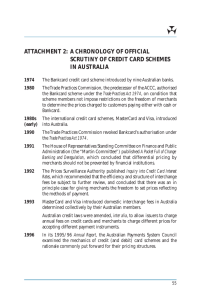

Credit Card Networks in Australia: An Appropriate Regulatory Framework Australian Bankers’ Association

advertisement