by Stephen Tokarick May 1, 2006

advertisement

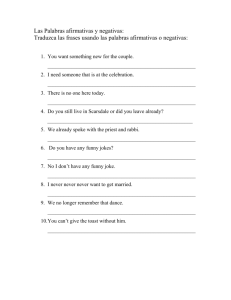

Should Countries Worry About Immiserizing Growth? by Stephen Tokarick1 May 1, 2006 Abstract It is well known that in the presence of tariff protection, factor accumulation could reduce a country’s real income if it is biased sufficiently toward production of a tariffprotected good. This paper examines the exact conditions under which immiserization could occur in the specific-factor’s model with more than one import good and a nontraded good. A key result is that in this type of model, if factor accumulation is biased toward the mobile factor, then immiserization cannot occur. This result has policy relevance in that if the mobile factor is labor, then immigration cannot immiserize the recipient country in the short run with capital immobile. Also, the likelihood of immiserization is greater the larger the degree of tariff dispersion. Therefore, in reforming a country’s tariff structure, this result provides a justification for moving toward a more uniform tariff structure. JEL Codes: F13, C68 Keywords: immiserizing growth, protection, factor accumulation, welfare 1 Senior economist, International Monetary Fund, Research Department, Trade and Investment Division, 700 19th Street N.W., Room 9-700A, Washington D.C., 20431. E-mail address: stokarick@imf.org. Phone: 202-623-7590. FAX: 202-623-7590. The views expressed in this paper are those of the author and should not be attributed to the International Monetary Fund, its Executive Board, or its Management. -2- I. Introduction The theory of international trade has pointed out at least two situations under which economic growth or technical progress could reduce a country’s real income. The first, attributed to Bhagwati (1958), is if factor accumulation is biased toward a country’s export sector, it will deteriorate the country’s terms of trade. And, if this effect is sufficiently large, then factor accumulation could reduce welfare. The second situation, attributed to Johnson (1967), is one in which factor accumulation takes place in the presence of tariff protection. Johnson showed that if the accumulation is sufficiently biased toward the tariff-protected sector, it could indeed reduce real income. Prior literature has examined the conditions under which immiserization could occur in both situations, but the analysis has been largely confined to the standard two-good, two-factor model of international trade, in which all factors of production are intersectorally mobile.2 An exception is Miyagiwa (1993) who derived the conditions for immiserization in the specific-factor’s model, but he only considered one imported good and did not allow for nontraded goods. It turns out that the choice of model structure is crucial in examining the conditions under which immiserization could occur. This paper examines the conditions under which factor accumulation could immiserize a country in the presence of protection in the context of the specific factor’s or Ricardo-Viner model of international trade which allows for more 2 The conditions under which factor accumulation could immiserize a country by deteriorating its terms of trade are presented in Woodland (1982). The conditions under which accumulation could immiserize in the presence of protection are presented in Bertrand and Flatters (1971) and Martin (1977). -3- than one imported good and for a nontraded good. In this model, if factor accumulation is biased toward the factor that is intersectorally mobile, it cannot lead to immiserization. This result has implications for policy discussions about the desirability of international factor movements. For example, if the mobile factor is thought of as labor, then immigration cannot harm the recipient country in the presence of protection in the short run when capital is immobile. In the long run when capital can adjust, immigration could reduce welfare. Thus, the welfare impact of an inflow of labor could differ depending on whether one adopts a short-run or a long-run time frame. Furthermore, with more than one tariff protected sector, a high degree of tariff dispersion will make immiserizing growth more likely. This result provides a justification for moving toward a uniform tariff structure. II. The Model This section presents the conditions under which factor accumulation could immiserize a country in the presence of protection. For the case of two goods, exports (E) and imports (M), the economy’s budget constraint is: G ( PE , PM ,V ) + tM PM* ( E M − GM ) = E ( PE , PM ,U ) (1) where G ( PE , PM ,V ) is the economy’s GDP function, E ( PE , PM ,U ) is the expenditure function, and Pj and Pj* are the domestic and world prices of good j respectively. The domestic price of exports ( pE ) equals the world price ( pE* ), while the domestic price of imports ( pM ) equals the world price ( pM* ) multiplied by (1 + tM ) , where tM is the ad-valorem -4- tariff rate on imports. A subscript next to the expenditure or GDP function represents partial differentiation with respect to that variable, e.g. EM denotes the derivative of the expenditure function with respect to the price of imports. The term tM PM* ( EM − GM ) measures tariff revenue on imports. The vector V denotes the supplies of factor endowments and U denotes the level of utility. Totally differentiating (1) gives the welfare effect of a change in factor endowments, dV: dU ⎡⎣ EU − tM PM* EMU ⎤⎦ = ⎡⎣GV − tM PM* GMV ⎤⎦ dV (2) where EU measures the marginal utility of income, EMU captures how the demand for imports changes when utility changes, GV is the derivative of the GDP function with respect to factor endowments, and GMV measures how output of the import good changes when endowments change—the Rybczynski derivative. Since the bracketed term on the left-hand side of equation (2) is positive assuming imports are normal, the effect of a change in endowments on welfare depends on the sign of the bracketed term on the right-hand side of (2). Equation (2) can be written as: dU ⎡⎣ EU − tM PM* EMU ⎤⎦ = ⎡⎣ PE*GEV + PM* GMV ⎤⎦ dV (3). -5- Thus, the welfare effect of factor accumulation depends on whether the value of output at world prices rises or falls. The sign of the right-hand side of (3) depends on the Rybczynski terms GEV and GMV and how outputs of each good respond to changes in factor endowments depends on the model structure. Equation (3) can be written in the following percentage change form: dU ⎡⎣ EU − tM PM* EMU ⎤⎦ = ⎡⎣( PE* X E ) Xˆ E + ( PM* X M ) Xˆ M ⎤⎦ (4) dX E where a “^” denotes proportional change, i.e., Xˆ E = . XE A. Mobile Factors: Two Goods and Two Factors In the standard two-good (exports and imports), two-factor (labor and capital) model of international trade, with both factors intersectorally mobile, the expressions for Xˆ E and Xˆ M are well known (see appendix), so using equation (4), the condition for factor accumulation to immiserize in the presence of a tariff is: ( PM* X M λKE − PE* X E λKM ) ˆ ( PE* X E λLM − PM* X M λLE ) ˆ L+ K <0 (λLM λKE − λLE λKM ) (λLM λKE − λLE λKM ) (5) -6- where each λij measures the proportion of each factor (i=L (labor) and K (capital)) used in each sector j (j=E (exports) and M (imports)). Suppose that the endowment of labor is constant ( Lˆ = 0 ) and that the import sector is capital intensive, so that (λLM λKE − λLE λKM ) < 0 . Thus, immiserization will occur if: ( PE* X E λLM − PM* X M λLE ) > 0 (6) which requires: (1 + tM ) > θ LE θ LM (7). where θij is the share of factor i in the cost of producing a unit of good j. B. Specific-Factor’s Model In the specific factor’s model, the response of sectoral outputs to changes in factor endowments differs compared to the all factors mobile model. In general, increases in the amount of a specific factor will cause output of that sector to rise, and outputs of all other sectors to fall. An increase in the endowment of the mobile factor will cause outputs of all goods to increase. -7- Using the expressions for the changes in the outputs of the two goods in the specificfactor’s model, and equation (4), the conditions for immiserization depend on the type of factor accumulation. In a two-sector model, factor accumulation will lead to immiserization if: ⎡⎣ (σ E λLEθ KM θ KE + σ M λLM θ KE ) PE* X E + ( −θ LM σ M λLEθ KE ) PM* X M ⎤⎦ Kˆ E + ⎡⎣ ( −θ LEσ E λLM θ KM ) PE* X E + (σ E λLEθ KM + σ M λLM θ KEθ KM ) PM* X M ⎤⎦ Kˆ M + (8) ⎡⎣ (σ Eθ LEθ KM ) PE* X E + (σ M θ LM θ KE ) PM* X M ⎤⎦ Lˆ < 0 where σ j is the elasticity of substitution among factors in sector j. 1. Case 1: Kˆ E > 0, Kˆ M = Lˆ = 0 : Assuming that factor accumulation occurs only in the export sector, it will immiserize if: ⎡⎣ (σ E λLEθ KM θ KE + σ M λLM θ KE ) PE* X E + ( −θ LM σ M λLEθ KE ) PM* X M ⎤⎦ Kˆ E < 0 (9). Equation (9) can be written as: σ E λLEθ KM PE* X E + σ M ⎡⎣λLM PE* X E − λLEθ LM PM* X M ⎤⎦ < 0 (10) -8- which can only be negative if the bracketed term is negative. This can only occur if θ LE > 1 + tM , which is not possible since by definition, θ LE < 1 . Therefore, factor accumulation biased toward the specific factor in the export sector cannot immiserize the country in the presence of a tariff, provided of course, the terms of trade remain unaffected. This result is similar to the one obtained by Srinivasan (1983), although he considered the welfare impact of an increase in capital from abroad. 2. Case 2: Kˆ M > 0, Kˆ E = Lˆ = 0 : An increase in the amount of capital specific to the import sector will immiserize if: −θ LEσ E λLM θ KM PE* X E + [σ E λLEθ KM + σ M λLM θ KEθ KM ] PM* X M < 0 (11) or when: σ E ⎡⎣λLE PM* X M − λLM θ LE PE* X E ⎤⎦ + σ M λLM θ KE PM* X M < 0 (12) which can only be negative if the bracketed term is negative. This will occur when: tM > θ KM 1 , or when (1 + tM ) > θ LM θ LM (13) -9- which is identical to the condition established by Miyagiwa (1993). Thus, factor accumulation biased toward the specific factor in the tariff-protected sector will reduce welfare if equation (13) is satisfied. In comparing (7) with (13), immiserization becomes more difficult in the specific-factor’s model, relative to the case in which all factors are mobile. 3. Case 3: Lˆ > 0, Kˆ E = Kˆ M = 0 : Using (8), it is easy to see that factor accumulation biased toward the mobile factor must raise welfare, since the coefficients of PE* X E and PM* X M in equation (14) are always positive: ⎡⎣ (σ Eθ LEθ KM ) PE* X E + (σ M θ LM θ KE ) PM* X M ⎤⎦ Lˆ > 0 (14). This result occurs because in the specific factor’s model, an increase in the supply of the mobile factor will raise outputs of both goods—no sector will contract. Thus, the value of output at world prices must rise. Figure 1 demonstrates how an increase in the supply of labor will raise welfare. ⎛ P* Initially, with no tariff, equilibrium is at A, given by the terms of trade ⎜ E* ⎝ PM ⎞ ⎟ . A tariff shifts ⎠ production to point B and lowers the value of production at world prices (the line through - 10 - ⎛ P* point B with slope equal to ⎜ E* ⎝ PM ⎞ ⎟ lies below the value of production at A). Starting from ⎠ point B, an increase in the supply of labor will cause the new equilibrium to lie to the northeast of point B (inside the dashed region), such as point C, since outputs of both goods must rise. Thus, the value of output at world prices at the new equilibrium must be higher than the value of output at B. Figure 1. Welfare Effect of an Increase in the Supply of a Mobile Factor in the Presence of Protection Imports ⎛ PE* ⎞ ⎜ *⎟ ⎝ PM ⎠ o C o B ⎛ PE* ⎞ ⎜ * ⎟ ⎝ PM (1 + t ) ⎠ o A Exports - 11 - C. Additional Cases: Many Goods This section examines the circumstances under which immiserization could occur in a case not previously studied—the case of two import goods subject to tariff protection and one export good. Adding a second import good to the specific factor’s model used above means that the effect of accumulation on welfare is: dU ⎡⎣ EU − t1PM* 1EM 1U − t2 PM* 2 EM 2U ⎤⎦ = ⎡⎣( PE* X E ) Xˆ E + ( PM* 1 X M 1 ) Xˆ M 1 + ( PM* 2 X M 2 ) Xˆ M 2 ⎤⎦ (15) where t1 and t2 denote the tariff rates on imports of good 1 and 2 respectively. Suppose factor accumulation is biased toward the specific factor (capital) used in the first import sector, K M 1 . Using the equations for the proportional change in the outputs of all three goods at constant output prices (see appendix), accumulation will lead to immiserization when: PM* 1 X M 1 [λLEσ Eθ KM 1θ KM 2 + λLM 1σ M 1θ KEθ KM 2θ KM 1 + λLM 2σ M 2θ KEθ KM 1 ] < (16). P X E [λLM 1σ Eθ KM 1θ KM 2θ LE ] + P X M 2 [λLM 1σ M 2θ KEθ KM 1θ LM 2 ] * E * M2 A sufficient condition for an increase in K M 1 to lead to immiserization is: - 12 - t1 > (1 + t2 ) [θ KM 1σ E λLEθ KM 2 + θ KEσ M 1λLM 1θ KM 2 ] + θ KEσ M 2λLM 2 (θ KM 1 + t2 ) θ LM 1 [σ E λLEθ KM 2 (1 + t2 ) + σ M 2λLM 2θ KE ] (17). It is also helpful to write equation (17) in an alternative way: t1 + σ M 2θ KE (1 + t1 )λLM 2 θ KM 1 θ KE [σ M 1λLM 1θ KM 2 + σ M 2λLM 2 ] > + σ Eθ KM 2 (1 + t2 )λLE θ LM 1 σ E λLEθ LM 1θ KM 2 (18). A number of conclusions can be drawn from equations (17) and (18) regarding the likelihood that capital accumulation specific to the first import sector will lead to immiserization. First, immiserization will be more likely the larger the cost share of the mobile factor, i.e. labor, in production of the sector experiencing the accumulation—the first import good, θ LM 1 . This occurs because a larger value for θ LM 1 leads to a larger expansion in output of the first import sector, as well as a larger contraction in output of the other sectors. Second, the larger the elasticity of substitution between labor and capital in the import sector experiencing the accumulation (σ M 1 ) , the smaller the chance of immiserization because a larger value for (σ M 1 ) will cause a smaller contraction in the output of exports and the other import good.3 Finally, the larger the elasticity of substitution between labor and capital in the export sector, the greater the likelihood of immiserization because this would lead to a larger 3 This result is obtained by differentiating the right-hand side of equation (17) with respect to σ M 1 , which will always be positive. As well, σ M 1 appears only in the numerator of equation (17). Thus, a larger value for σ M 1 will increase the value of the right-hand side of (17), all else equal. - 13 - contraction in the output of exports when the first import sector receives an infusion of capital.4 Changes in the elasticity of substitution between labor and capital in the import sector not experiencing the accumulation (σ M 2 ) have an ambiguous effect on the likelihood of immiserization because the effect depends on the value of (σ M 1 ) , the tariff rate in the import sector that does not experience accumulation t2 , λLE , and λLM 1 . Differentiating the righthand side of equation (17) with respect to (σ M 2 ) gives: ∂ ( RHS equation 19) = ∂σ M 2 ( σ E λLE t2 − σ M 1λLM 1θ KE )2 (19). and the sign of (19) depends on the sign of the numerator. Thus, an increase in (σ M 2 ) will make immiserization more likely if equation (19) is negative, and this will occur when: σ E λLE t2 < σ M 1λLM 1θ KE , or when t2 < σ M 1λLM 1θ KE σ E λLE (20). Equations (17) and (18) also reveal that immiserization will be more likely as a result of an infusion of capital to the first import sector the larger the difference between tariff 4 This result is obtained by differentiating the right-hand side of equation (19) with respect to σ E , which will always be negative. - 14 - rates. Differentiating the right-hand side of equation (17) with respect to the tariff rate on the second import good t2 , for a given value of t1 , gives: ∂ ( RHS equation 17) θ KEσ M 2λLM 2θ LM 1 (σ M 1λLM 1θ KM 2θ KE + σ Eθ KM 2λLE + σ M 2θ KE λLM 2 ) = > 0 (21) ∂t2 ( )2 which is always positive. So, for a given tariff rate in the sector experiencing the factor accumulation t1 , an infusion of capital specific to the first import sector will increase the likelihood of immiserization the lower the tariff rate in the other import sector, t2 . This occurs because a higher tariff in the import sector that does not experience the infusion of capital will reduce output of the first import sector, and thus, reduce the welfare cost of the existing tariff in that sector. These results suggest that the greater the degree of dispersion in a country’s tariff rates, the greater the chance of immiserization. As equation (17) shows, however, a difference in tariff rates is not required for immiserization—it can occur even if tariff rates are the same in both sectors. Dispersion in tariff rates has been viewed traditionally as undesirable. For example, Anderson and Neary (2005) demonstrate that an increase in the variance of tariff rates always reduces welfare. Thus, a common prescription for trade policy reform is to reduce the degree of dispersion in a country’s tariff structure and move toward a more uniform structure because this will raise welfare. The results from equations (17) and (18) offer an additional reason why a reduction in tariff dispersion is desirable: It reduces the - 15 - chances that factor accumulation specific to a tariff-protected import sector will lead to immiserizing growth, all else equal. Can anything be said regarding how far apart the two tariff rates need to be for immiserization to occur? Rewriting equation (17) gives: (1 + t1 ) 1 σ θ λ σ θ λ > + M 1 KM 2 LM 1 + E KM 2 LE (1 + t2 ) θ LM 1 σ M 2θ LM 1λLM 2 σ M 2θ KE λLM 2 ⎡ θ KM 1 ⎤ − t1 ⎥ ⎢θ ⎣ LM 1 ⎦ (22). The first term on the right-hand side of (22) is positive and greater than one, since θ LM 1 < 0 . The second term and the coefficient of the bracketed term are also positive, but greater or less than one depending on values for the substitution elasticities and the shares. The bracketed term will be positive when θ KM 1 > t . If this condition is satisfied, the right-hand θ LM 1 1 side of (22) will be positive and greater than one. Therefore, for immiserization to occur, the tariff rate on the first import good ( t1 ) must be larger than the tariff rate on the second import good ( t2 ) and the extent to which it exceeds one depends on values for the substitution elasticities, cost shares, and distributive shares. However, if θ KM 1 < t , then the bracketed θ LM 1 1 term on the right-hand side of (22) is negative and the right-hand side could be less than one. Thus, immiserization is possible even if t1 < t2 . - 16 - As an illustration, Table 1 presents sample calculations for the value of the righthand side of equation (17), for assumed values of the substitution elasticities ( σ j ), factor shares ( θij ), and the distributive share of labor ( λLj ). These right-hand side values determine how large the tariff rate needs to be on the sector experiencing the factor accumulation in order for the growth to immiserize the economy. Several distinctive features are evident from table 1. First, even for a wide range in values in the elasticities and shares, the difference between the tariff rates in the two sectors needed to generate immiserizing growth is quite large. Second, as mentioned earlier, a higher value of the cost-share of labor in the production of the sector experiencing the factor accumulation, the greater the likelihood of immiserizing growth. This is demonstrated in table 1 by comparing column three with column two. For every value of t2 , the value of the right-hand side of equation (17) is smaller for θ LM 1 = 0.8 , compared to the base case (θ LM 1 = 0.5) . As well, a larger value for the elasticity of substitution between labor and capital in the export sector also increases the likelihood of immiserization, which is demonstrated by comparing column four (which is calculated for values of σ E = 1.5 ) with column two, the base case with σ E = 0.5 . Finally, a larger value for the elasticity of substitution between labor and capital in the sector experiencing the growth, i.e. the first import sector, the larger the value for the right-hand side of equation (17) and therefore, the smaller the chance of immiserization. Suppose both tariff rates were equal. What parameter values could satisfy equation (22)? If t1 = t2 , the left-hand side of equation (22) equals one, and for immiserization to occur, the following condition must hold: - 17 - Table 1. Three Examples of Tariff Rates Needed to Generate Immiserizing Growth ___________________________________________________________________________ Higher cost share Higher elasticity Higher elasticity of Base Case of labor in of substitution substitution in 1 growing sector in export sector growing sector Values ( σ E = 1.5 ) ( σ M 1 = 3.0 ) ( θ LM 1 = 0.8 ) __________ ________________ ______________ ________________ Value Right-hand Right-hand Right-hand Right-hand side of (17) side of (17) side of (17) side of (17) for t2 ___________________________________________________________________________ 0.0 1.390 0.494 1.358 1.78 0.1 1.612 0.636 1.562 2.05 0.2 1.843 0.777 1.761 2.31 0.3 2.066 0.916 1.955 2.57 0.4 2.287 1.054 2.144 2.82 0.5 2.506 1.191 2.329 3.08 0.6 2.723 1.327 2.510 3.33 0.7 2.939 1.462 2.686 3.58 0.8 3.152 1.595 2.858 3.83 0.9 3.363 1.727 3.027 4.08 1.0 3.573 1.858 3.192 4.32 __________________________________________________________________________ Source: Author’s calculations. The base case values are: σ M 1 = 1.5, σ M 2 = 2.0, σ E = 0.5, θ LM 1 = 0.5, θ LM 2 = 0.8, θ LE = 0.3, λLM 1 = 0.45, λLM 2 = 0.33, λLE = 0.22. 1 - 18 - t> θ KM 1 ⎡ σ M 2θ KE λLM 2 ⎤ σ M 1θ KE λLM 1 1+ + θ LM 1 ⎢⎣ σ Eθ KM 2λLE ⎥⎦ σ Eθ LM 1λLE so the capital-labor ratio in the expanding sector, (23) θ KM 1 , serves as a lower bound on the size θ LM 1 of the two tariff rates needed to be generate immiserizing growth. For example, all of the terms on the right-hand side of (23) are positive. If θ KM 1 is greater than or equal to one, θ LM 1 then the tariff rates needed for immiserizing growth must be at least 100 percent, regardless of the values for the elasticities and shares. Is it possible to have immiserizing growth with very low tariff rates? It turns out that the answer is “yes”, but this would require large differences in other parameter values. For example, if σ M 1 = 0.1, σ M 2 = 0.2, σ E = 10, θ LM 1 = 0.99, θ LM 2 = 0.1, θ LE = 0.8, λLM 1 = 0.05, λLM 2 = 0.1, and λLE = 0.85 , then, using equation (23), tariff rates on the two goods greater than one percent would be consistent with immiserizing growth. However, in order to generate this case, the elasticity of substitution between labor and capital in the export sector needs to be 100 times greater than the elasticity of substitution between labor and capital in the import sector experiencing the growth, and 50 times greater than the elasticity of substitution between labor and capital in other import sector. Since σ E , θ LM 1 , and λLE appear in the denominator of (23), they cannot be “too small” in order to get low tariff rates. - 19 - As in a model with only one imported good presented in section B, an increase in the endowment of the mobile factor, i.e. labor, cannot lead to immiserization in a model with more than two tariff-protected goods. This is because an increase in the supply of the mobile factor raises output of all goods. With the production structure assumed here, each good shares only one factor with each other sector. Therefore, if the supply of the mobile factor increases, no sector will contract. D. Nontraded Goods The distinctive feature of nontraded goods is that their markets must clear locally. Adding a nontraded good to the model described in section C above yields the following expression for the effect of factor accumulation on welfare: dU ⎡⎣ EU − t1PM* 1EM 1U − t2 PM* 2 EM 2U ⎤⎦ = ⎡⎣GV − t1PM* 1GM 1V − t2 PM* 2GM 2V ⎤⎦ dV (24) + ⎡⎣t1PM* 1 ( EM 1N − GM 1N ) + t2 PM* 2 ( EM 2 N − GM 2 N ) ⎤⎦ dpN where EM 1N and EM 2 N capture how domestic demand for each imported good ( EM 1 and EM 2 ) change as a result of a change in the price of the nontraded good and GM 1 N and GM 2 N measure how output of each imported good ( GM 1 and GM 2 ) changes as a result of a change in the price of the nontraded good. EM 1U and EM 2U measure how the demand for both imported goods respond to changes in real income. The change in the price of the nontraded good, dpN , as a result of factor accumulation is given by: - 20 - ⎡ ⎤ GNV ( EU − t1 PM* 1 EM 1U − t2 PM* 2 E M 2U ) + E NU (t1 PM* 1GM 1V + t2 PM* 2GM 2V − GV ) dPN = ⎢ ⎥ dV * * * * ⎣ ( E NN − GNN )( EU − t1 PM 1 EM 1U − t2 PM 2 E M 2U ) + E NU t1 PM 1 ( EM 1 N − GM 1N ) + E NU t2 PM 2 ( EM 2 N − GM 2 N ) ⎦ There are now two distinct channels through which factor accumulation can affect welfare in the presence of tariffs. The first is by altering sectoral outputs, captured by the term ⎡⎣GV − t1PM* 1GM 1V − t2 PM* 2GM 2V ⎤⎦ dV , which has appeared in earlier expressions and the second is through changes in the demand for imports of both goods induced by the change in the price of the nontraded good as a result of the factor accumulation, ⎡⎣ t1PM* 1 ( EM 1N − GM 1N ) + t2 PM* 2 ( EM 2 N − GM 2 N ) ⎤⎦ dpN . The welfare effect of factor accumulation now depends on how the accumulation alters the price of the nontraded good, as well as the degree of substitutability between imports and the nontraded good in demand.5 For example, suppose the pattern of factor accumulation reduces the price of the nontraded good. If imports are a substitute for the nontraded good in demand, the demand for imports will fall, which will worsen welfare, since imports are below the optimum initially as a result of the tariffs. Therefore, immiserization is more likely if : (i) imports and the nontraded good are substitutes in demand and factor accumulation causes pN to fall; or if (ii) imports and the nontraded good are complements in demand and accumulation causes pN to increase (see Tokarick (2006) for a discussion of this issue). In each case, immiserization becomes more 5 See equation (14a) in the appendix for an expression relating how factor accumulation affects the price of the nontraded good. - 21 - likely because imports contract. And, since they are already “too low” because of the tariffs, any further contraction will reduce welfare. III. Country Examples While the previous sections established some general conclusions regarding the likelihood of immiserization induced by factor accumulation in the presence of tariffs, it could not cover all possible cases and model structures. Therefore, this section uses simulation techniques to assess empirically how different types of factor accumulation would affect welfare for a group of low-income countries that have higher than average degrees of tariff dispersion, as measured by the standard deviation of tariff rates. The methodology uses a computable general equilibrium model for twenty countries. The model structure for each country is the same, but the parameters and benchmark data vary to capture the particular circumstances of each country. The model structure is the specific-factor’s model discussed in section B. For each country model, there are five sectors: two exportable goods, two importable sectors, and a nontraded good. The two export and import sectors can be thought of as primary products (agriculture and raw materials) and manufactured goods. Each of the five goods is produced by using a sector-specific factor (i.e. capital), a factor that is mobile across all five sectors (i.e. labor), and domestic and imported intermediate inputs. The terms of trade are taken as given, but the price of the nontraded good is determined endogenously. In each country, a representative consumer is assumed to possess a cobb-douglass utility function over all five goods. Equilibrium is determined when a set of factor prices and price for the nontraded good is found that is consistent with market - 22 - clearing. The individual country models are benchmarked to data contained in the GTAP database, version 6, for production, trade flows, and protection.6 Each country model is used to determine the welfare effect of six types of factor accumulation: an increase in the amount of capital that is specific to all five sectors, plus an increase in the supply of the mobile factor, labor. The change in welfare is measured by the equivalent variation. For simplicity, the experiments simulate the welfare impact of one percent increases in each of these six factor of production. The results are reported in Table 2.7 Of the twenty countries examined, only one, Tunisia, would experience a decline in welfare as a result of factor accumulation, and this occurs as a result of an increase in capital specific to the first import sector—imports of primary products such as agriculture, raw materials, and minerals. This result largely stems from the large dispersion in Tunisia’s tariff structure: In the model, the tariff rate on primary products is 41.2 percent, while the tariff on manufactured goods is only 11.8 percent. While all other countries gain as a result of capital accumulation specific to both import sectors, the magnitude of these gains is generally lower 6 GTAP is the Global Trade Analysis Project and it includes a global economic model and database. Documentation of the database can be found in Dimarmaran and McDougal (2006). 7 The choice of a one-percent increase is arbitrary. As is well known, if the magnitude of the increase in factor supply is large enough, the country must gain even with a distortion, provided specialization does not occur. As well, if the magnitude of the increase is small enough, the country must be worse off. See Johnson (1967). - 23 - Table 2. Welfare Effects of a One Percent Increase in Factor Endowments (Welfare effects are in millions of 2001 U.S. Dollars; percent of GDP in parenthesis) ______________________________________________________________________________________________________________ Capital in Capital in Capital in Capital in Capital in First Export Second Export First Import Second Import Nontraded Labor Sector Sector Sector Sector Sector Endowment_________ Albania 1.4 11.7 1.5 2.2 2.9 14.7 (0.0) (0.3) (0.0) (0.1) (0.1) (0.3) Argentina 11.8 (0.1) Bangladesh 1.7 (0.0) Botswana 0.4 (0.1) Brazil 0.5 (0.0) 46.1 (0.2) 27.8 (0.1) 122.6 (0.6) 5.4 (0.1) 2.0 (0.0) 8.5 (0.2) 24.2 (0.5) 11.4 (0.1) 0.5 (0.0) 46.1 (0.2) 27.8 (0.1) 122.6 (0.6) 21.7 (0.1) 22.1 (0.1) 5.6 (0.0) 61.4 (0.1) 78.0 (0.2) 2506.2 (0.6) China 10.2 (0.1) 18.9 (0.2) 1.0 (0.0) 6.6 (0.1) 9.6 (0.1) 53.7 (0.6) Colombia 5.7 (0.1) 8.5 (0.1) 1.6 (0.0) 5.4 (0.1) 10.1 (0.1) 46.2 (0.6) Egypt 0.5 (0.2) 0.1 (0.1) 0.0 (0.0) 0.5 (0.2) 0.3 (0.1) 0.8 (0.3) India 66.6 (0.2) 88.3 (0.2) 6.4 (0.0) 16.3 (0.0) 71.6 (0.2) 204.0 (0.5) Madagascar 9.2 (0.2) 0.9 (0.0) 1.4 (0.0) 4.2 (0.1) 4.6 (0.1) 25.0 (0.5) Malawi 1.8 (0.1) 2.5 (0.2) 1.3 (0.1) 1.3 (0.1) 0.6 (0.0) 9.1 (0.6) Morocco 29.2 (0.1) 65.1 (0.2) 3.1 (0.0) 8.7 (0.0) 39.8 (0.1) 180.9 (0.5) Mozambique 2.1 (0.1) 3.5 (0.1) 1.3 (0.0) 5.8 (0.2) 5.8 (0.2) 18.1 (0.5) Peru 6.9 (0.1) 7.3 (0.1) 3.1 (0.1) 9.4 (0.2) 7.2 (0.1) 16.6 (0.3) Philippines 8.9 (0.1) 6.5 (0.1) 4.3 (0.1) 11.6 (0.2) Romania 3.4 (0.1) 5.9 (0.1) 3.7 (0.1) 8.4 (0.2) 3.8 (0.1) 13.4 (0.3) Tanzania 19.3 (0.2) 4.8 (0.1) 1.0 (0.0) 12.2 (0.1) 8.2 (0.1) 43.4 (0.5) Tunisia 12.6 (0.1) 62.0 (0.3) -1.4 (0.0) 13.0 (0.1) 9.9 (0.1) 84.8 (0.4) Vietnam 5.9 (0.1) 8.4 (0.2) 1.9 (0.0) 5.5 (0.1) 10.3 (0.2) 11.7 (0.2) Zambia 11.4 (0.1) 3.8 (0.1) 9.6 (0.1) 19.9 (0.3) 3.0 2.2 1.0 4.4 7.0 16.0 (0.1) (0.1) (0.0) (0.1) (0.2) (0.5) ___________________________________________________________________________________________________________ Source: Author’s calculations. - 24 - than the gains from other types of factor accumulation—export-biased or labor biased. Every country gains as a result of an increase in the supply of the mobile factor, labor, as expected. IV. Conclusions This paper has examined the conditions under which factor accumulation could immiserize an economy in the presence of protection. It turns out that different conclusions emerge depending on the model structure assumed. For example, in the two-good, two-factor model in which all factors are mobile, factor accumulation can make a country worse off if it is sufficiently biased toward the factor that is used intensively in the protected sector. Thus, if imports are labor intensive, factor accumulation that is biased toward labor could reduce real income in the presence of tariff protection. In the specific-factors model, however, results differ. Factor accumulation biased toward a specific factor in a sector can lead to immiserization, but accumulation biased toward the mobile factor cannot, even in the presence of protection. This result is due to the fact that an increase in the supply of the mobile factor must raise outputs of all goods, unlike in the two-good, two-factor model. If the mobile factor is taken to be labor, then an increase in the supply of labor available to the economy, perhaps through immigration, cannot make the economy worse off in the short run, provided there is no change in the terms of trade. This conclusion is not valid in the long run when all factors can be thought of as mobile. In a model with all factors mobile, an increase in the labor supply could indeed lead to immiserization. This could explain differences in attitudes toward immigration in the short and long run. - 25 - While factor accumulation can lead to immiserization in the specific-factor’s model, the conditions required are fairly stringent and in general, more difficult to satisfy compared to a model in which all factors are mobile. In the case where there is more than one import good, a high degree of tariff dispersion is one factor that could increase the chances that factor accumulation would immiserize an economy. Ultimately, with more complicated model structures, whether factor accumulation will immiserize a country in the presence of tariff protection is an empirical question. Simulations for twenty countries with higher than average tariff dispersion revealed that only one would likely experience immiserizing growth. Overall, immiserizing growth of the “Johnson type” does not seem to be very likely, mainly because most country’s tariff structures do not contain a degree of dispersion necessary to produce this outcome. - 26 - References Anderson, James, and J. Peter Neary, 2005, “Welfare Versus Market Access: The Implications of Tariff Structure For Tariff Reform,” Journal of International Economics, forthcoming. Bertrand, Trent, and Frank Flatters, 1971, “Tariffs, Capital Accumulation, and Immiserizing Growth,” Journal of International Economics, vol. 1, pp. 453-460. Bhagwati, Jagdish, 1958, “Immiserizing Growth: A Geometric Note,” Review of Economic Studies, vol. xxv, pp. 201-5. Dimaranan, Betina V. and Robert A. McDougall, editors, 2006, Global Trade, Assistance, and Production: The GTAP 6 Data Base, Center for Global Trade Analysis, Purdue University. Johnson, Harry, 1967, “The Possibility of Income Losses From Increased Efficiency or Factor Accumulation in the Presence of Tariffs,” Economic Journal, vol. 77, pp. 151-54. Martin, Ricardo, 1977, “Immiserizing Growth For A Tariff-Distorted, Small Economy: Further Analysis,” Journal of International Economics, vol. 7, pp. 323-328. Miyagiwa, Kaz, 1993, “On the Impossibility of Immiserizing Growth,” International Economic Journal, vol. 7, no. 2, pp. 1-13. Srinivasan, T.N., 1983, “International Factor Movements, Commodity Trade, and Commercial Policy in a Specific Factor Model,” Journal of International Economics, vol. 14, pp. 289-312. Tokarick, Stephen, 2006, “Immiserizing Foreign Aid: The Role of Tariffs and Nontraded Goods,” International Monetary Fund, Working Paper 06/xx, Washington, D.C. Woodland, Alan, 1982, International Trade and Resource Allocation, North Holland. - 27 - Appendix I 1. Mobile-Factor’s Model: Two Goods, Two Factors Xˆ E = −λKM λLM Lˆ + Kˆ (λLM λKE − λLE λKM ) (λLM λKE − λLE λKM ) Xˆ M = λKE −λLE Lˆ + Kˆ (λLM λKE − λLE λKM ) (λLM λKE − λLE λKM ) 2. Specific-Factor’s Model: Two Goods and Three Factors ⎡ σ λ θ θ + σ M λLM θ KE ⎤ ˆ ⎡ ⎤ ˆ −θ LEσ E λLM θ KM Xˆ E = ⎢ E LE KM KE KE + ⎢ ⎥ ⎥ KM + λ σ λ θ σ λ θ λ σ λ θ σ λ θ + + ( ) ( ) M LM KE ⎦ M LM KE ⎦ ⎣ KE E LE KM ⎣ KM E LE KM ⎡ ⎤ˆ ⎡ ⎤ˆ ⎡ ⎤ˆ −θ LEσ Eσ M λLM σ Eθ LEθ KM σ M λLM θ LEσ E ⎢ σ λ θ + σ λ θ ⎥ L + ⎢ σ λ θ + σ λ θ ⎥ PE + ⎢ σ λ θ + σ λ θ ⎥ PM M LM KE ⎦ M LM KE ⎦ M LM KE ⎦ ⎣ E LE KM ⎣ E LE KM ⎣ E LE KM ⎡ ⎤ ˆ ⎡ σ λ θ + σ M λLM θ KEθ KM ⎤ ˆ −θ LM σ M λLEθ KE Xˆ M = ⎢ K E + ⎢ E LE KM ⎥ ⎥ KM + ⎣ λKE (σ E λLEθ KM + σ M λLM θ KE ) ⎦ ⎣ λKM (σ E λLEθ KM + σ M λLM θ KE ) ⎦ ⎤ˆ ⎡ ⎤ˆ ⎡ ⎤ˆ ⎡ σ M θ LM θ KE θ LM σ M λLEσ E −θ LM σ M λLEσ E ⎢ σ λ θ + σ λ θ ⎥ L + ⎢ σ λ θ + σ λ θ ⎥ PE + ⎢ σ λ θ + σ λ θ ⎥ PM M LM KE ⎦ M LM KE ⎦ M LM KE ⎦ ⎣ E LE KM ⎣ E LE KM ⎣ E LE KM - 28 - 3. Specific-Factor’s Model: Three Goods and Four Factors ⎡ λ σ θ θ θ + λLM 1σ M 1θ KEθ KM 2 + λLM 2σ M 2θ KEθ KM 1 ⎤ ˆ Xˆ E = ⎢ LE E KE KM 1 KM 2 ⎥ KE ⎣ λKE [λLEσ Eθ KM 1θ KM 2 + λLM 1σ M 1θ KEθ KM 2 + λLM 2σ M 2θ KEθ KM 1 ] ⎦ ⎡ ⎤ ˆ −θ LEσ Eθ KM 1θ KM 2λLM 1 +⎢ ⎥ KM 1 ⎣ λKM 1 [ λLEσ Eθ KM 1θ KM 2 + λLM 1σ M 1θ KEθ KM 2 + λLM 2σ M 2θ KEθ KM 1 ] ⎦ ⎡ ⎤ ˆ −θ LEσ Eθ KM 1θ KM 2λLM 2 +⎢ ⎥ KM 2 ⎣ λKM 2 [ λLEσ Eθ KM 1θ KM 2 + λLM 1σ M 1θ KEθ KM 2 + λLM 2σ M 2θ KEθ KM 1 ] ⎦ ⎡ ⎤ θ LEσ Eθ KM 1θ KM 2 +⎢ ⎥ Lˆ λ σ θ θ λ σ θ θ λ σ θ θ + + [ ] LM 1 M 1 KE KM 2 LM 2 M 2 KE KM 1 ⎦ ⎣ LE E KM 1 KM 2 ⎡ ⎤ˆ θ LEσ E (λLM 1σ M 1θ KEθ KM 2 + λLM 2σ M 2θ KEθ KM 1 ) +⎢ ⎥ PE ⎣ θ KE [λLEσ Eθ KM 1θ KM 2 + λLM 1σ M 1θ KEθ KM 2 + λLM 2σ M 2θ KEθ KM 1 ] ⎦ ⎡ ⎤ˆ −θ KM 2λLM 1σ M 1θ LEσ E +⎢ ⎥ PM 1 ⎣ [ λLEσ Eθ KM 1θ KM 2 + λLM 1σ M 1θ KEθ KM 2 + λLM 2σ M 2θ KEθ KM 1 ] ⎦ ⎡ ⎤ˆ −θ KM 1λLM 2σ M 2θ LEσ E +⎢ ⎥ PM 2 ⎣ [ λLEσ Eθ KM 1θ KM 2 + λLM 1σ M 1θ KEθ KM 2 + λLM 2σ M 2θ KEθ KM 1 ] ⎦ - 29 - ⎡ ⎤ −θ LM 1σ M 1θ KEθ KM 2λLE Xˆ M 1 = ⎢ ⎥ Kˆ E ⎣ λKE [λLEσ Eθ KM 1θ KM 2 + λLM 1σ M 1θ KEθ KM 2 + λLM 2σ M 2θ KEθ KM 1 ] ⎦ ⎡ λLEσ Eθ KM 1θ KM 2 + λLM 1σ M 1θ KEθ KM 2θ KM 1 + λLM 2σ M 2θ KEθ KM 1 ⎤ ˆ ⎢ ⎥ KM 1 ⎣ λKM 1 [ λLEσ Eθ KM 1θ KM 2 + λLM 1σ M 1θ KEθ KM 2 + λLM 2σ M 2θ KEθ KM 1 ] ⎦ ⎡ ⎤ ˆ −θ LM 1σ M 1θ KEθ KM 2λLM 2 +⎢ ⎥ KM 2 ⎣ λKM 2 [ λLEσ Eθ KM 1θ KM 2 + λLM 1σ M 1θ KEθ KM 2 + λLM 2σ M 2θ KEθ KM 1 ] ⎦ ⎡ ⎤ θ LM 1σ M 1θ KEθ KM 2 +⎢ ⎥ Lˆ ⎣ [ λLEσ Eθ KM 1θ KM 2 + λLM 1σ M 1θ KEθ KM 2 + λLM 2σ M 2θ KEθ KM 1 ] ⎦ ⎡ ⎤ˆ −θ LM 1σ M 1θ KM 2λLM 1σ M 1 +⎢ ⎥ PE ⎣ [ λLEσ Eθ KM 1θ KM 2 + λLM 1σ M 1θ KEθ KM 2 + λLM 2σ M 2θ KEθ KM 1 ] ⎦ ⎡ ⎤ˆ θ LM 1σ M 1 (λLEσ Eθ KM 1θ KM 2 + λLM 2σ M 2θ KEθ KM 1 ) ⎢ ⎥ PM 1 ⎣ θ KM 1 [λLEσ Eθ KM 1θ KM 2 + λLM 1σ M 1θ KEθ KM 2 + λLM 2σ M 2θ KEθ KM 1 ] ⎦ ⎡ ⎤ˆ −θ LM 1σ M 1θ KE λLM 2σ M 2 +⎢ ⎥ PM 2 ⎣ [ λLEσ Eθ KM 1θ KM 2 + λLM 1σ M 1θ KEθ KM 2 + λLM 2σ M 2θ KEθ KM 1 ] ⎦ - 30 - ⎡ ⎤ −θ LM 2σ M 2θ KEθ KM 1λLE Xˆ M 2 = ⎢ ⎥ Kˆ E ⎣ λKE [λLEσ Eθ KM 1θ KM 2 + λLM 1σ M 1θ KEθ KM 2 + λLM 2σ M 2θ KEθ KM 1 ] ⎦ ⎡ ⎤ ˆ −θ LM 2σ M 2θ KEθ KM 1λLM 1 +⎢ ⎥ KM 1 ⎣ λKM 1 [ λLEσ Eθ KM 1θ KM 2 + λLM 1σ M 1θ KEθ KM 2 + λLM 2σ M 2θ KEθ KM 1 ] ⎦ ⎡ λLEσ Eθ KM 1θ KM 2 + λLM 1σ M 1θ KEθ KM 2 + λLM 2σ M 2θ KEθ KM 1θ KM 2 ⎤ ˆ ⎢ ⎥ KM 2 ⎣ λKM 2 [λLEσ Eθ KM 1θ KM 2 + λLM 1σ M 1θ KEθ KM 2 + λLM 2σ M 2θ KEθ KM 1 ] ⎦ ⎡ ⎤ θ LM 2σ M 2θ KEθ KM 1 +⎢ ⎥ Lˆ ⎣ [ λLEσ Eθ KM 1θ KM 2 + λLM 1σ M 1θ KEθ KM 2 + λLM 2σ M 2θ KEθ KM 1 ] ⎦ ⎡ ⎤ˆ −θ LM 2σ M 2θ KM 1λLEσ E +⎢ ⎥ PE ⎣ [ λLEσ Eθ KM 1θ KM 2 + λLM 1σ M 1θ KEθ KM 2 + λLM 2σ M 2θ KEθ KM 1 ] ⎦ ⎡ ⎤ˆ −θ KEθ LM 2σ M 2λLM 1σ M 1 +⎢ ⎥ PM 1 ⎣ [ λLEσ Eθ KM 1θ KM 2 + λLM 1σ M 1θ KEθ KM 2 + λLM 2σ M 2θ KEθ KM 1 ] ⎦ ⎡ ⎤ˆ θ LM 2σ M 2 (λKEσ Eθ KM 1θ KM 2 + λLM 1σ M 1θ KEθ KM 2 ) +⎢ ⎥ PM 2 ⎣ θ KM 2 [ λLEσ Eθ KM 1θ KM 2 + λLM 1σ M 1θ KEθ KM 2 + λLM 2σ M 2θ KEθ KM 1 ] ⎦ - 31 - 4. Specific-Factor’s Model: Four Goods and Five Factors Including a Nontraded Good The price of the nontraded good is determined by the requirement that the quantity of the nontraded good demanded equal the quantity supplied: E N ( p E , p M 1 , p M 2 , p N , U ) = G N ( p E , p M 1 , p M 2 , p N ,V ) (10a). The demand for the nontraded good EN , equals the derivative of the expenditure function with respect to the price of the nontraded good, pN , while GN , the supply of the nontraded good, equals the derivative of the GDP function with respect to the price of the nontraded good. Real income, or utility, is given by U and V is the vector of factor supplies. The budget constraint for the economy is: G ( PE , PM 1 , PM 2 , PN ,V ) + t1PM* 1 ( EM 1 − GM 1 ) + t2 PM* 2 ( EM 2 − GM 2 ) = E ( PE , PM 1 , PM 2 , PN ,U ) , (11a) where G ( PE , PM 1 , PM 2 , PN ,V ) is the economy’s GDP function, E ( PE , PM 1 , PM 2 , PN ,U ) is the expenditure function, and Pj and Pj* are the domestic and world prices of good j respectively. The subscripts E, M, and N denote the exportable, importable, and nontraded sector respectively and a subscript next to the expenditure or GDP function represents partial - 32 - differentiation with respect to that variable. The terms t1 PM* 1 ( EM 1 − GM 1 ) and t2 PM* 2 ( EM 2 − GM 2 ) measure tariff revenue on imports of good 1 and 2 respectively. Totally differentiating (11a) gives the welfare effect of a change in factor endowments, dV: dU ⎣⎡ EU − t1PM* 1EM 1U − t2 PM* 2 EM 2U ⎤⎦ = ⎡⎣GV − t1PM* 1GM 1V − t2 PM* 2GM 2V ⎤⎦ dV (12a) + ⎡⎣t P * 1 M1 ( EM 1N − GM 1N ) + t P ( EM 2 N − GM 2 N ) ⎤⎦ dpN * 2 M2 where EM 1N and EM 2 N capture how domestic demand for each imported good ( EM 1 and EM 2 ) changes as a result of a change in the price of the nontraded good and ( GM 1 N and GM 2 N ) measure how output of each imported good ( GM 1 and GM 2 ) changes as a result of changes in the price of the nontraded good. To see how pN is affected by a change in endowments, totally differentiate (10a), which gives dPN = ( ENN 1 [GNV dV − ENU dU ] − GNN ) (13a). - 33 - Substituting the expression for dU from (12a) into (13a) gives the effect of a change in factor endowments on the price of the nontraded good: ⎡ ⎤ GNV ( EU − t1 PM* 1 EM 1U − t2 PM* 2 E M 2U ) + E NU (t1 PM* 1GM 1V + t2 PM* 2GM 2V − GV ) dPN = ⎢ ⎥ dV * * * * ⎣ ( E NN − GNN )( EU − t1 PM 1 EM 1U − t2 PM 2 E M 2U ) + E NU t1 PM 1 ( EM 1 N − GM 1N ) + E NU t2 PM 2 ( EM 2 N − GM 2 N ) ⎦ (14a). Substituting (14a) for dPN in equation (12a) gives the welfare effect of a change in endowments dV: dU ( EU − t1PM* 1EM 1U − t2 PM* 2U EM 2U ) = (GV − t1PM* 1GM 1V − t2 PM* 2GM 2V )dV +t1PM* 1 ( EM 1N − GM 1N ) + t2 PM* 2 ( EM 2 N − GM 2 N ) ⎡ ⎤ GNV ( EU − t1PM* 1EM 1U − t2 PM* 2 EM 2U ) + E NU (t1PM* 1GM 1V + t2 PM* 2GM 2V − GV ) ⎢ ( E − G )( E − t P* E ⎥ dV * * * NN U 1 M 1 M 1U − t2 PM 2 E M 2U ) + E NU t1 PM 1 ( E M 1 N − GM 1 N ) + E NU t2 PM 2 ( E M 21 N − GM 2 N ) ⎦ ⎣ NN (15a). Solutions For Endogenous Variables: Using the model in equations (1a) through (9a), the changes in sectoral outputs are: - 34 - ⎡ λ σ θ θ θ θ + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ⎤ ˆ Xˆ E = ⎢ LE E KE KM 1 KM 2 KN ⎥ KE ⎣ λKE [λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ ⎡ ⎤ ˆ −θ LEσ Eθ KM 1θ KM 2θ KN λLM 1 +⎢ ⎥ KM 1 ⎣ λKM 1 [ λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ ⎡ ⎤ ˆ −θ LEσ Eθ KM 1θ KM 2θ KN λLM 2 +⎢ ⎥ KM 2 ⎣ λKM 2 [ λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ ⎡ ⎤ ˆ −θ LEσ Eθ KM 1θ KM 2θ KN λLN +⎢ ⎥ KN ⎣ λKN [λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ ⎡ ⎤ˆ θ LEσ Eθ KM 1θ KM 2θ KN +⎢ ⎥L ⎣ [ λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ ⎡ ⎤ˆ θ LEσ E (λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLN σ Nθ KEθ KM 1θ KM 2 ) +⎢ ⎥ PE ⎣ θ KE [λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ ⎡ ⎤ˆ −θ KM 2θ KN λLM 1σ M 1θ LEσ E +⎢ ⎥ PM 1 ⎣ [ λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ ⎡ ⎤ˆ −θ KM 1θ KN λLM 2σ M 2θ LEσ E +⎢ ⎥ PM 2 ⎣ [ λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ ⎡ ⎤ˆ −θ KM 1θ KM 2λLN σ Nθ LEσ E +⎢ ⎥ PN ⎣ [ λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ (16a) - 35 - ⎡ λ σ θ θ θ + λLM 1σ M 1θ KEθ KM 1θ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ⎤ ˆ Xˆ M 1 = ⎢ LE E KM 1 KM 2 KN ⎥ KM 1 ⎣ λKM 1 [λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ ⎡ ⎤ ˆ −θ LM 1σ M 1θ KEθ KM 2θ KN λLE +⎢ ⎥ KE λ λ σ θ θ θ λ σ θ θ θ λ σ θ θ θ λ σ θ θ θ + + + [ ] 1 2 KE LE E KM KM KN LM M KE KM KN LM M KE KM KN LN N KE KM KM 1 1 2 2 2 1 1 2 ⎣ ⎦ ⎡ ⎤ ˆ −θ LM 1σ M 1θ KEθ KM 2θ KN λLM 2 +⎢ ⎥ KM 2 ⎣ λKM 2 [λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ ⎡ ⎤ ˆ −θ LM 1σ M 1θ KEθ KM 2θ KN λLN +⎢ ⎥ KN θ θ θ λ σ θ θ θ λ σ θ θ θ λ σ θ θ θ λ λ σ + + + [ ] LM 1 M 1 KE KM 2 KN LM 2 M 2 KE KM 1 KN LN N KE KM 1 KM 2 ⎦ ⎣ KN LE E KM 1 KM 2 KN ⎡ ⎤ˆ θ LM 1σ M 1θ KEθ KM 2θ KN +⎢ ⎥L ⎣ [λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ ⎡ ⎤ˆ θ LM 1σ M 1 (λKEσ Eθ KM 1θ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLN σ Nθ KEθ KM 1θ KM 2 ) +⎢ ⎥ PM 1 ⎣ θ KM 1 [ λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ ⎡ ⎤ˆ −θ LM 1σ M 1θ KM 2θ KN λLEσ E +⎢ ⎥ PE λ σ θ θ θ λ σ θ θ θ λ σ θ θ θ λ σ θ θ θ + + + [ ] LE E KM 1 KM 2 KN LM 1 M 1 KE KM 2 KN LM 2 M 2 KE KM 1 KN LN N KE KM 1 K M 2 ⎣ ⎦ ⎡ ⎤ˆ −θ LM 1σ M 1θ KEθ KN λLM 2σ M 2 +⎢ ⎥ PM 2 ⎣ [λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ ⎡ ⎤ −θ LM 1σ M 1θ KEθ KM 2λLN σ N +⎢ ⎥ PˆN λ σ θ θ θ λ σ θ θ θ λ σ θ θ θ λ σ θ θ θ + + + [ ] LM 1 M 1 KE KM 2 KN LM 2 M 2 KE KM 1 KN LN N KE KM 1 KM 2 ⎦ ⎣ LE E KM 1 KM 2 KN (17a). - 36 - ⎡ λ σ θ θ θ + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KM 2θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ⎤ ˆ Xˆ M 2 = ⎢ LE E KM 1 KM 2 KN ⎥ KM 2 ⎣ λKM 2 [λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ ⎡ ⎤ ˆ −θ LM 2σ M 2θ KEθ KM 1θ KN λLE +⎢ ⎥ KE ⎣ λKE [λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ ⎡ ⎤ −θ LM 2σ M 2θ KEθ KM 1θ KN λLM 1 +⎢ ⎥ Kˆ M 1 ⎣ λKM 1 [ λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ ⎡ ⎤ ˆ −θ LM 2σ M 2θ KEθ KM 1θ KN λLN +⎢ ⎥ KN ⎣ λKN [λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ ⎡ ⎤ˆ θ LM 2σ M 2θ KEθ KM 1θ KN +⎢ ⎥L ⎣ [ λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ ⎡ ⎤ θ LM 2σ M 2 (λKEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLN σ Nθ KEθ KM 1θ KM 2 ) +⎢ ⎥ PˆM 2 ⎣ θ KM 2 [λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ ⎡ ⎤ˆ −θ LM 2σ M 2θ KN λLM 1σ M 1 +⎢ ⎥ PM 1 ⎣ [ λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ ⎡ ⎤ˆ −θ LM 2σ M 2θ KM 1θ KN λLEσ E +⎢ ⎥ PE ⎣ [ λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ ⎡ ⎤ˆ −θ LM 2σ M 2θ KEθ KM 1λLN σ N +⎢ ⎥ PN ⎣ [ λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ (18a). - 37 - ⎡ λ σ θ θ θ + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2θ KN ⎤ ˆ Xˆ N = ⎢ LE E KM 1 KM 2 KN ⎥ KN ⎣ λKN [λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ ⎡ ⎤ ˆ −θ LN σ Nθ KEθ KM 1θ KM 2λLE +⎢ ⎥ KE ⎣ λKE [λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ ⎡ ⎤ ˆ −θ LN σ Nθ KEθ KM 1θ KM 2λLM 1 +⎢ ⎥ KM 1 ⎣ λKM 1 [ λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ ⎡ ⎤ ˆ −θ LN σ Nθ KEθ KM 1θ KM 2λLM 2 +⎢ ⎥ KM 2 ⎣ λKM 2 [ λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ ⎡ ⎤ˆ θ LN σ Nθ KEθ KM 1θ KM 2 +⎢ ⎥L ⎣ [ λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ ⎡ ⎤ˆ θ LN σ N (λKEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN ) +⎢ ⎥ PN ⎣ θ KN [λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ ⎡ ⎤ˆ −θ LN σ Nθ KEθ KM 2λLM 1σ M 1 +⎢ ⎥ PM 1 ⎣ [ λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ ⎡ ⎤ˆ −θ LN σ Nθ KEθ KM 1λLM 2σ M 2 +⎢ ⎥ PM 2 ⎣ [ λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ ⎡ ⎤ˆ −θ LN σ Nθ KM 1θ KM 2λLEσ E +⎢ ⎥ PE ⎣ [ λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ] ⎦ (19a), where σ j is the elasticity of substitution between labor and capital in sector j, θij is the costshare of factor i in good j, λij is the share of factor i employed in sector j, and a “^” denotes dX M proportional change, i.e. Xˆ M = . XM - 38 - Finally, the solution for the wage rate is: wˆ = (λLEσ Eθ KM 1θ KM 2θ KN + λLM 1σ M 1θ KEθ KM 2θ KN 1 + λLM 2σ M 2θ KEθ KM 1θ KN + λLNσ Nθ KEθ KM 1θ KM 2 ) ⎡ ⎤ ⎢ ( −θ θ θ θ ) Lˆ + (λ σ θ θ θ ) Pˆ + (λ σ θ θ θ ) Pˆ ⎥ LE E KM 1 KM 2 KN E LM 1 M 1 KE KM 2 KN M1⎥ ⎢ KE KM 1 KM 2 KN ⎢ ⎥ ⎢ ⎥ ⎢ + (λLM 2σ M 2θ KEθ KM 1θ KN ) PˆM 2 + (λLNσ Nθ KEθ KM 1θ KM 2 ) PˆN + ⎥ ⎢ ⎥ ⎢ ⎥ ⎢ ⎛ λLE ⎞ ˆ ⎥ ⎛ λLN ⎞ ˆ ⎛ λLM 1 ⎞ ˆ ⎛ λLM 2 ⎞ ˆ ⎢⎜ ⎥ ⎟ KN ⎟ KE + ⎜ ⎟ KM 1 + ⎜ ⎟ KM 2 + ⎜ ⎝ λKM 1 ⎠ ⎝ λKM 2 ⎠ ⎝ λKN ⎠ ⎣ ⎝ λKE ⎠ ⎦ (20a).