Please do not quote results are preliminary Comments are welcome

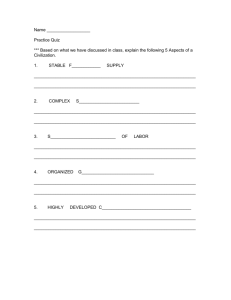

advertisement