the rest of the sectors in Mexico. On the other hand, state GDP is not significant for the manufacturing sector, but it is deemed important for the non-tradeable sectors, and the pooled regression results back this claim since the products of the sector dummies and the log-GDP enter with positive signs and most of them are significant (at 10% level of confidence). These findings provide additional support for the horizontal investment hypothesis in the case of non-tradeables sectors, while for the tradeable goods sector (manufacturing) one finds author upon request. 20 support for the vertical integration and the export platform hypotheses for FDI in Mexico. 6 Conclusion. In this paper I develop a simple theoretical model to capture the different behaviour of (foreign) investors with respect to plant location depending on whether their output is tradeable or nontradeable, and use the model predictions to interpret the results of the empirical analysis. Mexican state-level data on FDI flows for 8 economic sectors are used along with measures of labour costs and of domestic and foreign market potential (constructed for the 31 states and for Distrito Federal) to identify the determinants of investment flows into the Mexican states. These data set allows one to distinguish between export-platform versus horizontal investment FDI. The export platform story of FDI is that foreign investment is for production which is exported in foreign markets located in the proximity of the recipient state or region. By contrast, the horizontal investment theory conjectures that investment is meant to supply the domestic market. In both cases, optimal plant location choice is driven by firm’s desire to minimize costs, such as labor and transportation, and by the relative market sizes of the trading entities. A simple economic geography model of plant location for a firm producing a tradeable good and serving two (geographically separated) markets shows that a border separating two countries and creating a discontinuity in the input cost schedule has the effect of inducing plant clustering in the border region and in the country where unit costs are lower. For non-tradeable goods, which are defined as goods whose transportation costs are very high, the clustering of firms is (in or) around the metropolitan area they serve. Using Mexican state-level data for FDI flows in eight economic sectors between 1999 and 2003, as well as measures of domestic and foreign export potential for the 31 states and for Distrito Federal, I employ Instrumental Variables regressions to show that foreign investment in the tradeables sector (manufacturing) is driven by the foreign market potential and that clustering in the northern border states is present. For the non-tradeables goods sectors the proximity to the border is not important for FDI location. In this case, the own state GDP is most important for investment which means that foreign firms invest in a state in order to serve the local market. Domestic market potential variable enters these regressions with negative (and often significant) signs which is indicative of the high transportation costs that 21 are characteristic for non-tradeable goods and services. To my knowledge this is the first study to use of state level data disaggregated by economic sector for the purpose of identifying different patterns for FDI inflows, and thus to find support for either one of the two major hypothesis of FDI —the export platform hypothesis and the horizontal investment hypothesis. In the case of manufacturing sector I find support for the former while for financial services, commerce and other sectors whose output is essentially non-tradeable the latter hypothesis is shown to be true. Due to restrictions imposed by data availability, in the current study the period of analysis is 1999- 2003. Future work will involve using FDI data from before 1999 (once adjustements are made by the Mexican National Registry of Foreign Investment), as well as the use of data at sub-sector level for both the manufacturing industries and for the non-tradeable goods sectors. References [1] Bergstrand, J.H. and Peter Egger. 2005. “A Knowledge-and-Physical-Capital Model of International Trade, Foreign Direct Investment, and Outsourcing: Part I Developed Countries”, mimeo. [2] Blonigen, B.A., Davies, R., Waddell, G. and Helen T. Naughton. 2004. “FDI in Space: Spatial Autoregressive Relationships in Foreign Direct Investment ”, NBER Working Paper No. 10939. [3] Carr, D.L., Markusen, J. and Keith E. Maskus. 2003. “Estimating the Knowledge-Capital Model of the Multinational Enterprise”, American Economic Review, Vol. 93, No. 3, pp. 995-1001. [4] Chiquiar, D. 2004. “Globalization, Regional Wage Differentials and the Stolper-Samuelson Theorem: Evidence from Mexico.” Banco de Mexico, Working Paper 2004-06. [5] Chiquiar, D. 2005.“Why Mexico’s Regional Income Convergence Broke Down”, Journal of Development Economics, No. 77, pp. 257-275. [6] De Propis, L., Driffield, Nigel and Stefano Menghinello. 2005. “Local Industrial Systems and the Location of FDI in Italy ”, International Journal of the Economics of Business, Vol. 12, No.1, pp. 105-21. 22 [7] Ekholm, K., Forslid, R. and James Markusen. 2003. “Export-Platform Foreign Direct Investment ”, CEPR Discussion Pap No. 3823. [8] Head, K. and Thierry Mayer. 2004. “Market Potential and the Location of Japanese Investment in the European Union”, Review of Economics and Statistics, Vol. 86, No. 4, pp. 959-72. [9] Livas Elizondo, R and Paul Krugman. 1992. ”Trade Policy and the Third World Metropolis”, NBER Working Papers 4238. [10] Lopez-Cordova, E. 2003. “NAFTA and Manufacturing Productivity in Mexico”, Economia: Journal of the Latin American and Caribbean Economic Association, Vol. 4, No.1, pp. 5588. [11] Mayer, Th. 2004. “Where Do Foreign Firms Locate in France and Why?” EIB Papers, Vol. 9, No. 2, pp. 38-61. [12] Mollick, A. Varella, Ramos Duran, Rene Alberto and Esteban Silva Ochoa. 2005. “Infrastructure and FDI Inflows in Mexico: 1994- 2001” (mimeo), University of Texas-Pan American. [13] Tornell, A., Westermann, Frank and Lorenza Martinez. 2004. “NAFTA and Mexico’s LessThan-Stellar Performance”, NBER Working Paper No. 10289. [14] Waldkirch, A. 2003. “The ’New Regionalism’ and Foreign Direct Investment: The Case of Mexico”, Journal of International Trade and Economic Development, Vol. 12, No. 2, June 2003, pp. 151-84. 7 Appendix. Firm profit is given by 1 − 1−ε ε ε Π(d) = aM cM 1 ε 1 − 1−ε ε + aBε cB = = aM γ + t − (β + t)x + αx2 − 1−ε ε 1 + aBε γ − (β − t)x + αx2 Maximizing profits with respect to location d, the F.O.C. is ∂ ∂x 1 ε aM (γ + t) − (β + t)x 1 ε = − 1−ε ε aB 2xα+(β−t) 1 (γ−(β−t)x+αx2 ) ε − 1−ε ε + αx2 − 1 ε 1 ε + aB γ − (β ε − 1−ε ε − t)x + αx2 2xα−(β+t) 1−ε ε aM ((γ+t)−(β+t)x+αx2 ) 1ε 23 − 1−ε =0 = or − aB aM 1 ε x− Denote b , t) = − Φ(x, m 1 β + t 1 β−t − x γ − (β − t)x + αx2 ε = 0 (γ + t) − (β + t)x + αx2 ε − 2α 2α (3) aB aM 1 ε x− β−t 2α (γ + t) − (β + t)x + αx2 1 ε − β+t 2α −x γ − (β − t)x + αx2 1 ε β+t b b Remark that Φ( β−t 2α , m , t) > 0 while Φ( 2α , m , t) < 0. Thus there are 1 or more solutions lying in this interval, and the number of solutions is odd. Denoting the roots for equation (3) x∗j —with j = 1..2N + 1— roots x∗2k+1 correspond to (local) maxima of Π(x), while x∗2k correspond to local minima, where k = 1..N . When aB aM ↑ marginally, Φ(x) declines for all values of x and all odd-numbered roots of Φ decrease, implying that dx∗ a d( a B ) < 0. M 24 Table 1: Share of FDI by economic sector (%). Year 1999 2000 2001 2002 2003 2004 Average Volume (mil.USD) 13,336.90 16,909.60 27,720.80 15,325.20 11,663.60 16,115.10 16,845.2 Agriculture 0.6 0.5 0.2 0.0 -0.1 0.1 0.23 Mining 1.0 1.0 0.1 1.4 0.6 0.7 0.79 Manufacturing 67.6 56.4 22.0 42.6 44.6 52.2 47.56 Electricity & Water 1.0 0.7 1.2 2.5 2.8 0.6 1.46 Construction 0.8 1.0 0.4 1.4 0.5 0.7 0.81 Commerce 10.2 14.1 8.0 10.5 10.1 5.9 9.79 Transport & Communic. 1.7 -13.4 10.6 5.3 14.5 7.7 4.41 Financial Services 5.7 28.2 52.0 29.2 16.9 29.5 26.93 Other Services 11.4 11.3 5.6 7.0 10.0 2.6 8.01 Table 2: Shares of FDI across regions (%). Border NorthCentral MexicoCity SouthCentral South Manufacturing 42.69 3.01 35.01 18.68 0.62 Financial Services 9.24 0.21 88.42 1.99 0.14 Commerce 31.33 0.87 53.68 13.83 0.29 Other Services 10.81 67.51 0.41 18.76 2.51 Trasnport & Communic. 6.61 0.25 86.33 6.77 0.04 25 Table 3: Groups of states State Region State Region Baja California Norte border Colima southcentral Chihuahua border Guanajuato southcentral Coahuila border Hidalgo southcentral Nuevo Leon border Jalisco southcentral Sonora border Michoacan southcentral Tamaulipas border Puebla southcentral Aguascalientes northcentral Queretaro southcentral Baja California Sur northcentral Tlaxcala southcentral Durango northcentral Veracruz southcentral Nayarit northcentral Campeche south San Luis Potosi northcentral Chiapas south Sinaloa northcentral Guerrero south Zacatecas northcentral Oaxaca south Mexico City (DF) mexicocity Quintana Roo south Estado de Mexico mexicocity Tabasco south Yucatan south 26 Table 4: I.V. Regression results (logFDI as dependent variable) Financial Manufacturing logskill logdommktpot logformktpot dyear2000 dyear2001 dyear2002 dyear2003 border northcentral southcentral mexicocity const_ Other Construction Services logstategdp Transp.& Commerce Communic. Services 0.2407 1.1940 1.0016 1.3230 -0.4737 2.9101 (0.64) (3.02) (1.67) (1.24) (-0.59) (4.14) 3.3208 1.3686 2.2116 7.0689 4.0321 3.2290 (2.61) (0.99) (1.07) (1.90) (1.84) (1.04) -9.5205 -5.9777 -6.7616 7.6031 -1.8963 -6.9456 (-6.10) (2.61) (-3.08) (1.39) (-0.64) (-2.60) 90.8829 45.3003 23.1904 10.2739 0.9502 -84.3157 (6.18) (3.02) (1.08) (0.21) (0.03) (-2.79) -1.2850 -1.0394 -.30754 -1.4971 0.2799 1.4038 (-1.85) (-1.48) (-0.49) (-0.76) (0.20) (1.22) -1.1382 -0.82561 0.3370 -2.0112 1.0126 0.76416 (-1.58) (-1.10) (0.32) (-1.16) (0.72) (0.62) -3.5922 -2.13973 0.20524 -2.2540 0.6422 4.5424 (-3.96) (-2.34) (0.16) (-0.82) (0.37) (2.84) -7.9207 -4.7588 -2.3712 -1.9438 -1.6505 4.0656 (-5.89) (-3.55) (-1.28) (-0.47) (-0.64) (1.62) 2.21697 0.6014 0.6003 -1.6600 0.8327 -2.5871 (3.21) (0.85) (0.61) (-0.77) (0.67) (-1.90) -.24552 0.3961 -0.3984 0.7056 -2.5469 -2.4484 (-.40) (0.64) (-0.43) (0.42) (-1.77) (-2.38) 5.27297 2.2967 0.2787 -0.2025 -1.8369 -3.8535 (8.16) (3.27) (0.30) (-0.13) (-1.55) (-2.13) 12.3242 8.2750 9.0731 -4.7417 6.4327 -2.5460 (6.99) (4.50) (3.76) (-1.06) (1.86) (-0.69) -993.116 -462.841 -175.688 -247.765 43.7095 1115.59 (-5.55) (-2.67) (0.70) (-0.43) (0.12) (3.26) Number Obs. 142 137 115 49 82 60 R-square 0.5637 0.4671 0.4324 0.6400 0.3343 0.5495 (T-statistics in brackets. Coefficients signifficant at 10% are shown in bold.) 27 Figure 1: Location choice with two geographically separated markets. Figure 2: Location choice with different labour markets separated by a border. 28 Figure 3: The case of non-tradeable goods. FDI by region and sector (1999-2004) 90.00 Manufacturing 80.00 70.00 Financial services 60.00 Commerce 50.00 40.00 Other services 30.00 Transport & communic. SOUTH SCENTRAL MEXCITY NCENTRAL 0.00 BORDER 20.00 10.00 Figure 4: Regional averages of FDI inflows. 29